please help

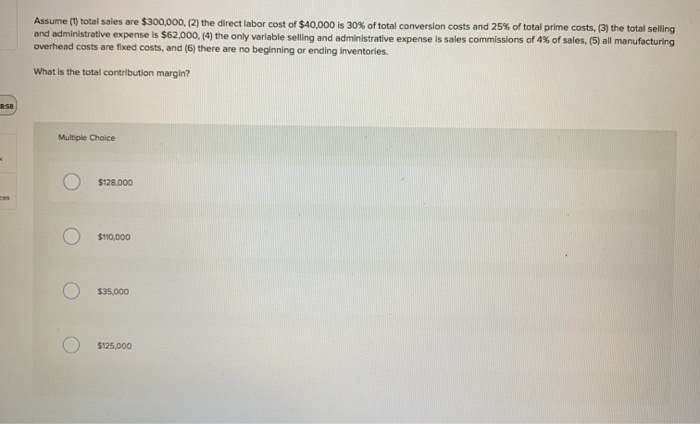

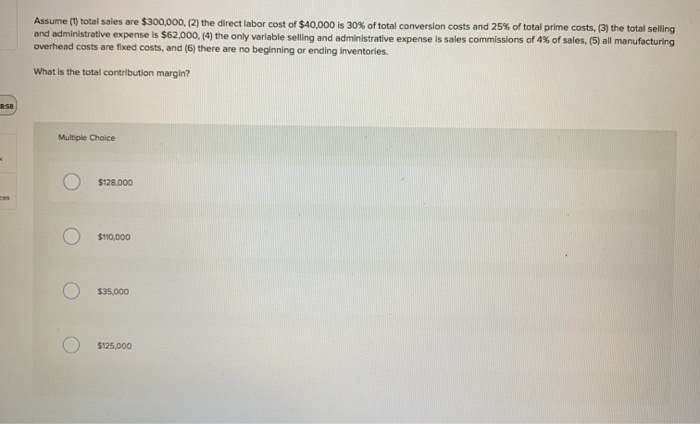

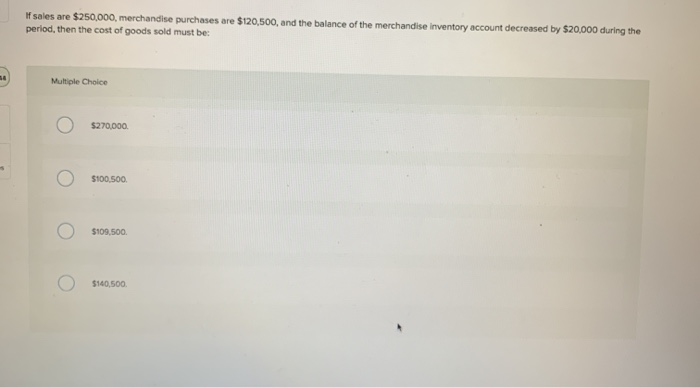

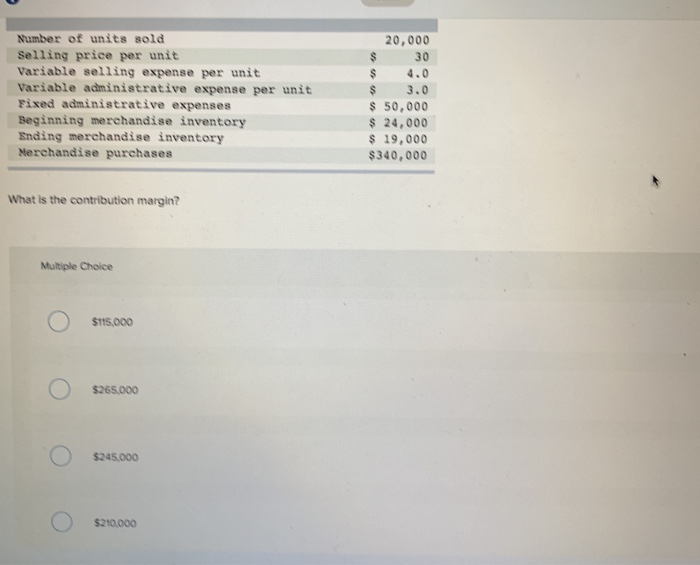

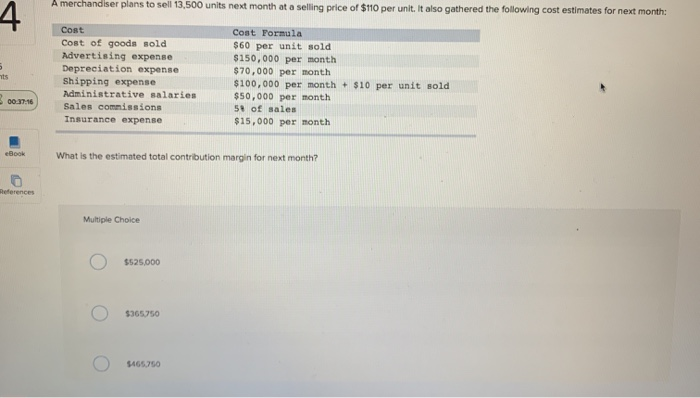

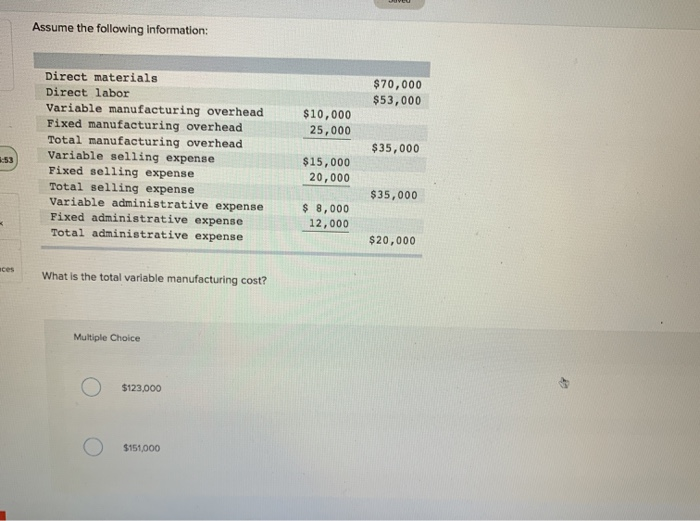

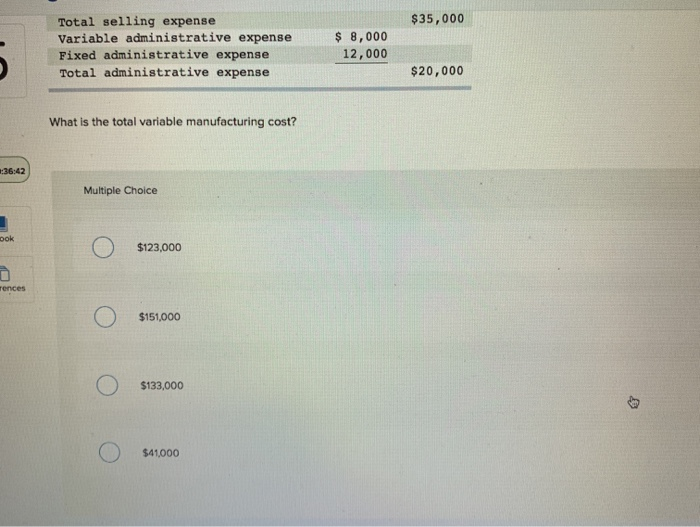

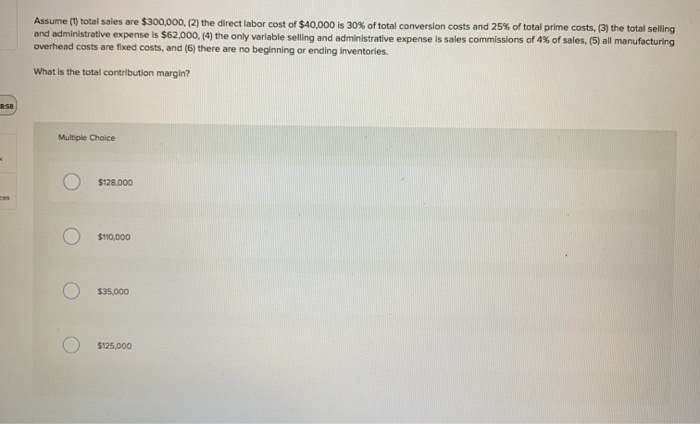

Assume (1) total sales are $300,000, (2) the direct labor cost of $40,000 is 30% of total conversion costs and 25% of total prime costs, (3) the total selling and administrative expense Is $62,000, (4) the only variable selling and administrative expense is sales commissions of 4% of sales, (5) all manufacturing overhead costs are fixed costs, and (6) there are no beginning or ending Inventories. What is the total contribution margin? R:58 Multiple Choice Y $128.000 $110,000 $35,000 $125,000 If sales are $250,000, merchandise purchases are $120,500, and the balance of the merchandise inventory account decreased by $20,000 during the period, then the cost of goods sold must be: Multiple Choice $270,000 $100,500 $109,500 $140,500 Number of units sold Selling price per unit Variable selling expense per unit Variable administrative expense per unit Fixed administrative expenses Beginning merchandise inventory Ending merchandise inventory Merchandise purchases 20,000 $ 30 $ 4.0 $ 3.0 $ 50,000 $ 24,000 $ 19,000 $340,000 What is the contribution margin? Multiple Choice $115.000 $265.000 $245.000 $210,000 A merchandiser plans to sell 13,500 units next month at a selling price of $110 per unit. It also gathered the following cost estimates for next month: 4 5 Cost Cost of goods sold Advertising expense Depreciation expense Shipping expense Administrative salaries Sales commissions Insurance expense Cost Formula $60 per unit sold $150,000 per month $70,000 per month $100,000 per month + $10 per unit sold $50,000 per month 58 of sales $15,000 per month 3 00:37:16 eBook What is the estimated total contribution margin for next month? References Multiple Choice $525,000 $365.750 5465,750 Assume the following information: $70,000 $53,000 $10,000 25,000 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total manufacturing overhead Variable selling expense Fixed selling expense Total selling expense Variable administrative expense Fixed administrative expense Total administrative expense $35,000 $15,000 20,000 $35,000 $ 8,000 12,000 $20,000 aces What is the total variable manufacturing cost? Multiple Choice $123,000 $151,000 $35,000 Total selling expense Variable administrative expense Fixed administrative expense Total administrative expense $ 8,000 12,000 $20,000 What is the total variable manufacturing cost? 7:36:42 Multiple Choice DOK $123,000 Tences $151,000 $133,000 $41,000