please help

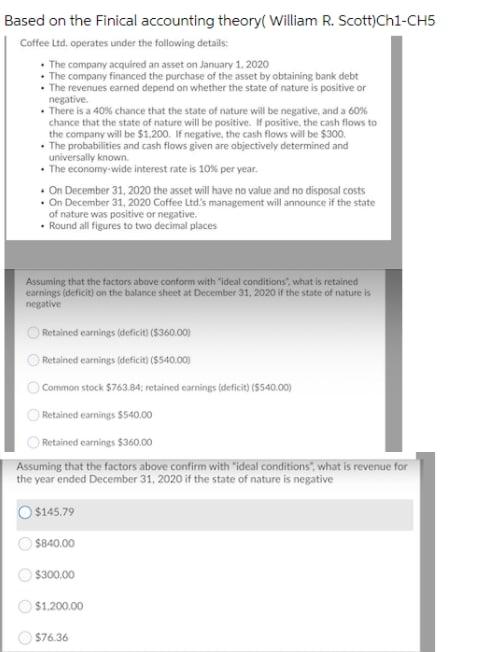

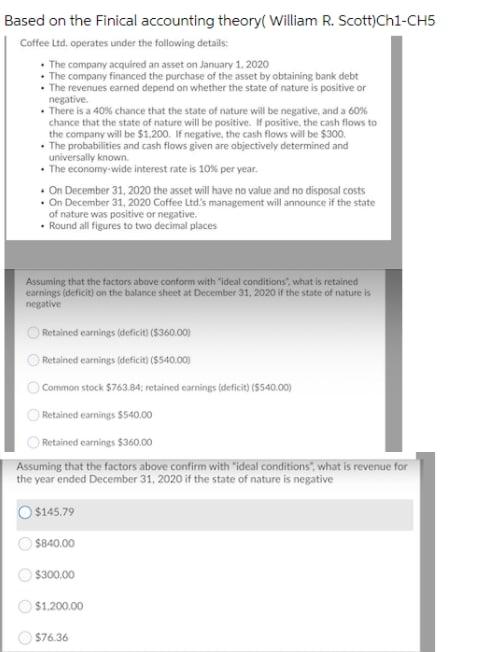

Based on the Finical accounting theory( William R. Scott)Ch1-CH5 Coffee Ltd. operates under the following details: The company acquired an asset on January 1, 2020 The company financed the purchase of the asset by obtaining bank debt The revenues earned depend on whether the state of nature is positive or negative There is a 40% chance that the state of nature will be negative, and a 60% chance that the state of nature will be positive. If positive, the cash flows to the company will be $1,200. If negative, the cash flows will be $300. . The probabilities and cash flows given are objectively determined and universally known . The economy-wide interest rate is 10% per year. On December 31, 2020 the asset will have no value and no disposal costs On December 31, 2020 Coffee Ltd's management will announce if the state of nature was positive or negative. Round all figures to two decimal places Assuming that the factors above contorm with ideal conditions, what is retained earnings (deficit) on the balance sheet at December 31, 2020 if the state of nature is negative Retained earnings (defich) (5360.00) Retained earnings deficit) (5540.00) Common stock $763.BA: retained carnings (deficit) ($540.00) Retained earnings 5540,00 Retained earnings $360,00 Assuming that the factors above confirm with "ideal conditions what is revenue for the year ended December 31, 2020 if the state of nature is negative $145.79 $840.00 $300,00 $1,200.00 $76.36 Based on the Finical accounting theory( William R. Scott)Ch1-CH5 Coffee Ltd. operates under the following details: The company acquired an asset on January 1, 2020 The company financed the purchase of the asset by obtaining bank debt The revenues earned depend on whether the state of nature is positive or negative There is a 40% chance that the state of nature will be negative, and a 60% chance that the state of nature will be positive. If positive, the cash flows to the company will be $1,200. If negative, the cash flows will be $300. . The probabilities and cash flows given are objectively determined and universally known . The economy-wide interest rate is 10% per year. On December 31, 2020 the asset will have no value and no disposal costs On December 31, 2020 Coffee Ltd's management will announce if the state of nature was positive or negative. Round all figures to two decimal places Assuming that the factors above contorm with ideal conditions, what is retained earnings (deficit) on the balance sheet at December 31, 2020 if the state of nature is negative Retained earnings (defich) (5360.00) Retained earnings deficit) (5540.00) Common stock $763.BA: retained carnings (deficit) ($540.00) Retained earnings 5540,00 Retained earnings $360,00 Assuming that the factors above confirm with "ideal conditions what is revenue for the year ended December 31, 2020 if the state of nature is negative $145.79 $840.00 $300,00 $1,200.00 $76.36