Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help!! Bonus Problem 2 (Optional, 30 marks) (a) We consider an investment problem with 1 riskfree asset (with return ri) and N risky assets

please help!!

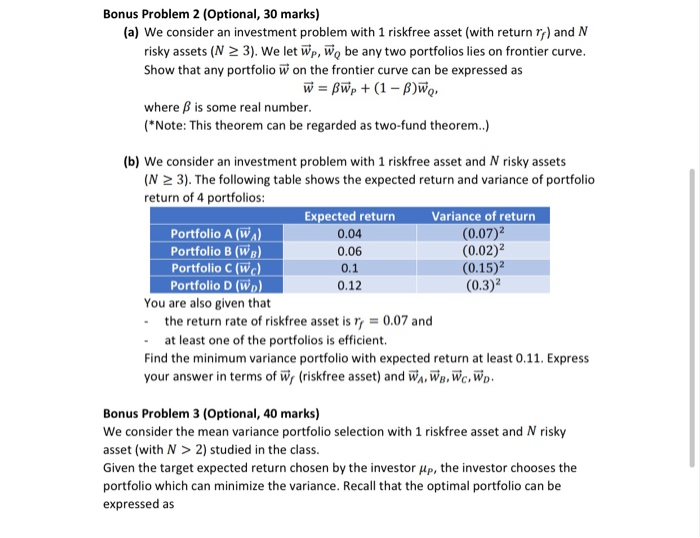

Bonus Problem 2 (Optional, 30 marks) (a) We consider an investment problem with 1 riskfree asset (with return ri) and N risky assets (N > 3). We let Wp, Wo be any two portfolios lies on frontier curve. Show that any portfolio w on the frontier curve can be expressed as W = BWp + (1 - Bw. where B is some real number. (Note: This theorem can be regarded as two-fund theorem..) (b) We consider an investment problem with 1 riskfree asset and N risky assets (N 3). The following table shows the expected return and variance of portfolio return of 4 portfolios: Expected return variance of return Portfolio A (WA) 0.04 (0.07) Portfolio B (WB) 0.06 (0.02) Portfolio Cwc) 0.1 Portfolio D (wo) 0.12 (0.3) You are also given that - the return rate of riskfree asset is r = 0.07 and - at least one of the portfolios is efficient. Find the minimum variance portfolio with expected return at least 0.11. Express your answer in terms of W, (riskfree asset) and W W . Wc, WD. (0.15) Bonus Problem 3 (Optional, 40 marks) We consider the mean variance portfolio selection with 1 riskfree asset and N risky asset (with N > 2) studied in the class. Given the target expected return chosen by the investor up, the investor chooses the portfolio which can minimize the variance. Recall that the optimal portfolio can be expressed as Bonus Problem 2 (Optional, 30 marks) (a) We consider an investment problem with 1 riskfree asset (with return ri) and N risky assets (N > 3). We let Wp, Wo be any two portfolios lies on frontier curve. Show that any portfolio w on the frontier curve can be expressed as W = BWp + (1 - Bw. where B is some real number. (Note: This theorem can be regarded as two-fund theorem..) (b) We consider an investment problem with 1 riskfree asset and N risky assets (N 3). The following table shows the expected return and variance of portfolio return of 4 portfolios: Expected return variance of return Portfolio A (WA) 0.04 (0.07) Portfolio B (WB) 0.06 (0.02) Portfolio Cwc) 0.1 Portfolio D (wo) 0.12 (0.3) You are also given that - the return rate of riskfree asset is r = 0.07 and - at least one of the portfolios is efficient. Find the minimum variance portfolio with expected return at least 0.11. Express your answer in terms of W, (riskfree asset) and W W . Wc, WD. (0.15) Bonus Problem 3 (Optional, 40 marks) We consider the mean variance portfolio selection with 1 riskfree asset and N risky asset (with N > 2) studied in the class. Given the target expected return chosen by the investor up, the investor chooses the portfolio which can minimize the variance. Recall that the optimal portfolio can be expressed as Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started