Answered step by step

Verified Expert Solution

Question

1 Approved Answer

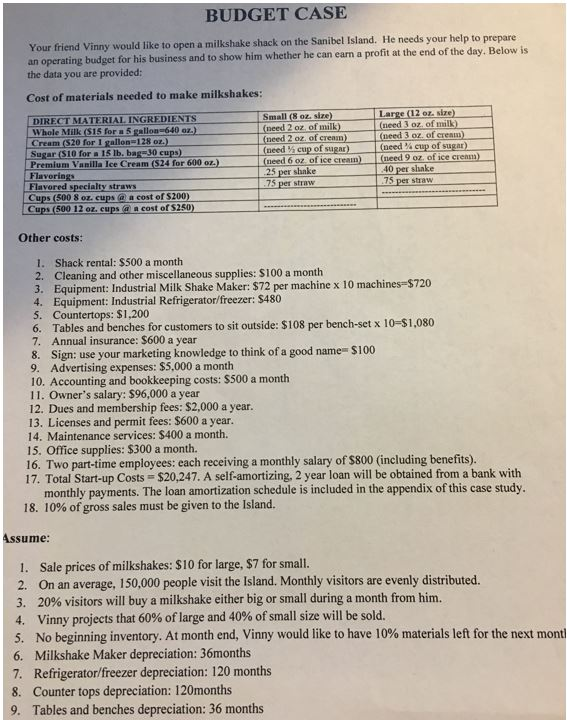

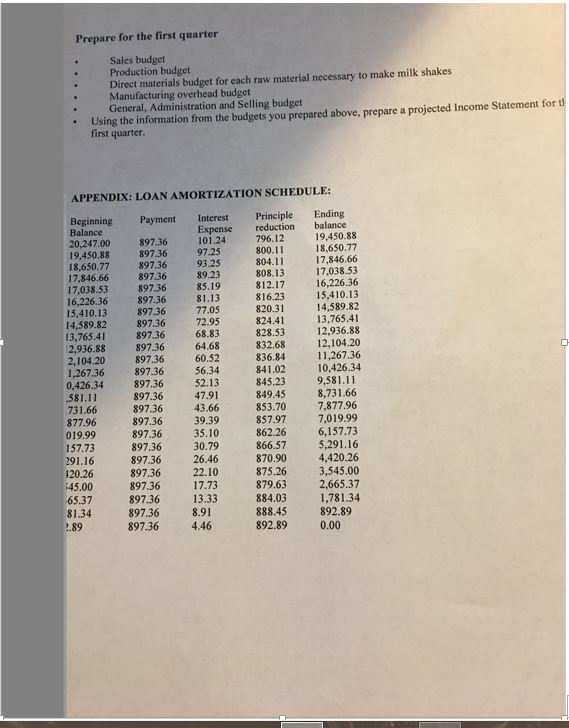

please help! BUDGET CASE Your friend Vinny would like to open a milkshake shack on the Sanibel Island. He needs your help to the data

please help!

BUDGET CASE Your friend Vinny would like to open a milkshake shack on the Sanibel Island. He needs your help to the data you are provided: Cost of materials needed to make milkshakes: prepare r his business and to show him whether he can earn a profit at the end of the day. Below is Large (12 or, size) Small (8 oz, size) need 2 oz, of milk (need 2 oz. of cream (need cup of sugar) DIRECT MATERIAL INGREDIENTS Whole Milk (S15 for a 5 gallon 640 0z.) Cream ($20 for I gallon-128 oz.) need 3 oz, of milk) need of (nee Sugar(S10 for a 15 Ib. bag 30 cups) oficecrea Premium, Vanilla IceCream(S24for6000.) !(need 6 ozoficeeleala) - 25 per shake 40 per shake 15 per straw Flavorin Flavored specialty straws Cups (500 8 oz. cups a a cost of S200) Cups (500 12 oz, cups @ a cost of S250) Other costs: I. Shack rental: $500 a month 2. Cleaning and other miscellaneous supplies: $100 a month 3. Equipment: Industrial Milk Shake Maker: $72 per machine x 10 machines $720 4. Equipment: Industrial Refrigerator/freezer: $480 5. Countertops: $1,200 6. Tables and benches for customers to sit outside: $108 per bench-set x 10-$1,080 7. Annual insurance: $600 a year 8. Sign: use your marketing knowledge to think of a good name $100 9. Advertising expenses: $5,000 a month 10. Accounting and bookkeeping costs: $500 a month 11. Owner's salary: $96,000 a year 12. Dues and membership fees: $2,000 a year. 13. Licenses and permit fees: $600 a year. 14. Maintenance services: $400 a month. 15. Office supplies: $300 a month. 16. Two part-time employees: each receiving a monthly salary of $800 (including benefits). 17. Total Start-up Costs- $20,247. A self-amortizing. 2 year loan will be obtained from a bank with monthly payments. The loan amortization schedule is included in the appendix of this case study. 18, 10% ofgross sales must be given to the Island. Assume I. Sale prices of milkshakes: $10 for large, $7 for small. 2. On an average, 150,000 people visit the Island. Monthly visitors are evenly distributed. 3, 20% visitors will buy a milkshake either big or small during a month from him. 4. Vinny projects that 60% of large and 40% of small size will be sold. 5, No beginning inventory. At month end, Vinny would like to have 10% materials left for the next mont 6. Milkshake Maker depreciation: 36months 7. Refrigerator/freezer depreciation: 120 months 8. Counter tops depreciation: 120months 9. Tables and benches depreciation: 36 months Prepare for the first quarter Sales budget Production budget Direct materials budget for each raw material necessary to make milk shakes Manufacturing overhead budget .General, Administration and Selling budget " Using the information from the budgets you prepared above, prepare a projected Income Statement for first quarter. APPENDIX: LOAN AMORTIZATION SCHEDULE: Beginning Payment Interest Principle Ending Balance Expense reduction balance 20,247.00 897.36 101.24 897.36 97.25 93.25 796.12 800.11 804.11 808.13 17,038.53 812.17 816.23 15,410.13 820.31 19,450.88 18,650.77 17,846.66 19,450.88 18,650.77 17,846.66 17,038.53 897.36 897.36 897.36 16,226.36 16,226.36 897.36 81.13 77.05 72.95 68.83 64.68 2,104.20 897.36 60.52 1,267.36 897.3 56.34 897.36 897.36 897.36 2,936.88 897.36 15,410.13 14,589.82 13,765.41 12,936.88 12,104.20 14,589.82 13,765.41 828.53 832.68 836.84 11,267.36 84102 10,426.34 845.23 9,581.11 0,426.34 897.36 52.13 897.36 897.36 897.36 897.36 897.36 897.36 897.36 897.36 47.91 43.66 8,731.66 731.66 877.96 853.70 7,877.96 857.97 7,019.99 862.26 6,157.73 866.57 5,291.16 870.90 4,420.26 875.26 3,545.00 879.63 2,665.37 35.10 26.46 22.10 120.26 65.37 2.89 897.36 13.33 897.36 8.91 897.36 884.03 888.45 892.89 1,781.34 892.89 0.00 BUDGET CASE Your friend Vinny would like to open a milkshake shack on the Sanibel Island. He needs your help to the data you are provided: Cost of materials needed to make milkshakes: prepare r his business and to show him whether he can earn a profit at the end of the day. Below is Large (12 or, size) Small (8 oz, size) need 2 oz, of milk (need 2 oz. of cream (need cup of sugar) DIRECT MATERIAL INGREDIENTS Whole Milk (S15 for a 5 gallon 640 0z.) Cream ($20 for I gallon-128 oz.) need 3 oz, of milk) need of (nee Sugar(S10 for a 15 Ib. bag 30 cups) oficecrea Premium, Vanilla IceCream(S24for6000.) !(need 6 ozoficeeleala) - 25 per shake 40 per shake 15 per straw Flavorin Flavored specialty straws Cups (500 8 oz. cups a a cost of S200) Cups (500 12 oz, cups @ a cost of S250) Other costs: I. Shack rental: $500 a month 2. Cleaning and other miscellaneous supplies: $100 a month 3. Equipment: Industrial Milk Shake Maker: $72 per machine x 10 machines $720 4. Equipment: Industrial Refrigerator/freezer: $480 5. Countertops: $1,200 6. Tables and benches for customers to sit outside: $108 per bench-set x 10-$1,080 7. Annual insurance: $600 a year 8. Sign: use your marketing knowledge to think of a good name $100 9. Advertising expenses: $5,000 a month 10. Accounting and bookkeeping costs: $500 a month 11. Owner's salary: $96,000 a year 12. Dues and membership fees: $2,000 a year. 13. Licenses and permit fees: $600 a year. 14. Maintenance services: $400 a month. 15. Office supplies: $300 a month. 16. Two part-time employees: each receiving a monthly salary of $800 (including benefits). 17. Total Start-up Costs- $20,247. A self-amortizing. 2 year loan will be obtained from a bank with monthly payments. The loan amortization schedule is included in the appendix of this case study. 18, 10% ofgross sales must be given to the Island. Assume I. Sale prices of milkshakes: $10 for large, $7 for small. 2. On an average, 150,000 people visit the Island. Monthly visitors are evenly distributed. 3, 20% visitors will buy a milkshake either big or small during a month from him. 4. Vinny projects that 60% of large and 40% of small size will be sold. 5, No beginning inventory. At month end, Vinny would like to have 10% materials left for the next mont 6. Milkshake Maker depreciation: 36months 7. Refrigerator/freezer depreciation: 120 months 8. Counter tops depreciation: 120months 9. Tables and benches depreciation: 36 months Prepare for the first quarter Sales budget Production budget Direct materials budget for each raw material necessary to make milk shakes Manufacturing overhead budget .General, Administration and Selling budget " Using the information from the budgets you prepared above, prepare a projected Income Statement for first quarter. APPENDIX: LOAN AMORTIZATION SCHEDULE: Beginning Payment Interest Principle Ending Balance Expense reduction balance 20,247.00 897.36 101.24 897.36 97.25 93.25 796.12 800.11 804.11 808.13 17,038.53 812.17 816.23 15,410.13 820.31 19,450.88 18,650.77 17,846.66 19,450.88 18,650.77 17,846.66 17,038.53 897.36 897.36 897.36 16,226.36 16,226.36 897.36 81.13 77.05 72.95 68.83 64.68 2,104.20 897.36 60.52 1,267.36 897.3 56.34 897.36 897.36 897.36 2,936.88 897.36 15,410.13 14,589.82 13,765.41 12,936.88 12,104.20 14,589.82 13,765.41 828.53 832.68 836.84 11,267.36 84102 10,426.34 845.23 9,581.11 0,426.34 897.36 52.13 897.36 897.36 897.36 897.36 897.36 897.36 897.36 897.36 47.91 43.66 8,731.66 731.66 877.96 853.70 7,877.96 857.97 7,019.99 862.26 6,157.73 866.57 5,291.16 870.90 4,420.26 875.26 3,545.00 879.63 2,665.37 35.10 26.46 22.10 120.26 65.37 2.89 897.36 13.33 897.36 8.91 897.36 884.03 888.45 892.89 1,781.34 892.89 0.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started