Answered step by step

Verified Expert Solution

Question

1 Approved Answer

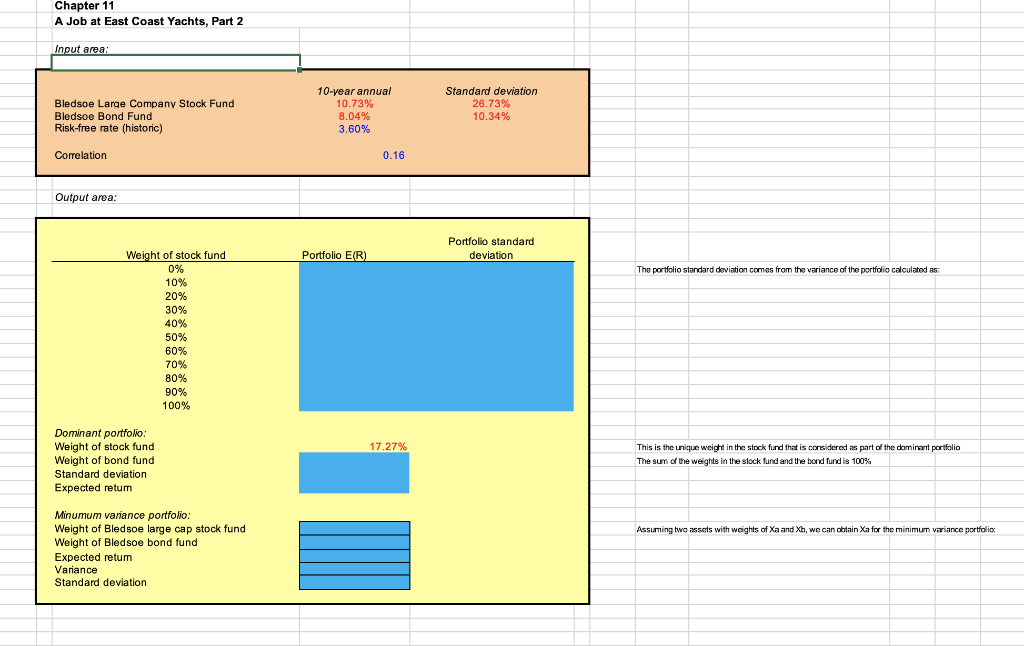

PLEASE HELP by filling out the blue cells! Chapter 11 A Job at East Coast Yachts, Part 2 Input area Bledsoe Large Company Stock Fund

PLEASE HELP by filling out the blue cells!

Chapter 11 A Job at East Coast Yachts, Part 2 Input area Bledsoe Large Company Stock Fund Bledsoe Bond Fund Risk-free rate (historic) 10-year annual 10.73% 8.04% 3.60% Standard deviation 26.73% 10.34% Correlation 0.16 Output area: Portfolio standard deviation Portfolio E(R) The portfolio Standard deviation comes from the variance of the portfolio calculated as Weight of stock fund 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% % 17.27% Dominant portfolio: Weight of stock fund Weight of bond fund Standard deviation Expected return This is the unique weight in the stock fund that is considered as part of the dominant portfolio The sum of the weights in the stock fund and the bond fund is 100% Assuming two assets with weights of Xa and Xh, we can obtain Xa for the minimum variance portfolio Minumum variance portfolio: Weight of Bledsoe large cap stock fund Weight of Bledsoe bond fund Expected return Variance Standard deviation Chapter 11 A Job at East Coast Yachts, Part 2 Input area Bledsoe Large Company Stock Fund Bledsoe Bond Fund Risk-free rate (historic) 10-year annual 10.73% 8.04% 3.60% Standard deviation 26.73% 10.34% Correlation 0.16 Output area: Portfolio standard deviation Portfolio E(R) The portfolio Standard deviation comes from the variance of the portfolio calculated as Weight of stock fund 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% % 17.27% Dominant portfolio: Weight of stock fund Weight of bond fund Standard deviation Expected return This is the unique weight in the stock fund that is considered as part of the dominant portfolio The sum of the weights in the stock fund and the bond fund is 100% Assuming two assets with weights of Xa and Xh, we can obtain Xa for the minimum variance portfolio Minumum variance portfolio: Weight of Bledsoe large cap stock fund Weight of Bledsoe bond fund Expected return Variance Standard deviationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started