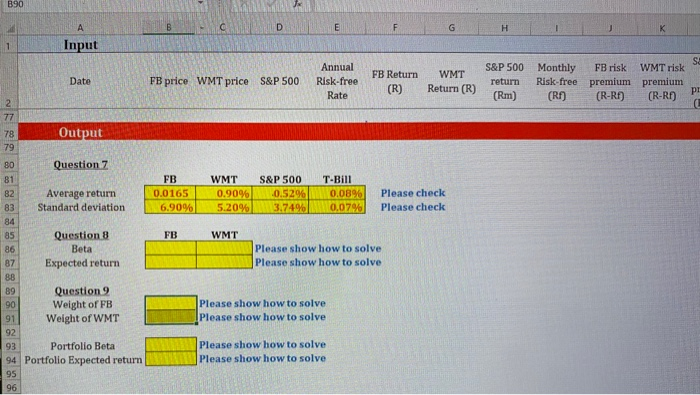

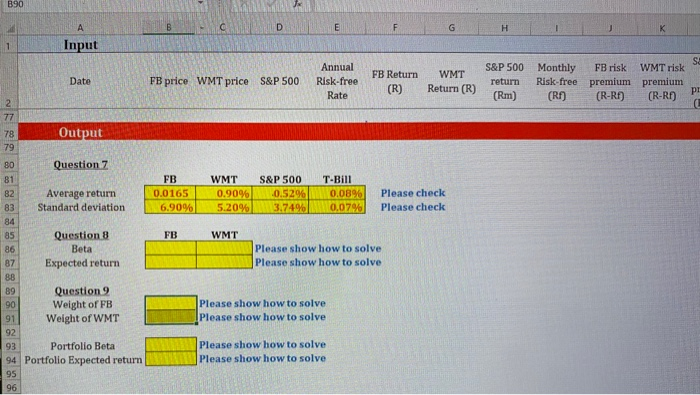

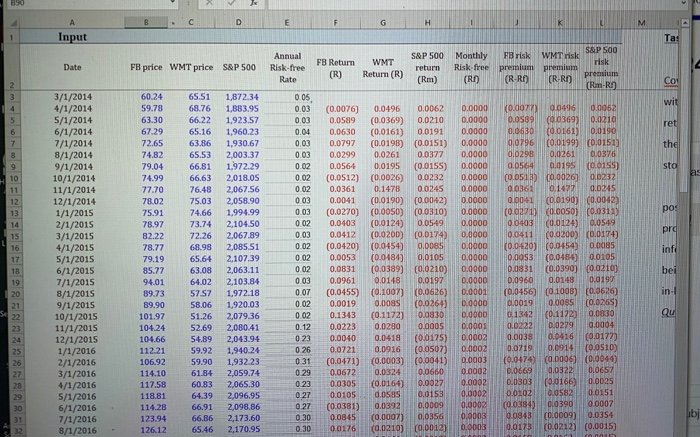

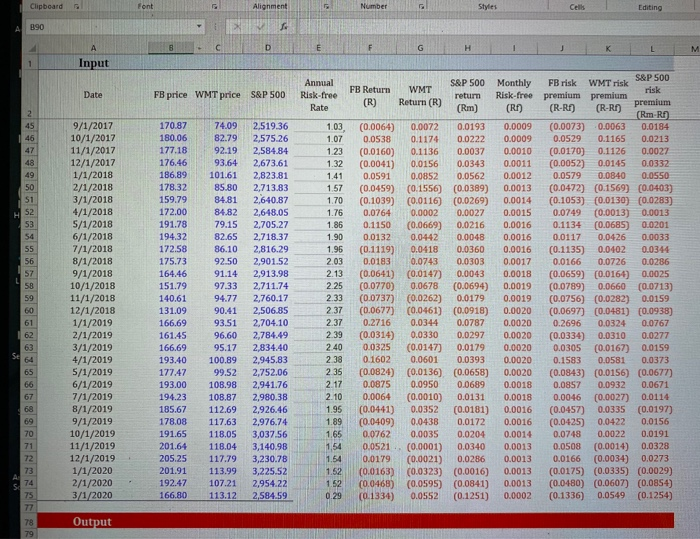

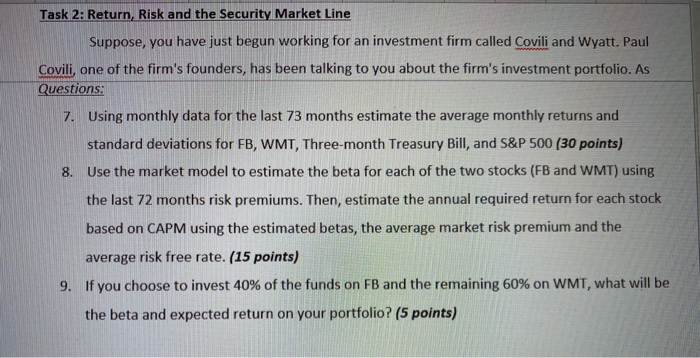

Please help calculate questions 8-9. i attached the data as well. The formulas i was given are not working for this one. Thank you.

If you could just provide the formulas I need to use for questions 8 &9 and reference the column headers so there will be no misunderstanding with terminology, that will be a big help. That's really all I need. I just posted everything else so you knew what I was working with in case it changed how to solve and I wouldn't be asked for additional information.

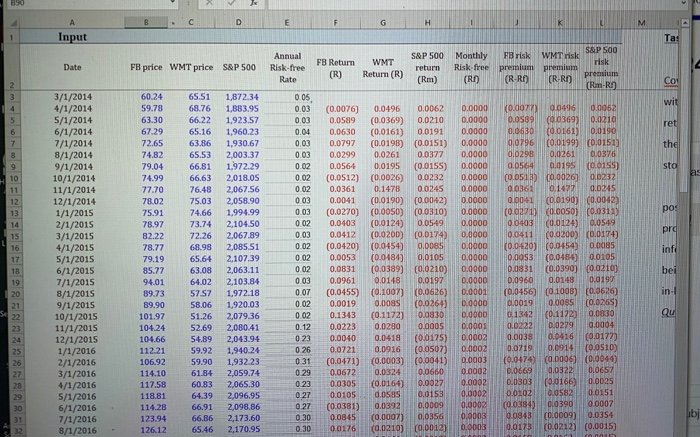

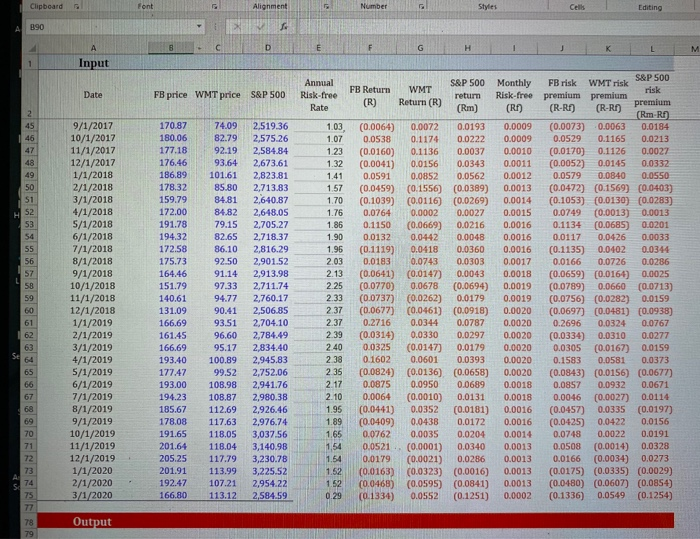

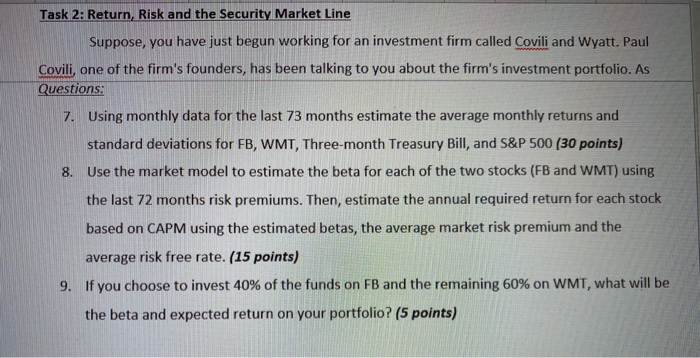

B90 En la FIGHT Input Date FB price WMT price S&P 500 Annual Risk-free Rate FB Return (R) WMT Return (R) S&P 500 return (Rm) Monthly Risk-free (R) FB risk premium (R-RA) WMT risk premium (R-RE) Output Question 7 Average return Standard deviation 0.0165 6.90% WMT 0.90% 5.20% S&P 500 0.52% 3.74% T-Bill 0.0896 0.07% Please check Please check 82 83 84 85 WMT Question 8 Beta Expected return Please show how to solve Please show how to solve 87 89 90 91 Question 9 Weight of FB Weight of WMT Please show how to solve Please show how to solve 93 Portfolio Beta 94 Portfolio Expected return Please show how to solve Please show how to solve 96 B . G Input &P 500 risk Date FB price WMT price S&P 500 Annual Risk-free Rate FB Return (R) WMT Return (R) S&P 500 return (Rm) Monthly Risk-free (RO) FB risk premium (R-R WMT S premium (R-R Premium (Rm-RN 0.05 0.03 0.03 0.04 0.03 0.03 0.02 0.02 0 02 0.03 0.03 0.02 3/1/2014 4/1/2014 5/1/2014 6/1/2014 7/1/2014 8/1/2014 9/1/2014 10/1/2014 11/1/2014 12/1/2014 1/1/2015 2/1/2015 3/1/2015 4/1/2015 5/1/2015 6/1/2015 7/1/2015 8/1/2015 9/1/2015 10/1/2015 11/1/2015 12/1/2015 1/1/2016 2/1/2016 3/1/2016 4/1/2016 5/1/2016 6/1/2016 7/1/2016 8/1/2016 60.24 59.78 63.30 67.29 72.65 74.82 79.04 74.99 77.70 78.02 75.91 78.97 82.22 78.77 79.19 85.77 94.01 39.73 89.90 101.97 104.24 104.66 112.21 106.92 114.10 117.58 118.81 114.28 123.94 126.12 65.51 1,872 34 68.76 1,883.95 66.22 1.923.57 65.16 1.960.23 63.86 1.930.67 65.53 2.003.37 66.81 1.972.29 66.63 2,018.05 76.48 2,067.56 75.03 2.058.90 74.66 1.994.99 73.74 2.10450 72.26 2.067.89 68.98 2.085.51 65.64 2.107.39 63.08 2.063.11 64.02 2.103.84 5757 1.972.18 58.06 1.920,03 51.26 2.079 36 52.69 2,080.41 54.89 2.043.94 59.921,940.24 59.90 1,932.23 61.84 2.059.74 60.83 2,065.30 64.39 2,096.95 66,91 2,098,86 66.86 2,173.60 65. 46 2,170.95 18 0.03 0.02 0.02 002 0.03 0.07 0.02 002 0.12 023 0.26 0.31 (0.0076) 0.0589 0.0630 0.0797 0.0299 0.0564 (0.0512) 0.0361 0.0041 (0.0270) 0.0403 0.0412 (0.0420) 0.0053 0.0031 0.0961 (0.0455) 0.0019 0.1343 0.0223 0.0040 0.0221 0.0471) 0.0672 0.0305 0.0105 (0.0381) 0.0845 0.0176 0.0496 0,0062 0.0000 (0.0369) 0.0210 0.0000 (0.0161) 0.0191 0.0000 (0.019B) (0.0151) 0.0000 0.0261 0.0377 0.0000 0.0195 0.0155) 0,0000 (0.0026) 0.0232 0.0000 0.1478 0.0345 0.0000 (0.0190) (0.0042) 0.0000 (0.0050) (0.0310) 0.0000 (0.0124) 0.0549 0.0000 (0.0200) (0.0174) 0.0000 (0.0454) 0.0085 0.0000 (0.0484) 0.0105 0.0000 (0,03891 0.0210 0.0148 0.0197 0.0000 (0.1007) 0.0626) 0.0001 0.0085 (0.0264) 0.0000 (0.1172 0.08300.0000 0.0280 0.0005 0.0001 0.0418 (0.0175) 0.0002 0,0916 0.05071 0.0002 (0.0003) (0.00413 0.0003 0.0324 0.06600.0002 (0.0164) 0.0027 0.0002 0.05 0.0153 0.0002 0.0392 0.0009 (0.0007) 0.0356 0.0003 (0.0210) 0.00121 0.0003 0.007 0.0496 0.0952 0.0589 (0.0369) 0.0210 0.0630 (0.0161) 0.0190 0.0796 (0.0199) (0.0151) 0.0298 0.0261 0.0376 0.0564 0.0195 (0.0155) (0.0513) (0.0026 0.0232 0.0361 0.1477 0.0245 0.0041 (0.0190) (0.0042) (0.0270 (0.0050) (0.0311) 0.0403 (0.0124) 0.0549 0.0411 (0.0200) (0.0174) (0.0420] (0.0454) 0.0085 0.0053 (0.0484 0.0105 0.0831 (0.0390) (0.0210) 0.0960 0.0148 0.0197 (0.0456) (01008) (0.0626) 0.0019 0.0085 (0.0265) 0.1342 (0.1172) 0.0830 0.0222 0.0279 0.0004 0.0038 0.0416 0.0177 0.0719 0.0911 0.0510) (0.0474) 9.0006) (0.0046 0.0669 0.0322 0.0657 0.0303 0.0166) 00025 0.0102 0.0582 0.0151 0003843 OL0390 0 0007 0.0843 (0.0009) 0.0354 0.0173 (0.0212) (0.0015) 0.23 0.27 027 0.30 - 0 300.017 Clipboard Alignment Number Styles Editing 890 D HIJ K L Input Date FB price WMT price S&P 500 Annual Risk-free Rate FB Return (R) WMT Return (R) S&P 500 return (Rm) 1.03 1.07 123 1.32 1.41 1.57 1.70 1.76 1.86 1.90 0 1.96 2.03 2.13 2 25 9/1/2017 10/1/2017 11/1/2017 12/1/2017 1/1/2018 2/1/2018 3/1/2018 4/1/2018 5/1/2018 6/1/2018 7/1/2018 8/1/2018 9/1/2018 10/1/2018 11/1/2018 12/1/2018 1/1/2019 2/1/2019 3/1/2019 4/1/2019 5/1/2019 6/1/2019 7/1/2019 8/1/2019 9/1/2019 10/1/2019 11/1/2019 12/1/2019 1/1/2020 2/1/2020 3/1/2020 170.87 180.06 177.18 176.46 186.89 178.32 159.79 172.00 191.78 194.32 172.58 175.73 164.46 151.79 140.61 131,09 166.69 161.45 166.69 193.40 177.47 193.00 194.23 185.67 178.08 191.65 201.64 205.25 201.91 192.47 166.80 74.09 82.79 92.19 93.64 101.61 85.80 84.81 84.82 79.15 82.65 86.10 92 50 91.14 97 33 94.77 90.41 93.51 96.60 95.17 100.89 99.52 108.98 108.87 112.69 117.63 118.05 118.04 117.79 113.99 107.21 113.12 2,519.36 2,575.26 2.584.84 2,673.61 2,823.81 2,713.83 2,640.87 2,648.05 2.705.27 2,718.37 2.816.29 2.901.52 2.913.98 2.711.74 2,760.17 2,506.85 2.704.10 2,784.49 2,834.40 2,945.83 2,752.06 2,941.76 2.980.38 2,926.46 2,976.74 3,037.56 3.140.98 3.230.78 3.225.52 2,954.22 2,584.59 (0.0064) 0.0072 0.0538 0.1174 (0.0160) 0.1136 (0.0041) 0.0156 0.0591 0.0852 (0.0459) (0.1556) (0.1039) (0.0116) 0.0764 0.0002 0.1150 (0.0669) 0.0132 0.0442 (0.1119) 0.0418 0.0183 0.0743 (0.0641) (0.0147) 10.0770) 0.0678 (0.0737) (0.0262) (0.0677) (0.0461) 0.2716 0.0344 (0.0314) 0.0330 0.0325 (0.0147) 0.1602 0.0601 (0.0824) (0.0136) 0.0875 0.0950 0.0064 (0.0010) (0.0441) 0.0352 (0.0409) 0.0438 0.0762 0.0035 0.0521 .. (0.0001) 0.0179 (0.0021) (0.0163) (0.0323) (0.0468) (0.0595) (0.1334) 0.0552 2.33 2 37 Monthly FB risk WMT risk S&P 500 Risk-free premium premium risk (R) (R-RI) premium (R-RN (Rm-R 0.0009 (0.0073) 0.0063 0.0184 0.0009 0.0529 0.1165 0.0213 0.0010 (0.0170) 0.1126 0.0027 0.0011 (0.0052) 0.0145 0.0332 0.0012 0.05790.0840 0.0550 0.0013 (0.0472) (0.1569) (0.0403) 0.0014 (0.1053) (0.0130) (0.0283) 0.0015 0.0749 (0.0013) 0.0013 0.0016 0.1134 (0.0685) 0.0201 0.0016 0.0117 0.0426 0.0033 0.0016 (0.1135) 0.0402 0.0344 0.0017 0.0166 0.0726 0.0286 0.0018 (0.0659) (0.0164) 0.0025 0.0019 (0.0789) 0.0660 (0.0713) 0.0019 (0.0756) (0.0282) 0.0159 0.0020 (0.0697) (0.0481) (0.0938) 0.0020 0.2696 0.0324 0.0767 0.0020 (0.0334) 0.0310 0.0277 0.0020 0.0305 (0.0167) 0.0159 0.00200.1583 0.0581 0.0373 0.0020 (0.0843) (0.0156) (0.0677) 0.0018 0.0857 0.0932 0.0671 0.0018 0.0046 (0.0027) 0.0114 0.0016 (0.0457) 0.0335 (0.0197) 0.0016 (0.0425) 0.0422 0.0156 0.0014 0.0748 0.0022 0.0191 0.0013 0.0508 (0.0014) 0.0328 0.0013 0.0166 (0.0034) 0.0273 0.0013 (0.0175) (0.0335) (0.0029) 0.0013 (0.0480) (0.0607) (0.08S4) 0.0002 (0.1336) 0.0549 (0.1254) 0.0193 0.0222 0.0037 0.0343 0.0562 (0.0389) (0.0269) 0.0027 0.0216 0.0048 0.0360 0.0303 0.0043 (0.0694) 0.0179 (0.0918) 0.0787 0.0297 0.0179 0.0393 (0.0658) 0.0689 0.0131 (0.0181) 0.0172 0.0204 0.0340 0.0286 (0.0016) (0.0841) (0.1251) 237 2 39 2.40 238 235 2.17 2.10 1.95 1.89 1.65 1.54 1.54 1.52 0 29 Output Task 2: Return, Risk and the Security Market Line Suppose, you have just begun working for an investment firm called Covili and Wyatt. Paul Covili, one of the firm's founders, has been talking to you about the firm's investment portfolio. As Questions: 7. Using monthly data for the last 73 months estimate the average monthly returns and standard deviations for FB, WMT, Three-month Treasury Bill, and S&P 500 (30 points) 8. Use the market model to estimate the beta for each of the two stocks (FB and WMT) using the last 72 months risk premiums. Then, estimate the annual required return for each stock based on CAPM using the estimated betas, the average market risk premium and the average risk free rate. (15 points) 9. If you choose to invest 40% of the funds on FB and the remaining 60% on WMT, what will be the beta and expected return on your portfolio? (5 points) B90 En la FIGHT Input Date FB price WMT price S&P 500 Annual Risk-free Rate FB Return (R) WMT Return (R) S&P 500 return (Rm) Monthly Risk-free (R) FB risk premium (R-RA) WMT risk premium (R-RE) Output Question 7 Average return Standard deviation 0.0165 6.90% WMT 0.90% 5.20% S&P 500 0.52% 3.74% T-Bill 0.0896 0.07% Please check Please check 82 83 84 85 WMT Question 8 Beta Expected return Please show how to solve Please show how to solve 87 89 90 91 Question 9 Weight of FB Weight of WMT Please show how to solve Please show how to solve 93 Portfolio Beta 94 Portfolio Expected return Please show how to solve Please show how to solve 96 B . G Input &P 500 risk Date FB price WMT price S&P 500 Annual Risk-free Rate FB Return (R) WMT Return (R) S&P 500 return (Rm) Monthly Risk-free (RO) FB risk premium (R-R WMT S premium (R-R Premium (Rm-RN 0.05 0.03 0.03 0.04 0.03 0.03 0.02 0.02 0 02 0.03 0.03 0.02 3/1/2014 4/1/2014 5/1/2014 6/1/2014 7/1/2014 8/1/2014 9/1/2014 10/1/2014 11/1/2014 12/1/2014 1/1/2015 2/1/2015 3/1/2015 4/1/2015 5/1/2015 6/1/2015 7/1/2015 8/1/2015 9/1/2015 10/1/2015 11/1/2015 12/1/2015 1/1/2016 2/1/2016 3/1/2016 4/1/2016 5/1/2016 6/1/2016 7/1/2016 8/1/2016 60.24 59.78 63.30 67.29 72.65 74.82 79.04 74.99 77.70 78.02 75.91 78.97 82.22 78.77 79.19 85.77 94.01 39.73 89.90 101.97 104.24 104.66 112.21 106.92 114.10 117.58 118.81 114.28 123.94 126.12 65.51 1,872 34 68.76 1,883.95 66.22 1.923.57 65.16 1.960.23 63.86 1.930.67 65.53 2.003.37 66.81 1.972.29 66.63 2,018.05 76.48 2,067.56 75.03 2.058.90 74.66 1.994.99 73.74 2.10450 72.26 2.067.89 68.98 2.085.51 65.64 2.107.39 63.08 2.063.11 64.02 2.103.84 5757 1.972.18 58.06 1.920,03 51.26 2.079 36 52.69 2,080.41 54.89 2.043.94 59.921,940.24 59.90 1,932.23 61.84 2.059.74 60.83 2,065.30 64.39 2,096.95 66,91 2,098,86 66.86 2,173.60 65. 46 2,170.95 18 0.03 0.02 0.02 002 0.03 0.07 0.02 002 0.12 023 0.26 0.31 (0.0076) 0.0589 0.0630 0.0797 0.0299 0.0564 (0.0512) 0.0361 0.0041 (0.0270) 0.0403 0.0412 (0.0420) 0.0053 0.0031 0.0961 (0.0455) 0.0019 0.1343 0.0223 0.0040 0.0221 0.0471) 0.0672 0.0305 0.0105 (0.0381) 0.0845 0.0176 0.0496 0,0062 0.0000 (0.0369) 0.0210 0.0000 (0.0161) 0.0191 0.0000 (0.019B) (0.0151) 0.0000 0.0261 0.0377 0.0000 0.0195 0.0155) 0,0000 (0.0026) 0.0232 0.0000 0.1478 0.0345 0.0000 (0.0190) (0.0042) 0.0000 (0.0050) (0.0310) 0.0000 (0.0124) 0.0549 0.0000 (0.0200) (0.0174) 0.0000 (0.0454) 0.0085 0.0000 (0.0484) 0.0105 0.0000 (0,03891 0.0210 0.0148 0.0197 0.0000 (0.1007) 0.0626) 0.0001 0.0085 (0.0264) 0.0000 (0.1172 0.08300.0000 0.0280 0.0005 0.0001 0.0418 (0.0175) 0.0002 0,0916 0.05071 0.0002 (0.0003) (0.00413 0.0003 0.0324 0.06600.0002 (0.0164) 0.0027 0.0002 0.05 0.0153 0.0002 0.0392 0.0009 (0.0007) 0.0356 0.0003 (0.0210) 0.00121 0.0003 0.007 0.0496 0.0952 0.0589 (0.0369) 0.0210 0.0630 (0.0161) 0.0190 0.0796 (0.0199) (0.0151) 0.0298 0.0261 0.0376 0.0564 0.0195 (0.0155) (0.0513) (0.0026 0.0232 0.0361 0.1477 0.0245 0.0041 (0.0190) (0.0042) (0.0270 (0.0050) (0.0311) 0.0403 (0.0124) 0.0549 0.0411 (0.0200) (0.0174) (0.0420] (0.0454) 0.0085 0.0053 (0.0484 0.0105 0.0831 (0.0390) (0.0210) 0.0960 0.0148 0.0197 (0.0456) (01008) (0.0626) 0.0019 0.0085 (0.0265) 0.1342 (0.1172) 0.0830 0.0222 0.0279 0.0004 0.0038 0.0416 0.0177 0.0719 0.0911 0.0510) (0.0474) 9.0006) (0.0046 0.0669 0.0322 0.0657 0.0303 0.0166) 00025 0.0102 0.0582 0.0151 0003843 OL0390 0 0007 0.0843 (0.0009) 0.0354 0.0173 (0.0212) (0.0015) 0.23 0.27 027 0.30 - 0 300.017 Clipboard Alignment Number Styles Editing 890 D HIJ K L Input Date FB price WMT price S&P 500 Annual Risk-free Rate FB Return (R) WMT Return (R) S&P 500 return (Rm) 1.03 1.07 123 1.32 1.41 1.57 1.70 1.76 1.86 1.90 0 1.96 2.03 2.13 2 25 9/1/2017 10/1/2017 11/1/2017 12/1/2017 1/1/2018 2/1/2018 3/1/2018 4/1/2018 5/1/2018 6/1/2018 7/1/2018 8/1/2018 9/1/2018 10/1/2018 11/1/2018 12/1/2018 1/1/2019 2/1/2019 3/1/2019 4/1/2019 5/1/2019 6/1/2019 7/1/2019 8/1/2019 9/1/2019 10/1/2019 11/1/2019 12/1/2019 1/1/2020 2/1/2020 3/1/2020 170.87 180.06 177.18 176.46 186.89 178.32 159.79 172.00 191.78 194.32 172.58 175.73 164.46 151.79 140.61 131,09 166.69 161.45 166.69 193.40 177.47 193.00 194.23 185.67 178.08 191.65 201.64 205.25 201.91 192.47 166.80 74.09 82.79 92.19 93.64 101.61 85.80 84.81 84.82 79.15 82.65 86.10 92 50 91.14 97 33 94.77 90.41 93.51 96.60 95.17 100.89 99.52 108.98 108.87 112.69 117.63 118.05 118.04 117.79 113.99 107.21 113.12 2,519.36 2,575.26 2.584.84 2,673.61 2,823.81 2,713.83 2,640.87 2,648.05 2.705.27 2,718.37 2.816.29 2.901.52 2.913.98 2.711.74 2,760.17 2,506.85 2.704.10 2,784.49 2,834.40 2,945.83 2,752.06 2,941.76 2.980.38 2,926.46 2,976.74 3,037.56 3.140.98 3.230.78 3.225.52 2,954.22 2,584.59 (0.0064) 0.0072 0.0538 0.1174 (0.0160) 0.1136 (0.0041) 0.0156 0.0591 0.0852 (0.0459) (0.1556) (0.1039) (0.0116) 0.0764 0.0002 0.1150 (0.0669) 0.0132 0.0442 (0.1119) 0.0418 0.0183 0.0743 (0.0641) (0.0147) 10.0770) 0.0678 (0.0737) (0.0262) (0.0677) (0.0461) 0.2716 0.0344 (0.0314) 0.0330 0.0325 (0.0147) 0.1602 0.0601 (0.0824) (0.0136) 0.0875 0.0950 0.0064 (0.0010) (0.0441) 0.0352 (0.0409) 0.0438 0.0762 0.0035 0.0521 .. (0.0001) 0.0179 (0.0021) (0.0163) (0.0323) (0.0468) (0.0595) (0.1334) 0.0552 2.33 2 37 Monthly FB risk WMT risk S&P 500 Risk-free premium premium risk (R) (R-RI) premium (R-RN (Rm-R 0.0009 (0.0073) 0.0063 0.0184 0.0009 0.0529 0.1165 0.0213 0.0010 (0.0170) 0.1126 0.0027 0.0011 (0.0052) 0.0145 0.0332 0.0012 0.05790.0840 0.0550 0.0013 (0.0472) (0.1569) (0.0403) 0.0014 (0.1053) (0.0130) (0.0283) 0.0015 0.0749 (0.0013) 0.0013 0.0016 0.1134 (0.0685) 0.0201 0.0016 0.0117 0.0426 0.0033 0.0016 (0.1135) 0.0402 0.0344 0.0017 0.0166 0.0726 0.0286 0.0018 (0.0659) (0.0164) 0.0025 0.0019 (0.0789) 0.0660 (0.0713) 0.0019 (0.0756) (0.0282) 0.0159 0.0020 (0.0697) (0.0481) (0.0938) 0.0020 0.2696 0.0324 0.0767 0.0020 (0.0334) 0.0310 0.0277 0.0020 0.0305 (0.0167) 0.0159 0.00200.1583 0.0581 0.0373 0.0020 (0.0843) (0.0156) (0.0677) 0.0018 0.0857 0.0932 0.0671 0.0018 0.0046 (0.0027) 0.0114 0.0016 (0.0457) 0.0335 (0.0197) 0.0016 (0.0425) 0.0422 0.0156 0.0014 0.0748 0.0022 0.0191 0.0013 0.0508 (0.0014) 0.0328 0.0013 0.0166 (0.0034) 0.0273 0.0013 (0.0175) (0.0335) (0.0029) 0.0013 (0.0480) (0.0607) (0.08S4) 0.0002 (0.1336) 0.0549 (0.1254) 0.0193 0.0222 0.0037 0.0343 0.0562 (0.0389) (0.0269) 0.0027 0.0216 0.0048 0.0360 0.0303 0.0043 (0.0694) 0.0179 (0.0918) 0.0787 0.0297 0.0179 0.0393 (0.0658) 0.0689 0.0131 (0.0181) 0.0172 0.0204 0.0340 0.0286 (0.0016) (0.0841) (0.1251) 237 2 39 2.40 238 235 2.17 2.10 1.95 1.89 1.65 1.54 1.54 1.52 0 29 Output Task 2: Return, Risk and the Security Market Line Suppose, you have just begun working for an investment firm called Covili and Wyatt. Paul Covili, one of the firm's founders, has been talking to you about the firm's investment portfolio. As Questions: 7. Using monthly data for the last 73 months estimate the average monthly returns and standard deviations for FB, WMT, Three-month Treasury Bill, and S&P 500 (30 points) 8. Use the market model to estimate the beta for each of the two stocks (FB and WMT) using the last 72 months risk premiums. Then, estimate the annual required return for each stock based on CAPM using the estimated betas, the average market risk premium and the average risk free rate. (15 points) 9. If you choose to invest 40% of the funds on FB and the remaining 60% on WMT, what will be the beta and expected return on your portfolio? (5 points)