Question

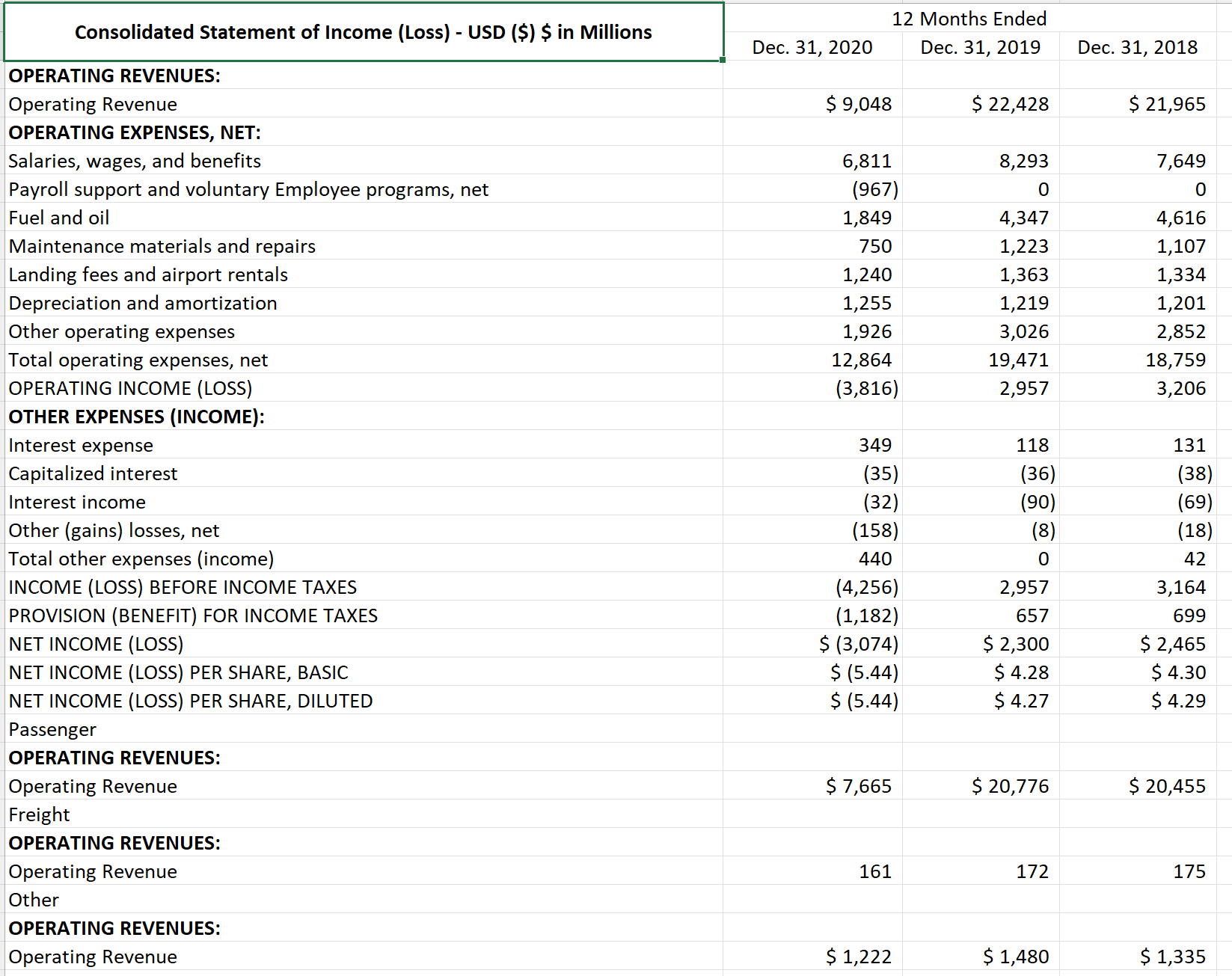

Please help calculate the following ratios below based on the financial statements below for Southwest Airlines from 2019-2020: Gross profit margin Operating profit margin Net

Please help calculate the following ratios below based on the financial statements below for Southwest Airlines from 2019-2020:

Gross profit margin

Operating profit margin

Net profit margin or net return on sales

Total return on assets

Net return on total assets (ROA)

Return on stockholder's equity (ROE)

Return on invested capital (ROIC) or return on capital employed

Earnings per share (EPS)

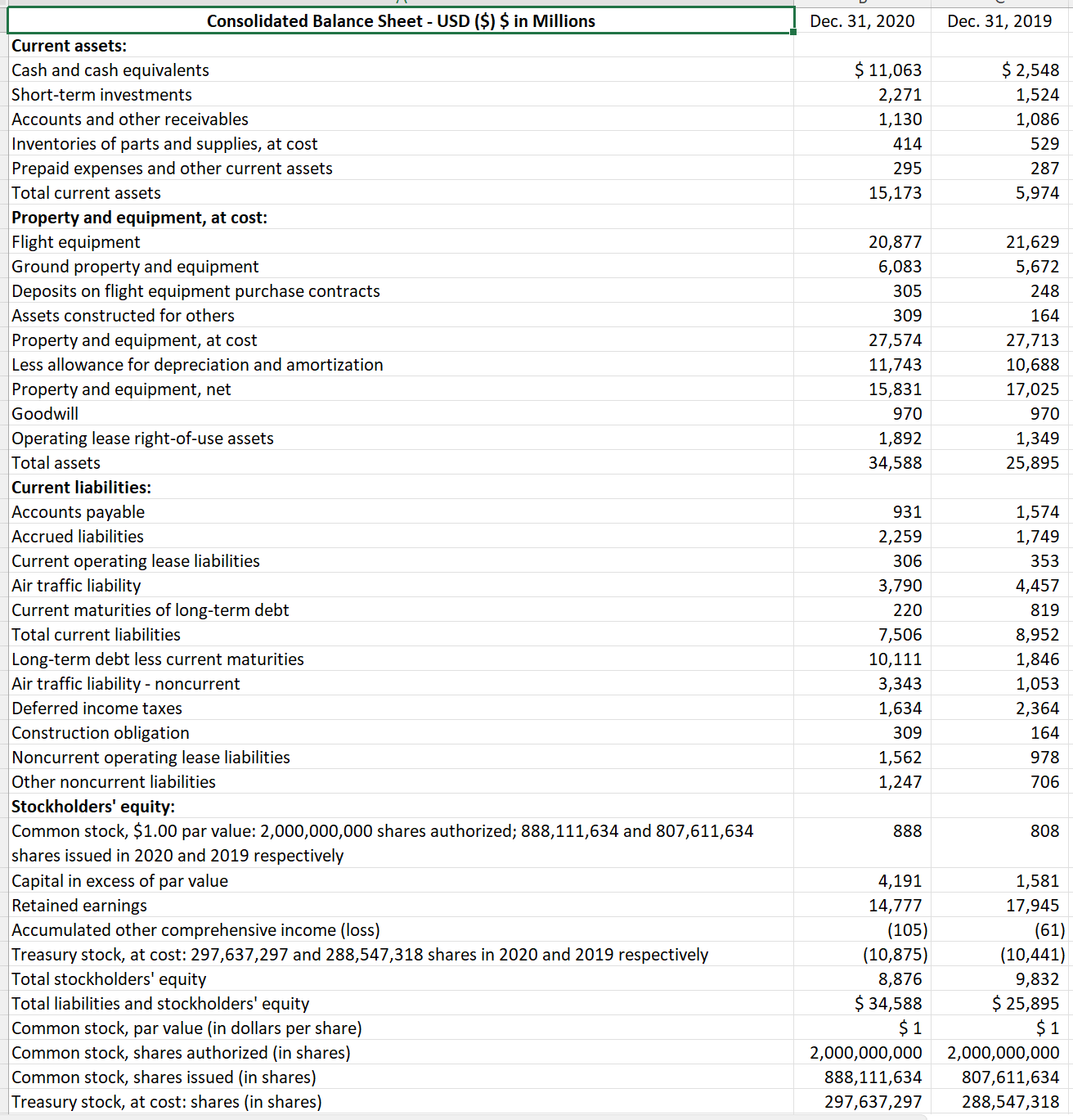

Current ratio

Working capital

Total debt to assets ratio

Long-term debt-to-capital ratio

Debt to equity ratio

Long-term debt to-equity ratio

Times-interest-earned or coverage ratio

Days of inventory

Inventory turnover

Average Collection

Period Price-to-earnings ratio

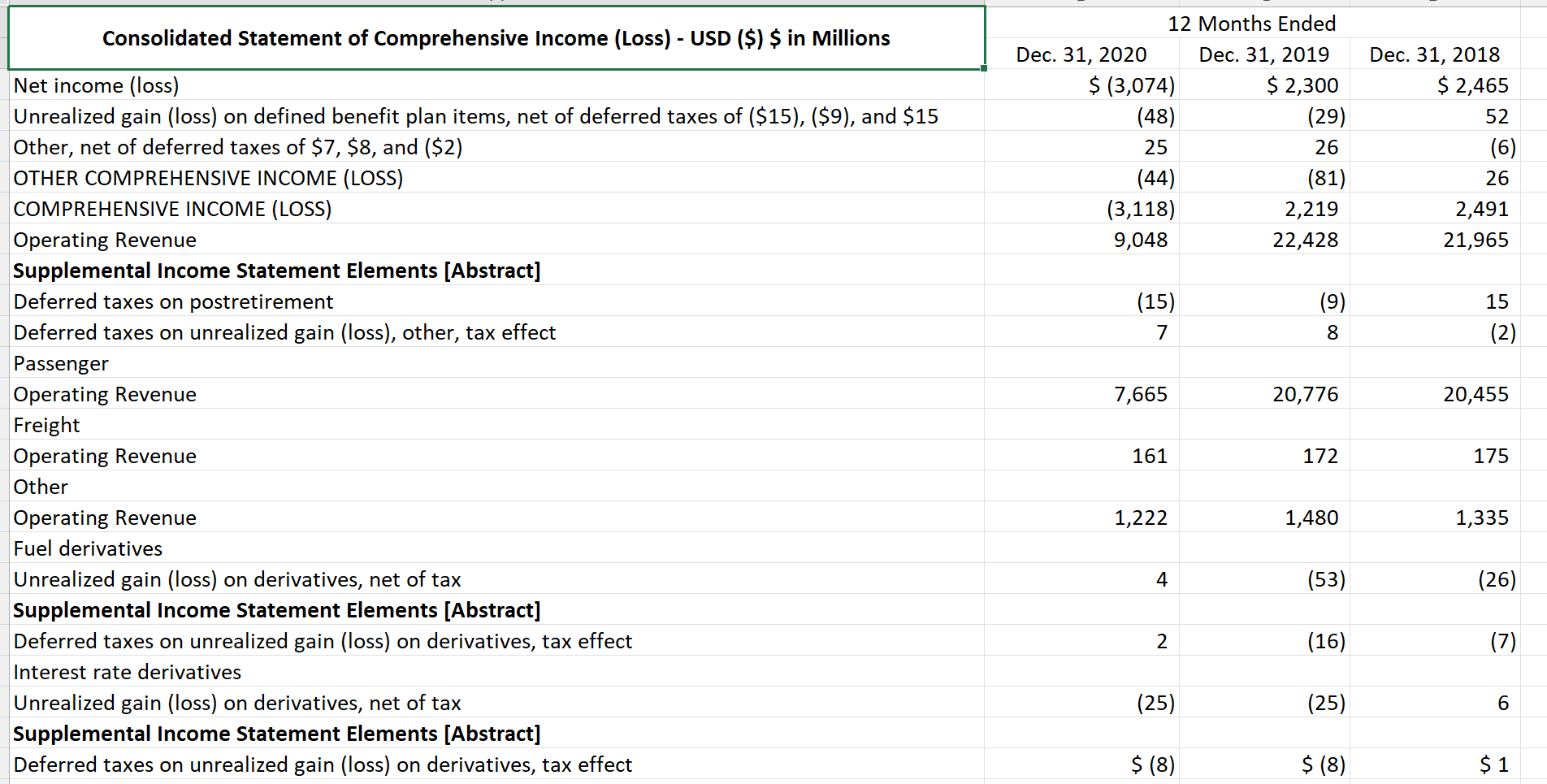

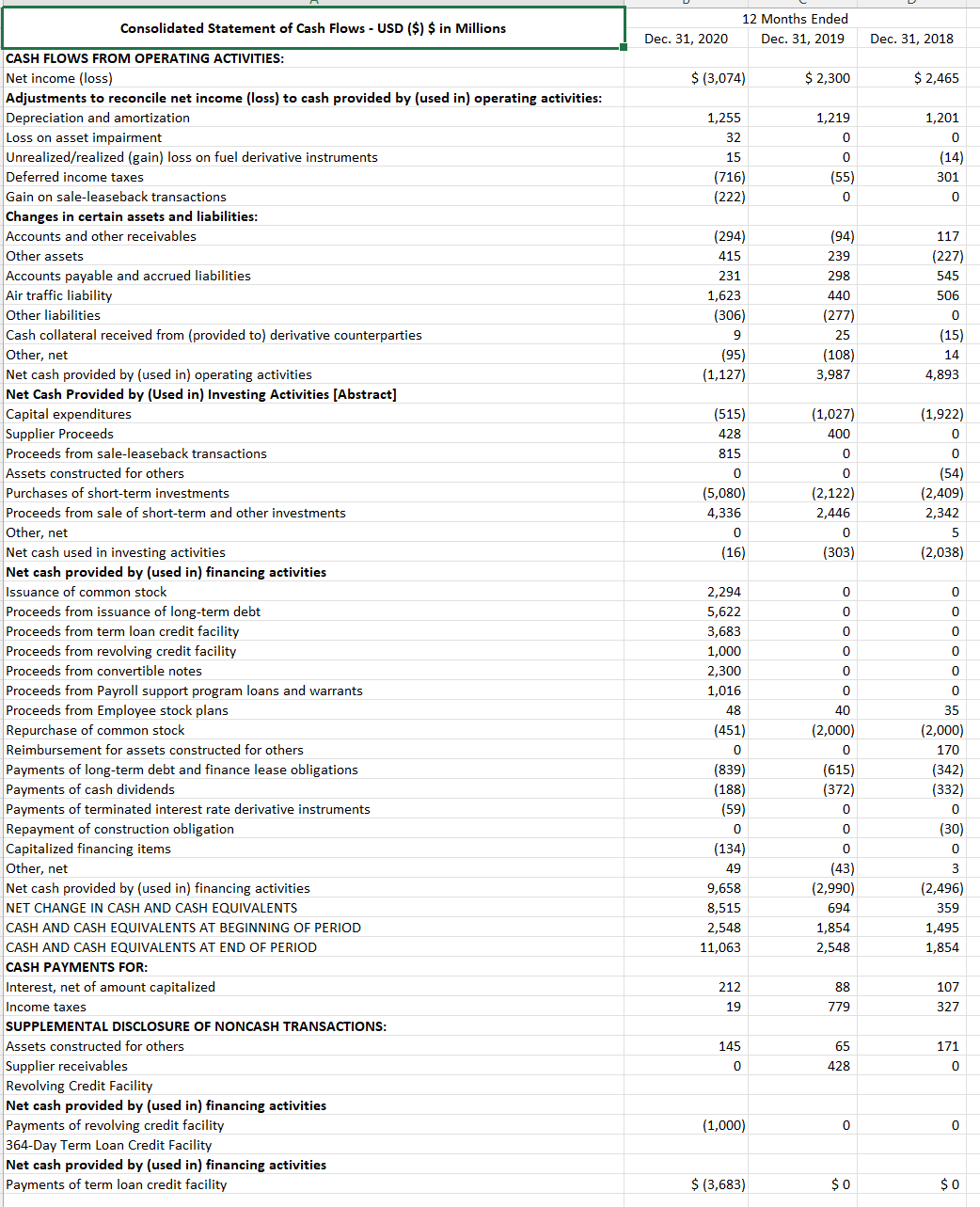

Consolidated Statement of Comprehensive Income (Loss) - USD (\$) \$ in Millions Net income (loss) Unrealized gain (loss) on defined benefit plan items, net of deferred taxes of ($15),($9), and $15 Other, net of deferred taxes of \$7, \$8, and (\$2) OTHER COMPREHENSIVE INCOME (LOSS) COMPREHENSIVE INCOME (LOSS) Operating Revenue Supplemental Income Statement Elements [Abstract] Deferred taxes on postretirement Deferred taxes on unrealized gain (loss), other, tax effect Passenger Operating Revenue Freight Operating Revenue Other Operating Revenue Fuel derivatives Unrealized gain (loss) on derivatives, net of tax Supplemental Income Statement Elements [Abstract] Deferred taxes on unrealized gain (loss) on derivatives, tax effect Interest rate derivatives Unrealized gain (loss) on derivatives, net of tax Supplemental Income Statement Elements [Abstract] Deferred taxes on unrealized gain (loss) on derivatives, tax effect 12 Months Ended Dec. 31, 2020 Dec. 31, 2019 Dec. 31, 2018 $(3,074) $2,300 $2,465 (29) 52 (6) (44) (3,118) (81) 26 9,048 2,219 2,491 22,428 21,965 (15) (9) 15 7 8 (2) 7,665 20,776 161 172 1,222 4 2 (25) (25) $(8) $(8) $(8) (53) (26) (7) 175 1,480 1,335 20,455 175 1,335 (26) (7) 6 $1 Consolidated Statement of Cash Flows - USD (\$) \$ in Millions 12 Months Ended CASH FLOWS FROM OPERATING ACTIVITIES: Net income (loss) Adjustments to reconcile net income (loss) to cash provided by (used in) operating activities: Depreciation and amortization Loss on asset impairment Unrealized/realized (gain) loss on fuel derivative instruments Deferred income taxes Gain on sale-leaseback transactions Changes in certain assets and liabilities: Accounts and other receivables Other assets Accounts payable and accrued liabilities Air traffic liability Other liabilities Cash collateral received from (provided to) derivative counterparties Other, net Net cash provided by (used in) operating activities Net Cash Provided by (Used in) Investing Activities [Abstract] Capital expenditures Supplier Proceeds Proceeds from sale-leaseback transactions Assets constructed for others Purchases of short-term investments Proceeds from sale of short-term and other investments Other, net Net cash used in investing activities Net cash provided by (used in) financing activities Issuance of common stock Proceeds from issuance of long-term debt Proceeds from term loan credit facility Proceeds from revolving credit facility Proceeds from convertible notes Proceeds from Payroll support program loans and warrants Proceeds from Employee stock plans Repurchase of common stock Reimbursement for assets constructed for others Payments of long-term debt and finance lease obligations Payments of cash dividends Payments of terminated interest rate derivative instruments Repayment of construction obligation Capitalized financing items Other, net Net cash provided by (used in) financing activities NET CHANGE IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD CASH AND CASH EQUIVALENTS AT END OF PERIOD CASH PAYMENTS FOR: Interest, net of amount capitalized Income taxes SUPPLEMENTAL DISCLOSURE OF NONCASH TRANSACTIONS: Assets constructed for others Supplier receivables Revolving Credit Facility Net cash provided by (used in) financing activities Payments of revolving credit facility Dec. 31,2020 Dec. 31, 2018 364-Day Term Loan Credit Facility Net cash provided by (used in) financing activities Payments of term loan credit facility $(3,074) 1,255 32 15 (716) (222) (294) 415 231 1,623 (306) 9 (95) (1,127) (515) 428 815 0 (5,080) 4,336 0 (16) 2,294 5,622 3,683 1,000 2,300 1,016 48 (451) 0 (839) (188) (59) 0 (134) 49 9,658 8,515 2,548 11,063 212 19 145 0 (1,000) $(3,683) $(3,683) $2,300 1,219 0 0 (55) 0 (94) 239 298 440 (277) 25 (108) 3,987 (1,027) 400 0 0 (2,122) 2,446 0 (303) 0 0 0 0 0 0 40 (2,000) 0 (615) (372) 0 0 0 (43) (2,990) 694 1,854 2,548 88 779 65 428 0 0 (2,000) 170 (342) (332) 0 (30) 0 3 (2,496) 359 1,495 1,854 107 327 171 0 0 \begin{tabular}{|l|l|l|l|l|l|} \hline Payments of term loan credit facility & $(3,683) \\ \hline \end{tabular} $0 $0 0 Consolidated Statement of Comprehensive Income (Loss) - USD (\$) \$ in Millions Net income (loss) Unrealized gain (loss) on defined benefit plan items, net of deferred taxes of ($15),($9), and $15 Other, net of deferred taxes of \$7, \$8, and (\$2) OTHER COMPREHENSIVE INCOME (LOSS) COMPREHENSIVE INCOME (LOSS) Operating Revenue Supplemental Income Statement Elements [Abstract] Deferred taxes on postretirement Deferred taxes on unrealized gain (loss), other, tax effect Passenger Operating Revenue Freight Operating Revenue Other Operating Revenue Fuel derivatives Unrealized gain (loss) on derivatives, net of tax Supplemental Income Statement Elements [Abstract] Deferred taxes on unrealized gain (loss) on derivatives, tax effect Interest rate derivatives Unrealized gain (loss) on derivatives, net of tax Supplemental Income Statement Elements [Abstract] Deferred taxes on unrealized gain (loss) on derivatives, tax effect 12 Months Ended Dec. 31, 2020 Dec. 31, 2019 Dec. 31, 2018 $(3,074) $2,300 $2,465 (29) 52 (6) (44) (3,118) (81) 26 9,048 2,219 2,491 22,428 21,965 (15) (9) 15 7 8 (2) 7,665 20,776 161 172 1,222 4 2 (25) (25) $(8) $(8) $(8) (53) (26) (7) 175 1,480 1,335 20,455 175 1,335 (26) (7) 6 $1 Consolidated Statement of Cash Flows - USD (\$) \$ in Millions 12 Months Ended CASH FLOWS FROM OPERATING ACTIVITIES: Net income (loss) Adjustments to reconcile net income (loss) to cash provided by (used in) operating activities: Depreciation and amortization Loss on asset impairment Unrealized/realized (gain) loss on fuel derivative instruments Deferred income taxes Gain on sale-leaseback transactions Changes in certain assets and liabilities: Accounts and other receivables Other assets Accounts payable and accrued liabilities Air traffic liability Other liabilities Cash collateral received from (provided to) derivative counterparties Other, net Net cash provided by (used in) operating activities Net Cash Provided by (Used in) Investing Activities [Abstract] Capital expenditures Supplier Proceeds Proceeds from sale-leaseback transactions Assets constructed for others Purchases of short-term investments Proceeds from sale of short-term and other investments Other, net Net cash used in investing activities Net cash provided by (used in) financing activities Issuance of common stock Proceeds from issuance of long-term debt Proceeds from term loan credit facility Proceeds from revolving credit facility Proceeds from convertible notes Proceeds from Payroll support program loans and warrants Proceeds from Employee stock plans Repurchase of common stock Reimbursement for assets constructed for others Payments of long-term debt and finance lease obligations Payments of cash dividends Payments of terminated interest rate derivative instruments Repayment of construction obligation Capitalized financing items Other, net Net cash provided by (used in) financing activities NET CHANGE IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD CASH AND CASH EQUIVALENTS AT END OF PERIOD CASH PAYMENTS FOR: Interest, net of amount capitalized Income taxes SUPPLEMENTAL DISCLOSURE OF NONCASH TRANSACTIONS: Assets constructed for others Supplier receivables Revolving Credit Facility Net cash provided by (used in) financing activities Payments of revolving credit facility Dec. 31,2020 Dec. 31, 2018 364-Day Term Loan Credit Facility Net cash provided by (used in) financing activities Payments of term loan credit facility $(3,074) 1,255 32 15 (716) (222) (294) 415 231 1,623 (306) 9 (95) (1,127) (515) 428 815 0 (5,080) 4,336 0 (16) 2,294 5,622 3,683 1,000 2,300 1,016 48 (451) 0 (839) (188) (59) 0 (134) 49 9,658 8,515 2,548 11,063 212 19 145 0 (1,000) $(3,683) $(3,683) $2,300 1,219 0 0 (55) 0 (94) 239 298 440 (277) 25 (108) 3,987 (1,027) 400 0 0 (2,122) 2,446 0 (303) 0 0 0 0 0 0 40 (2,000) 0 (615) (372) 0 0 0 (43) (2,990) 694 1,854 2,548 88 779 65 428 0 0 (2,000) 170 (342) (332) 0 (30) 0 3 (2,496) 359 1,495 1,854 107 327 171 0 0 \begin{tabular}{|l|l|l|l|l|l|} \hline Payments of term loan credit facility & $(3,683) \\ \hline \end{tabular} $0 $0 0

Consolidated Statement of Comprehensive Income (Loss) - USD (\$) \$ in Millions Net income (loss) Unrealized gain (loss) on defined benefit plan items, net of deferred taxes of ($15),($9), and $15 Other, net of deferred taxes of \$7, \$8, and (\$2) OTHER COMPREHENSIVE INCOME (LOSS) COMPREHENSIVE INCOME (LOSS) Operating Revenue Supplemental Income Statement Elements [Abstract] Deferred taxes on postretirement Deferred taxes on unrealized gain (loss), other, tax effect Passenger Operating Revenue Freight Operating Revenue Other Operating Revenue Fuel derivatives Unrealized gain (loss) on derivatives, net of tax Supplemental Income Statement Elements [Abstract] Deferred taxes on unrealized gain (loss) on derivatives, tax effect Interest rate derivatives Unrealized gain (loss) on derivatives, net of tax Supplemental Income Statement Elements [Abstract] Deferred taxes on unrealized gain (loss) on derivatives, tax effect 12 Months Ended Dec. 31, 2020 Dec. 31, 2019 Dec. 31, 2018 $(3,074) $2,300 $2,465 (29) 52 (6) (44) (3,118) (81) 26 9,048 2,219 2,491 22,428 21,965 (15) (9) 15 7 8 (2) 7,665 20,776 161 172 1,222 4 2 (25) (25) $(8) $(8) $(8) (53) (26) (7) 175 1,480 1,335 20,455 175 1,335 (26) (7) 6 $1 Consolidated Statement of Cash Flows - USD (\$) \$ in Millions 12 Months Ended CASH FLOWS FROM OPERATING ACTIVITIES: Net income (loss) Adjustments to reconcile net income (loss) to cash provided by (used in) operating activities: Depreciation and amortization Loss on asset impairment Unrealized/realized (gain) loss on fuel derivative instruments Deferred income taxes Gain on sale-leaseback transactions Changes in certain assets and liabilities: Accounts and other receivables Other assets Accounts payable and accrued liabilities Air traffic liability Other liabilities Cash collateral received from (provided to) derivative counterparties Other, net Net cash provided by (used in) operating activities Net Cash Provided by (Used in) Investing Activities [Abstract] Capital expenditures Supplier Proceeds Proceeds from sale-leaseback transactions Assets constructed for others Purchases of short-term investments Proceeds from sale of short-term and other investments Other, net Net cash used in investing activities Net cash provided by (used in) financing activities Issuance of common stock Proceeds from issuance of long-term debt Proceeds from term loan credit facility Proceeds from revolving credit facility Proceeds from convertible notes Proceeds from Payroll support program loans and warrants Proceeds from Employee stock plans Repurchase of common stock Reimbursement for assets constructed for others Payments of long-term debt and finance lease obligations Payments of cash dividends Payments of terminated interest rate derivative instruments Repayment of construction obligation Capitalized financing items Other, net Net cash provided by (used in) financing activities NET CHANGE IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD CASH AND CASH EQUIVALENTS AT END OF PERIOD CASH PAYMENTS FOR: Interest, net of amount capitalized Income taxes SUPPLEMENTAL DISCLOSURE OF NONCASH TRANSACTIONS: Assets constructed for others Supplier receivables Revolving Credit Facility Net cash provided by (used in) financing activities Payments of revolving credit facility Dec. 31,2020 Dec. 31, 2018 364-Day Term Loan Credit Facility Net cash provided by (used in) financing activities Payments of term loan credit facility $(3,074) 1,255 32 15 (716) (222) (294) 415 231 1,623 (306) 9 (95) (1,127) (515) 428 815 0 (5,080) 4,336 0 (16) 2,294 5,622 3,683 1,000 2,300 1,016 48 (451) 0 (839) (188) (59) 0 (134) 49 9,658 8,515 2,548 11,063 212 19 145 0 (1,000) $(3,683) $(3,683) $2,300 1,219 0 0 (55) 0 (94) 239 298 440 (277) 25 (108) 3,987 (1,027) 400 0 0 (2,122) 2,446 0 (303) 0 0 0 0 0 0 40 (2,000) 0 (615) (372) 0 0 0 (43) (2,990) 694 1,854 2,548 88 779 65 428 0 0 (2,000) 170 (342) (332) 0 (30) 0 3 (2,496) 359 1,495 1,854 107 327 171 0 0 \begin{tabular}{|l|l|l|l|l|l|} \hline Payments of term loan credit facility & $(3,683) \\ \hline \end{tabular} $0 $0 0 Consolidated Statement of Comprehensive Income (Loss) - USD (\$) \$ in Millions Net income (loss) Unrealized gain (loss) on defined benefit plan items, net of deferred taxes of ($15),($9), and $15 Other, net of deferred taxes of \$7, \$8, and (\$2) OTHER COMPREHENSIVE INCOME (LOSS) COMPREHENSIVE INCOME (LOSS) Operating Revenue Supplemental Income Statement Elements [Abstract] Deferred taxes on postretirement Deferred taxes on unrealized gain (loss), other, tax effect Passenger Operating Revenue Freight Operating Revenue Other Operating Revenue Fuel derivatives Unrealized gain (loss) on derivatives, net of tax Supplemental Income Statement Elements [Abstract] Deferred taxes on unrealized gain (loss) on derivatives, tax effect Interest rate derivatives Unrealized gain (loss) on derivatives, net of tax Supplemental Income Statement Elements [Abstract] Deferred taxes on unrealized gain (loss) on derivatives, tax effect 12 Months Ended Dec. 31, 2020 Dec. 31, 2019 Dec. 31, 2018 $(3,074) $2,300 $2,465 (29) 52 (6) (44) (3,118) (81) 26 9,048 2,219 2,491 22,428 21,965 (15) (9) 15 7 8 (2) 7,665 20,776 161 172 1,222 4 2 (25) (25) $(8) $(8) $(8) (53) (26) (7) 175 1,480 1,335 20,455 175 1,335 (26) (7) 6 $1 Consolidated Statement of Cash Flows - USD (\$) \$ in Millions 12 Months Ended CASH FLOWS FROM OPERATING ACTIVITIES: Net income (loss) Adjustments to reconcile net income (loss) to cash provided by (used in) operating activities: Depreciation and amortization Loss on asset impairment Unrealized/realized (gain) loss on fuel derivative instruments Deferred income taxes Gain on sale-leaseback transactions Changes in certain assets and liabilities: Accounts and other receivables Other assets Accounts payable and accrued liabilities Air traffic liability Other liabilities Cash collateral received from (provided to) derivative counterparties Other, net Net cash provided by (used in) operating activities Net Cash Provided by (Used in) Investing Activities [Abstract] Capital expenditures Supplier Proceeds Proceeds from sale-leaseback transactions Assets constructed for others Purchases of short-term investments Proceeds from sale of short-term and other investments Other, net Net cash used in investing activities Net cash provided by (used in) financing activities Issuance of common stock Proceeds from issuance of long-term debt Proceeds from term loan credit facility Proceeds from revolving credit facility Proceeds from convertible notes Proceeds from Payroll support program loans and warrants Proceeds from Employee stock plans Repurchase of common stock Reimbursement for assets constructed for others Payments of long-term debt and finance lease obligations Payments of cash dividends Payments of terminated interest rate derivative instruments Repayment of construction obligation Capitalized financing items Other, net Net cash provided by (used in) financing activities NET CHANGE IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD CASH AND CASH EQUIVALENTS AT END OF PERIOD CASH PAYMENTS FOR: Interest, net of amount capitalized Income taxes SUPPLEMENTAL DISCLOSURE OF NONCASH TRANSACTIONS: Assets constructed for others Supplier receivables Revolving Credit Facility Net cash provided by (used in) financing activities Payments of revolving credit facility Dec. 31,2020 Dec. 31, 2018 364-Day Term Loan Credit Facility Net cash provided by (used in) financing activities Payments of term loan credit facility $(3,074) 1,255 32 15 (716) (222) (294) 415 231 1,623 (306) 9 (95) (1,127) (515) 428 815 0 (5,080) 4,336 0 (16) 2,294 5,622 3,683 1,000 2,300 1,016 48 (451) 0 (839) (188) (59) 0 (134) 49 9,658 8,515 2,548 11,063 212 19 145 0 (1,000) $(3,683) $(3,683) $2,300 1,219 0 0 (55) 0 (94) 239 298 440 (277) 25 (108) 3,987 (1,027) 400 0 0 (2,122) 2,446 0 (303) 0 0 0 0 0 0 40 (2,000) 0 (615) (372) 0 0 0 (43) (2,990) 694 1,854 2,548 88 779 65 428 0 0 (2,000) 170 (342) (332) 0 (30) 0 3 (2,496) 359 1,495 1,854 107 327 171 0 0 \begin{tabular}{|l|l|l|l|l|l|} \hline Payments of term loan credit facility & $(3,683) \\ \hline \end{tabular} $0 $0 0 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started