please help calculating.

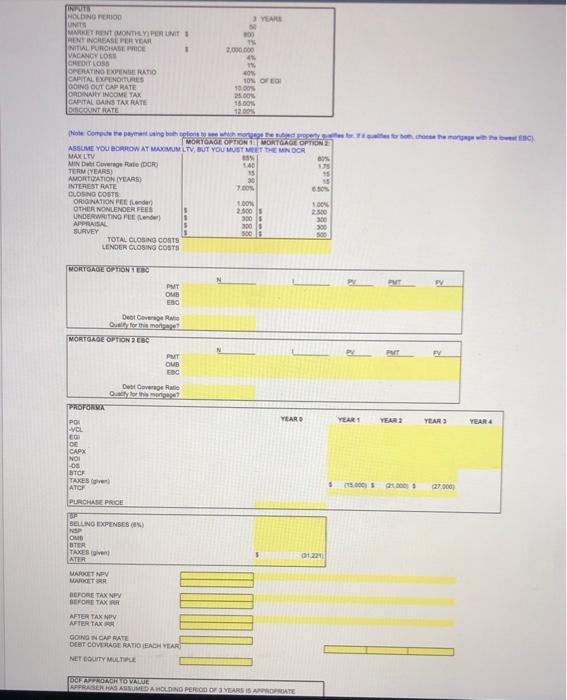

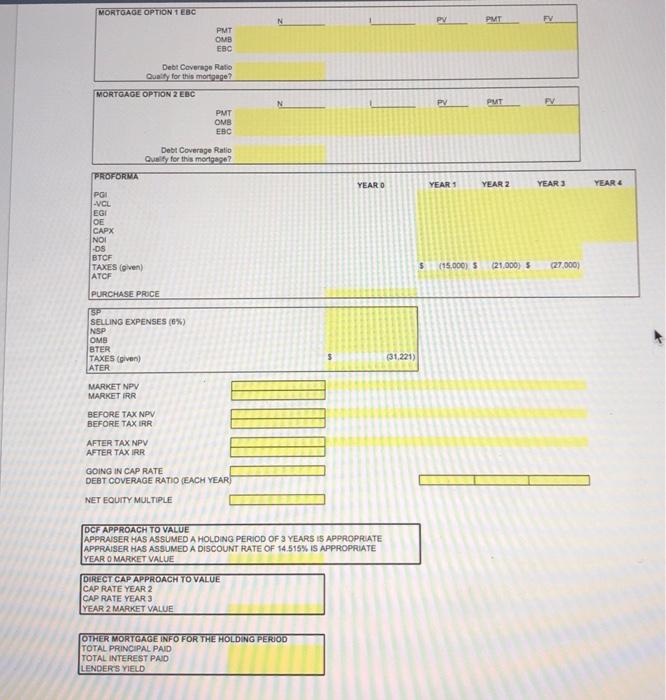

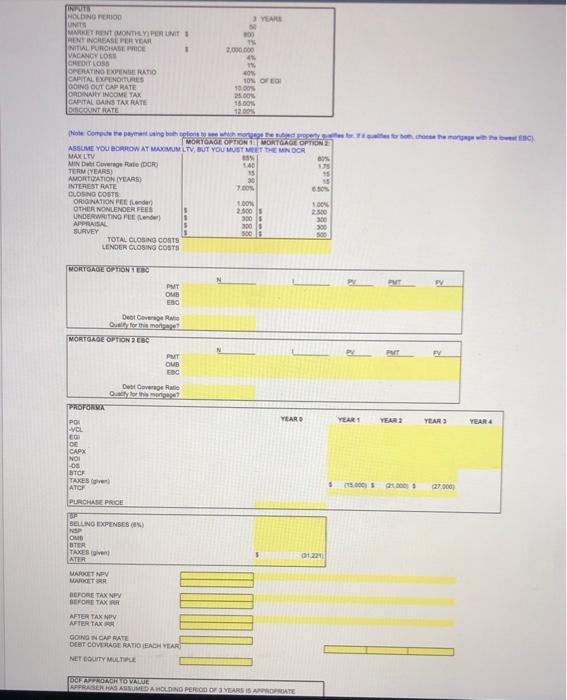

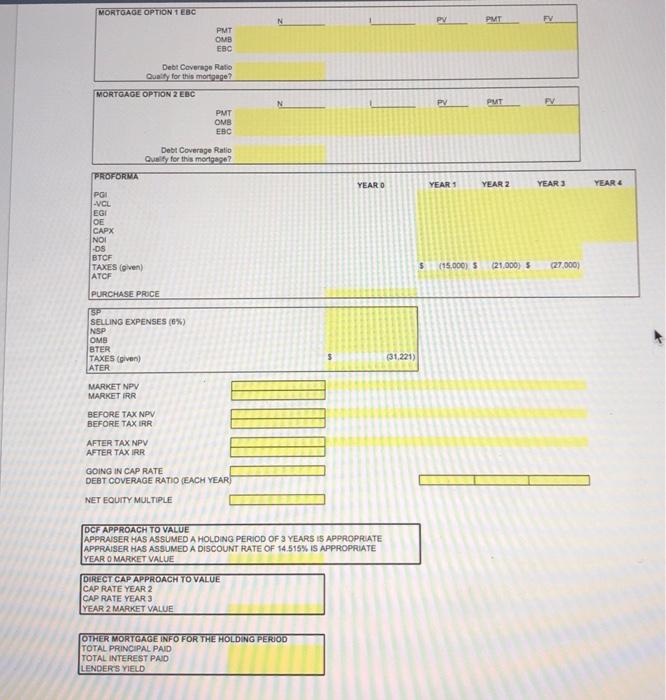

theres a note written in blue.

3 YEARS UNITS 00 1 INPUTS HOCONO PERIOD METRO MONTHLY POR UNIT RENT INCREASE PER YEAR NITAL PURCHASE PRICE VACANCY LOS CREDIT LOSS ROLATINO EXPERATIO CAPITAL EXPENDITURES OOING OUT CAP RATE ORDINARY INDOME TAX CAPITAL OAINS TAX RATE DISCOUNT RATE 2.000.000 41 609 10% OF 18.00 25.00 15.00 12.00 hecho C Noored the parenting both pline deporty MORTGAGE OPTIONS MORTGAGE OPTION ASSUME YOU BORROW AT MAXIMUM LTV, BUT YOU MUST MEET THE MNDOR MAX LTV MIND Overage Rate (DOR 140 135 TERMIYEARS 95 AMORTATION YEARS) 30 INTEREST RATE 7.00 CUOSNO COSTI ORIONATION FEEL 100 OTHER NONLENDER FEES 100 2.300 UNDERWRITINOPEL 2.5 300S 300 APPRAISAL 3000 > SURVEY 500 TOTAL CLOSING COSTS LENDER CLOSING COSTS MORTGAGE OPTION TE N PMT EM PUT OS Debt Cover MORTGAGE OPTION 2 EBC PMT OUB EDC Debt Coverage Rate PROFORA YEAR YEAR YEAR YEAR YEAR 4 PO -VOL CO OE CAPX NOI 00 BTCF TANES ATCH PURCHASE PRICE 13.00 27.000 SELLING EXPENSES NS OM BER TAXES ATER 5 01221 MARET NV MAGETRA BEFORE TAX NP BEFORE TAX RR AFTER TAXNPY AFTER TAX GON NCAP RATE DEBT COVERAGE RATIO EACH YEAR NET BOUTY MULTE DAFTSPROGRAO VALUE APRASERHAS ASSUMEDA HOLDING PERIOD OF YEARS SANGAT MORTGAGE OPTION 1 EBC N RY PMT FY PMT OMB EBC Debt Coverage Ratio Qunity for this mortgage? MORTGAGE OPTION 2 EBC PV PUT PMT OMS EBC Debt Coverage Ratio Quality for this mortgage? PROFORMA YEAR O YEARS YEAR 2 YEAR 3 YEAR PGI -VCL EGI OE CAPX NOI -OS BTCF TAXES (given) ATCF (15,000) 5 21.000) (27.000) PURCHASE PRICE 15 SELLING EXPENSES (6%) NSP OMS BTER TAXES (given) ATER MARKET NPV MARKET RR (31.221) BEFORE TAX NPV BEFORE TAX IRR AFTER TAX NPV AFTER TAXIRR GOING IN CAP RATE DEBT COVERAGE RATIO (EACH YEAR NET EQUITY MULTIPLE DCF APPROACH TO VALUE APPRAISER HAS ASSUMED A HOLDING PERIOD OF 3 YEARS IS APPROPRIATE APPRAISER HAS ASSUMED A DISCOUNT RATE OF 14.515% IS APPROPRIATE YEAR O MARKET VALUE DIRECT CAP APPROACH TO VALUE CAP RATE YEAR 2 CAP RATE YEAR 3 YEAR 2 MARKET VALUE OTHER MORTGAGE INFO FOR THE HOLDING PERIOD TOTAL PRINCIPAL PAID TOTAL INTEREST PAID LENDER'S YIELD 3 YEARS UNITS 00 1 INPUTS HOCONO PERIOD METRO MONTHLY POR UNIT RENT INCREASE PER YEAR NITAL PURCHASE PRICE VACANCY LOS CREDIT LOSS ROLATINO EXPERATIO CAPITAL EXPENDITURES OOING OUT CAP RATE ORDINARY INDOME TAX CAPITAL OAINS TAX RATE DISCOUNT RATE 2.000.000 41 609 10% OF 18.00 25.00 15.00 12.00 hecho C Noored the parenting both pline deporty MORTGAGE OPTIONS MORTGAGE OPTION ASSUME YOU BORROW AT MAXIMUM LTV, BUT YOU MUST MEET THE MNDOR MAX LTV MIND Overage Rate (DOR 140 135 TERMIYEARS 95 AMORTATION YEARS) 30 INTEREST RATE 7.00 CUOSNO COSTI ORIONATION FEEL 100 OTHER NONLENDER FEES 100 2.300 UNDERWRITINOPEL 2.5 300S 300 APPRAISAL 3000 > SURVEY 500 TOTAL CLOSING COSTS LENDER CLOSING COSTS MORTGAGE OPTION TE N PMT EM PUT OS Debt Cover MORTGAGE OPTION 2 EBC PMT OUB EDC Debt Coverage Rate PROFORA YEAR YEAR YEAR YEAR YEAR 4 PO -VOL CO OE CAPX NOI 00 BTCF TANES ATCH PURCHASE PRICE 13.00 27.000 SELLING EXPENSES NS OM BER TAXES ATER 5 01221 MARET NV MAGETRA BEFORE TAX NP BEFORE TAX RR AFTER TAXNPY AFTER TAX GON NCAP RATE DEBT COVERAGE RATIO EACH YEAR NET BOUTY MULTE DAFTSPROGRAO VALUE APRASERHAS ASSUMEDA HOLDING PERIOD OF YEARS SANGAT MORTGAGE OPTION 1 EBC N RY PMT FY PMT OMB EBC Debt Coverage Ratio Qunity for this mortgage? MORTGAGE OPTION 2 EBC PV PUT PMT OMS EBC Debt Coverage Ratio Quality for this mortgage? PROFORMA YEAR O YEARS YEAR 2 YEAR 3 YEAR PGI -VCL EGI OE CAPX NOI -OS BTCF TAXES (given) ATCF (15,000) 5 21.000) (27.000) PURCHASE PRICE 15 SELLING EXPENSES (6%) NSP OMS BTER TAXES (given) ATER MARKET NPV MARKET RR (31.221) BEFORE TAX NPV BEFORE TAX IRR AFTER TAX NPV AFTER TAXIRR GOING IN CAP RATE DEBT COVERAGE RATIO (EACH YEAR NET EQUITY MULTIPLE DCF APPROACH TO VALUE APPRAISER HAS ASSUMED A HOLDING PERIOD OF 3 YEARS IS APPROPRIATE APPRAISER HAS ASSUMED A DISCOUNT RATE OF 14.515% IS APPROPRIATE YEAR O MARKET VALUE DIRECT CAP APPROACH TO VALUE CAP RATE YEAR 2 CAP RATE YEAR 3 YEAR 2 MARKET VALUE OTHER MORTGAGE INFO FOR THE HOLDING PERIOD TOTAL PRINCIPAL PAID TOTAL INTEREST PAID LENDER'S YIELD