please help. (ch.4 app) (pr.04-02)

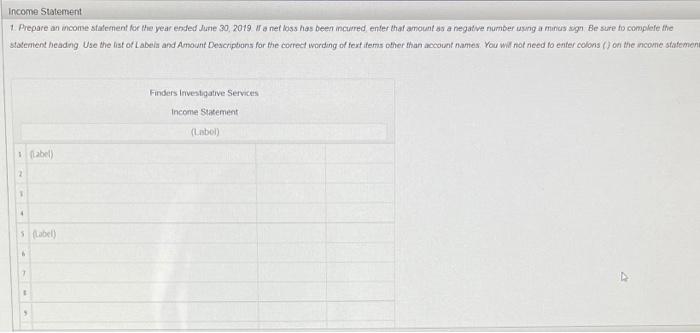

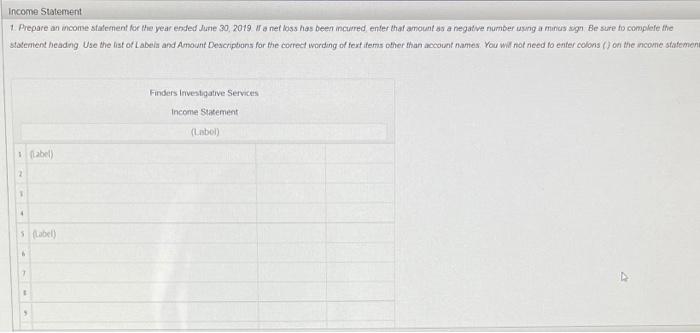

income statement has 15 rows

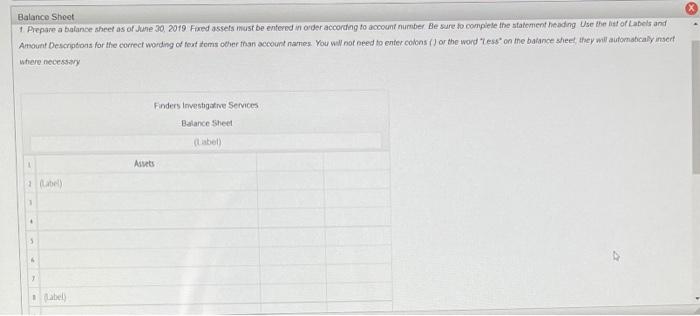

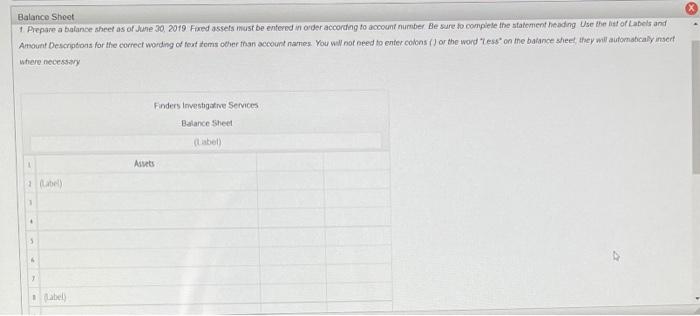

balance sheet has 21 rows

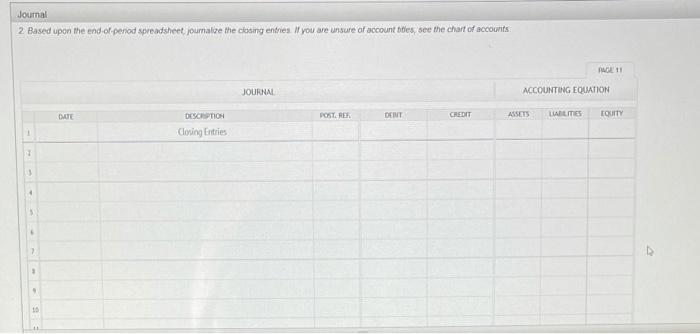

journal has 14 rows

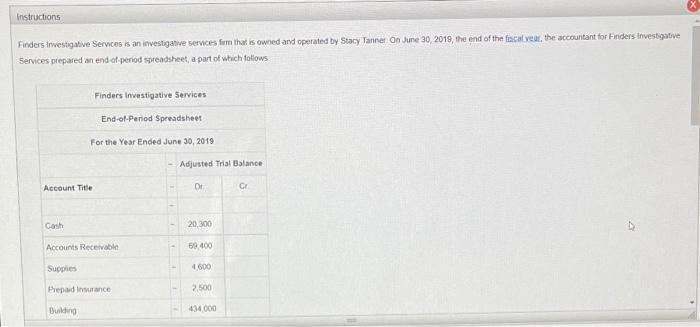

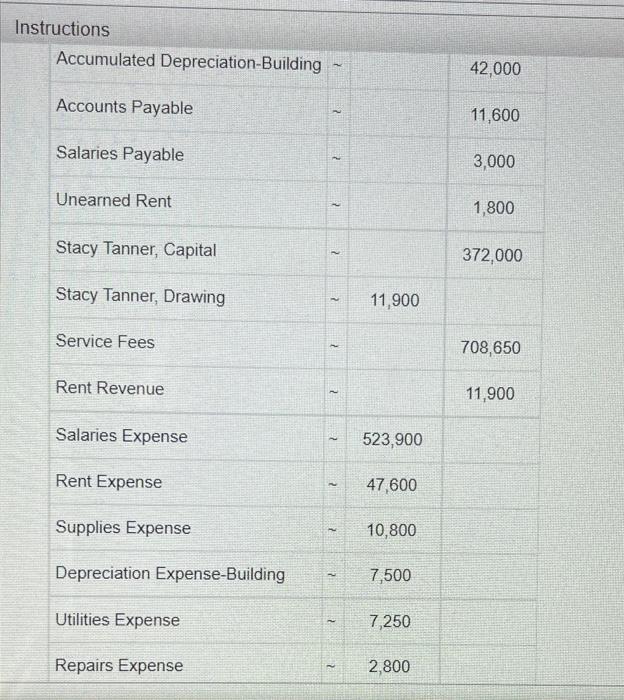

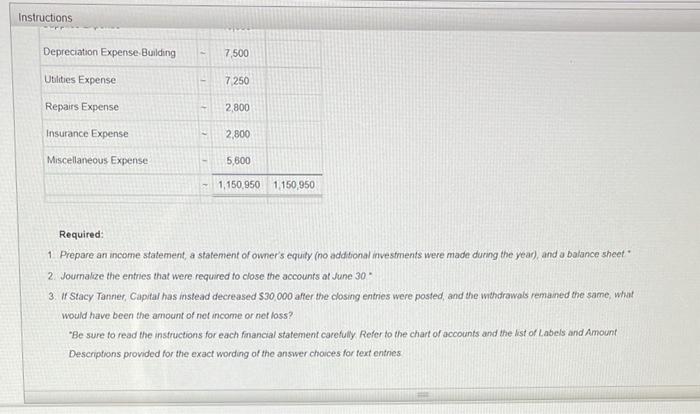

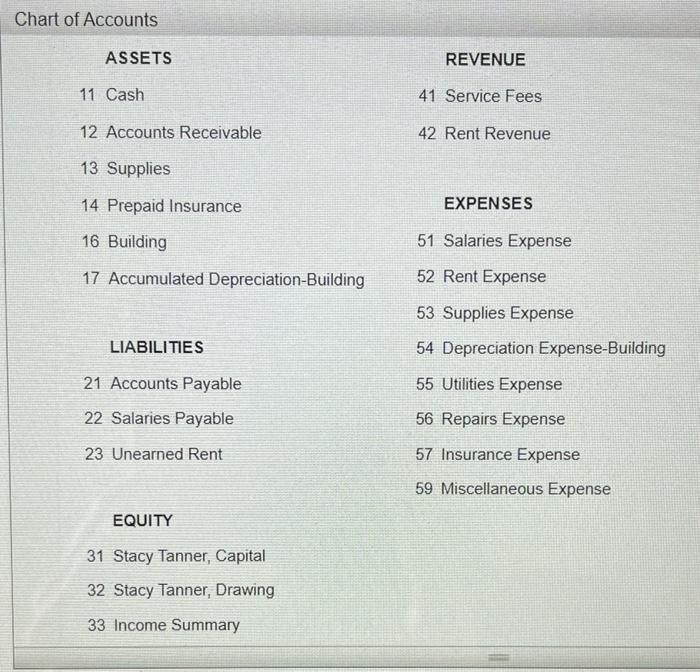

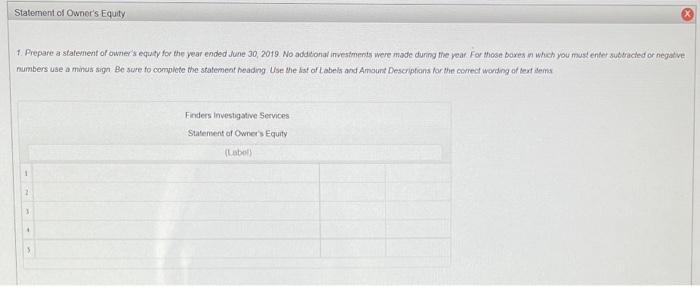

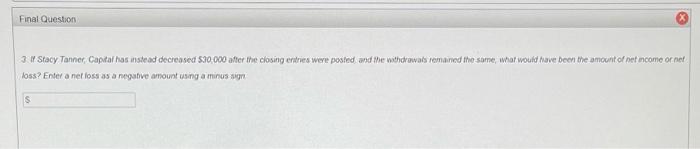

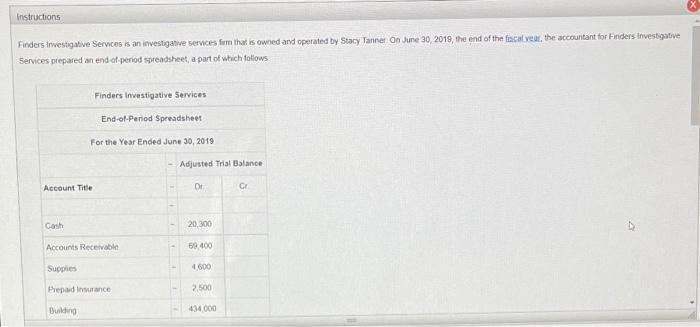

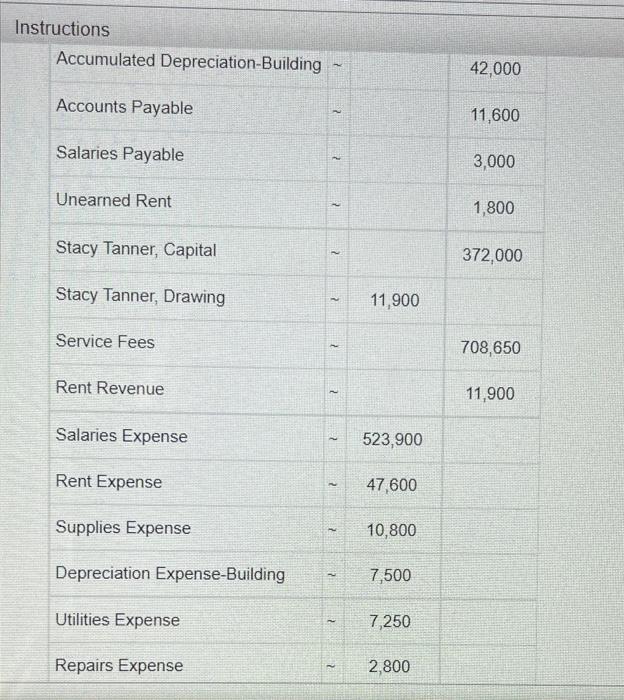

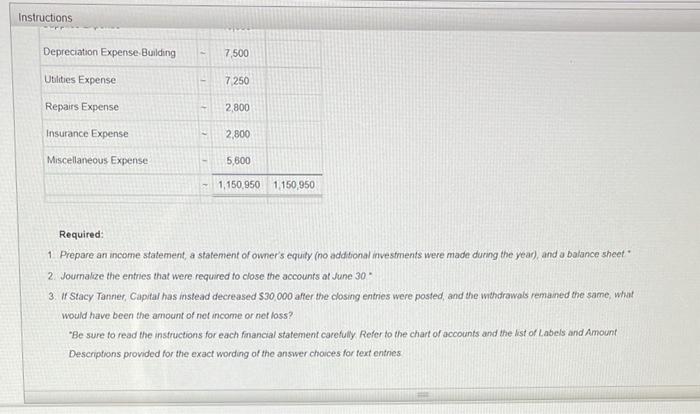

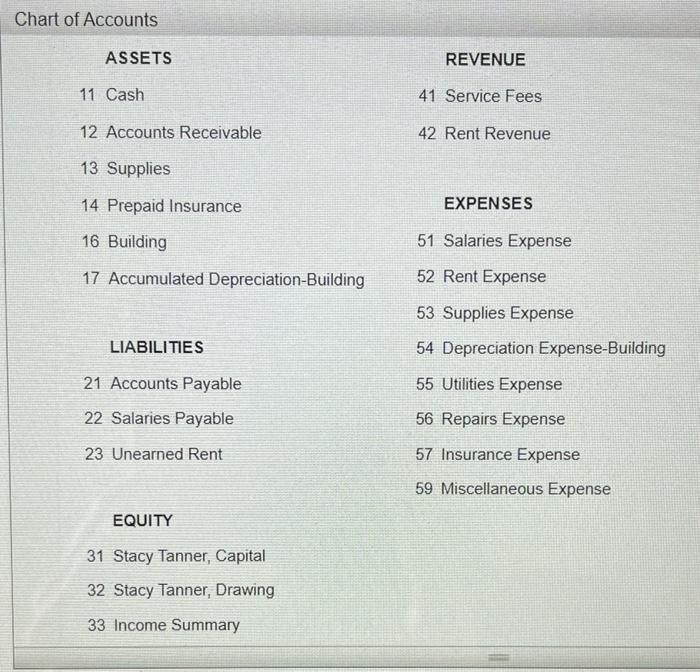

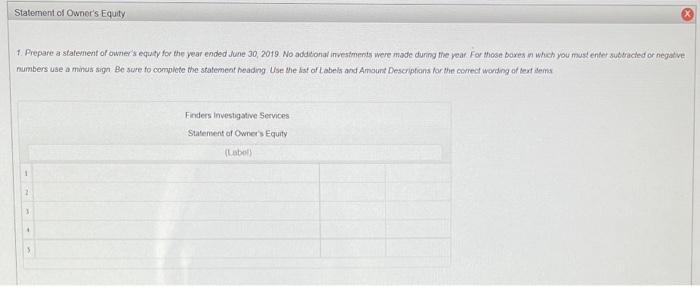

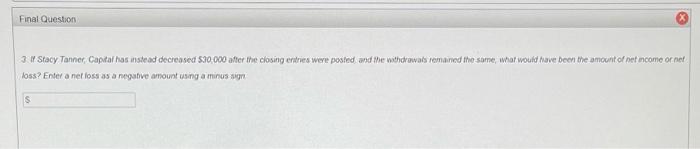

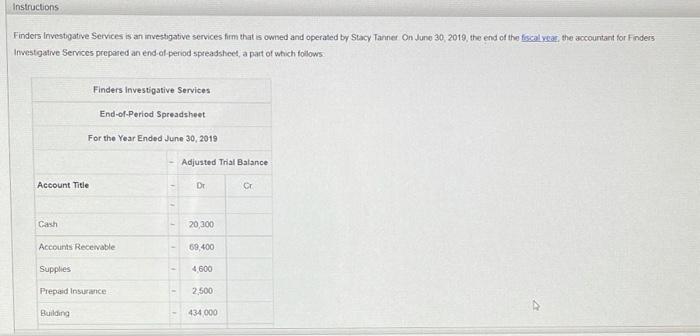

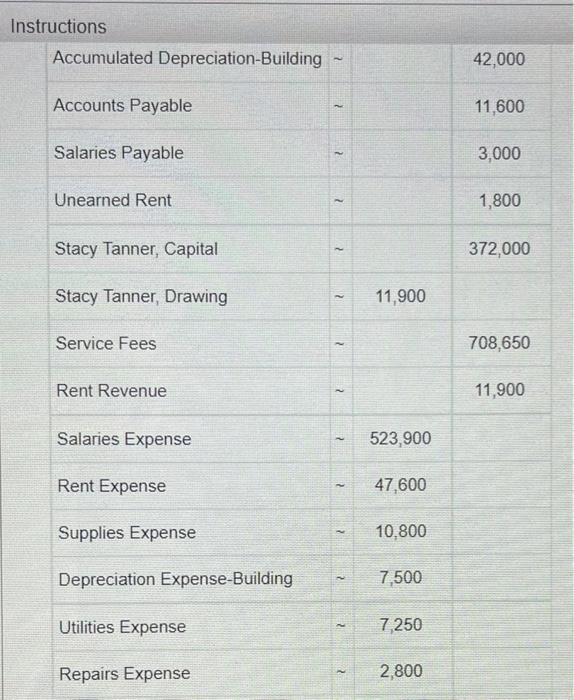

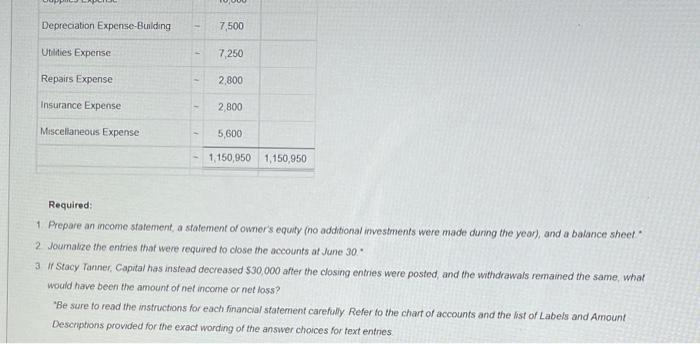

Instructions Finders Investigative Services is an investigative services firm that is owned and operated by Stacy Tanner On June 30, 2019, the end of the fiscal year, the accountant for Finders Investigative Services prepared an end of period spreadsheet a part of which follows Finders Investigative Services End-of-Period Spreadsheet For the Year Ended June 30, 2019 Adjusted Trial Balance Account Title DI Cash 20.300 D Accounts Receivable 59.400 Supplies 4600 Prepard Insurance 2.500 Building 434.000 Instructions Depreciation Expense Building 7,500 Utilities Expense - 7250 Repairs Expense - 2.800 Insurance Expense 2,800 Miscellaneous Expense - 5,600 1,150.950 1150,950 Required: 1 Prepare an income statement, a statement of owner's equity (no additional investments were made during the year), and a balance sheet" 2. Joumalce the entries that were required to close the accounts at June 30 3. If Stacy Tanner, Capital has instead decreased $30,000 after the closing entries were posted and the withdrawals remained the same, want would have been the amount of net income or net loss? "Be sure to read the instructions for each financial statement carefully Refer to the chart of accounts and the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entres Chart of Accounts ASSETS REVENUE 11 Cash 41 Service Fees 12 Accounts Receivable 42 Rent Revenue 13 Supplies 14 Prepaid Insurance EXPENSES 16 Building 51 Salaries Expense 52 Rent Expense 17 Accumulated Depreciation-Building 53 Supplies Expense LIABILITIES 54 Depreciation Expense-Building 21 Accounts Payable 55 Utilities Expense 22 Salaries Payable 56 Repairs Expense 23 Unearned Rent 57 Insurance Expense 59 Miscellaneous Expense EQUITY 31 Stacy Tanner, Capital 32 Stacy Tanner, Drawing 33 Income Summary Income Statement 1. Prepare an income statement for the year ended June 30, 2019 e nel loss has been incurred enter that amount as a negative number nga minus agn Be sure to complete the statement heading Use the list of Labels and Amount Descriptions for the correct wording of text items other than account names. You will not need to enter colons() on the income statemeni Finders Investigative Services Income Statement (bol) 1 label 2 1 4 5 Label) Statement of Owner's Equity 1. Prepare a statement of owner's equity for the year ended June 30, 2019. No additional investments were made during the year For Moseboren in which you must enter subirached or negative numbers use a minus sign Be sure to complete the statement heading Use the list of bels and Amount Descriptions for the correct wording of text tema Finders investigative Services Statement of Owner's Equity Label 1 2 1 3 Balance Shoot 1 Prepare a balance sheet as of June 30, 2019 Fixed assets must be entered in order according to account number Be sure to complete the statement reading Use the for Labels and Amount Descriptions for the correct wording of feat toms other than account names. You will not need to enter colons() or the word 'Yess on the balance sheet they will automatically insert where necessary Finders Investigative Services Balance Sheet (label) 1 Assets 1 . 7 Label Journal 2 Based upon the end of period spreadsheet journalize the closing entries you are unsure of account bles, see the chart of accounts PAGE 1 JOURNAL ACCOUNTING EQUATION DATE POST. REX DET CREDIT ASSETS LITIES EQUITY DESCEPTION Closing Entries 16 Final Question 3. Stacy Tanner, Capital has instead decreased 530.000 after the closing entries were posted and he withdrawals remained the some, what would have been the amount of net income or net loss? Entra nel loss as a negative amount using a minusson S Instructions Finders Investigative Services is an mestigative services firm that is owned and operated by Stacy Tanner On June 30 2019, the end of the fiscal year, the accountant for Finders Investgative Services prepared an end-of-period spreadsheet, a part of which follows Finders investigative Services End-of-Period Spreadsheet For the Year Ended June 30, 2019 Adjusted Trial Balance Account Title De Cr Cash 20 300 Accounts Receivable 59.400 Supplies - 4.600 Prepaid Insurance 2.500 Building 434 000 Instructions Accumulated Depreciation-Building 42,000 Accounts Payable 2 11,600 Salaries Payable 2 3,000 Unearned Rent 2 1,800 Stacy Tanner, Capital 2 372,000 Stacy Tanner, Drawing 11,900 Service Fees 2 708,650 Rent Revenue 2 11,900 Salaries Expense 2 523,900 Rent Expense 2 47,600 Supplies Expense 10.800 Depreciation Expense-Building 7,500 Utilities Expense 7250 Repairs Expense 2,800 Depreciation Expense-Building 7,500 Utilities Expense 7.250 Repairs Expense 2.800 Insurance Expense 2,800 Miscellaneous Expense 5,600 1.150,950 1,150,950 Required: 1. Prepare an income statement a statement of owner's equity (no additional investments were made during the year), and a balance sheet 2 Joumalize the entries that were required to close the accounts of June 30. 3 / Stacy Tanner, Capital has instead decreased 530,000 after the closing entries were posted, and the withdrawals remained the same, what would have been the amount of net income or net loss? "Be sure to read the instructions for each financial statement carefully Refer to the chart of accounts and the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entres