please help

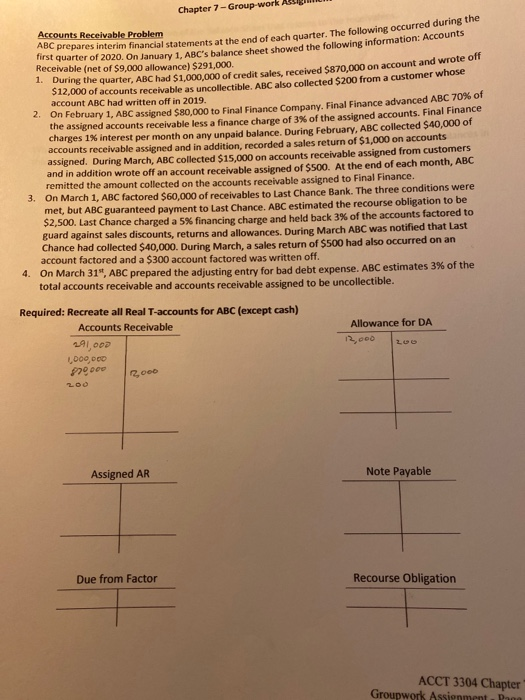

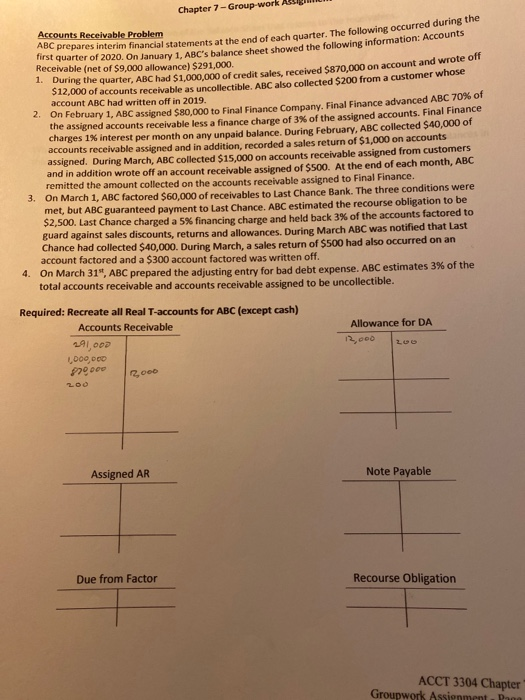

Chapter 7 - Group work Acil ABC prep 1. During the Accounts Receivable Problem followipe occurred during the repares interim financial statements at the end of each quarter. The following Occurred our quarter of 2020. On January 1. ABC's balance sheet showed the following information: Account Receivable (net of $9,000 allowance) $291,000. woning the quarter, ABC had $1.000.000 of credit sales received S870.000 on account and wrote on $12,000 of accounts receivable as uncollectible. ABC also collected $200 from a customer whose account ABC had written off in 2019. On February 1, ABC assigned $80,000 to Final Finance Company. Final Finance advanced ABC 70% of the assigned accounts receivable less a finance charge of 3% of the assigned accounts. Final Finance charges 1% interest per month on any unpaid balance. During February, ABC collected $40,000 of accounts receivable assigned and in addition, recorded a sales return of $1,000 on accounts assigned. During March, ABC collected $15,000 on accounts receivable assigned from customers and in addition wrote off an account receivable assigned of $500. At the end of each month, ABC remitted the amount collected on the accounts receivable assigned to Final Finance. On March 1, ABC factored $60,000 of receivables to Last Chance Bank. The three conditions were met, but ABC guaranteed payment to Last Chance. ABC estimated the recourse obligation to be $2,500. Last Chance charged a 5% financing charge and held back 3% of the accounts factored to guard against sales discounts, returns and allowances. During March ABC was notified that Last Chance had collected $40,000. During March, a sales return of $500 had also occurred on an account factored and a $300 account factored was written off. 4. On March 31", ABC prepared the adjusting entry for bad debt expense. ABC estimates 3% of the total accounts receivable and accounts receivable assigned to be uncollectible. Required: Recreate all Real T-accounts for ABC (except cash) Accounts Receivable 291,000 DOO, DOO P2000 Allowance for DA 12,000 LUO Assigned AR Note Payable Due from Factor Recourse Obligation ACCT 3304 Chapter Groupwork Assignment. Pana Chapter 7 - Group work Acil ABC prep 1. During the Accounts Receivable Problem followipe occurred during the repares interim financial statements at the end of each quarter. The following Occurred our quarter of 2020. On January 1. ABC's balance sheet showed the following information: Account Receivable (net of $9,000 allowance) $291,000. woning the quarter, ABC had $1.000.000 of credit sales received S870.000 on account and wrote on $12,000 of accounts receivable as uncollectible. ABC also collected $200 from a customer whose account ABC had written off in 2019. On February 1, ABC assigned $80,000 to Final Finance Company. Final Finance advanced ABC 70% of the assigned accounts receivable less a finance charge of 3% of the assigned accounts. Final Finance charges 1% interest per month on any unpaid balance. During February, ABC collected $40,000 of accounts receivable assigned and in addition, recorded a sales return of $1,000 on accounts assigned. During March, ABC collected $15,000 on accounts receivable assigned from customers and in addition wrote off an account receivable assigned of $500. At the end of each month, ABC remitted the amount collected on the accounts receivable assigned to Final Finance. On March 1, ABC factored $60,000 of receivables to Last Chance Bank. The three conditions were met, but ABC guaranteed payment to Last Chance. ABC estimated the recourse obligation to be $2,500. Last Chance charged a 5% financing charge and held back 3% of the accounts factored to guard against sales discounts, returns and allowances. During March ABC was notified that Last Chance had collected $40,000. During March, a sales return of $500 had also occurred on an account factored and a $300 account factored was written off. 4. On March 31", ABC prepared the adjusting entry for bad debt expense. ABC estimates 3% of the total accounts receivable and accounts receivable assigned to be uncollectible. Required: Recreate all Real T-accounts for ABC (except cash) Accounts Receivable 291,000 DOO, DOO P2000 Allowance for DA 12,000 LUO Assigned AR Note Payable Due from Factor Recourse Obligation ACCT 3304 Chapter Groupwork Assignment. Pana

please help

please help