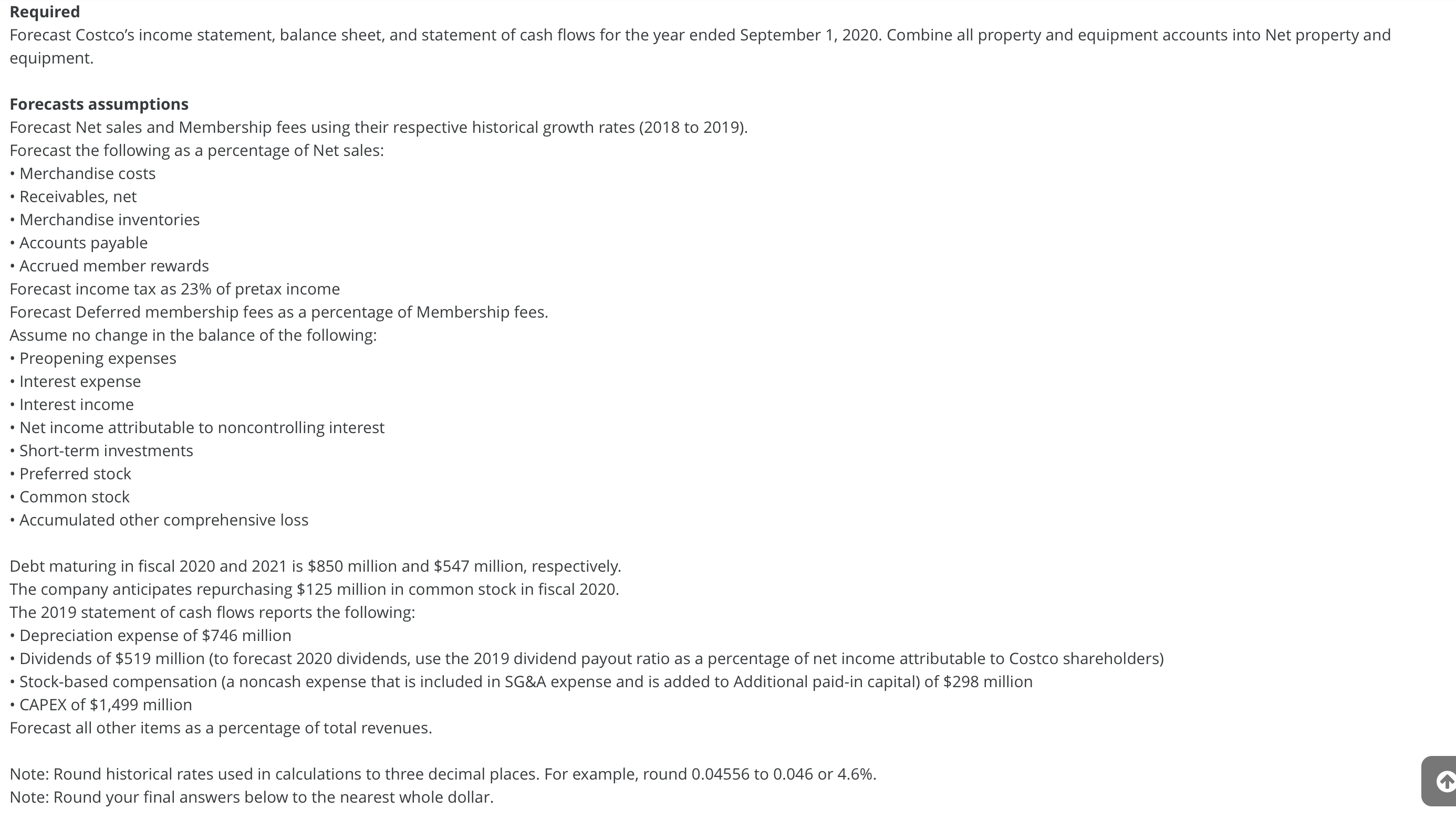

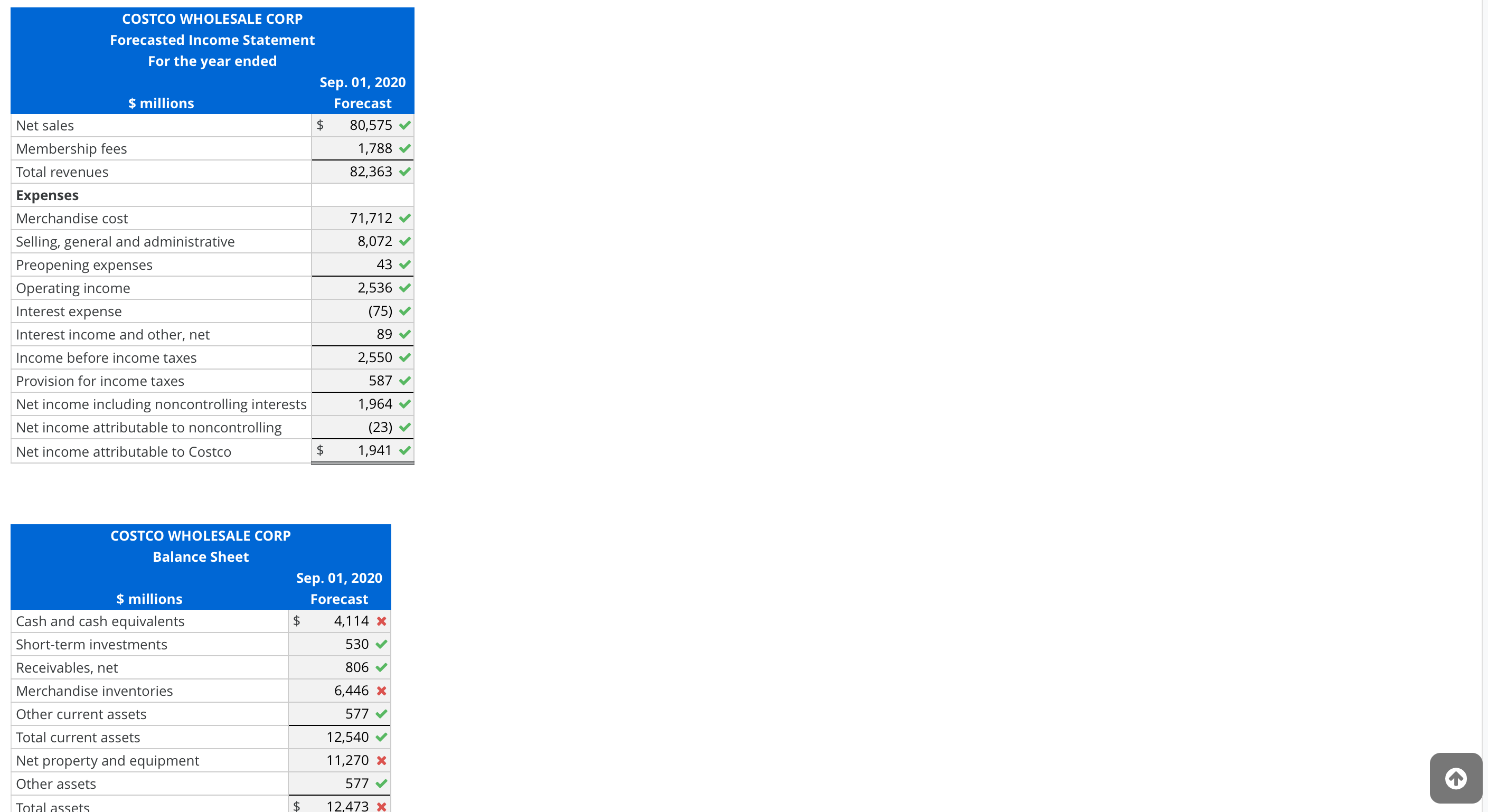

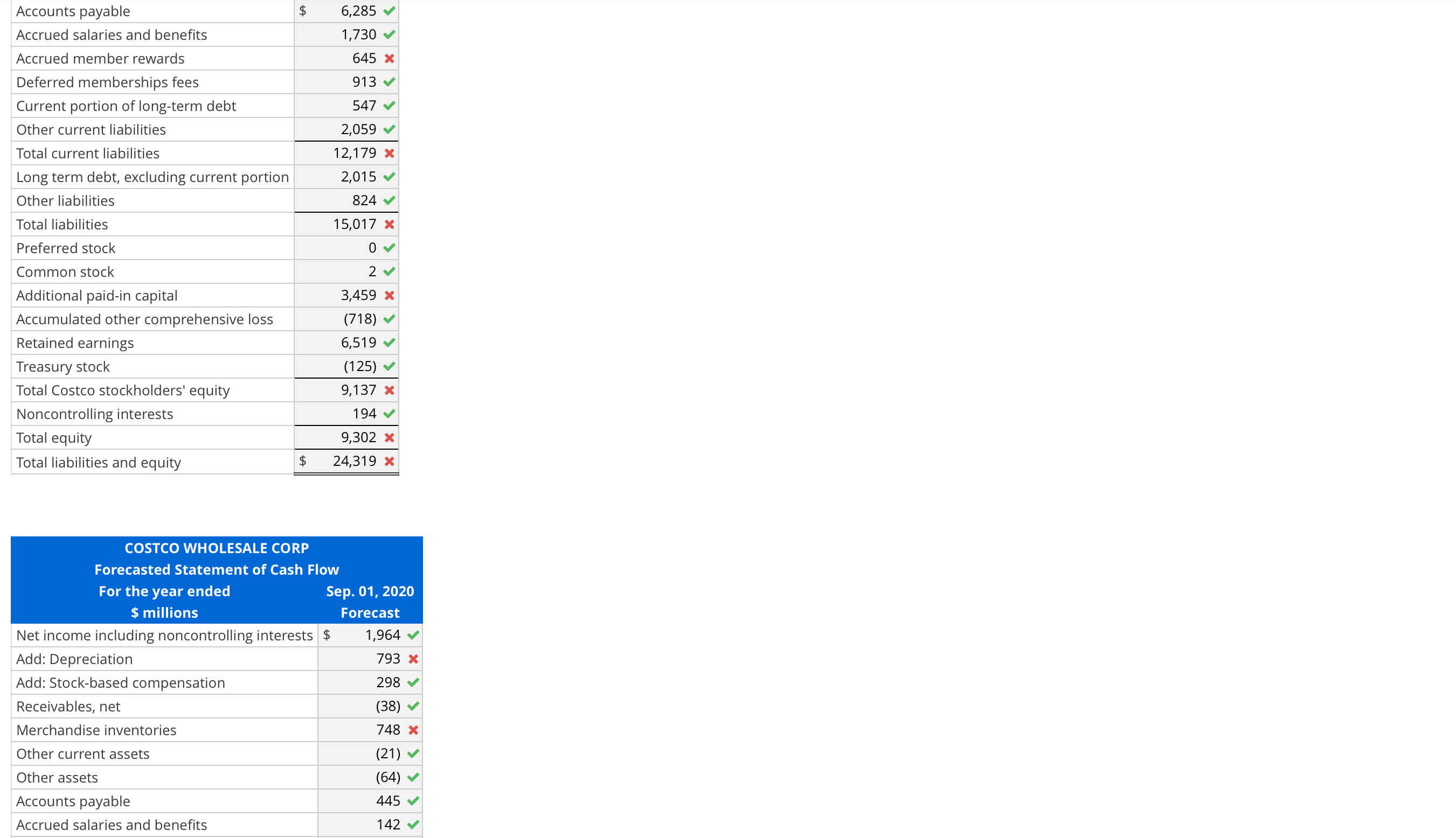

please help determine the remaining missing balances

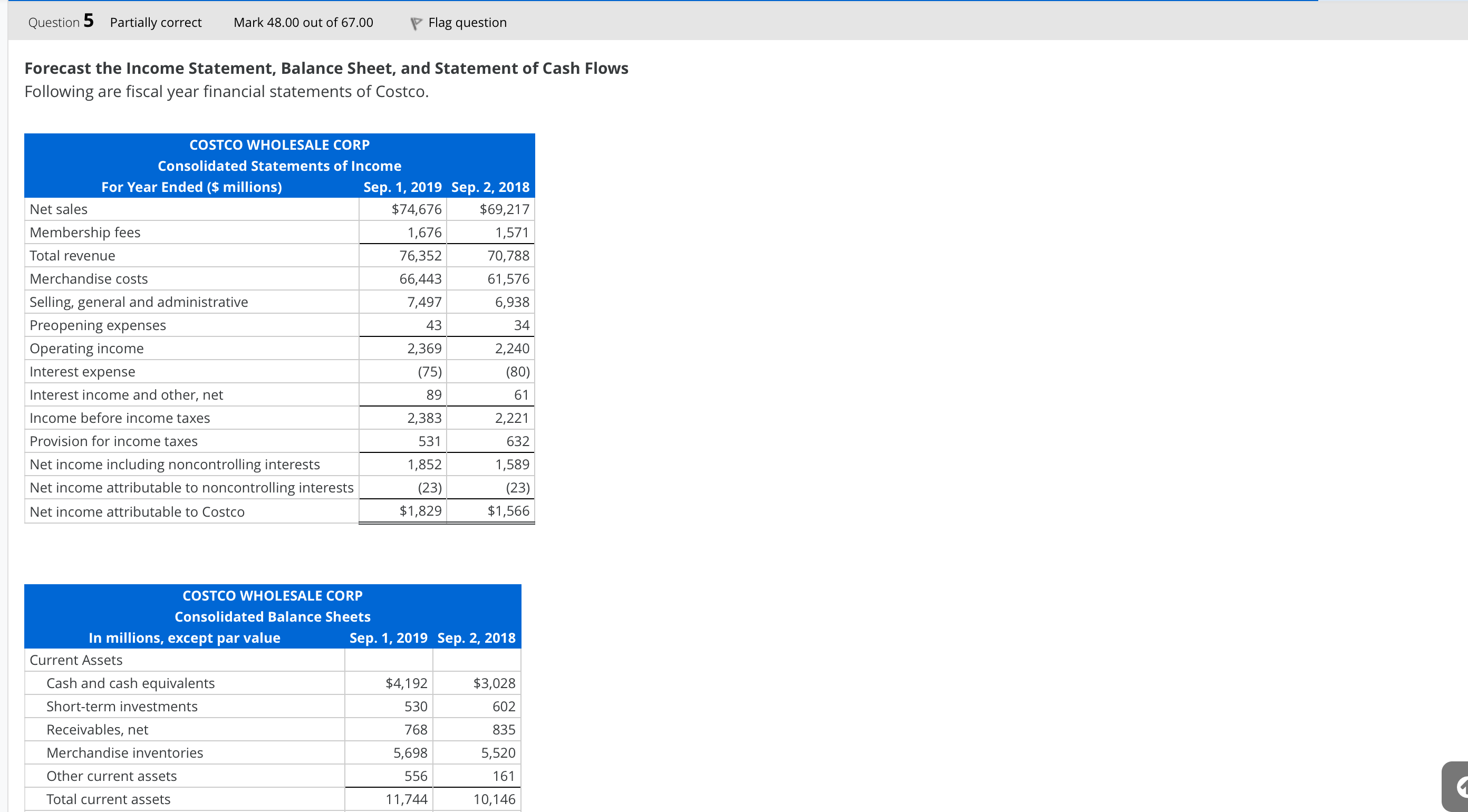

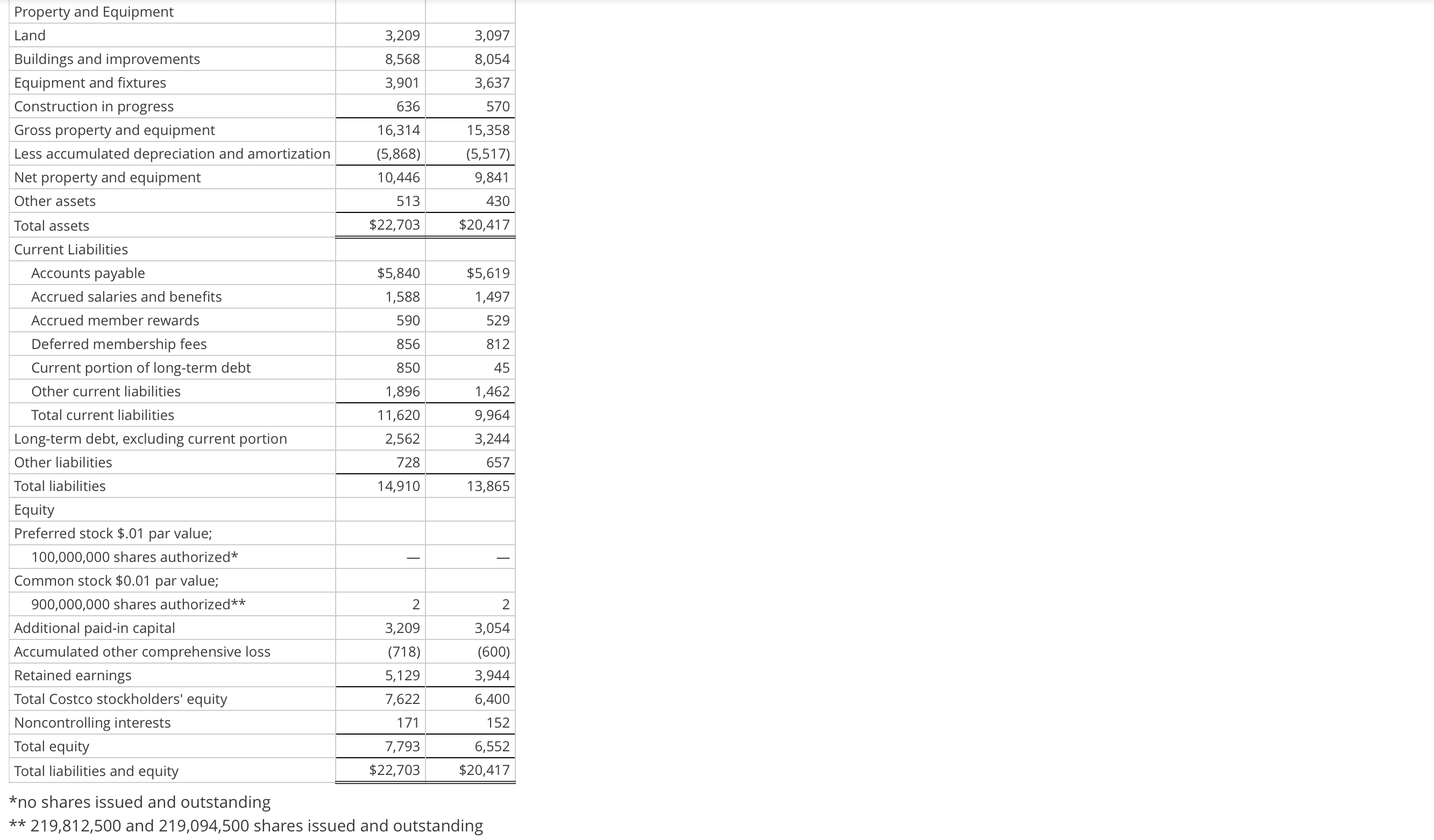

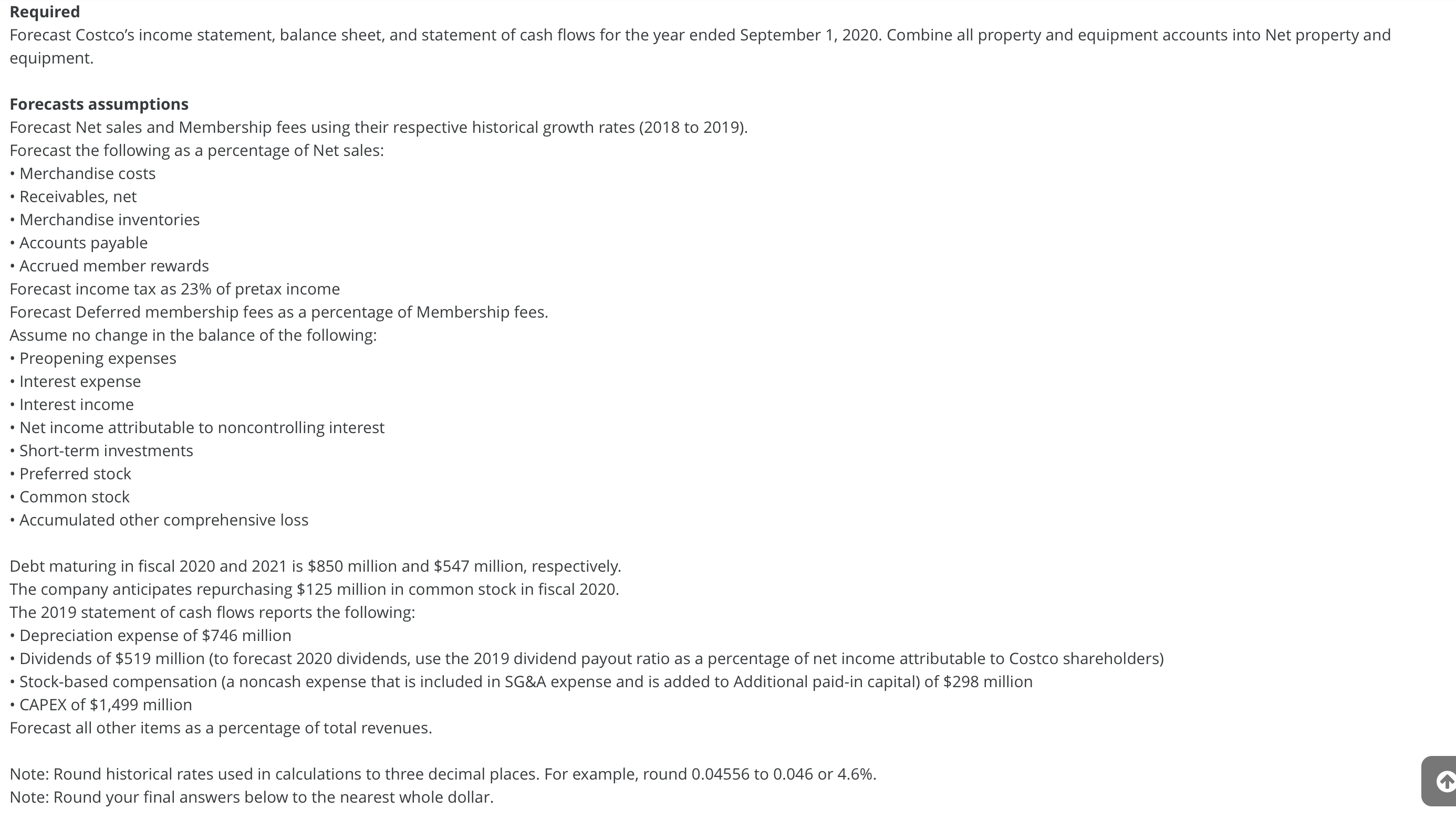

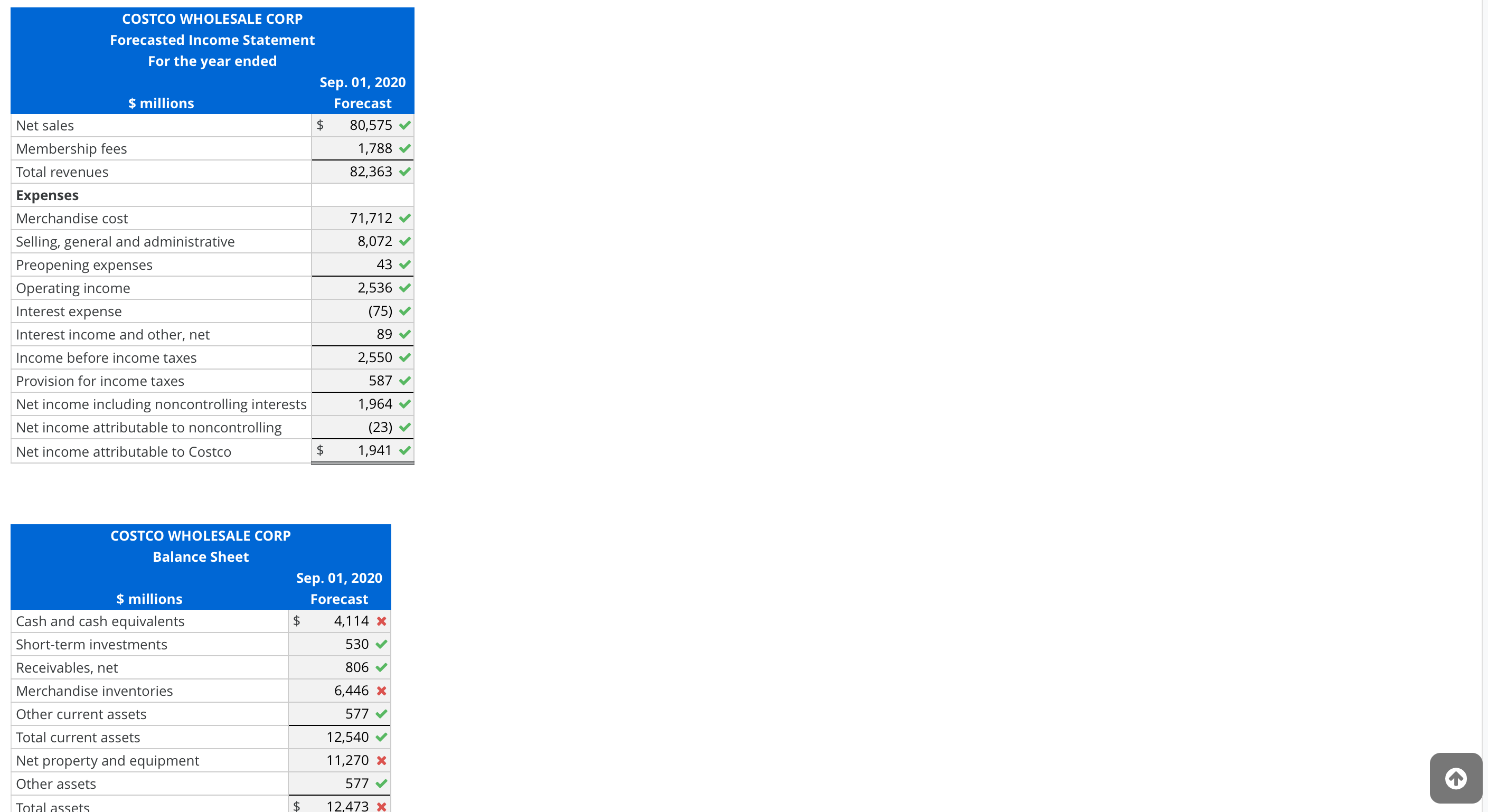

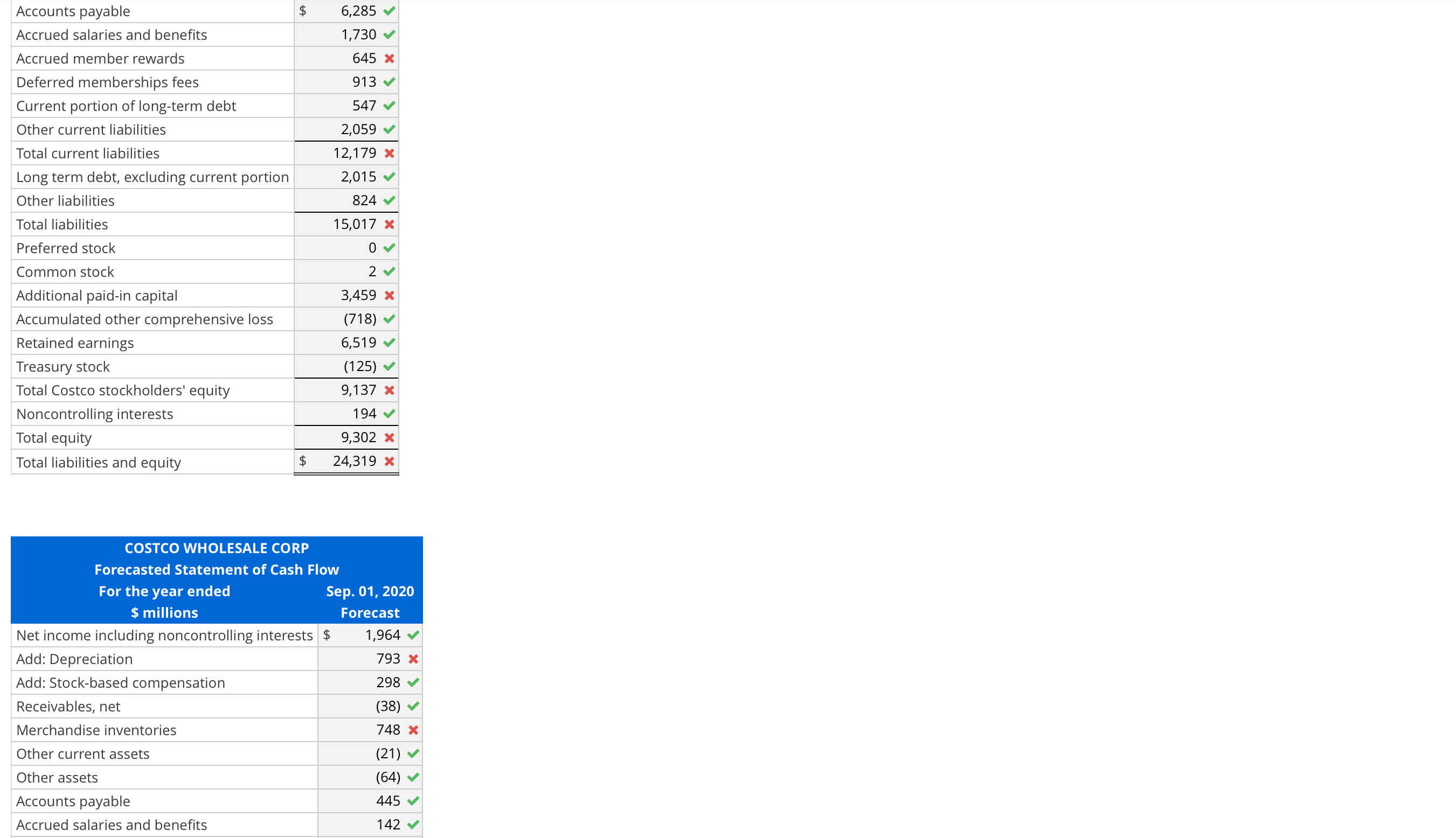

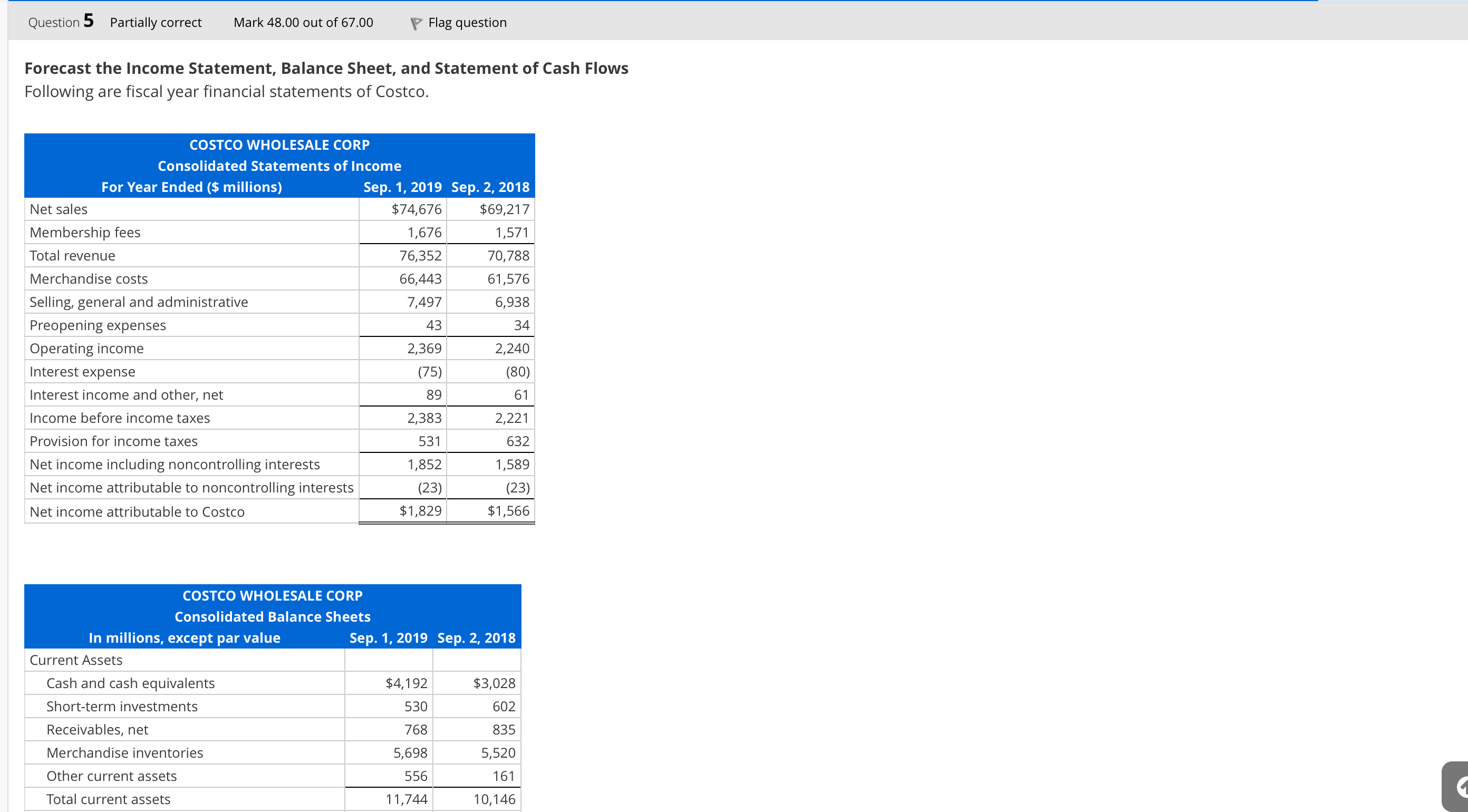

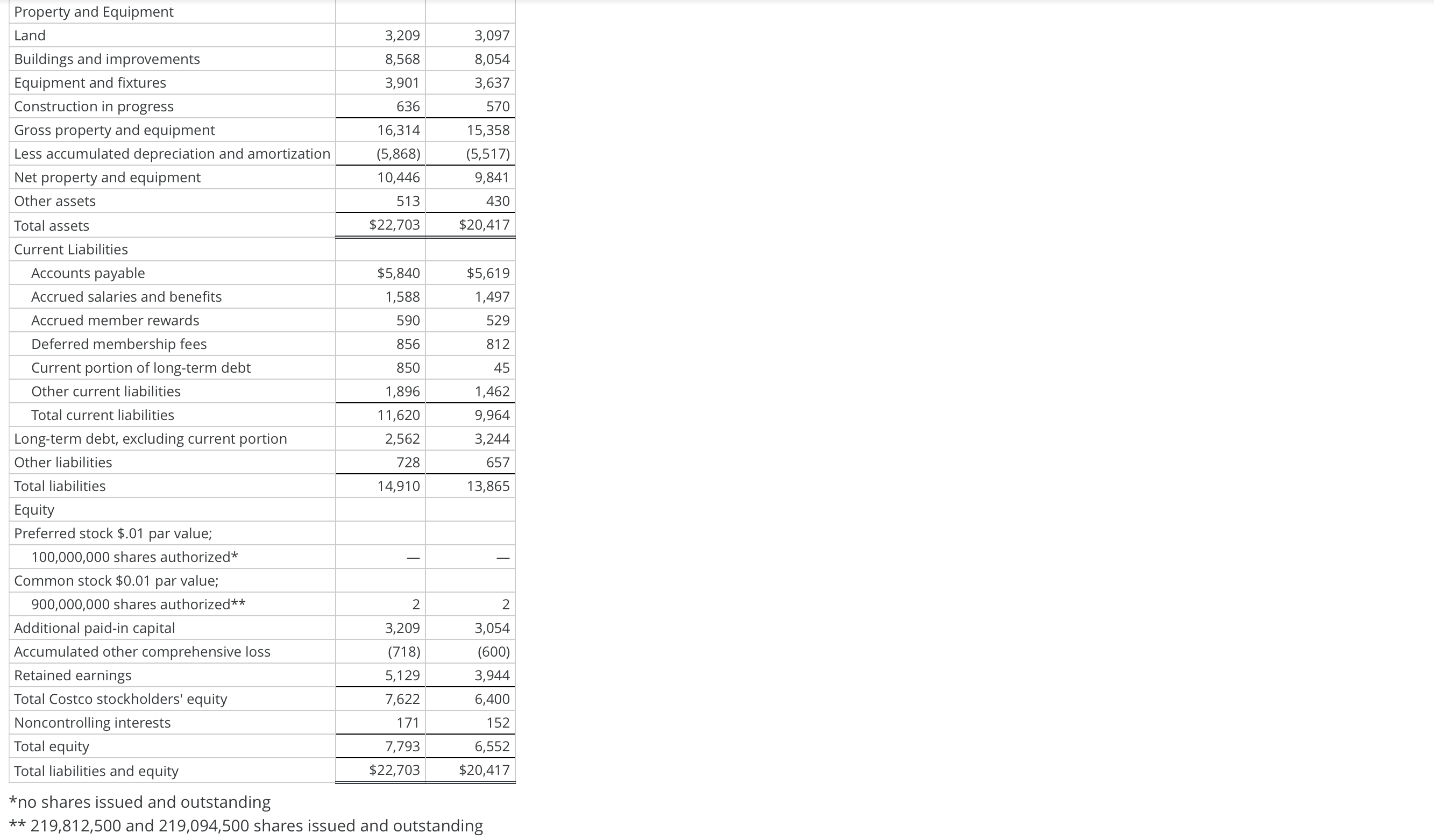

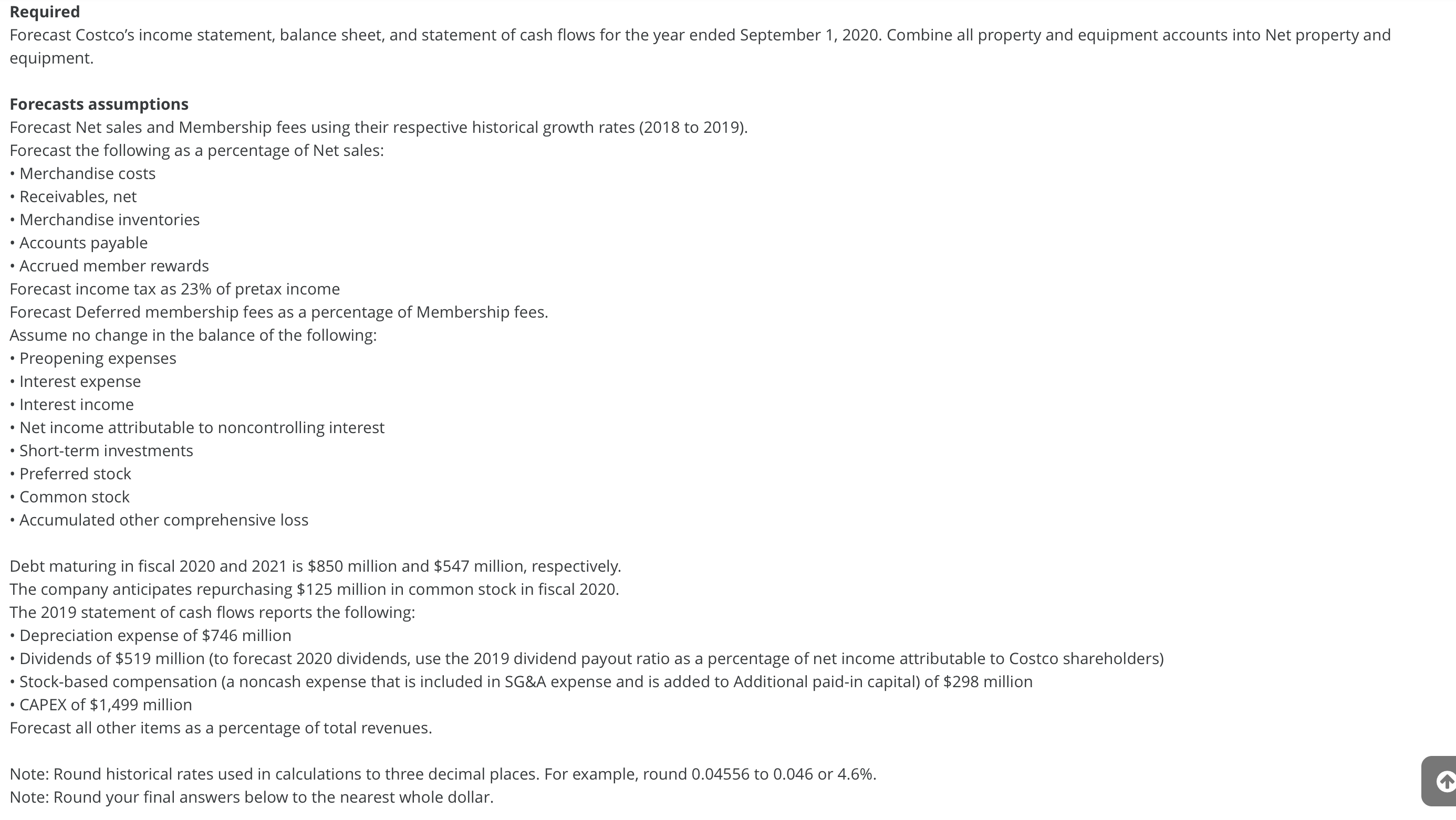

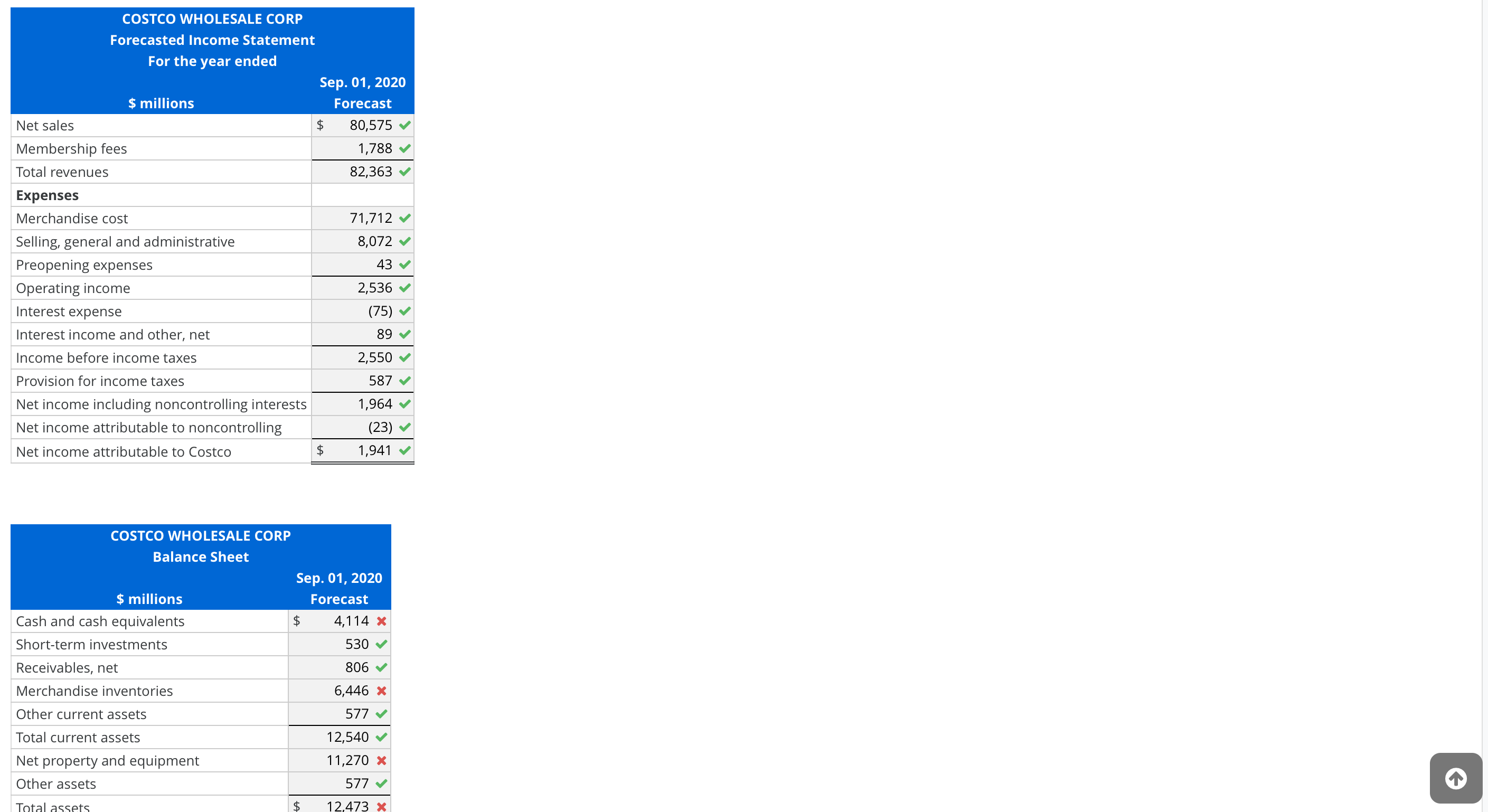

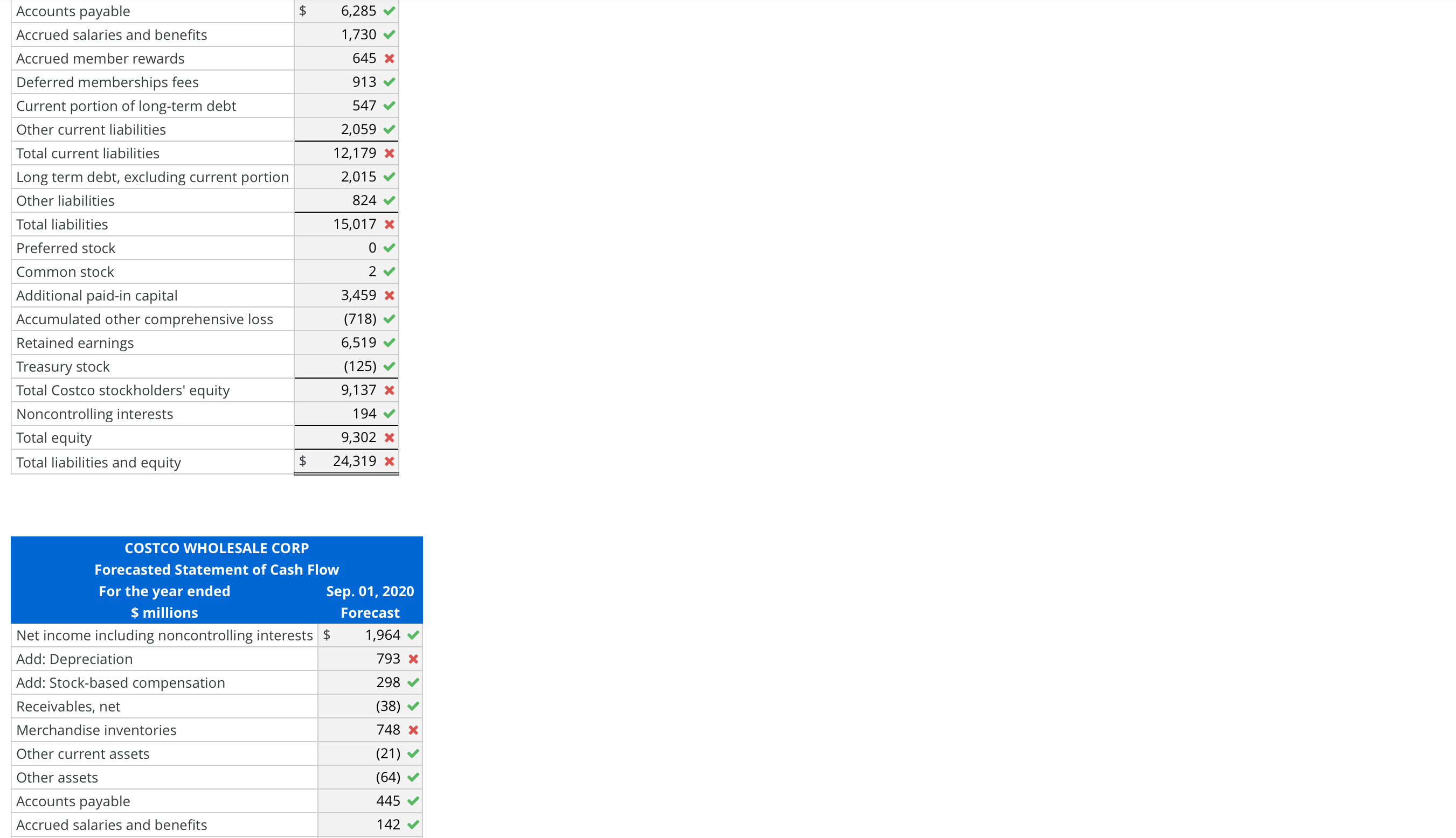

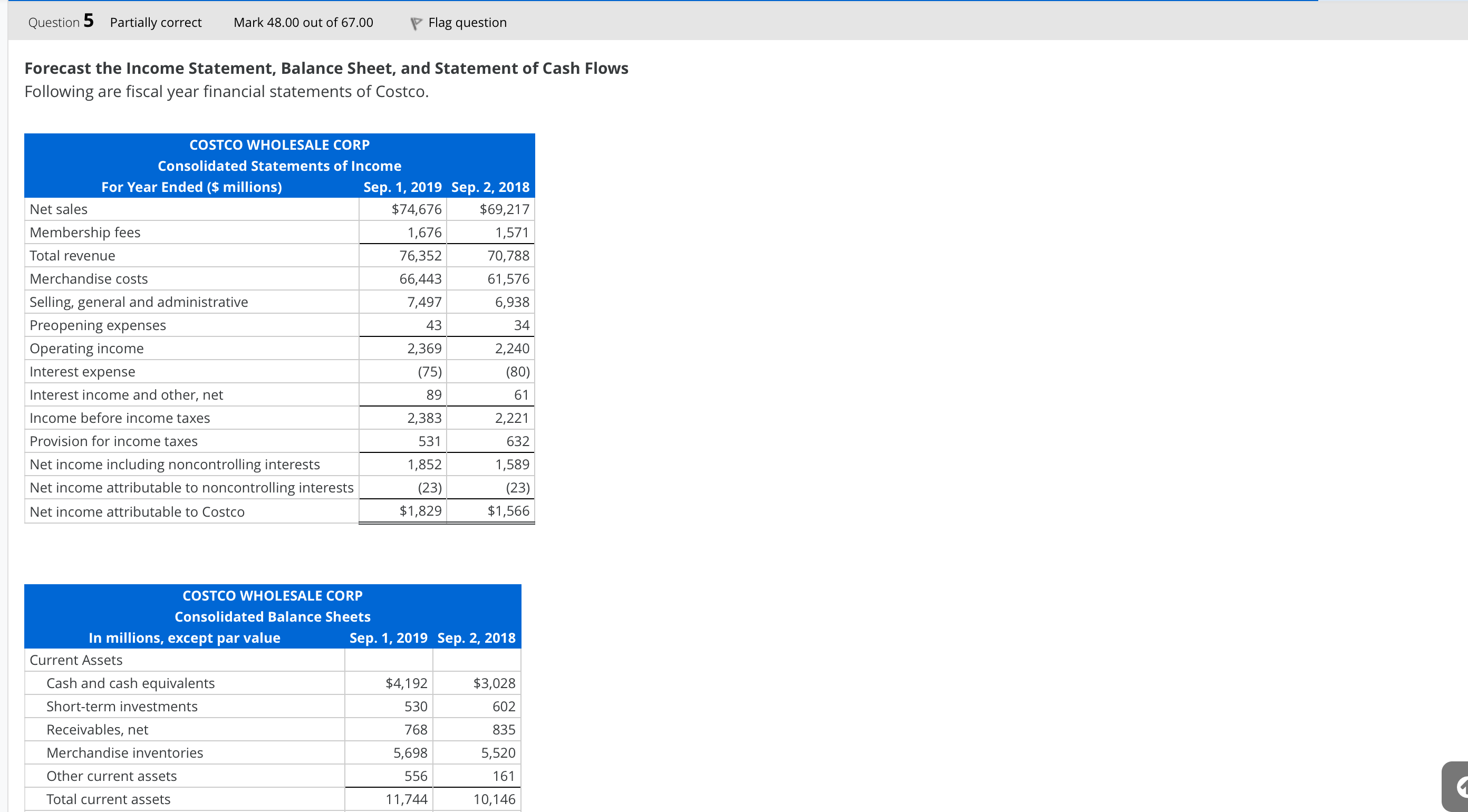

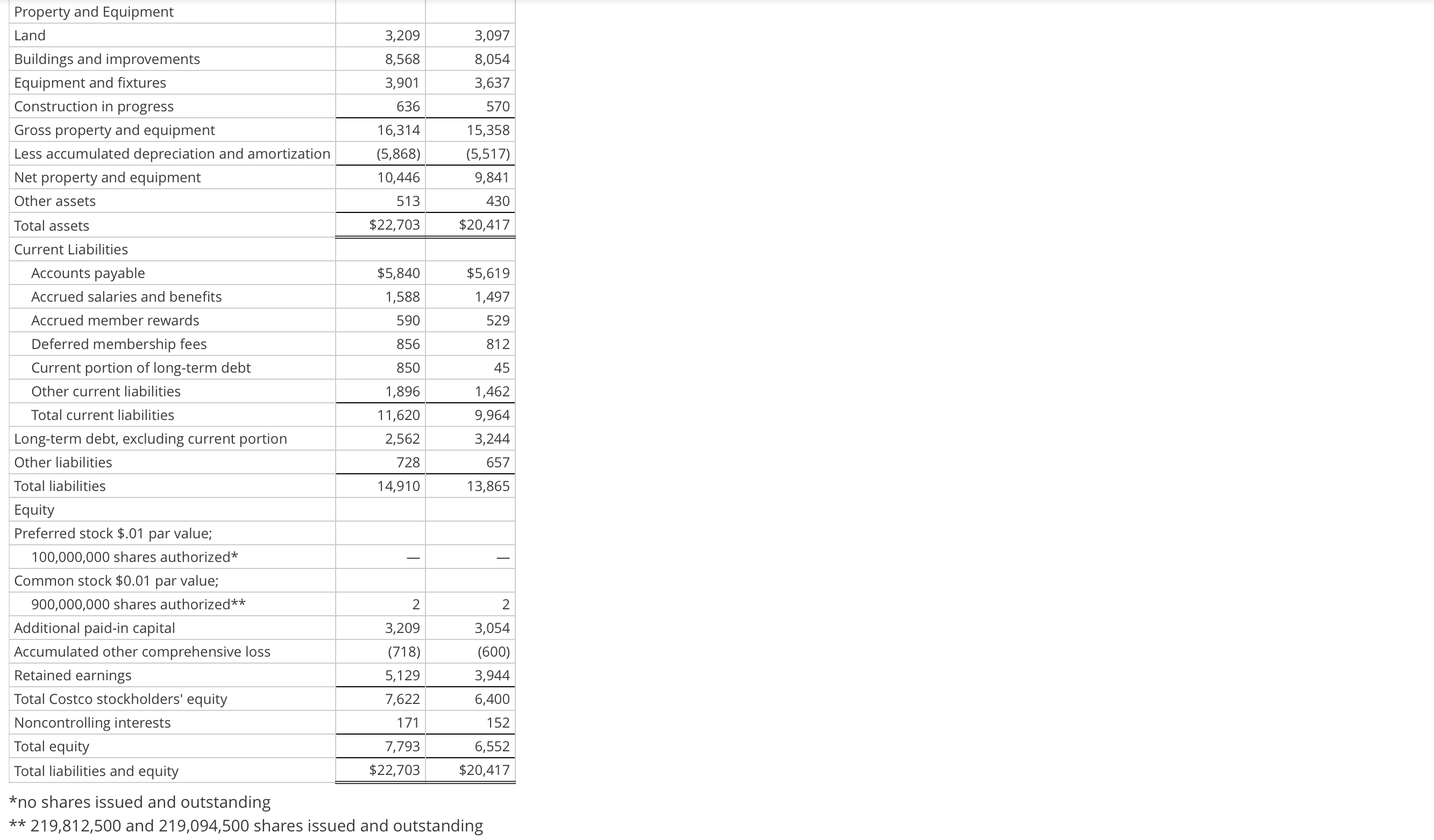

Question 5 Partially correct Mark 4800 out of 6700 '7 Flag question Forecast the Income Statement, Balance Sheet, and Statement of Cash Flows Following are scal year financial statements of Costco. COSTCO WHOLESALE CORP Consolidated Statements of Income For Year Ended (3 millions) Sept 1, 2019 Sept 2, 2018 Net sales ' $74,676 $69,217 Membership fees ' 1,676' 1,571 Total revenue ' 76,352 ' 70,788 Merchandise costs ' 66,443' 61,576 Selling, general and administrative ' 7,497' 6,938 Preopening expenses ' 43' 34 Operating income ' 2,369' 2,240 Interest expense ' (75) ' (80) Interest income and other, net ' 89' 61 Income before income taxes ' 2,383 ' 2,221 Provision for income taxes 531 632 Net income including noncontrolling interests 1,852 1,589 Net income attributable to noncontrolling interests' (23) ' (23) Net income attributable to Costco ' $1,829' $1,566 COSTCO WHOLESALE CORP Consolidated Balance Sheets In millions, except par value Sept 1, 2019 Sept 2, 2018 Current Assets Cash and cash equivalents $4,192' $3,028 Short-term investments 530 ' 602 Receivables, net 768 ' 835 Merchandise inventories 5,698 ' 5,520 Other current assets 556 ' 161 Total current assets 11,744' 10,146 Property and Equipment Land 3,209 3,097 Buildings and improvements 8,568 8,054 Equipment and fixtures 3,901 3,637 Construction in progress 636 570 Gross property and equipment 16,314 15,358 Less accumulated depreciation and amortization (5,868) (5,517) Net property and equipment 10,446 9,841 Other assets 513 430 Total assets $22,703 $20,417 Current Liabilities Accounts payable $5,840 $5,619 Accrued salaries and benefits 1,588 1,497 Accrued member rewards 590 529 Deferred membership fees 856 812 Current portion of long-term debt 850 45 Other current liabilities 1,896 1,462 Total current liabilities 11,620 9,964 Long-term debt, excluding current portion 2,562 3,244 Other liabilities 728 657 Total liabilities 14,910 13,865 Equity Preferred stock $.01 par value; 100,000,000 shares authorized* Common stock $0.01 par value; 900,000,000 shares authorized** 2 2 Additional paid-in capital 3,209 3,054 Accumulated other comprehensive loss (718) (600) Retained earnings 5,129 3,944 Total Costco stockholders' equity 7,622 6,400 Noncontrolling interests 171 152 Total equity 7,793 6,552 Total liabilities and equity $22,703 $20,417 *no shares issued and outstanding ** 219,812,500 and 219,094,500 shares issued and outstanding Required Forecast Costco's income statement, balance sheet, and statement of cash flows for the year ended September 1, 2020. Combine all property and equipment accounts into Net property and equipment. Forecasts assumptions Forecast Net sales and Membership fees using their respective historical growth rates (2018 to 2019). Forecast the following as a percentage of Net sales: - Merchandise costs - Receivables, net - Merchandise inventories - Accounts payable ~ Accrued member rewards Forecast income tax as 23% of pretax income Forecast Deferred membership fees as a percentage of Membership fees. Assume no change in the balance ofthe following: - Preopening expenses - Interest expense - Interest income - Net income attributable to noncontrolling interest - Short-term investments - Preferred stock - Common stock - Accumulated other comprehensive loss Debt maturing in fiscal 2020 and 2021 is $850 million and $547 million, respectively. The company anticipates repurchasing $125 million in common stock in scal 2020. The 2019 statement of cash flows reports the following: - Depreciation expense of $746 million - Dividends of $519 million (to forecast 2020 dividends, use the 2019 dividend payout ratio as a percentage of net income attributable to Costco shareholders) - Stockbased compensation (a noncash expense that is included in SG&A expense and is added to Additional paid-in capital) of $298 million - CAPEX of $1 ,499 million Forecast all other items as a percentage of total revenues. Note: Round historical rates used in calculations to three decimal places. For example, round 0.04556 to 0.046 or 4.6%. Note: Round your final answers below to the nearest whole dollar. COSTCO WHOLESALE CORP Forecasted Income Statement For the year ended Sep. 01, 2020 $ millions Forecast Net sales :5 80,575 v Membership fees 1,788 v Total revenues 82,363 v Expenses Merchandise cost 71,712 V Selling, general and administrative 8.072 V Preopening expenses 43 V Operating income 2.536 V Interest expense (75) v Interest income and other, net 89 v Income before income taxes 2,550 v Provision for income taxes 587 v Net income including noncontrolling interests 1,964 v Net income attributable to noncontrolling (23) v Net income attributable to Costco $ 1,941 v COSTCO WHOLESALE CORP Balance Sheet Sept 01, 2020 S millions Forecast Cash and cash equivalents $ 4,114 x Short-term investments 530 ~/ Receivables, net 806 ~/ Merchandise inventories 6,446 X Other current assets 577 o/ Total current assets 12,540 ./ Net property and equipment 11,270 X Other assets 577 \\l Total assets 3 12.473 X Accounts payable ' $ 6,285 0/ Accrued salaries and benefits 1,730 v Accrued member rewards 645 x Deferred memberships fees 913 v Current portion of long-term debt 547 V Other current liabilities 2,059 v Total current liabilities 12,179 at Long term debt, excluding current portion 2,015 v Other liabilities 824 V Total liabilities 15,017 3: Preferred stock 0 v Common stock 2 v/ Additional paid-in capital 3,459 x Accumulated other comprehensive loss (718) v/ Retained earnings 6,519 v Treasury stock (125) v/ Total Costco stockholders' equity 9,137 x Noncontrolling interests 194 ./ Total equity 9,302 at Total liabilities and equity $ 24,319 x COSTCO WHOLESALE CORP Forecasted Statement of Cash Flow For the year ended Sept01, 2020 s millions Forecast Net income including noncontrolling interests 3 1,964 ./ Add: Depreciation 793 X Add: Stock-based compensation ' 298 ./ Receivables, net (38) o/ Merchandise inventories 748 x Other current assets (21) o/ Other assets (64) ./ Accounts payable 445 o/ Accrued salaries and benefits 142v Accrued member rewards 55x Deferred membership fees 57 o/ Other current liabilities 163 v Other liabilities 96 v Net cash from operating activities 3,142 at Capital Expenditures 1,617 a: Net cash from investing activities 1,617 x Dividends (551) v Change in current maturities of L-T debt (303) V Change in L-T Debt (547) o/ Stock repurchases (125) Net cash from nancing activities (1,526) v Net change in cash 1,526 x Beginning cash 4,192 o/ 3 4,114 x Ending cash