Answered step by step

Verified Expert Solution

Question

1 Approved Answer

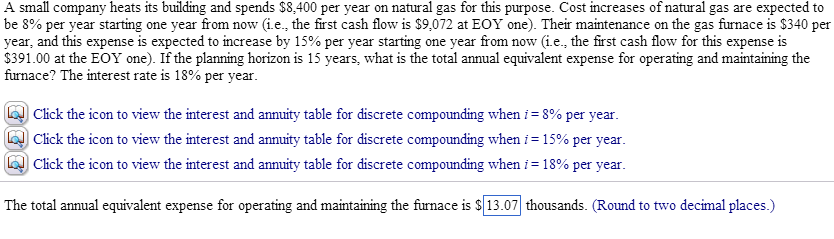

Please help, due by 4:00!! A small company heats its building and spends $8,400 per year on natural gas for this purpose. Cost increases of

Please help, due by 4:00!!

A small company heats its building and spends $8,400 per year on natural gas for this purpose. Cost increases of natural gas are expected to be 8% per year starting one year from now i-e., the first cash flow is $9,072 at EOY one). Their maintenance on the gas furnace is $340 per ear, and this expense is expected to increase by 15 per year starting one year from now i-e., the first cash flow for this expense is $391.00 at the EOY one). If the planning horizon is 15 years, what is the total annual equivalent expense for operating and maintaining the furnace? The interest rate is 18 per year Click the icon to view the interest and annuity table for discrete compounding when i 8% per year lick the icon to view the interest and annuity table for discrete compounding when i 15 per year. Click the icon to view the interest and annuity table for discrete compounding when i 18 per year The total annual equivalent expense for operating and maintaining the furnace is $13.07 thousands (Round to two decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started