Please help! Due in a few hours. :(

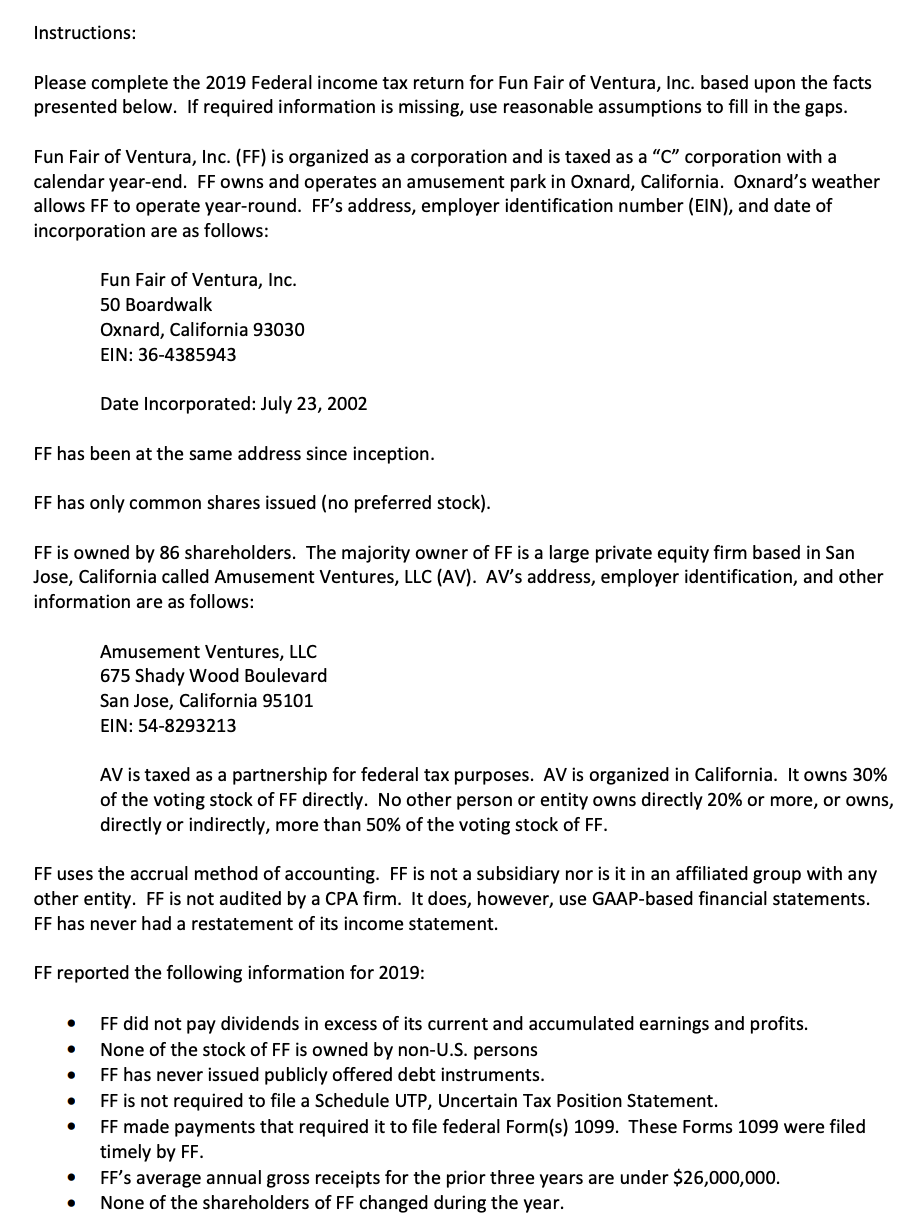

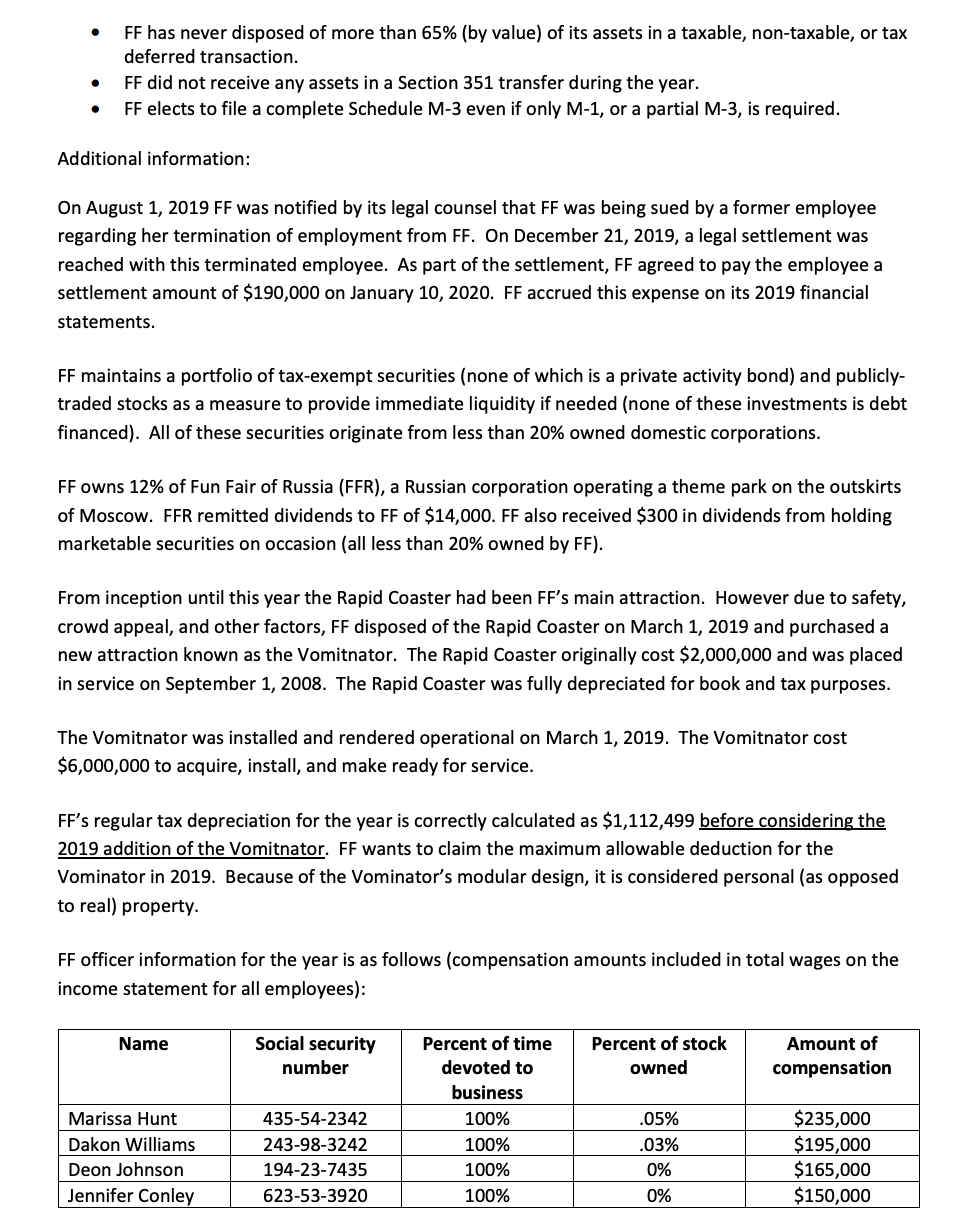

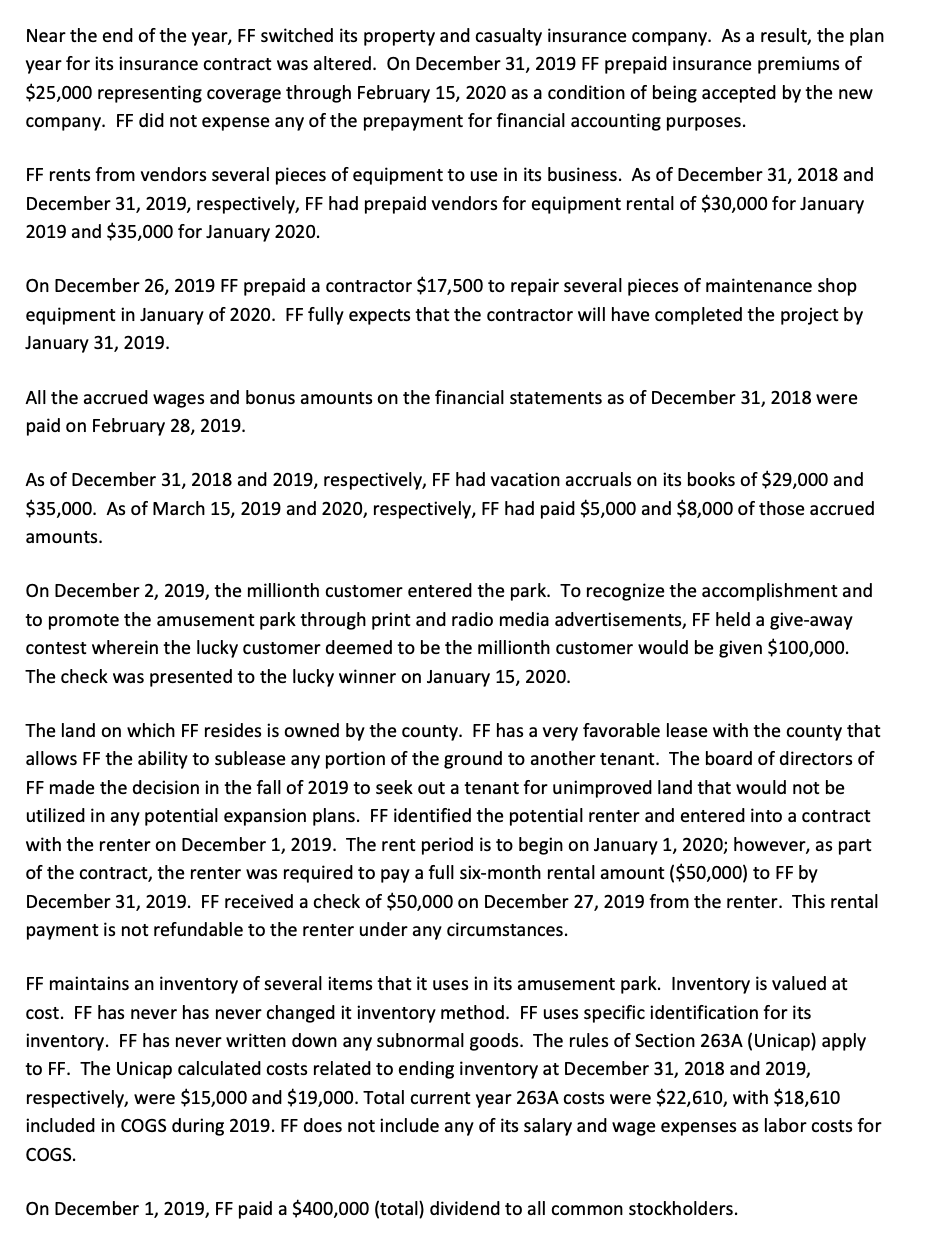

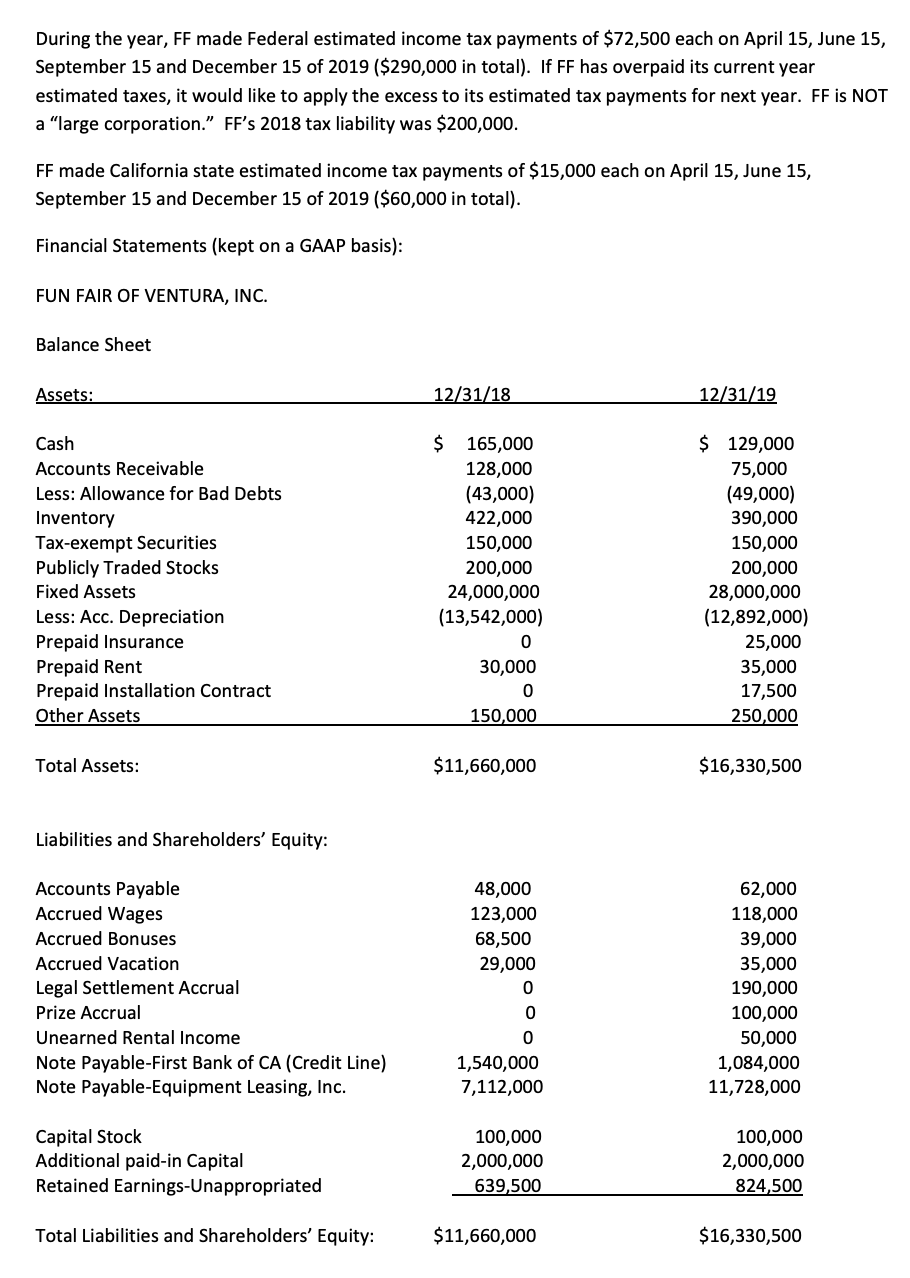

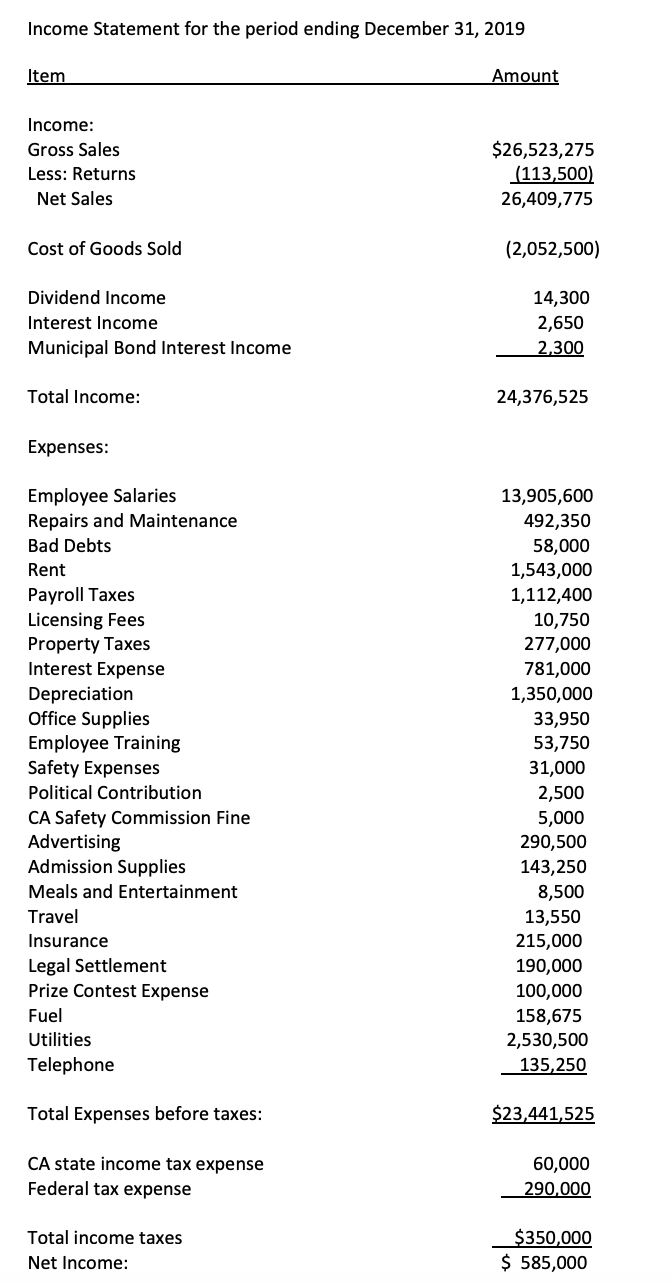

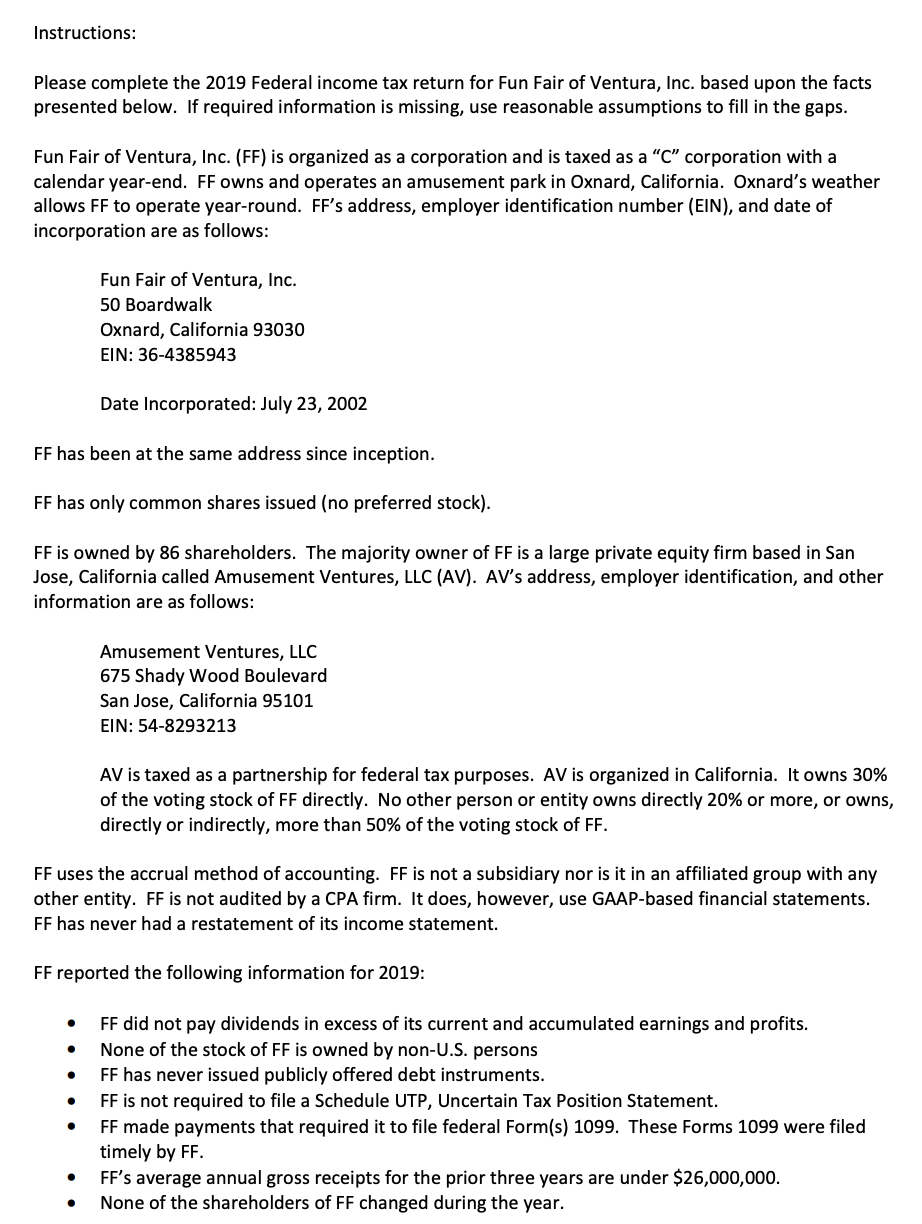

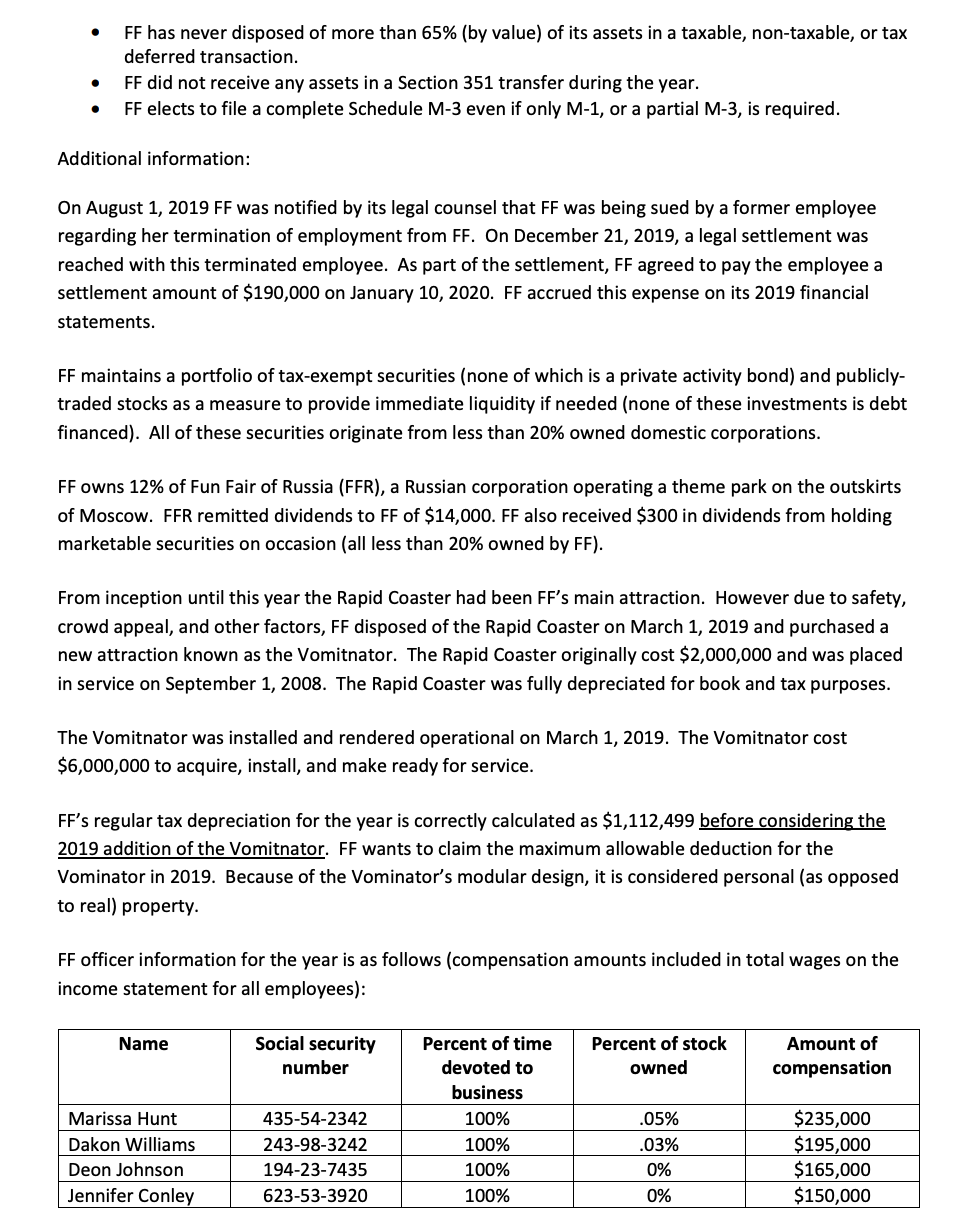

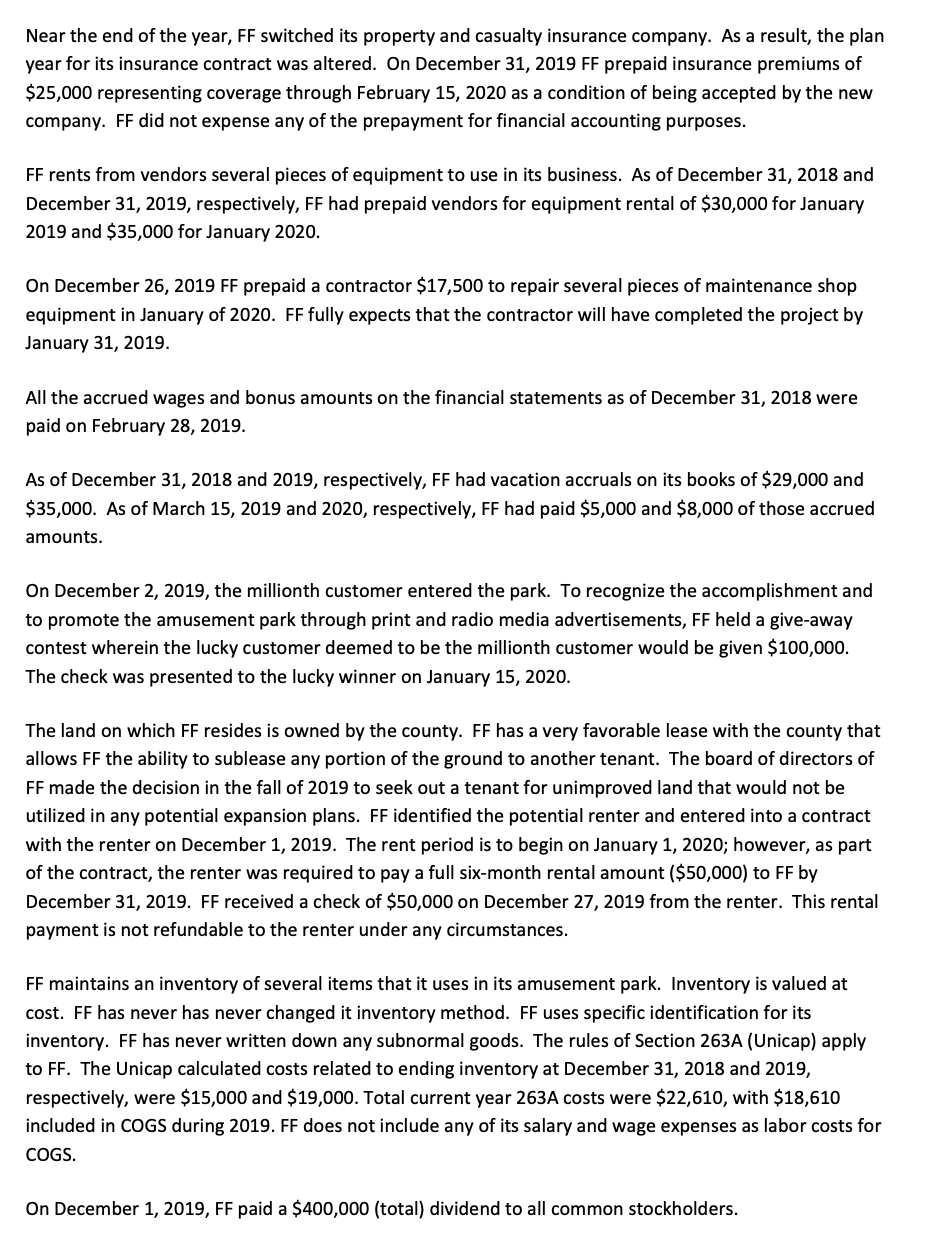

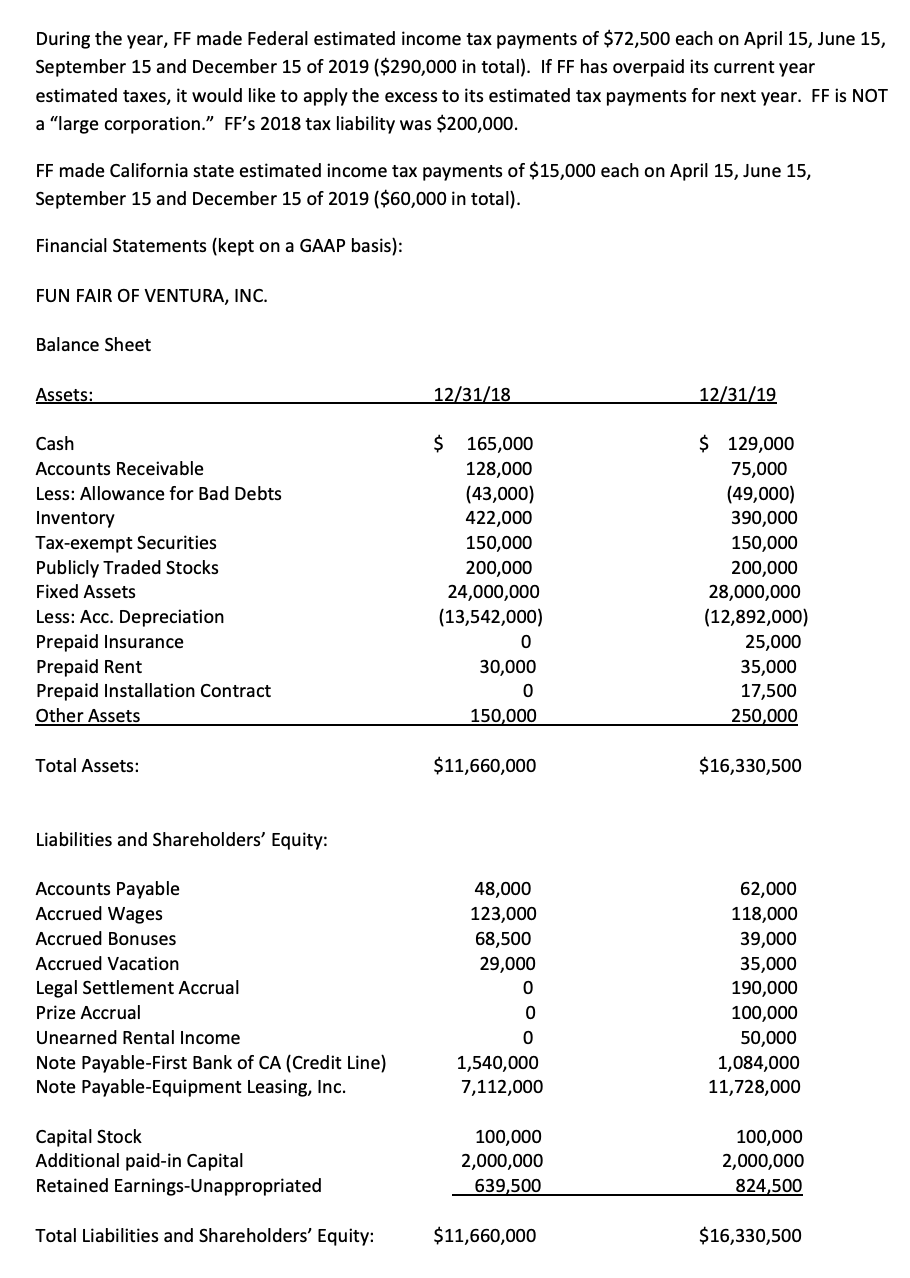

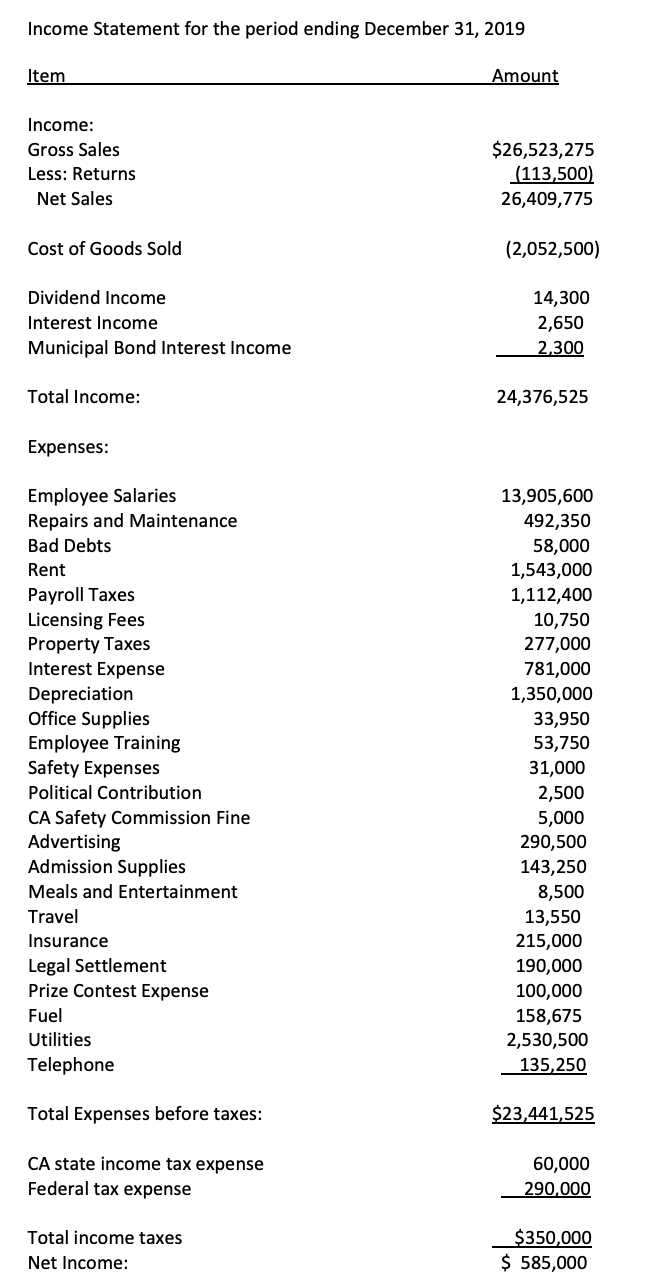

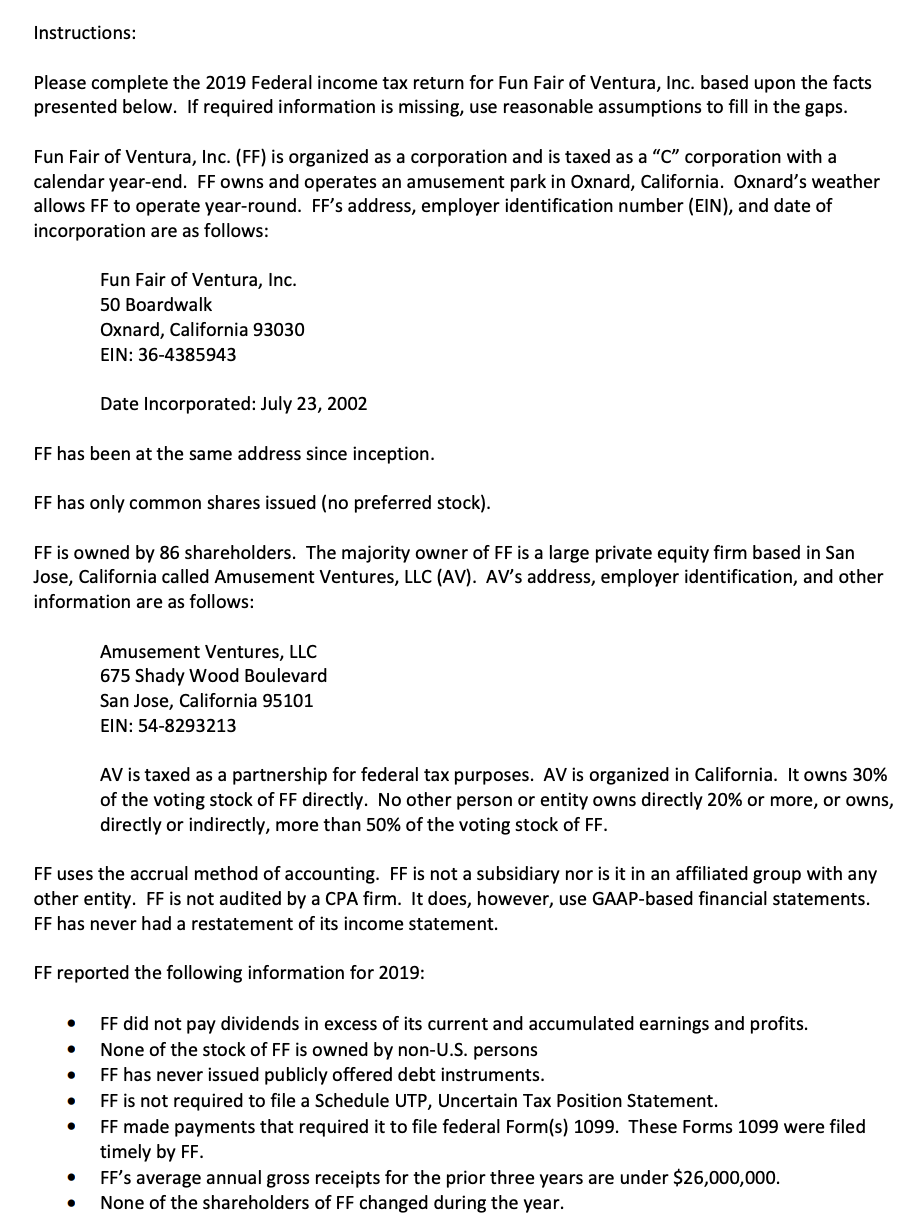

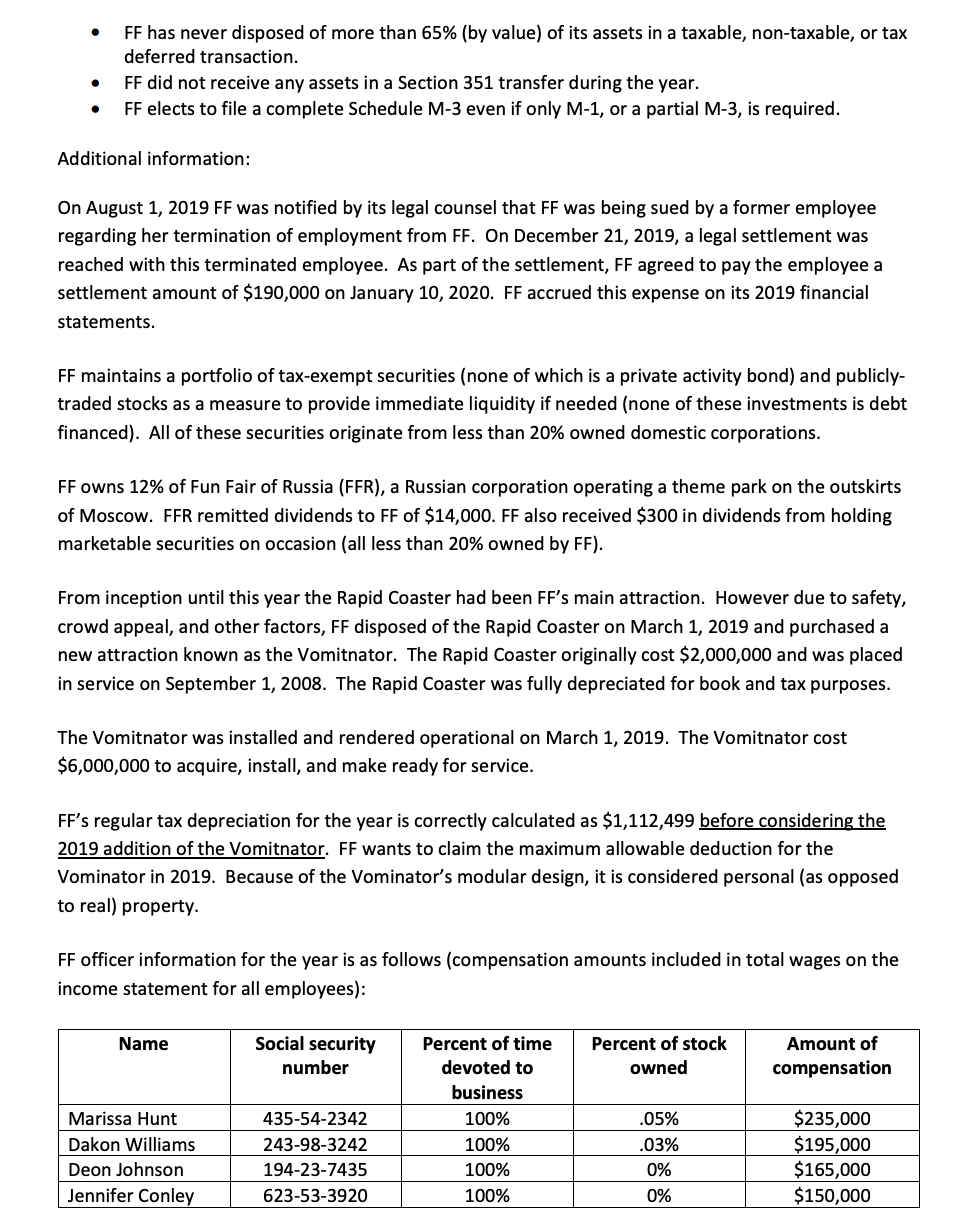

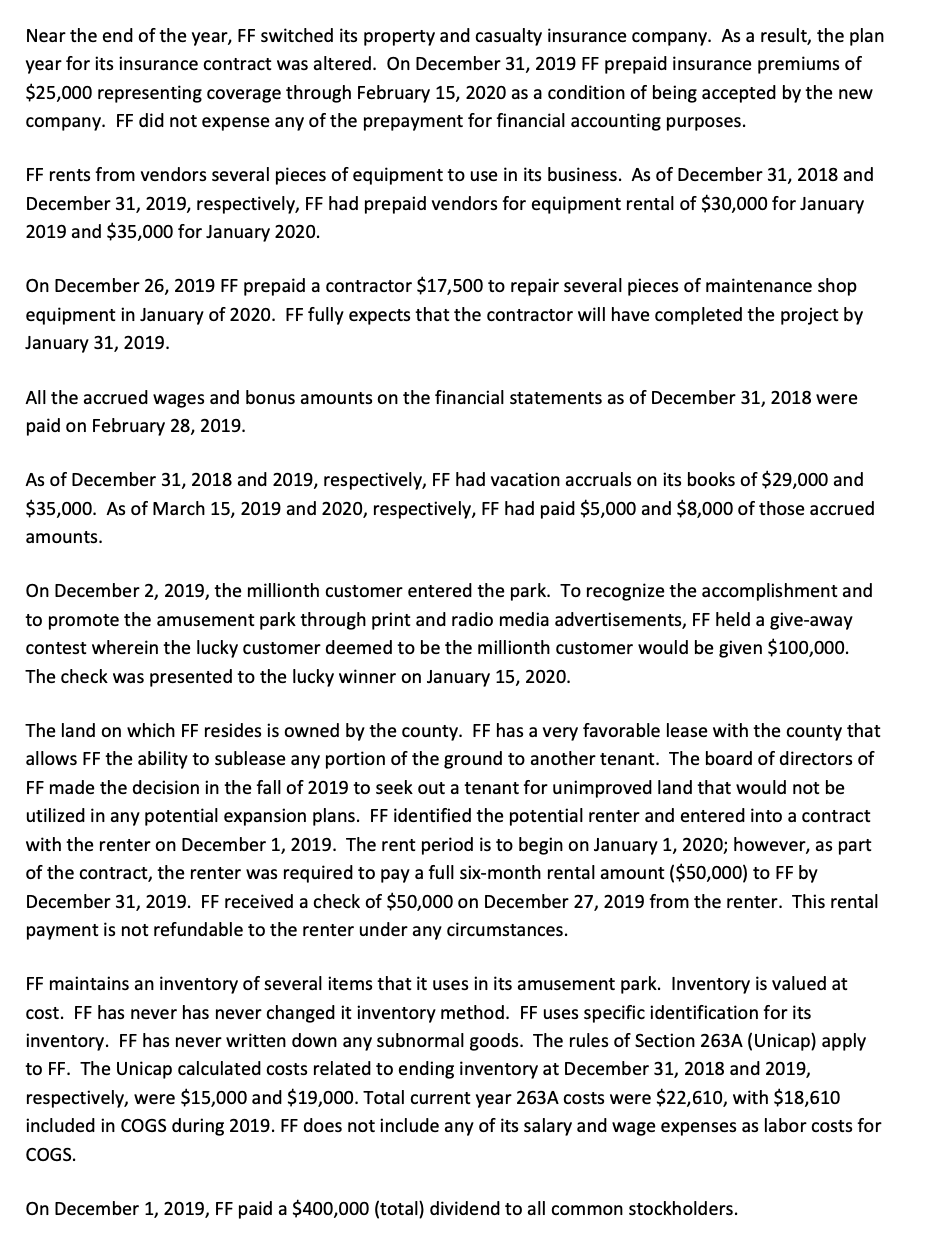

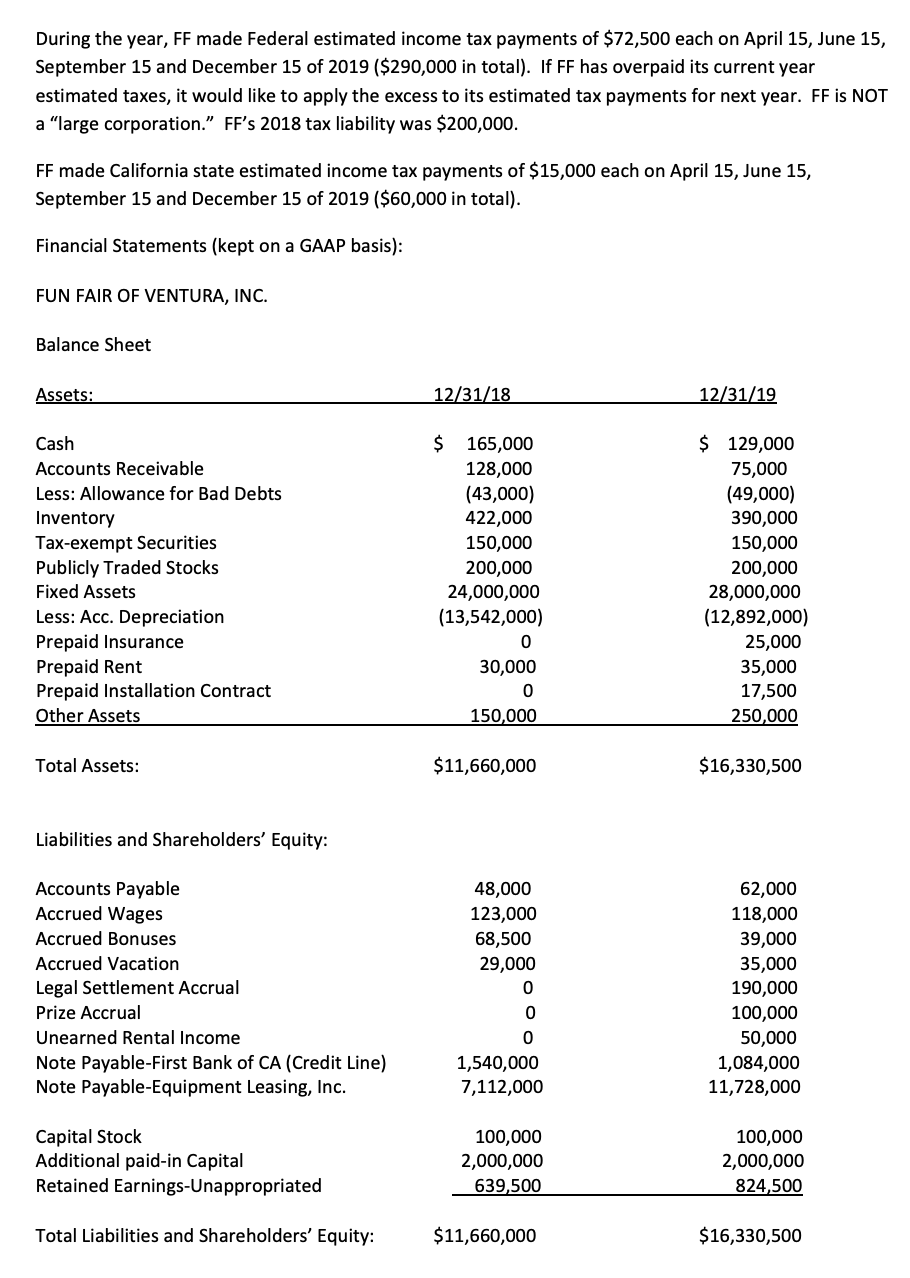

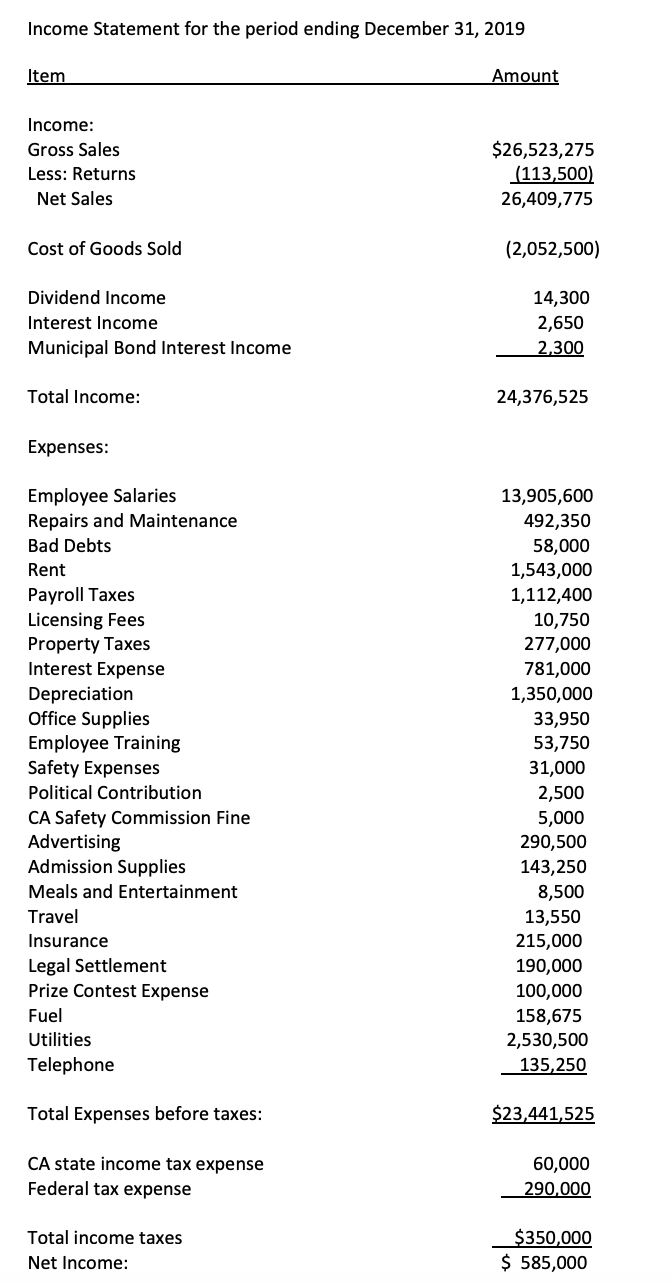

Instructions: Please complete the 2019 Federal income tax return for Fun Fair of Ventura, Inc. based upon the facts presented below. If required information is missing, use reasonable assumptions to ll in the gaps. Fun Fair of Ventura, Inc. (FF) is organized as a corporation and is taxed as a "C\" corporation with a calendar year-end. FF owns and operates an amusement park in Oxnard, California. Oxnard's weather allows FF to operate year-round. FF's address, employer identication number {ElN}, and date of incorporation are as follows: Fun Fair of Ventura, Inc. 50 Boa rdwalk Oxnard, California 93030 EIN: 364385943 Date Incorporated: July 23, 2002 FF has been at the same address since inception. FF has only common shares issued [no preferred stock}. FF is owned by 86 shareholders. The majority owner of FF is a large private equity rm based in San Jose, California called Amusement Ventures, LLC (AV). AV's address, employer identication, and other information are as follows: Amusement Ventures, LLC 675 Shady Wood Boulevard San Jose, California 95101 EIN: 54-8293213 AV is taxed as a partnership for federal tax purposes. AV is organized in California. It owns 30% of the voting stock of FF directly. No other person or entity owns directly 20% or more, or owns, directly or indirectly, more than 50% of the voting stock of FF. FF uses the accrual method of accounting. FF is not a subsidiary nor is it in an afliated group with any other entity. FF is not audited by a CPA rm. It does, however, use GAAP-based nancial statements. FF has never had a restatement of its income statement. FF reported the following information for 2019: FF did not pay dividends in excess of its current and accumulated earnings and prots. None of the stock of FF is owned by non-U.S. persons FF has never issued publicly offered debt instruments. FF is not required to le a Schedule UTP, Uncertain Tax Position Statement. FF made payments that required it to le federal Formfs) 1099. These Forms 1099 were filed timely by FF. FF's average annual gross receipts for the prior three years are under $26,000,000. None of the shareholders of FF changed during the yea r. 0 FF has never disposed of more than 65% {by value} of its assets in a taxable, non-taxable, or tax deferred transaction. 0 FF did not receive any assets in a Section 351 transfer during the year. 0 FF elects to file a complete Schedule M-3 even if only M-1, or a partial M-3, is required. Additional information: On August 1, 2019 FF was notified by its legal counsel that FF was being sued by a former employee regarding her termination of employment from FF. On December 21, 2019, a legal settlement was reached with this terminated employee. As part of the settlement, FF agreed to pay the employee a settlement amount of $190,000 on January 10, 2020. FF accrued this expense on its 2019 nancial statements. FF maintains a portfolio of tax-exempt securities {none of which is a private activity bond} and publicly- traded stocks as a measure to provide immediate liquidity if needed (none of these investments is debt financed). All of these securities originate from less than 20% owned domestic corporations. FF owns 12% of Fun Fair of Russia {FFR}, a Russian corporation operating a theme park on the outskirts of Moscow. FFR remitted dividends to FF of $14,000. FF also received $300 in dividends from holding marketable securities on occasion {all less than 20% owned by FF). From inception until this year the Rapid Coaster had been FF's main attraction. However due to safety, crowd appeal, and other factors, FF disposed of the Rapid Coaster on March 1, 2019 and purchased a new attraction known as the Vomitnator. The Rapid Coaster originally cost $2,000,000 and was placed in service on September 1, 2008. The Rapid Coaster was fully depreciated for book and tax purposes. The Vomitnator was installed and rendered operational on March 1, 2019. The Vomitnator cost $6,000,000 to acquire, install, and make ready for service. FF's regulartax depreciation for the year is correctly calculated as $1,112,499 before considering the 2019 addition of the Vomitnator. FF wants to claim the maximum allowable deduction for the Vominator in 2019. Because of the Vominator's modular design, it is considered personal {as opposed to real} property. FF ofcer information for the year is as follows {compensation amounts included in total wages on the income statement for all employees): Name Social security Percent of time Percent of stock Amount of number devoted to owned compensation business Marissa Hunt 435-54-2342 100% .0596 $235,000 Dakon Willia ms 243-518-3242 100% .0356 $195,000 Deon Johnson 194-23- 7435 100% 0% $165,000 Jennifer Conley 623-53 3920 100% 0% $150,000 Near the end of the year, FF switched its property and casualty insurance company. As a result, the plan year for its insurance contract was altered. On December 31, 2019 FF prepaid insurance premiums of $25,000 representing coverage through February 15, 2020 as a condition of being accepted by the new company. FF did not expense any ofthe prepayment for nancial accounting purposes. FF rents from vendors several pieces of equipment to use in its business. As of December 31, 2013 and December 31, 2019, respectively, FF had prepaid vendors for equipment rental of $30,000 for January 2019 and $35,000 for January 2020. On December 26, 2019 FF prepaid a contractor $17,500 to repair several pieces of maintenance shop equipment in January of 2020. FF fully expects that the contractor will have completed the project by January 31, 2019. All the accrued wages and bonus amounts on the nancial statements as of December 31, 2013 were paid on February 23, 2019. As of December 31, 2013 and 2019, respectively, FF had vacation accruals on its books of $29,000 and $35,000. As of March 15, 2019 and 2020, respectively, FF had paid $5,000 and $3,000 of those accrued amounts. On December 2, 2019, the millionth customer entered the park. To recognize the accomplishment and to promote the amusement park through print and radio media advertisements, FF held a give-away contest wherein the lucky customer deemed to be the millionth customer would be given $100,000. The check was presented to the lucky winner on January 15, 2020. The land on which FF resides is owned by the county. FF has a very favorable lease with the county that allows FF the ability to sublease any portion of the ground to another tenant. The board of directors of FF made the decision in the fall of 2019 to seek out a tenant for unimproved land that would not be utilized in any potential expansion plans. FF identied the potential renter and entered into a contract with the renter on December 1, 2019. The rent period is to begin on January 1, 2020; however, as part of the contract, the renter was required to pay a full six-month rental amount {$50,000} to FF by December 31, 2019. FF received a check of $50,000 on December 27, 2019 from the renter. This rental payment is not refundable to the renter under any circumstances. FF maintains an inventory of several items that it uses in its amusement park. Inventory is valued at cost. FF has never has never changed it inventory method. FF uses specic identication for its inventory. FF has never written down any subnormal goods. The rules of Section 263A {Unicap} apply to FF. The Unicap calculated costs related to ending inventory at December 31, 2013 and 2019, respectively, were $15,000 and $19,000. Total current year 263A costs were $22,610, with $13,610 included in COGS during 2019. FF does not include any of its salary and wage expenses as labor costs for COGS. On December 1, 2019, FF paid a $400,000 {total} dividend to all common stockholders. During the year, FF made Federal estimated income tax payments of $72,500 each on April 15, June 15, September 15 and December 15 of 2019 {$290,000 in total}. If FF has overpaid its current year estimated taxes, it would like to apply the excess to its estimated tax payments for next year. FF is NOT a "large corporation.\" FF's 2018 tax liability was $200,000. FF made California state estimated income tax payments of $15,000 each on April 15, June 15, September 15 and December 15 of 2019 {$60,000 in total). Financial Statements {kept on a GAAP basis): FUN FAIR OF VENTURA, INC. Balance Sheet Assets: 12 31 18 12 31 19 Cash S 165,000 $ 129,000 Accounts Receivable 128,000 75,000 Less: Allowance for Bad Debts {43,000} {49,000} Inventory 422,000 390,000 Tax-exempt Securities 150,000 150,000 Publicly Traded Stocks 200,000 200,000 Fixed Assets 24,000,000 28,000,000 Less: Acc. Depreciation {13,542,000} (12,892,000) Prepaid Insurance 0 25,000 Prepaid Rent 30,000 35,000 Prepaid Installation Contract 0 17,500 0the r Assets 150,000 250,000 Total Assets: $11,660,000 $16,330,500 Liabilities and Shareholders' Equity: Accounts Payable 48,000 62,000 Accrued Wages 123,000 118,000 Accrued Bonuses 68,500 39,000 Accrued Vacation 29,000 35,000 Legal Settlement Accrual 0 190,000 Prize Accrual 0 100,000 Unearned Rental Income 0 50,000 Note Payable-First Bank of CA {Credit Line) 1,540,000 1,084,000 Note Payable-Equipment Leasing, Inc. 7,112,000 11,728,000 Capital Stock 100,000 100,000 Additional paid-in Capital 2,000,000 2,000,000 Retained Earnings-Una ppropriated 639,500 824,500 Total Liabilities and shareholders' Equity: $11,660,000 $16,330,500 Income Statement for the period ending December 31, 2019 Item Income: Gross Sales Less: Returns Net Sales Cost of Goods Sold Dividend Income Interest Income Municipal Bond Interest Income Total Income: Expenses: Employee Salaries Repairs and Maintenance Bad Debts Rent Payroll Taxes Licensing Fees Property Taxes lnte rest Expense Depreciation Ofce Supplies Employee Training Safety Expenses Political Contribution CA Safety Commission Fine Advertising Admission Supplies Meals and Entertainment Travel Insurance Legal Settlement Prize Contest Expense Fuel Utilities Telephone Total Expenses before taxes: CA state income tax expense Federal tax expense Total income taxes Net Income: Amount $26,523,275 [113,500[ 26,409,775 {2,052,500} 14,300 2,550 2,300 24, 376, 525 13,905,600 492,350 53,000 1,543,000 1,112,400 10,750 277,000 731,000 1,350,000 33,950 53,750 31,000 2,500 5,000 290,500 143,250 3,500 13,550 215,000 190,000 100,000 153,675 2,530,500 135,250 $23:M1:525 50,000 290 000 $350,000 $ 535,000