Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP!! due tonight I REALLY NEED HELP ASAP!! Hoosier Technology, Inc, is a producer of digital rearview mirrors. Its current line of mirrors are

PLEASE HELP!! due tonight

I REALLY NEED HELP ASAP!!

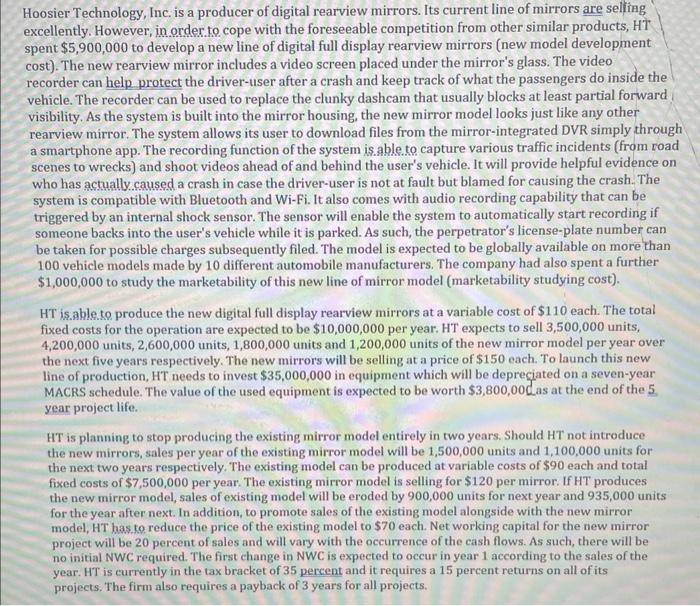

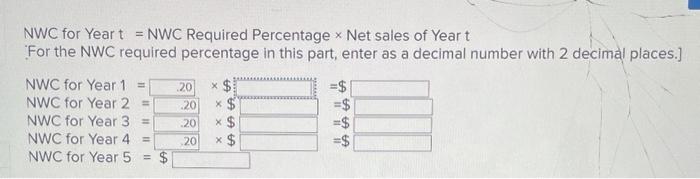

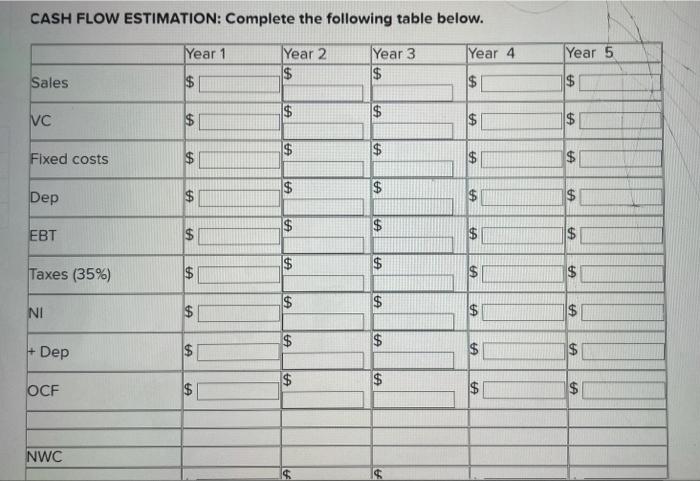

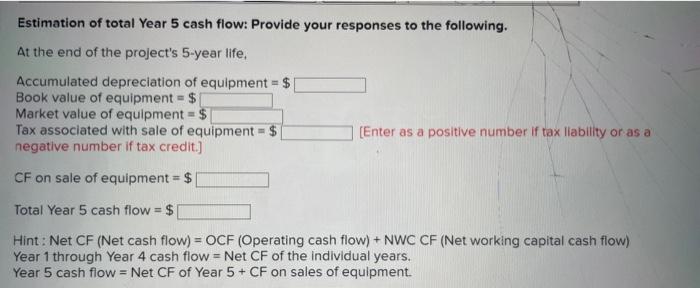

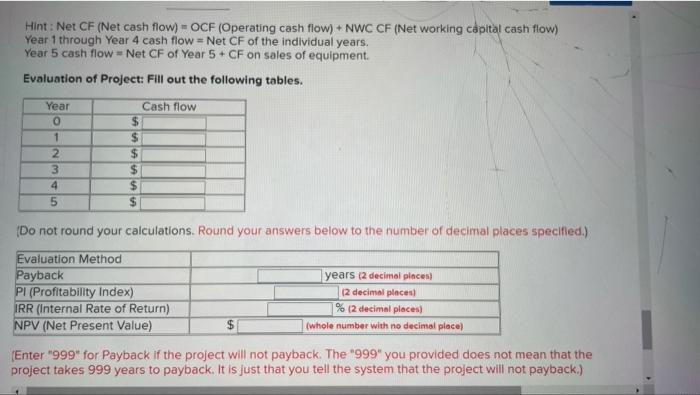

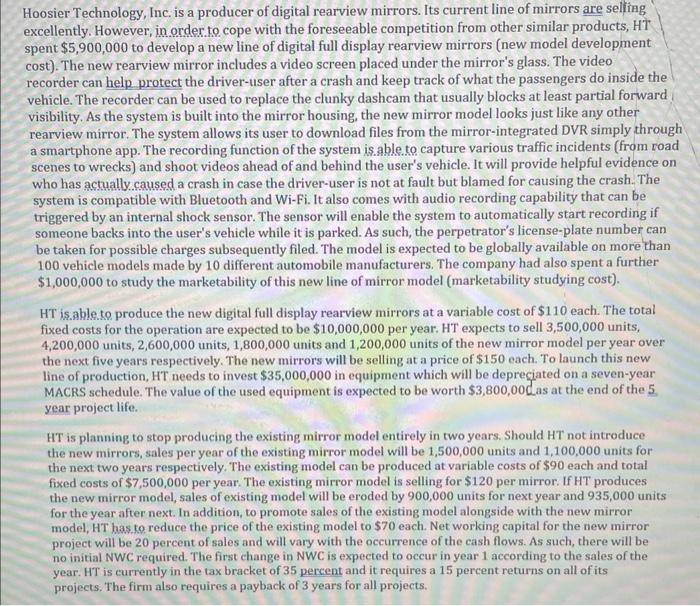

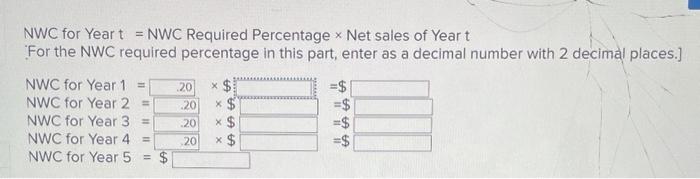

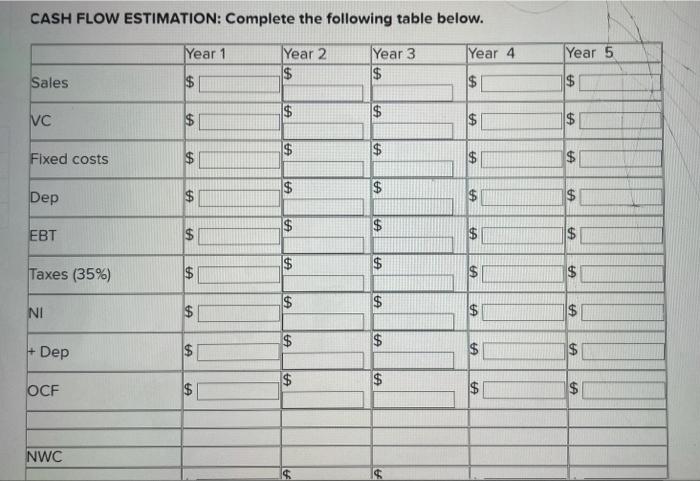

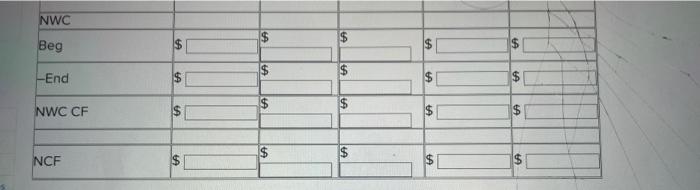

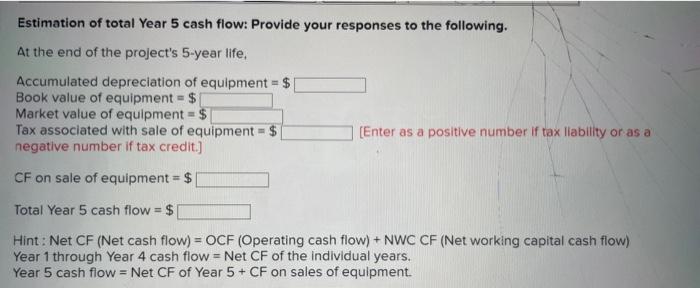

Hoosier Technology, Inc, is a producer of digital rearview mirrors. Its current line of mirrors are seling excellently. However, in order to cope with the foreseeable competition from other similar products, HT spent $5,900,000 to develop a new line of digital full display rearview mirrors (new model development cost). The new rearview mirror includes a video screen placed under the mirror's glass. The video recorder can help protect the driver-user after a crash and keep track of what the passengers do inside the vehicle. The recorder can be used to replace the clunky dashcam that usually blocks at least partial forward ; visibility. As the system is built into the mirror housing, the new mirror model looks just like any other rearview mirror. The system allows its user to download files from the mirror-integrated DVR simply through a smartphone app. The recording function of the system is.able to capture various traffic incidents (from road scenes to wrecks) and shoot videos ahead of and behind the user's vehicle. It will provide helpful evidence on who has actually. caused a crash in case the driver-user is not at fault but blamed for causing the crash. The system is compatible with Bluetooth and Wi-Fi. It also comes with audio recording capability that can be triggered by an internal shock sensor. The sensor will enable the system to automatically start recording if someone backs into the user's vehicle while it is parked. As such, the perpetrator's license-plate number can be taken for possible charges subsequently filed. The model is expected to be globally available on more than 100 vehicle models made by 10 different automobile manufacturers. The company had also spent a further $1,000,000 to study the marketability of this new line of mirror model (marketability studying cost). HT is.able to produce the new digital full display rearview mirrors at a variable cost of $110 each. The total fixed costs for the operation are expected to be $10,000,000 per year. HT expects to sell 3,500,000 units, 4,200,000 units, 2,600,000 units, 1,800,000 units and 1,200,000 units of the new mirror model per year aver the next five years respectively. The new mirrors will be selling at a price of $150 each. To launch this new line of production, HT needs to invest $35,000,000 in equipment which will be depreciated on a seven-year MACRS schedule. The value of the used equipment is expected to be worth $3,800,00 Cas at the end of the 5 year project life. HT is planning to stop producing the existing mirror model entirely in two years. Should HT not introduce the new mirrors, sales per year of the existing mirror model will be 1,500,000 units and 1,100,000 units for the next two years respectively. The existing model can be produced at variable costs of $90 each and total fixed costs of $7,500,000 per year. The existing mirror model is selling for $120 per mirror. If HT produces the new mirror model, sales of existing model will be eroded by 900,000 units for next year and 935,000 units for the year after next. In addition, to promote sales of the existing model alongside with the new mirror model, HT has to reduce the price of the existing model to $70 each. Net working capital for the new mirror project will be 20 percent of sales and will vary with the occurrence of the cash flows. As such, there will be no initial NWC required. The first change in NWC is expected to occur in year 1 according to the sales of the year. HT is currently in the tax bracket of 35 percent and it requires a 15 percent returns on all of its projects. The firm also requires a payback of 3 years for all projects. NWC for Year t= NWC Required Percentage Net sales of Year t For the NWC required percentage in this part, enter as a decimal number with 2 decimal places.] CASH FLOW ESTIMATION: Complete the following table below. Estimation of total Year 5 cash flow: Provide your responses to the following. At the end of the project's 5-year life, Accumulated depreciation of equipment =$ Book value of equipment =$ Market value of equipment =$ Tax associated with sale of equipment =$ [Enter as a positive number if tax llability or as a negative number if tax credit.] CF on sale of equipment =$ Total Year 5 cash flow =$ Hint : Net CF (Net cash flow) = OCF (Operating cash flow) + NWC CF (Net working capital cash flow) Year 1 through Year 4 cash flow = Net CF of the individual years. Year 5 cash flow = Net CF of Year 5+ CF on sales of equipment. Hint : Net CF (Net cash flow) = OCF (Operating cash flow) + NWC CF (Net working capital cash flow) Year 1 through Year 4 cash flow = Net CF of the individual years. Year 5 cash flow = Net CF of Year 5+CF on sales of equipment. Evaluation of Project: Fill out the following tables. (Do not round your calculations. Round your answers below to the number of decimal places specified.) Enter "999" for Payback if the project will not payback. The "999" you provided does not mean that the project takes 999 years to payback. It is just that you tell the system that the project will not payback.) Hoosier Technology, Inc, is a producer of digital rearview mirrors. Its current line of mirrors are seling excellently. However, in order to cope with the foreseeable competition from other similar products, HT spent $5,900,000 to develop a new line of digital full display rearview mirrors (new model development cost). The new rearview mirror includes a video screen placed under the mirror's glass. The video recorder can help protect the driver-user after a crash and keep track of what the passengers do inside the vehicle. The recorder can be used to replace the clunky dashcam that usually blocks at least partial forward ; visibility. As the system is built into the mirror housing, the new mirror model looks just like any other rearview mirror. The system allows its user to download files from the mirror-integrated DVR simply through a smartphone app. The recording function of the system is.able to capture various traffic incidents (from road scenes to wrecks) and shoot videos ahead of and behind the user's vehicle. It will provide helpful evidence on who has actually. caused a crash in case the driver-user is not at fault but blamed for causing the crash. The system is compatible with Bluetooth and Wi-Fi. It also comes with audio recording capability that can be triggered by an internal shock sensor. The sensor will enable the system to automatically start recording if someone backs into the user's vehicle while it is parked. As such, the perpetrator's license-plate number can be taken for possible charges subsequently filed. The model is expected to be globally available on more than 100 vehicle models made by 10 different automobile manufacturers. The company had also spent a further $1,000,000 to study the marketability of this new line of mirror model (marketability studying cost). HT is.able to produce the new digital full display rearview mirrors at a variable cost of $110 each. The total fixed costs for the operation are expected to be $10,000,000 per year. HT expects to sell 3,500,000 units, 4,200,000 units, 2,600,000 units, 1,800,000 units and 1,200,000 units of the new mirror model per year aver the next five years respectively. The new mirrors will be selling at a price of $150 each. To launch this new line of production, HT needs to invest $35,000,000 in equipment which will be depreciated on a seven-year MACRS schedule. The value of the used equipment is expected to be worth $3,800,00 Cas at the end of the 5 year project life. HT is planning to stop producing the existing mirror model entirely in two years. Should HT not introduce the new mirrors, sales per year of the existing mirror model will be 1,500,000 units and 1,100,000 units for the next two years respectively. The existing model can be produced at variable costs of $90 each and total fixed costs of $7,500,000 per year. The existing mirror model is selling for $120 per mirror. If HT produces the new mirror model, sales of existing model will be eroded by 900,000 units for next year and 935,000 units for the year after next. In addition, to promote sales of the existing model alongside with the new mirror model, HT has to reduce the price of the existing model to $70 each. Net working capital for the new mirror project will be 20 percent of sales and will vary with the occurrence of the cash flows. As such, there will be no initial NWC required. The first change in NWC is expected to occur in year 1 according to the sales of the year. HT is currently in the tax bracket of 35 percent and it requires a 15 percent returns on all of its projects. The firm also requires a payback of 3 years for all projects. NWC for Year t= NWC Required Percentage Net sales of Year t For the NWC required percentage in this part, enter as a decimal number with 2 decimal places.] CASH FLOW ESTIMATION: Complete the following table below. Estimation of total Year 5 cash flow: Provide your responses to the following. At the end of the project's 5-year life, Accumulated depreciation of equipment =$ Book value of equipment =$ Market value of equipment =$ Tax associated with sale of equipment =$ [Enter as a positive number if tax llability or as a negative number if tax credit.] CF on sale of equipment =$ Total Year 5 cash flow =$ Hint : Net CF (Net cash flow) = OCF (Operating cash flow) + NWC CF (Net working capital cash flow) Year 1 through Year 4 cash flow = Net CF of the individual years. Year 5 cash flow = Net CF of Year 5+ CF on sales of equipment. Hint : Net CF (Net cash flow) = OCF (Operating cash flow) + NWC CF (Net working capital cash flow) Year 1 through Year 4 cash flow = Net CF of the individual years. Year 5 cash flow = Net CF of Year 5+CF on sales of equipment. Evaluation of Project: Fill out the following tables. (Do not round your calculations. Round your answers below to the number of decimal places specified.) Enter "999" for Payback if the project will not payback. The "999" you provided does not mean that the project takes 999 years to payback. It is just that you tell the system that the project will not payback.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started