Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help faster Question 4 Harvey Ltd. distributes household electrical items to retail shops and DIY centres. The company has been trading for the last

please help faster

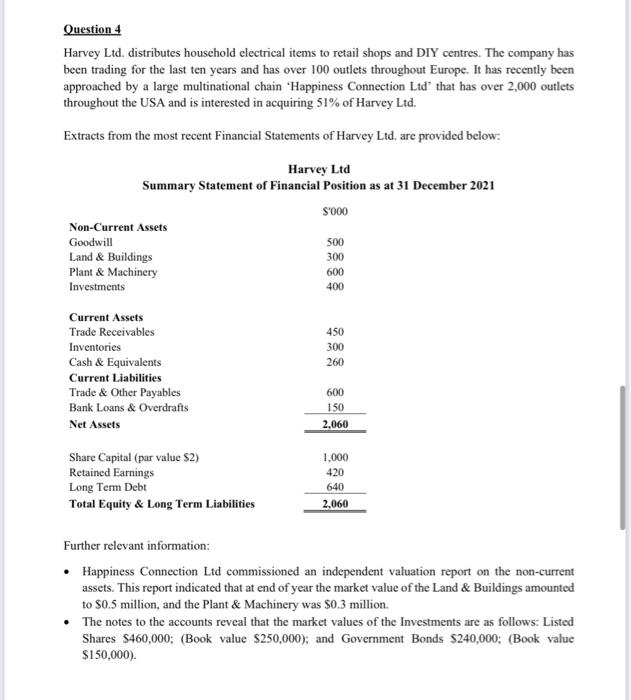

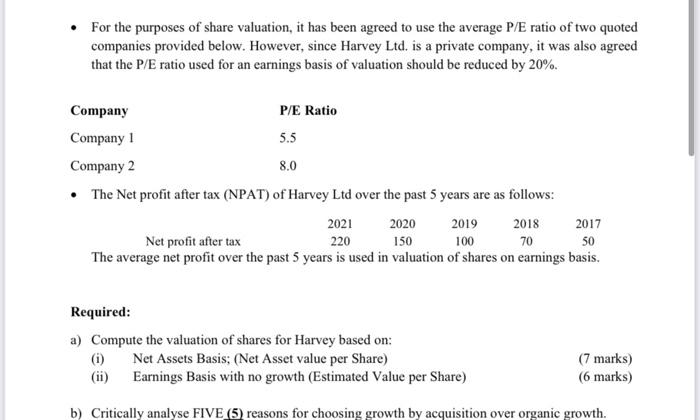

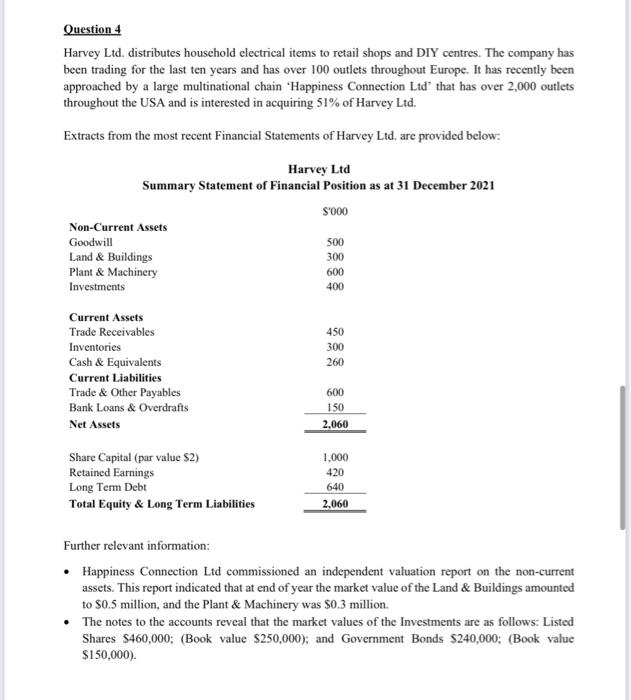

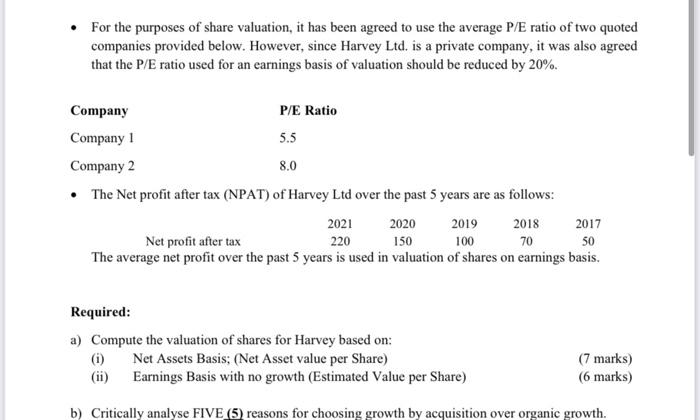

Question 4 Harvey Ltd. distributes household electrical items to retail shops and DIY centres. The company has been trading for the last ten years and has over 100 outlets throughout Europe. It has recently been approached by a large multinational chain 'Happiness Connection Ltd' that has over 2,000 outlets throughout the USA and is interested in acquiring 51% of Harvey Ltd. Extracts from the most recent Financial Statements of Harvey Ltd. are provided below: Harvey Ltd Summary Statement of Financial Position as at 31 December 2021 S'000 Non-Current Assets Goodwill 500 Land & Buildings 300 Plant & Machinery 600 Investments 400 450 300 260 Current Assets Trade Receivables Inventories Cash & Equivalents Current Liabilities Trade & Other Payables Bank Loans & Overdrafts Net Assets 600 150 2,060 Share Capital (par value $2) Retained Earnings Long Term Debt Total Equity & Long Term Liabilities 1,000 420 640 2,060 Further relevant information: Happiness Connection Ltd commissioned an independent valuation report on the non-current assets. This report indicated that at end of year the market value of the Land & Buildings amounted to 80.5 million, and the Plant & Machinery was $0.3 million. The notes to the accounts reveal that the market values of the Investments are as follows: Listed Shares $460,000: (Book value $250,000); and Government Bonds $240,000: (Book value $150,000). For the purposes of share valuation, it has been agreed to use the average P/E ratio of two quoted companies provided below. However, since Harvey Ltd. is a private company, it was also agreed that the P/E ratio used for an earnings basis of valuation should be reduced by 20%. Company P/E Ratio Company 1 5.5 Company 2 8.0 The Net profit after tax (NPAT) of Harvey Ltd over the past 5 years are as follows: 2021 2020 2019 2018 2017 Net profit after tax 220 150 100 70 50 The average net profit over the past 5 years is used in valuation of shares on earnings basis. Required: a) Compute the valuation of shares for Harvey based on: (i) Net Assets Basis; (Net Asset value per Share) Earnings Basis with no growth (Estimated Value per Share) (7 marks) (6 marks) b) Critically analyse FIVE (5) reasons for choosing growth by acquisition over organic growth

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started