Question: Please help fill in the blank boxes! APPLY THE CONCEPTS: Record payroll entries The payroll clerk at Rivera, Inc., has used a spreadsheet program to

Please help fill in the blank boxes!

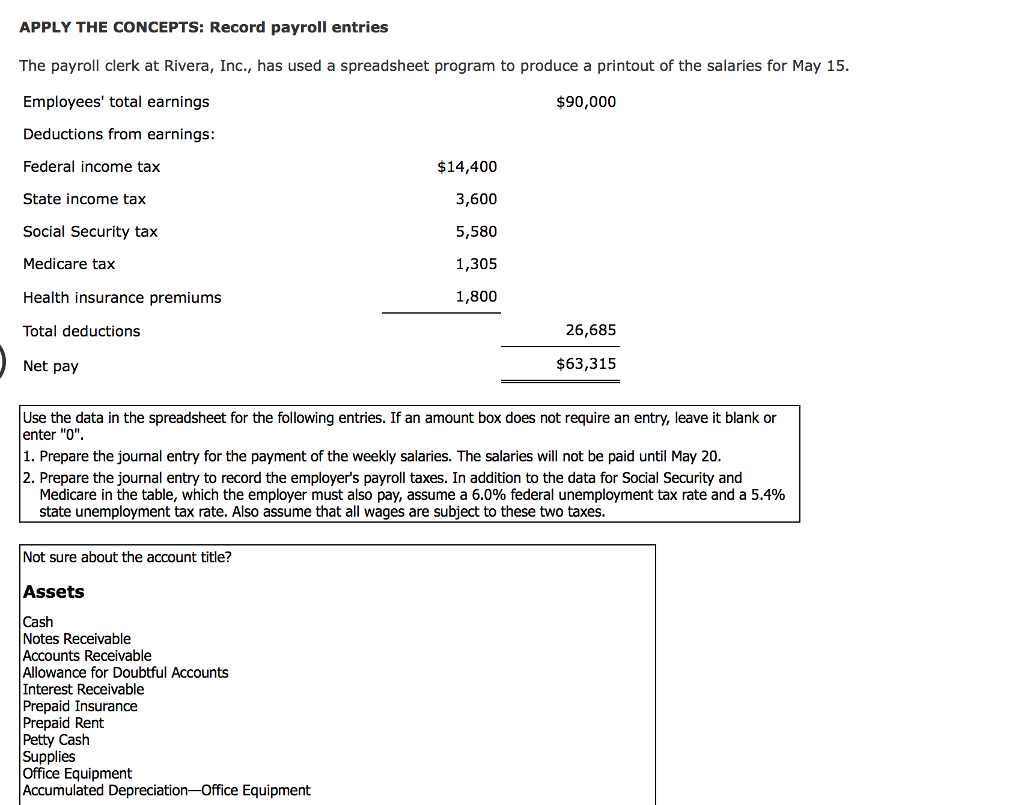

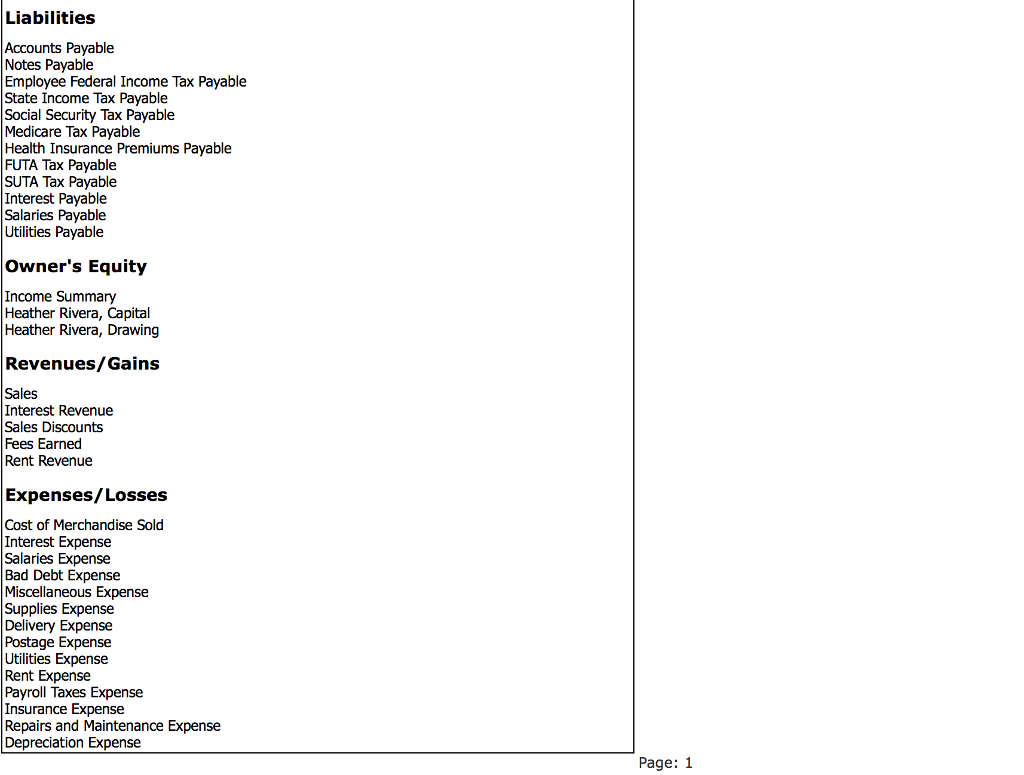

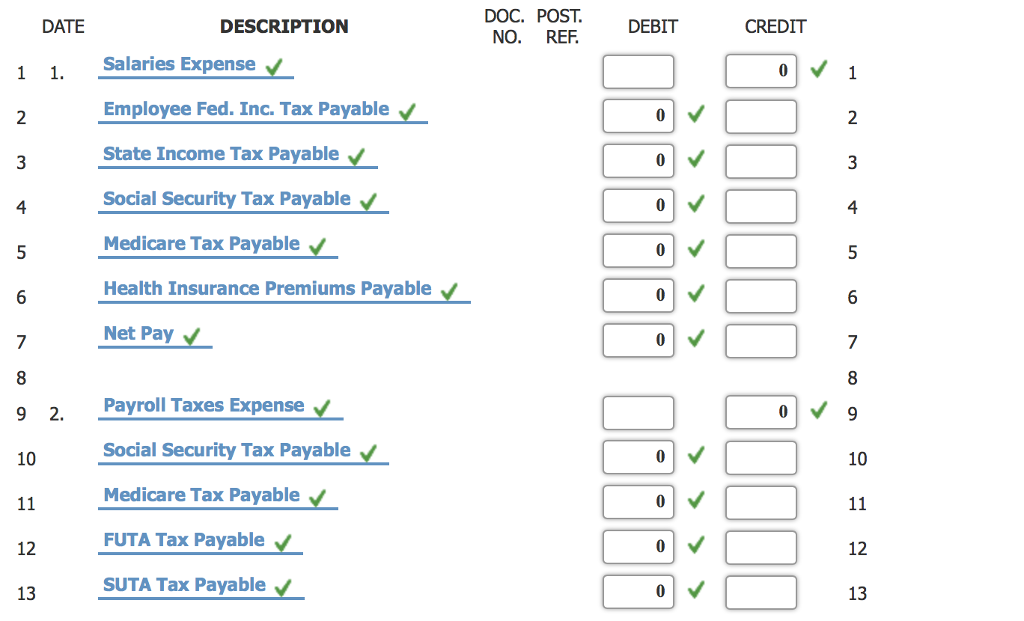

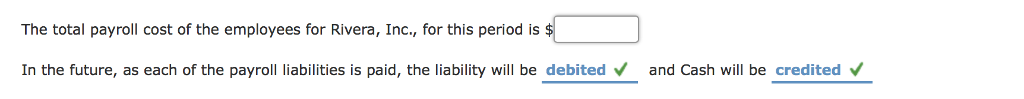

APPLY THE CONCEPTS: Record payroll entries The payroll clerk at Rivera, Inc., has used a spreadsheet program to produce a printout of the salaries for May 15 Employees' total earnings Deductions from earnings Federal income tax State income tax Social Security tax Medicare tax Health insurance premiums Total deductions Net pay $90,000 $14,400 3,600 5,580 1,305 1,800 26,685 $63,315 Use the data in the spreadsheet for the following entries. If an amount box does not require an entry, leave it blank or enter "O". 1. Prepare the journal entry for the payment of the weekly salaries. The salaries will not be paid until May 20 2. Prepare the journal entry to record the employer's payroll taxes. In addition to the data for Social Security and Medicare in the table, which the employer must also pay, assume a 6.0% federal unemployment tax rate and a 5.4% state unemployment tax rate. Also assume that all wages are subject to these two taxes. Not sure about the account title? Assets Cash Notes Receivabe Accounts Receivable Allowance for Doubtful Accounts Interest Receivable Prepaid Insurance Prepaid Rent Petty Cash Supplies Office Equipment Accumulated Depreciation-Office Equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts