Answered step by step

Verified Expert Solution

Question

1 Approved Answer

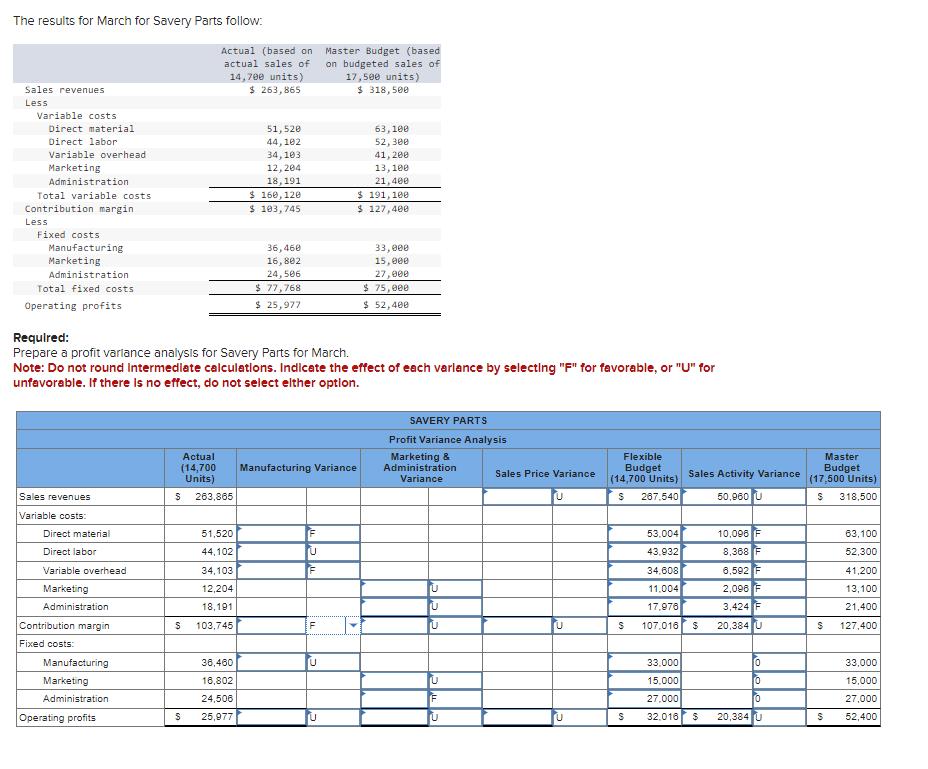

Fill in the missing information. The results for March for Savery Parts follow: Sales revenues Less Variable costs Direct material Direct labor Less Variable overhead

Fill in the missing information.

The results for March for Savery Parts follow: Sales revenues Less Variable costs Direct material Direct labor Less Variable overhead Marketing Administration Total variable costs Contribution margin Fixed costs Manufacturing Marketing Administration Total fixed costs Operating profits Sales revenues Variable costs: Direct material Direct labor Variable overhead Marketing Administration Contribution margin Fixed costs: Manufacturing Marketing Administration Actual (based on Master Budget (based actual sales of on budgeted sales of 17,500 units) $ 318,500 Operating profits 14,700 units) $ 263,865 Required: Prepare a profit variance analysis for Savery Parts for March. Note: Do not round Intermediate calculations. Indicate the effect of each varlance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option. Actual (14,700 Units) S 263,865 51,520 44,102 34,103 12,204 18,191 S 103,745 51,520 44,102 34,103 12,204 18, 191 $ 160, 120 $ 103,745 36,460 16,802 24,506 S 25,977 36,460 16,802 24,506 $ 77,768 $ 25,977 Manufacturing Variance U F U 63,100 52,300 41, 200 13,100 21,400 U $191,100 $ 127,400 33,000 15,000 27,000 $ 75,000 $ 52,400 SAVERY PARTS Profit Variance Analysis Marketing & Administration Variance U U U U F Sales Price Variance U U U Flexible Budget (14,700 Units) S 267,540 53.004 43.932 34.608 11.004 17,976 S 107.016 S 33.000 15.000 27,000 32.016 Sales Activity Variance 50,960 U $ 10,096 F 8,368 F 6,592 F 2,096 F 3,424 F 20,384 U 0 10 10 $ 20,384 U Master Budget (17,500 Units) $ 318,500 S S 63,100 52,300 41,200 13,100 21,400 127,400 33,000 15,000 27,000 52,400

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Actual 14700 Units Profit Variance Analysis Marketing Administrati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started