please help fill out form 4562 pg 1 and 2. thank you.

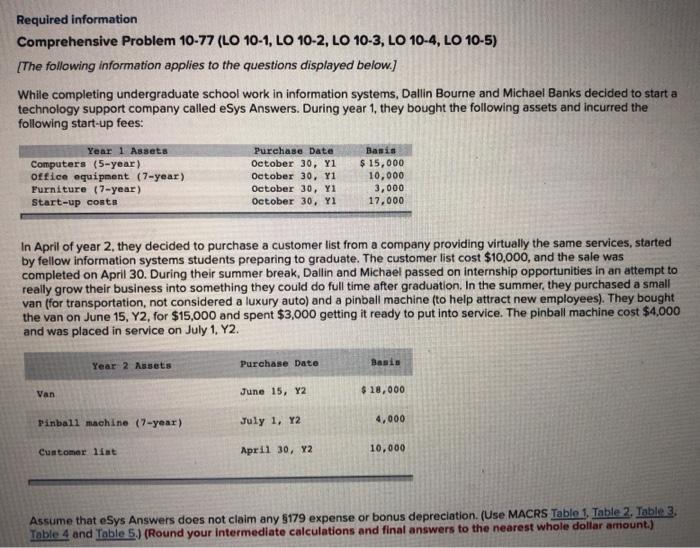

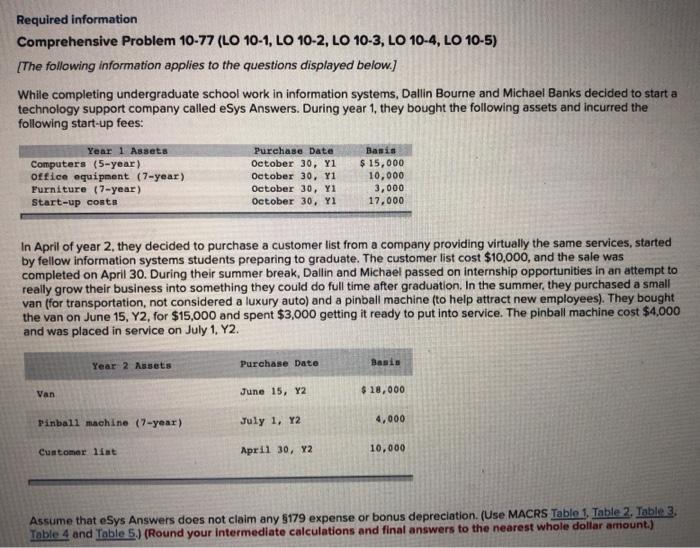

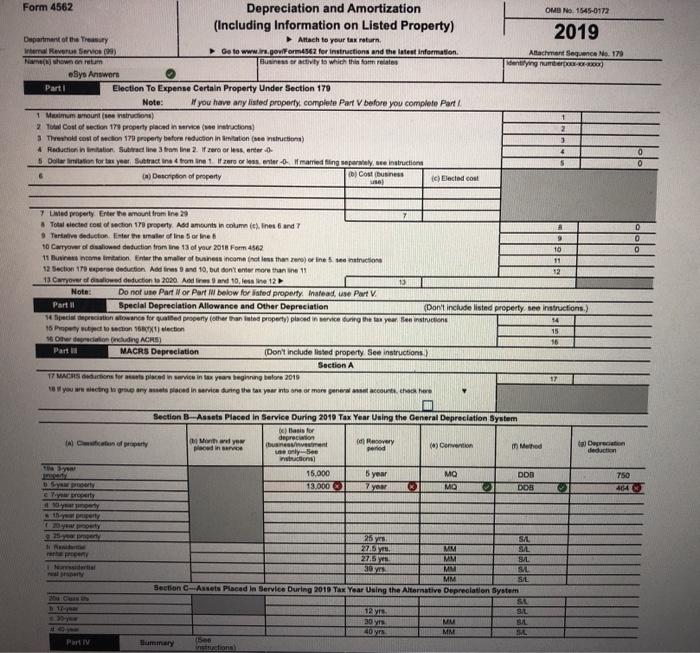

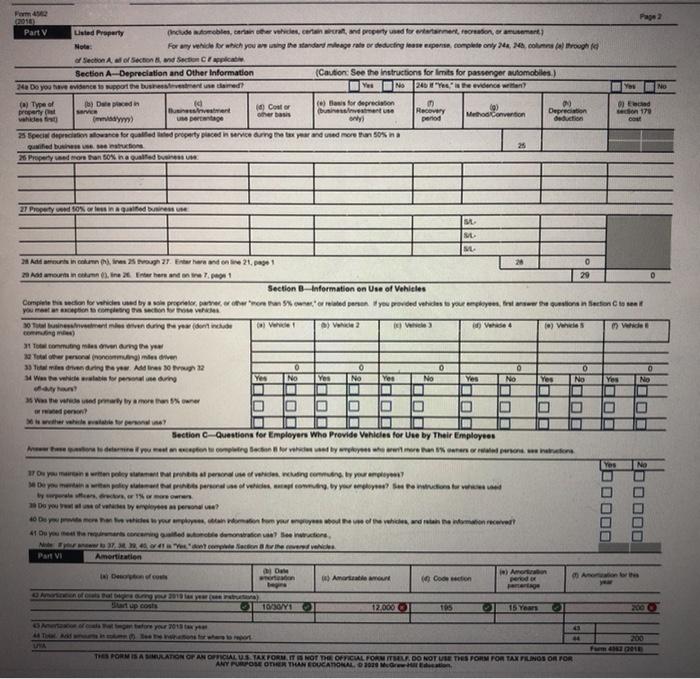

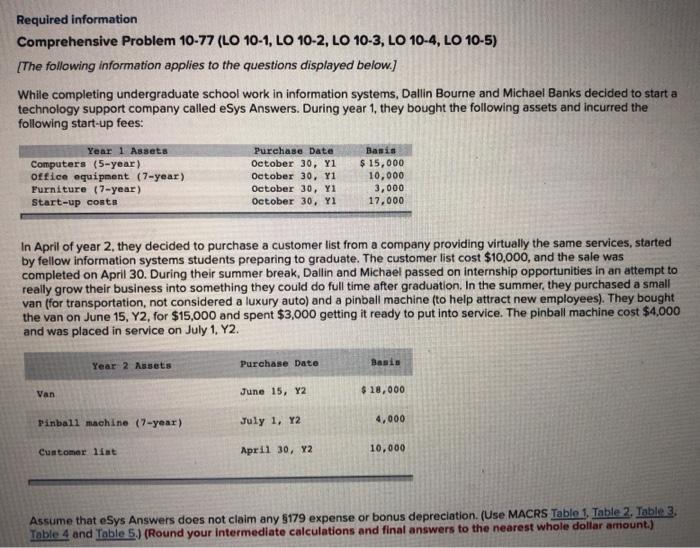

Required information Comprehensive Problem 10-77 (LO 10-1, LO 10-2, LO 10-3, LO 10-4, LO 10-5) [The following information applies to the questions displayed below.) While completing undergraduate school work in information systems, Dallin Bourne and Michael Banks decided to start a technology support company called eSys Answers. During year 1, they bought the following assets and incurred the following start-up fees: Year 1 Assets Computers (5-year) office equipment (7-year) Furniture (7-year) Start-up costs Purchase Data October 30, X1 October 30, Y1 October 30, Yi October 30, Yi Basis $ 15,000 10,000 3,000 17.000 In April of year 2, they decided to purchase a customer list from a company providing virtually the same services, started by fellow information systems students preparing to graduate. The customer list cost $10,000, and the sale was completed on April 30. During their summer break, Dallin and Michael passed on internship opportunities in an attempt to really grow their business into something they could do full time after graduation. In the summer, they purchased a small van (for transportation, not considered a luxury auto) and a pinball machine to help attract new employees). They bought the van on June 15, Y2, for $15,000 and spent $3,000 getting it ready to put into service. The pinball machine cost $4,000 and was placed in service on July 1, Y2. Year 2 Assets Purchase Date Basis Van June 15, Y2 $ 18,000 Pinball machine (7-year) July 1, Y2 4,000 Cuntomer liat April 30, Y2 10,000 Assume that eSys Answers does not claim any 5179 expense or bonus depreciation. (Use MACRS Table 1, Table 2. Table 3. Table 4 and Table 5.) (Round your intermediate calculations and final answers to the nearest whole dollar amount.) OMB No 1545-0172 2019 Attachment Sequence No. 179 lying number) Form 4562 Depreciation and Amortization (Including Information on Listed Property) Department of the Treasury Attach to your tax return. Internal Revenue Service Go to www.in.gov/form4562 for instructions and the latest Information Name(shown on ruum Business or activity to which this formats eSys Answers Parti Election To Expense Certain Property Under Section 179 Note: you have any listed property, complete Part V before you complete Party 1 Mem on see visto) 2 Total Cost of section 17 property placed in Intructions) 3 Threshold cost of con 179 property before reduction in mation (instruction) 4 Reduction in limitation Stradline from line 2. If zero or less, arter $ Dollar nation for a year Suntractina from net zero Oro married ling separately see instructions Description of property Cost business us (c) Elected cost 2 3 4 5 0 0 0 7 Led property. Enter the amount from Ine 29 # Total elected cost of section 17 property. Asd amounts in one). Ines 6 and 7 Tative deduction Enter the of line 5 ore 9 10 Carrowded deduction from the 13 of your 2018 Form 4562 10 11 Buone on. Enter the smaller of business income in less tha) in natione 11 12 Section 17 perseduction Add lines and 10, but don't ever more than in 11 12 13 Carryover losed deduction to 2020. Adresard 10 less line 12 13 Note: Do not use Part W or Part I below for sted property Instead, use Pot Parti Special Depreciation Allowance and Other Depreciation (Don't include listed property See Instructions) Hipertoniowance for quited property (other than inte property placed in service during the tax your Bestructions 14 15 Pmper you to thon section 15 O depreciation ding ACRS) 16 Parti MACRS Depreciation (Don't include listed property See instructions Section A 17 CR dedition for at placed in service in to years beginning before 2019 18 you wengige anys pedinia during the tax your tone or more new account Checker ST Section B Assets Placed in Service During 2010 Tax Year Uning the General Depreciation System c) lasis for Mondo deprecation uvement (Recovery din ce period ( Convention i Method neonly con 15.000 5 year MO DDD 13.000 7 year MO DDB Depreciation deduction 750 Det y porty perty 25 SAL MM SIL 2750 W MM SL 30 y. MM MM Section Assets Placed in Service During 2019 Tax Year Using the Alternative Depreciation System SE 92 30 y BAL 40 yrs MM Mummary 15 stustion 12. Part Page 2 Party Listed Property Include tomber er wieder and property used for entert, remation, or aument) Note For any whide for which you an wang the standartagerator deducting se experie, complete only controle Section All of Section and Sector Section A-Depreciation and Other Information (Caution: See the instructions for limits for passenger automobiles) 24 Do you have evidence to wpport the bustrant lamed? NS 240 "Yeshe evidence in NO Recovery pen End con 170 CE Depreciation deduction Method Convention ( Type of b) De placed (e) Blows for depreciation property Color Business Investment businesse whides herbasis m) u pere Specielowance for qualified the property placed in service during the box yaranded more than 50% na quified bon 26 Property and more than o nad 25 27 Property owd Songed business st ME Add me in So 27. Er har and on 21.1 0 20 Amorine Enthers and the 7.1 29 Section Information on Use of Vehicles Cumpleteddon for him and by proper amor." or wted at you provond which to your employees, he questionnection to to conting action to Messentiel during the yeden a) Wwe Ver e) was We Toutes von ung thay per mungen 3. Tumending the yew Addins 30 12 Was leuring 0 No 0 NO Yes Yes O NO 0 No 0 NO Yes Yes Yes Yes No Was the departly more than owner peront 20E DOT O IO Section Questions for Employers who provide Vehicles for Uwe by Their Employees 17 Osmanpower use of your em Do you mean we present wyr? Sanctions to Do you of sweeper? while you are now you thereof the which we Womation receive 41 Do you wanted wooden te word Welcome to the Part VI Amortization De I) Amor son 6) Amarante Coco prodon b0000 JO000 Anh 10OYI 12.000 1 Years 200 Furma THE PORMISAATION OF AN OFICIALUS TAXTORM IT IS NOT ADOPTICAL FORMELE DO NOT USE THE FORM FOR TAX PLINOS OR FOR ANY PURPOSE OR IN EUCATIONAL 2010 M