Please help fill out the tax forms i have listed below with pictures. thank you

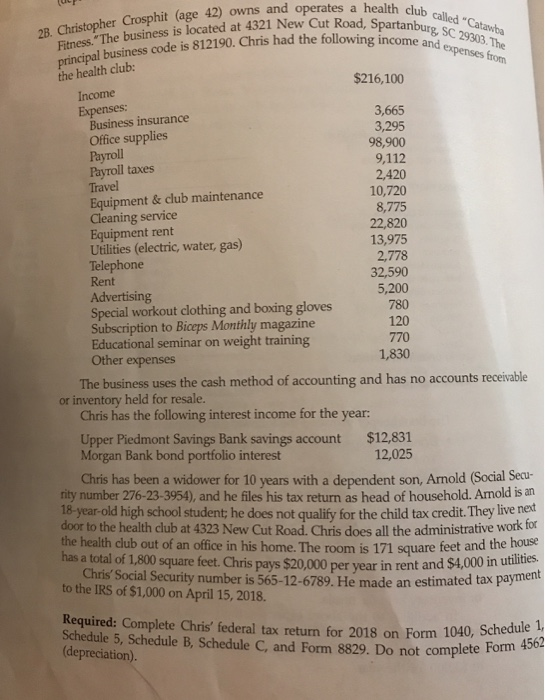

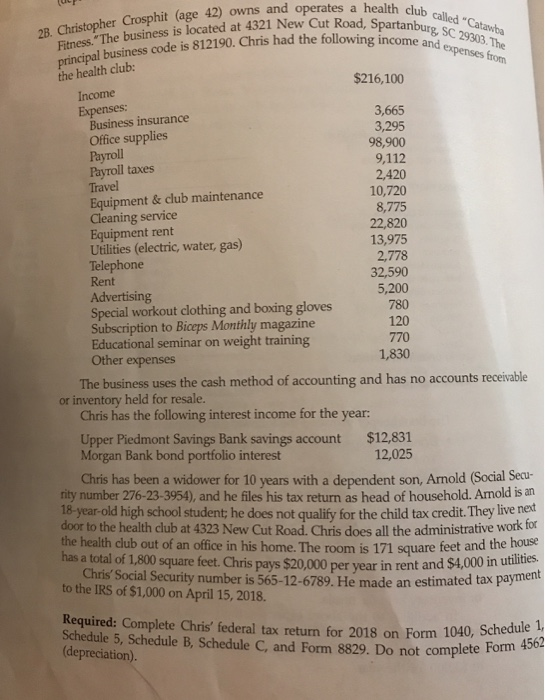

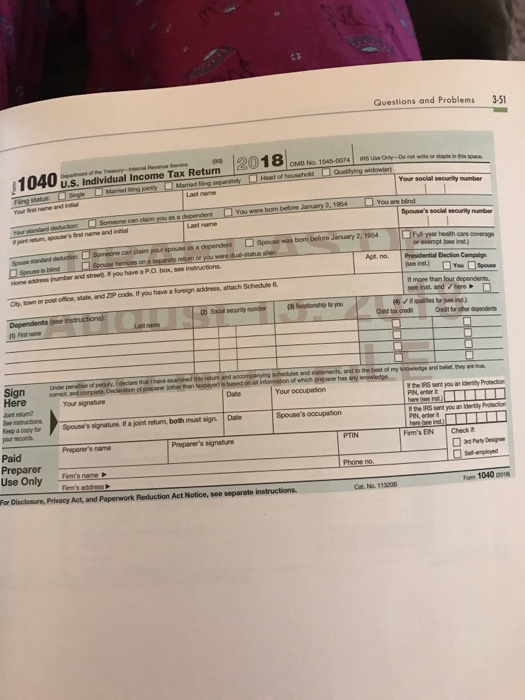

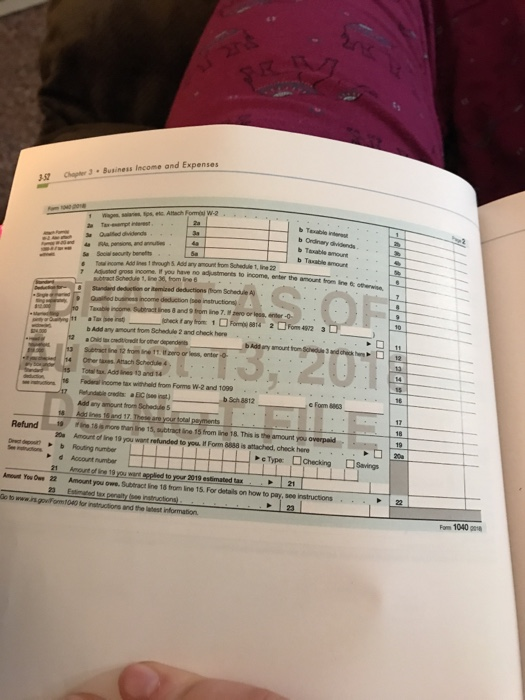

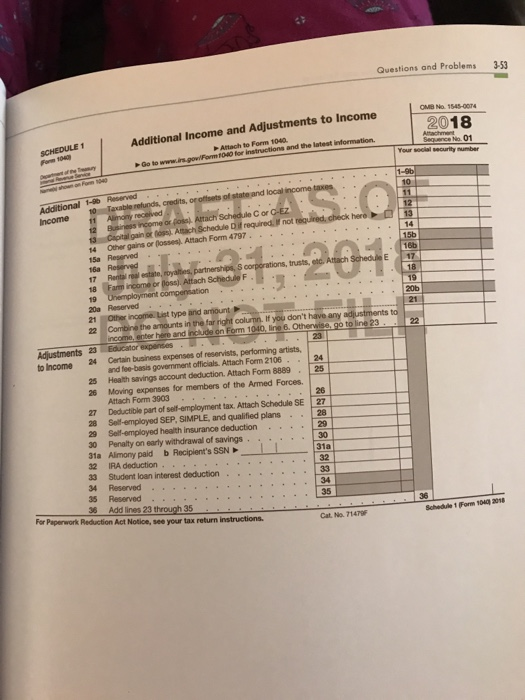

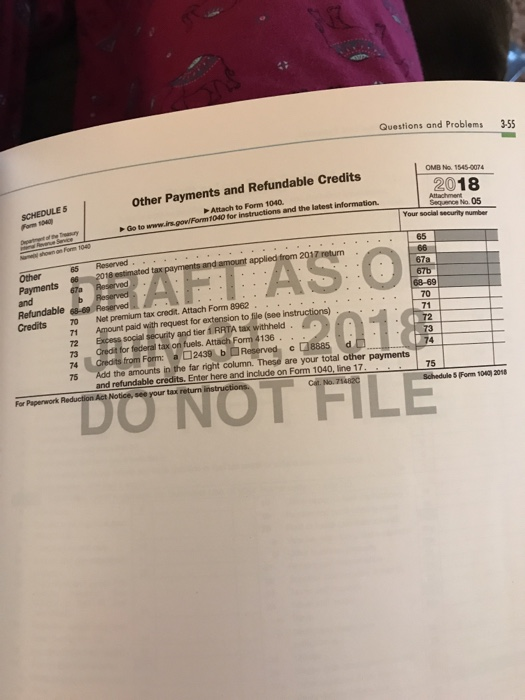

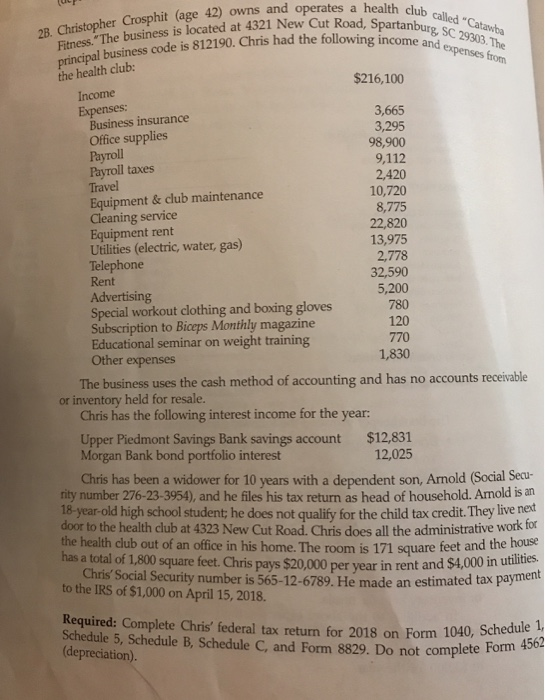

hit (age 42) owns and operates a health club Christopher Crosp Finess. The business is located at 4321 New Cut Road, S partanburg income and expenses from 2B. business code is 812190. Chris had the the health club: Income Expenses: $216,100 3,665 3,295 98,900 9,112 2,420 10,720 8,775 22,820 13,975 2,778 32,590 5,200 780 120 770 1,830 Business insurance Office supplies Payroll Payroll taxes Travel Equipment & club maintenance Cleaning service Equipment rent Utilities (electric, water, gas) Telephone Rent Advertising Special workout clothing and boxing gloves Subscription to Biceps Monthly magazine Educational seminar on weight training Other expenses The business uses the cash method of accounting and has no accounts receivable Chris has the following interest income for the year: Upper Piedmont Savings Bank savings account $12,831 or inventory held for resale. Morgan Bank bond portfolio interest Chris has been a widower for 10 years with a dependent son, Arnold (Social Secu 12,025 rity number 276-23-3954), and he files his tax return as head of household. Amold is an 18-year-old high school student; he does not qualify for the child tax credit. They live next door to the health club at 4323 New Cut Road. Chris does all the administrative work for the health club out of an office in his home. The room is 171 square fee has a total of 1,800 square feet. Chris pays $20,000 per year in rent and s4navment t and the house pays $20,000 per year in rent and $4,000 in utilities. d tax payment Chris' Social Security number is 565-12-6789. He made an estimate to the IRS of $1,000 on April 15, 2018. Required: Complete Chris federal tax return for 2018 on Form 1040 Schedule 5, Schedule B, Schedule C, and Form 8829. Do not complete (depreciation) Schedule 1, Form 4 Questions and Problems 3-51 eon- 218M 1 1040 us. Individual Income Tax bon before Here oint returns Keep a Date Date Spouse's signature. It a joint retum, both must sign Paid Preparer Use Only Cat. No. 113208 Chopter 3-Business Income and Expenses 57 and annuties b Add any amount from Schedule 2 and check here b Sch 8812 e Form 8863 Refund1 ne 18 is hone than ine 15, subtract ine 15 from line 18. This is the amount you Amout You Oue 22 Amount you owe. Subtract line 18 from line 15. For details on how to pay, see instructions Fom 1040 g Questions and Problems 3-53 Additional Income and Adjustments to Income PAttach to Form 1040 2018 Your social security number Additional 1-9 Reserved Schedule C or C-EZ hero 14 15b 14 Other gains or (losses) Attach Form 4797 15a Reserved 16a Reserved 17 Rental real 19 19 Dhemployment compensation 20a Reserved If you don't have any 22 Combine the amounts in the far right enter here and include on Form 1040, line 6. Otherwise, go to line 23 to Income 24 Certain business expenses of reservists, performing artists, and fee-basis govenment officials. Attach Form 2106 2 Health savings account deduction. Attach Form 8889 26 Moving expenses for members of the Armed Forces. Attach Form 3903 27 Deductible part of self-employment tax. Attach Schedule SE 27 28 Self-emplayed SEP, SIMPLE, and qualified plans Self-employed health insurance deduction 30 Penalty on early withdrawal of savings 31a Alimony paid b Reciplent's SSN 32 IRA deduction 33 Student loan interest deduction... 34 Reserved. 5 Reserved 36 Add lines 23 through 35 31a 32 35 Far Paperwork Reduction Act Notice, see your tax return instructions. Schedule 1 (Form 104q 2018 Cat 7147 Questions and Problems 3-55 OMB No. 1545-0074 2018 Sequence No. 05 Other Payments and Refundable Cre Attachment Attach to Form 1040. Form 1040 Go to www.irsgov/Form 1040 for instructions and the latest information Your social security number 65 applied from 20 67b 70 71 Credits 70Net premium tax credin. Atach Form 8962 71 Amount paid with request for extension to file (see instructions) 72 Excess social security and tier 1 RRTA tax withheld 73 Credlit for federal tax on fuels. Attach Form 4136 74 These are your total other payments 75 Add the amounts in the far right column. DO NOT FILE and refundable credits. Enter here and include on Form 1040, line 17 75 Motice, see your tax return hit (age 42) owns and operates a health club Christopher Crosp Finess. The business is located at 4321 New Cut Road, S partanburg income and expenses from 2B. business code is 812190. Chris had the the health club: Income Expenses: $216,100 3,665 3,295 98,900 9,112 2,420 10,720 8,775 22,820 13,975 2,778 32,590 5,200 780 120 770 1,830 Business insurance Office supplies Payroll Payroll taxes Travel Equipment & club maintenance Cleaning service Equipment rent Utilities (electric, water, gas) Telephone Rent Advertising Special workout clothing and boxing gloves Subscription to Biceps Monthly magazine Educational seminar on weight training Other expenses The business uses the cash method of accounting and has no accounts receivable Chris has the following interest income for the year: Upper Piedmont Savings Bank savings account $12,831 or inventory held for resale. Morgan Bank bond portfolio interest Chris has been a widower for 10 years with a dependent son, Arnold (Social Secu 12,025 rity number 276-23-3954), and he files his tax return as head of household. Amold is an 18-year-old high school student; he does not qualify for the child tax credit. They live next door to the health club at 4323 New Cut Road. Chris does all the administrative work for the health club out of an office in his home. The room is 171 square fee has a total of 1,800 square feet. Chris pays $20,000 per year in rent and s4navment t and the house pays $20,000 per year in rent and $4,000 in utilities. d tax payment Chris' Social Security number is 565-12-6789. He made an estimate to the IRS of $1,000 on April 15, 2018. Required: Complete Chris federal tax return for 2018 on Form 1040 Schedule 5, Schedule B, Schedule C, and Form 8829. Do not complete (depreciation) Schedule 1, Form 4 Questions and Problems 3-51 eon- 218M 1 1040 us. Individual Income Tax bon before Here oint returns Keep a Date Date Spouse's signature. It a joint retum, both must sign Paid Preparer Use Only Cat. No. 113208 Chopter 3-Business Income and Expenses 57 and annuties b Add any amount from Schedule 2 and check here b Sch 8812 e Form 8863 Refund1 ne 18 is hone than ine 15, subtract ine 15 from line 18. This is the amount you Amout You Oue 22 Amount you owe. Subtract line 18 from line 15. For details on how to pay, see instructions Fom 1040 g Questions and Problems 3-53 Additional Income and Adjustments to Income PAttach to Form 1040 2018 Your social security number Additional 1-9 Reserved Schedule C or C-EZ hero 14 15b 14 Other gains or (losses) Attach Form 4797 15a Reserved 16a Reserved 17 Rental real 19 19 Dhemployment compensation 20a Reserved If you don't have any 22 Combine the amounts in the far right enter here and include on Form 1040, line 6. Otherwise, go to line 23 to Income 24 Certain business expenses of reservists, performing artists, and fee-basis govenment officials. Attach Form 2106 2 Health savings account deduction. Attach Form 8889 26 Moving expenses for members of the Armed Forces. Attach Form 3903 27 Deductible part of self-employment tax. Attach Schedule SE 27 28 Self-emplayed SEP, SIMPLE, and qualified plans Self-employed health insurance deduction 30 Penalty on early withdrawal of savings 31a Alimony paid b Reciplent's SSN 32 IRA deduction 33 Student loan interest deduction... 34 Reserved. 5 Reserved 36 Add lines 23 through 35 31a 32 35 Far Paperwork Reduction Act Notice, see your tax return instructions. Schedule 1 (Form 104q 2018 Cat 7147 Questions and Problems 3-55 OMB No. 1545-0074 2018 Sequence No. 05 Other Payments and Refundable Cre Attachment Attach to Form 1040. Form 1040 Go to www.irsgov/Form 1040 for instructions and the latest information Your social security number 65 applied from 20 67b 70 71 Credits 70Net premium tax credin. Atach Form 8962 71 Amount paid with request for extension to file (see instructions) 72 Excess social security and tier 1 RRTA tax withheld 73 Credlit for federal tax on fuels. Attach Form 4136 74 These are your total other payments 75 Add the amounts in the far right column. DO NOT FILE and refundable credits. Enter here and include on Form 1040, line 17 75 Motice, see your tax return