Please help filling out the actual IRS forms attached at the bottom. Only form 1040 and form 8995 please!!

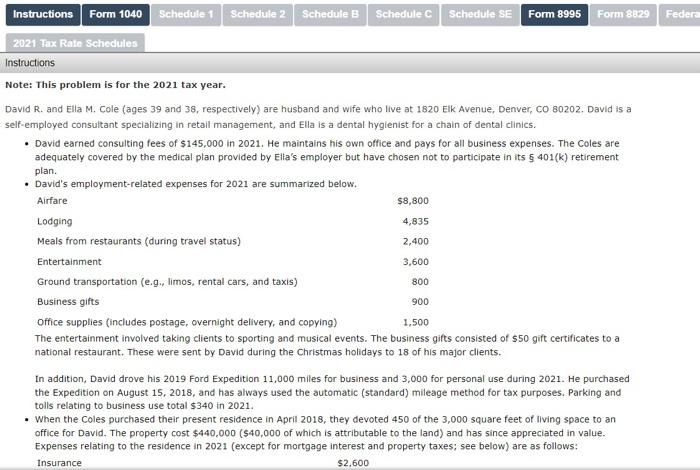

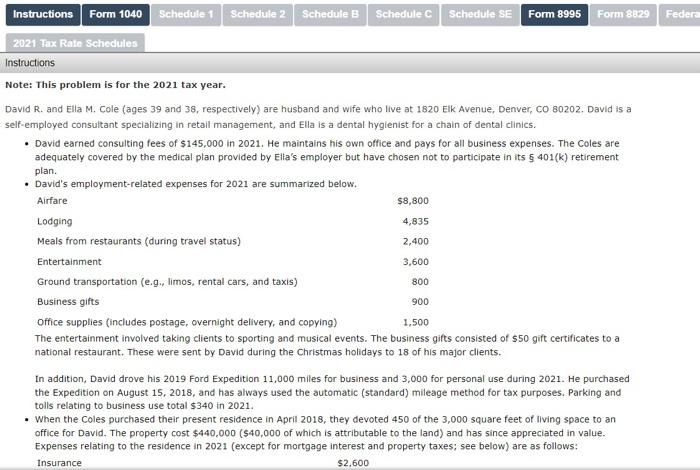

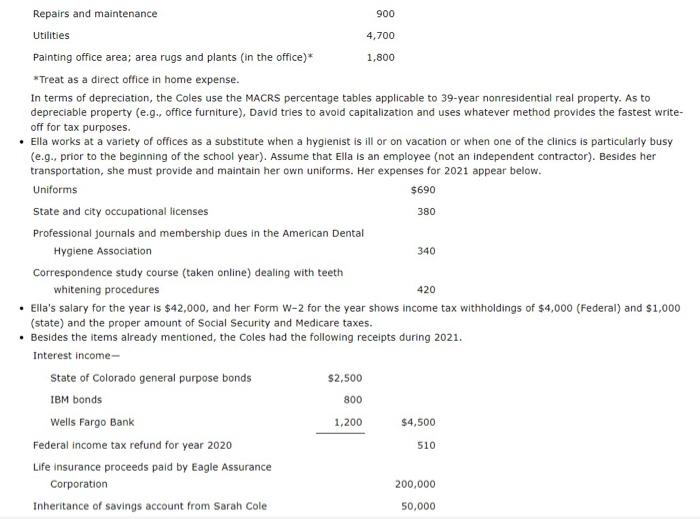

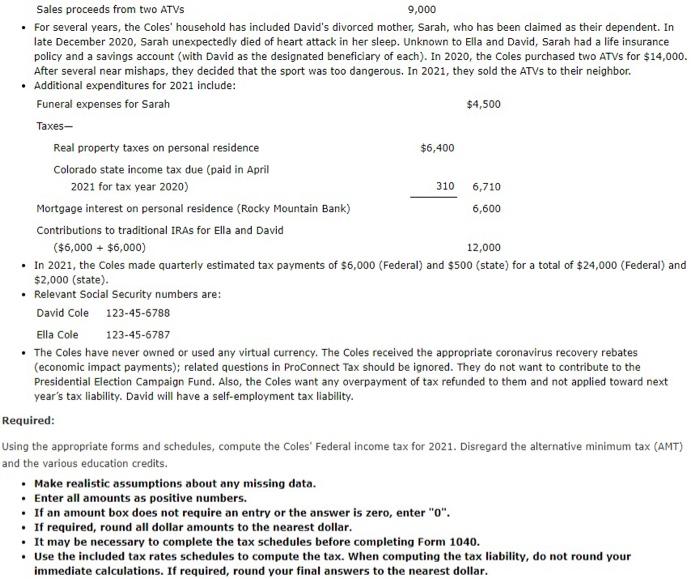

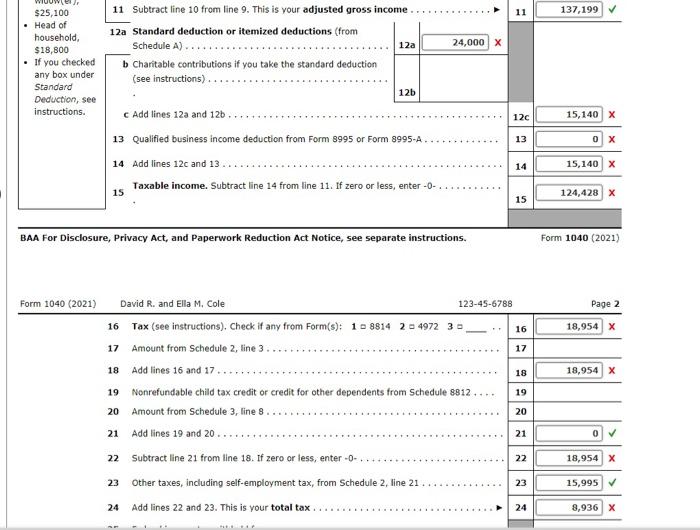

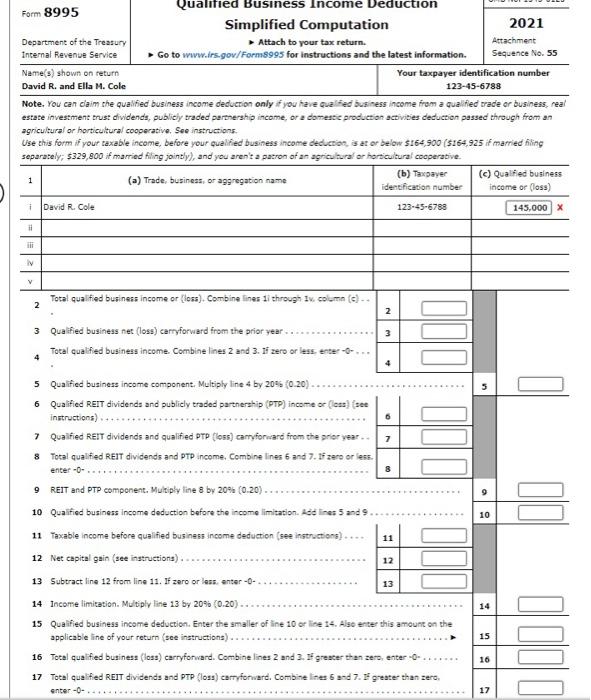

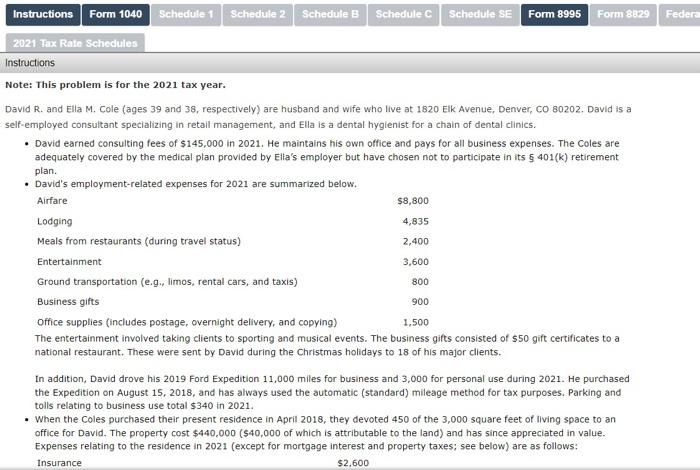

Note: This problem is for the 2021 tax year. David R. and Ella M. Cole (ages 39 and 38, respectively) are husband and wife who live at 1820 Elk Avenue, Denver, CO 80202. David is a self-employed consultant specializing in retail management, and Ella is a dental hygienist for a chain of dental clinics. - David earned consulting fees of $145,000 in 2021. He maintains his own office and pays for all business expenses. The Coles are adequately covered by the medical plan provided by Ella's employer but have chosen not to participate in its 401(k) retirement plan. - Mavid's emninument-related pxnenspe for 7021 arp summarized helnw. ine entertanment involved takmg cilents to sporung and musical events. Int business girts consisted of 550 gift certificates to a national restaurant. These were sent by David during the Christmas holidays to 18 of his major clients. In addition, David drove his 2019 Ford Expedition 11,000 miles for business and 3,000 for personal use during 2021. He purchased the Expedition on August 15, 2018, and has always used the automatic (standard) mileage method for tax purposes. Parking and tolls relating to business use total $340 in 2021. - When the Coles purchased their present residence in April 2018, they devoted 450 of the 3,000 square feet of Ilving space to an office for David. The property cost $440,000 ( $40,000 of which is attributable to the land) and has since appreciated in value. Expenses relating to the residence in 2021 (except for mortgage interest and property taxes; see below) are as follows: Insurance $2,600 "Treat as a direct office in home expense. In terms of depreciation, the Coles use the MACRS percentage tables applicable to 39-year nonresidential real property. As to depreciable property (e.g., office furniture), David tries to avold capitalization and uses whatever method provides the fastest writeoff for tax purposes. - Ella works at a variety of offices as a substitute when a hygienist is ill or on vacation or when one of the clinics is particularly busy (e.g., prior to the beginning of the school year). Assume that Ella is an employee (not an independent contractor). Besides her transportation, she must provide and maintain her own uniforms. Her expenses for 2021 appear below. - Ella's salary for the year is $42,000, and her form W-2 for the year shows income tax withholdings of $4,000 (Federal) and $1,000 (state) and the proper amount of Social Security and Medicare taxes. - Besides the items already mentioned, the Coles had the following receipts during 2021. Sales proceeds from two ATVs 9,000 - For several years, the Coles' household has included David's divorced mother, Sarah, who has been claimed as their dependent. In late December 2020, Sarah unexpectedly died of heart attack in her sleep. Unknown to Ella and David, Sarah had a life insurance policy and a savings account (with David as the designated beneficlary of each). In 2020 , the Coles purchased two ATVs for $14,000. After several near mishaps, they decided that the sport was too dangerous. In 2021, they sold the ATVs to their neighbor. - Additional expenditures for 2021 include: - In 2021, the Coles made quarterly estimated tax payments of $6,000 (Federal) and $500 (state) for a total of $24,000 (Federal) and $2,000 (state). - Relevant Social Security numbers are: David Cole 123-45-6788 Ella Cole 123-45-6787 - The Coles have never owned or used any virtual currency. The Coles received the appropriate coronavirus recovery rebates (economic impact payments); related questions in Proconnect Tax should be ignored. They do not want to contribute to the Presidential Election Campaign Fund. Also, the Coles want any overpayment of tax refunded to them and not applied toward next year's tax liability. David will have a self-employment tax liability. Required: Using the appropriate forms and schedules, compute the Coles' Federal income tax for 2021. Disregard the alternative minimum tax (AMT) and the various education credits. - Make realistic assumptions about any missing data. - Enter all amounts as positive numbers. - If an amount box does not require an entry or the answer is zero, enter " 0 ". - If required, round all dollar amounts to the nearest dollar. - It may be necessary to complete the tax schedules before completing Form 1040. - Use the included tax rates schedules to compute the tax. When computing the tax liability, do not round your immediate calculations. If required, round your final answers to the nearest dollar. BAA For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Form 1040(2021) Form 1040(2021) David R. and Ella M, Cole 123-45-6788 Page 2 16 Tax (see instructions), Check if any from Form(s): 1 a 88142=49723= 17 Amount from Schedule 2, line 3 . 18 Add lines 16 and 17. 19 Nonrefundable child tax credit or credit for other dependents from Schedule 8812 20 Amount from Schedule 3, line 8. 21 Add lines 19 and 20. 22 Subtract line 21 from line 18. If zero or less, enter 0 23 Other taxes, including self-employment tax, from Schedule 2, line 21 24 Add lines 22 and 23 . This is your total tax . \begin{tabular}{l|c} \hline Name(s) shown on return & Your taxpayer identification number \\ David R. and Ella M. Cole & 123456788 \\ \hline Note, You can claim she qualfied business income deduction only if you have qual fed business income from a qualifed vrade or business, real \end{tabular} estate investment trust dividends, publicly traded partherahip income, or a damestic production activities deduction passed through from an agricultural or horticultural cooperative. See instructions. Use chis form if your taxable income, before your qualifed business income deduction, is at or below $164,500 ( $164,925 if married filing separately; 5329,800 if married filing jointly), and you aren't a patron of an agricultural or horticultural cocperabive. Note: This problem is for the 2021 tax year. David R. and Ella M. Cole (ages 39 and 38, respectively) are husband and wife who live at 1820 Elk Avenue, Denver, CO 80202. David is a self-employed consultant specializing in retail management, and Ella is a dental hygienist for a chain of dental clinics. - David earned consulting fees of $145,000 in 2021. He maintains his own office and pays for all business expenses. The Coles are adequately covered by the medical plan provided by Ella's employer but have chosen not to participate in its 401(k) retirement plan. - Mavid's emninument-related pxnenspe for 7021 arp summarized helnw. ine entertanment involved takmg cilents to sporung and musical events. Int business girts consisted of 550 gift certificates to a national restaurant. These were sent by David during the Christmas holidays to 18 of his major clients. In addition, David drove his 2019 Ford Expedition 11,000 miles for business and 3,000 for personal use during 2021. He purchased the Expedition on August 15, 2018, and has always used the automatic (standard) mileage method for tax purposes. Parking and tolls relating to business use total $340 in 2021. - When the Coles purchased their present residence in April 2018, they devoted 450 of the 3,000 square feet of Ilving space to an office for David. The property cost $440,000 ( $40,000 of which is attributable to the land) and has since appreciated in value. Expenses relating to the residence in 2021 (except for mortgage interest and property taxes; see below) are as follows: Insurance $2,600 "Treat as a direct office in home expense. In terms of depreciation, the Coles use the MACRS percentage tables applicable to 39-year nonresidential real property. As to depreciable property (e.g., office furniture), David tries to avold capitalization and uses whatever method provides the fastest writeoff for tax purposes. - Ella works at a variety of offices as a substitute when a hygienist is ill or on vacation or when one of the clinics is particularly busy (e.g., prior to the beginning of the school year). Assume that Ella is an employee (not an independent contractor). Besides her transportation, she must provide and maintain her own uniforms. Her expenses for 2021 appear below. - Ella's salary for the year is $42,000, and her form W-2 for the year shows income tax withholdings of $4,000 (Federal) and $1,000 (state) and the proper amount of Social Security and Medicare taxes. - Besides the items already mentioned, the Coles had the following receipts during 2021. Sales proceeds from two ATVs 9,000 - For several years, the Coles' household has included David's divorced mother, Sarah, who has been claimed as their dependent. In late December 2020, Sarah unexpectedly died of heart attack in her sleep. Unknown to Ella and David, Sarah had a life insurance policy and a savings account (with David as the designated beneficlary of each). In 2020 , the Coles purchased two ATVs for $14,000. After several near mishaps, they decided that the sport was too dangerous. In 2021, they sold the ATVs to their neighbor. - Additional expenditures for 2021 include: - In 2021, the Coles made quarterly estimated tax payments of $6,000 (Federal) and $500 (state) for a total of $24,000 (Federal) and $2,000 (state). - Relevant Social Security numbers are: David Cole 123-45-6788 Ella Cole 123-45-6787 - The Coles have never owned or used any virtual currency. The Coles received the appropriate coronavirus recovery rebates (economic impact payments); related questions in Proconnect Tax should be ignored. They do not want to contribute to the Presidential Election Campaign Fund. Also, the Coles want any overpayment of tax refunded to them and not applied toward next year's tax liability. David will have a self-employment tax liability. Required: Using the appropriate forms and schedules, compute the Coles' Federal income tax for 2021. Disregard the alternative minimum tax (AMT) and the various education credits. - Make realistic assumptions about any missing data. - Enter all amounts as positive numbers. - If an amount box does not require an entry or the answer is zero, enter " 0 ". - If required, round all dollar amounts to the nearest dollar. - It may be necessary to complete the tax schedules before completing Form 1040. - Use the included tax rates schedules to compute the tax. When computing the tax liability, do not round your immediate calculations. If required, round your final answers to the nearest dollar. BAA For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Form 1040(2021) Form 1040(2021) David R. and Ella M, Cole 123-45-6788 Page 2 16 Tax (see instructions), Check if any from Form(s): 1 a 88142=49723= 17 Amount from Schedule 2, line 3 . 18 Add lines 16 and 17. 19 Nonrefundable child tax credit or credit for other dependents from Schedule 8812 20 Amount from Schedule 3, line 8. 21 Add lines 19 and 20. 22 Subtract line 21 from line 18. If zero or less, enter 0 23 Other taxes, including self-employment tax, from Schedule 2, line 21 24 Add lines 22 and 23 . This is your total tax . \begin{tabular}{l|c} \hline Name(s) shown on return & Your taxpayer identification number \\ David R. and Ella M. Cole & 123456788 \\ \hline Note, You can claim she qualfied business income deduction only if you have qual fed business income from a qualifed vrade or business, real \end{tabular} estate investment trust dividends, publicly traded partherahip income, or a damestic production activities deduction passed through from an agricultural or horticultural cooperative. See instructions. Use chis form if your taxable income, before your qualifed business income deduction, is at or below $164,500 ( $164,925 if married filing separately; 5329,800 if married filing jointly), and you aren't a patron of an agricultural or horticultural cocperabive