Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help! Financial Structure and Banking 1. Risky borrowers applying for a bank loan is an example of 2. Executive use of company funds for

please help!

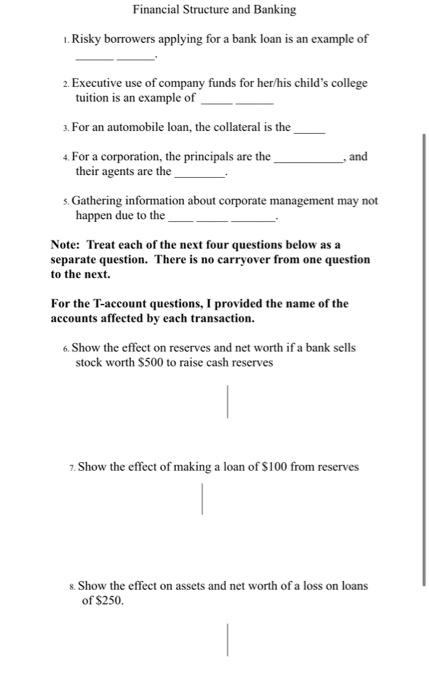

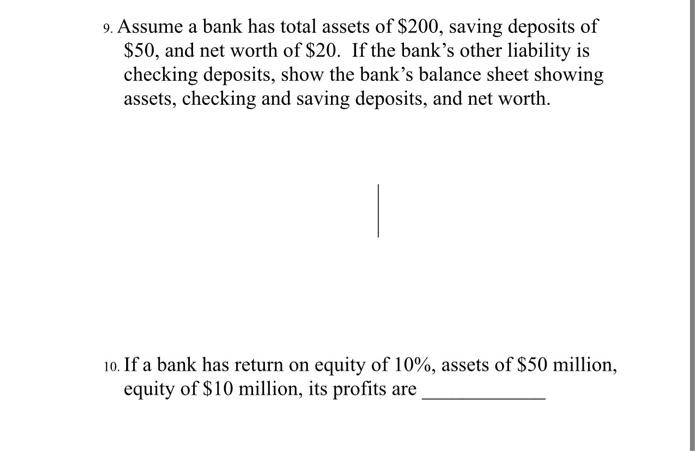

Financial Structure and Banking 1. Risky borrowers applying for a bank loan is an example of 2. Executive use of company funds for her/his child's college tuition is an example of 3. For an automobile loan, the collateral is the 4. For a corporation, the principals are the and their agents are the 5. Gathering information about corporate management may not happen due to the Note: Treat each of the next four questions below as a separate question. There is no carryover from one question to the next. For the T-account questions, I provided the name of the accounts affected by each transaction. 6. Show the effect on reserves and net worth if a bank sells stock worth $500 to raise cash reserves 7. Show the effect of making a loan of $100 from reserves 8. Show the effect on assets and net worth of a loss on loans of $250. 9. Assume a bank has total assets of $200, saving deposits of $50, and net worth of $20. If the bank's other liability is checking deposits, show the bank's balance sheet showing assets, checking and saving deposits, and net worth. 10. If a bank has return on equity of 10%, assets of $50 million, equity of $10 million, its profits are Financial Structure and Banking 1. Risky borrowers applying for a bank loan is an example of 2. Executive use of company funds for her/his child's college tuition is an example of 3. For an automobile loan, the collateral is the 4. For a corporation, the principals are the and their agents are the 5. Gathering information about corporate management may not happen due to the Note: Treat each of the next four questions below as a separate question. There is no carryover from one question to the next. For the T-account questions, I provided the name of the accounts affected by each transaction. 6. Show the effect on reserves and net worth if a bank sells stock worth $500 to raise cash reserves 7. Show the effect of making a loan of $100 from reserves 8. Show the effect on assets and net worth of a loss on loans of $250. 9. Assume a bank has total assets of $200, saving deposits of $50, and net worth of $20. If the bank's other liability is checking deposits, show the bank's balance sheet showing assets, checking and saving deposits, and net worth. 10. If a bank has return on equity of 10%, assets of $50 million, equity of $10 million, its profits are

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started