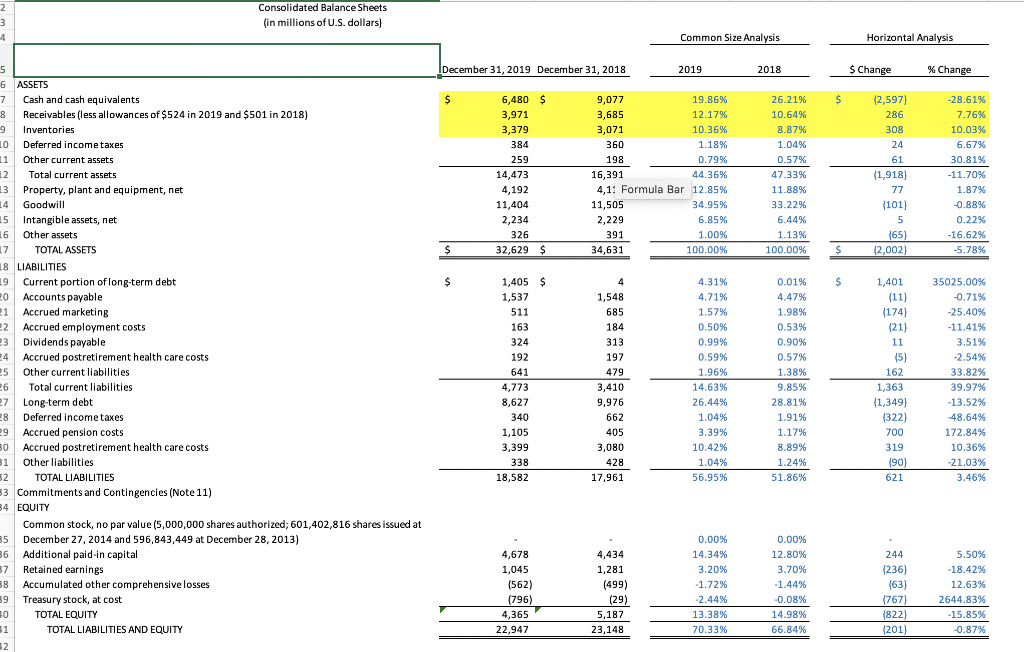

Please help finish excel chart based off on information provided below. The highlighted parts are on parts that I have completed. The rest of information in excel chart is part of the original document.

Data:

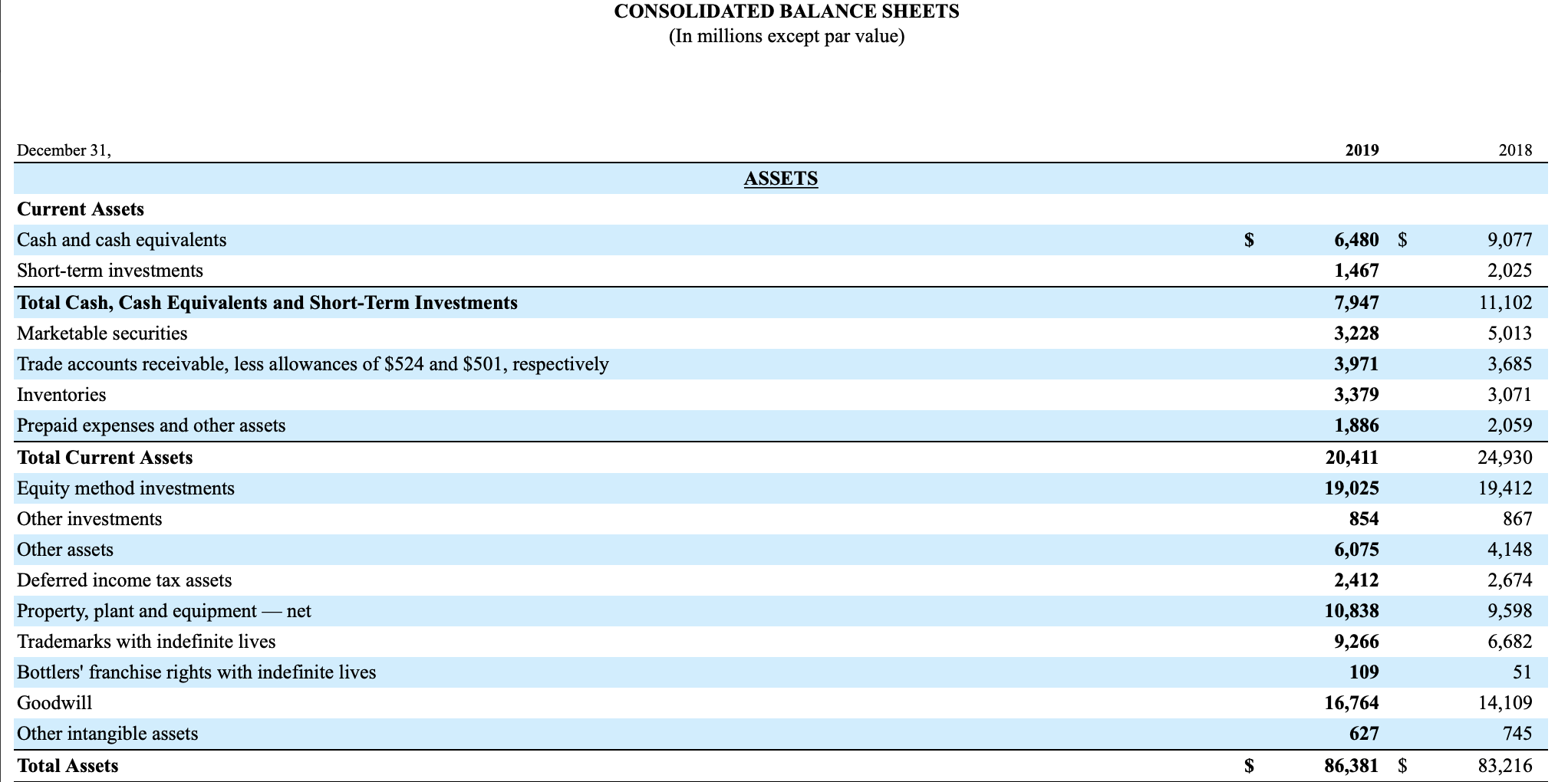

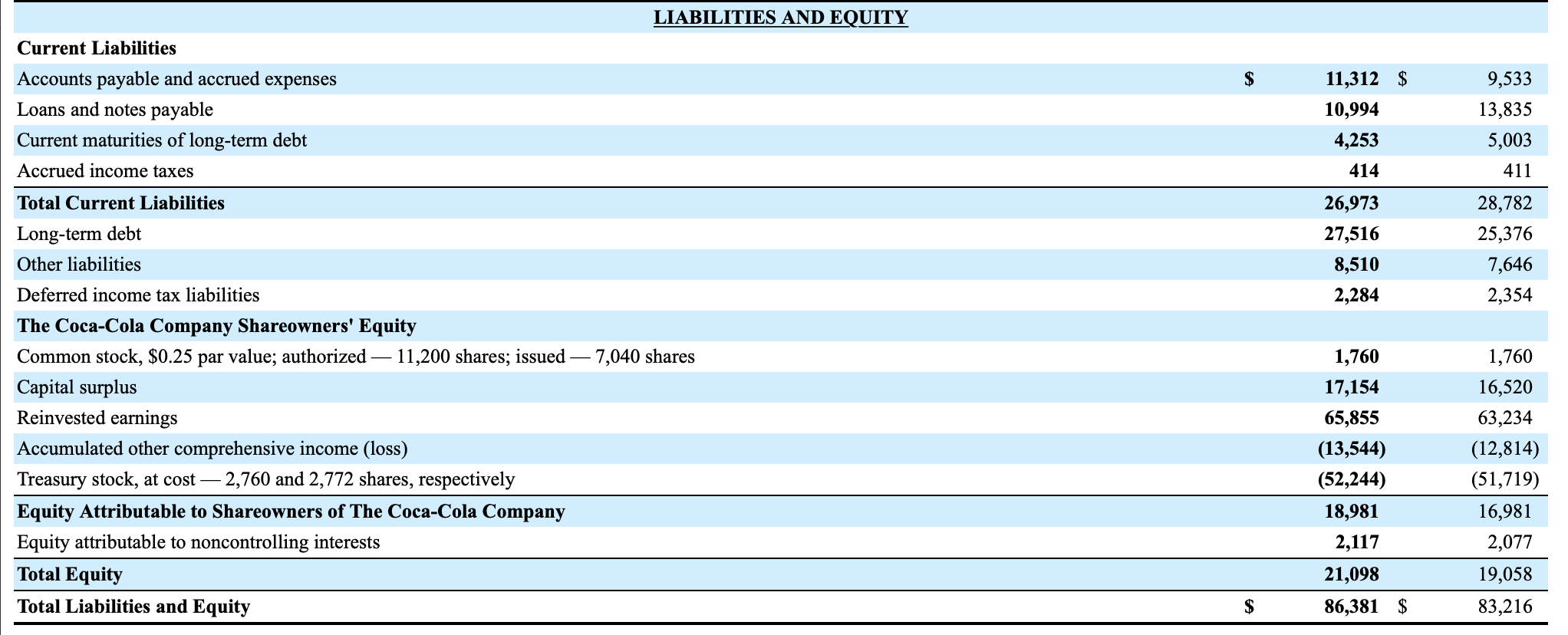

2 Consolidated Balance Sheets (in millions of U.S. dollars) w 4 Common Size Analysis Horizontal Analysis IDecember 31, 2019 December 31, 2018 2019 2018 $ Change % Change $ $ 9 LO 6,480 $ 3,971 3,379 384 259 14,473 4,192 11,404 2,234 326 32,629 $ 9,077 19.86% 3,685 12.17% 3,071 10.36% 360 1.18% 198 0.79% 16,391 44.36% 4,1: Formula Bar 12.85% 11,505 34.95% 2,229 6.85% 391 1.00% 34,631 100.00% 26.21% 10.64% 8.87% 1.04% 0.57% 47.33% 11.88% 33.22% 6.44% 1.13% 100.00% 12,597) 286 308 24 61 (1,918) 77 (101) 5 (65) (2,002) -28.61% 7.76% 10.03% 6.67% 30.81% -11.70% 1.87% -0.88% 0.22% -16.62% -5.78% $ $ $ $ 4 1,548 685 184 5 6 ASSETS 7 Cash and cash equivalents 8 Receivables (less allowances of $524 in 2019 and $501 in 2018) Inventories Deferred income taxes 11 Other current assets 12 Total current assets 13 Property, plant and equipment, net 14 Goodwill 15 Intangible assets, net 16 Other assets 2 17 TOTAL ASSETS 18 LIABILITIES 19 Current portion of long-term debt 20 Accounts payable 21 Accrued marketing 2 Accrued employment costs 23 Dividends payable 24 Accrued postretirement health care costs 25 Other current liabilities 26 Total current liabilities 27 Long-term debt 28 Deferred Income taxes 29 Accrued pension costs 30 Accrued postretirement health care costs 31 Other liabilities 32 TOTAL LIABILITIES 33 Commitments and Contingencies (Note 11) 4 EQUITY Common stock, no par value (5,000,000 shares authorized; 601,402,816 shares issued at 35 December 27, 2014 and 596,843,449 at December 28, 2013) 36 Additional paid in capital 37 Retained earnings 38 Accumulated other comprehensive losses 9 Treasury stock, at cost 30 TOTAL EQUITY TOTAL LIABILITIES AND EQUITY 12 1,405 $ 1,537 511 163 324 192 641 4,773 8,627 340 1,105 3,399 338 18,582 313 197 479 3,410 9,976 662 405 3,080 428 17,961 4.31% 4.71% 1.57% 0.50% 0.99% 0.59% 1.96% 14.63% 26.44% 1.04% 3.39% 10.42% 1.04% 56.95% 0.01% 4.47% 1.98% 0.53% 0.90% 0.57% 1.38% 9.85% 28.81% 1.91% 1.17% 8.89% 1.24% 51.86% 1,401 (11) (174) (21) 11 (5) 162 1,363 (1,349) (322) 700 319 (90) 621 35025.00% -0.71% -25.40% -11.41% 3.51% -2.54% 33.82% 39.97% -13.52% 48.64% 172.84% 10.36% -21.03% 3.46% 4,678 1,045 (562) (796) 4,365 22,947 4,434 1.281 (499) (29) 5,187 23,148 0.00% 14.34% 3.20% -1.72% -2.44% 13.38% 70.33% 0.00% 12.80% 3.70% -1.44% -0.08% 14.98% 66.84% 244 (236) (63) 1767) (822) (201) 5.50% -18.42% 12.63% 2644.83% -15.85% -0.87% 11 CONSOLIDATED BALANCE SHEETS (In millions except par value) December 31, 2019 2018 ASSETS Current Assets Cash and cash equivalents Short-term investments Total Cash, Cash Equivalents and Short-Term Investments Marketable securities Trade accounts receivable, less allowances of $524 and $501, respectively Inventories Prepaid expenses and other assets Total Current Assets Equity method investments Other investments 6,480 $ 1,467 7,947 3,228 3,971 3,379 1,886 20,411 19,025 854 6,075 2,412 10,838 9,266 9,077 2,025 11,102 5,013 3,685 3,071 2,059 24,930 19,412 867 4,148 2,674 9,598 6,682 51 Other assets Deferred income tax assets Property, plant and equipment net Trademarks with indefinite lives Bottlers' franchise rights with indefinite lives Goodwill Other intangible assets Total Assets 109 16,764 14,109 627 745 $ 86,381 $ 83,216 LIABILITIES AND EQUITY Current Liabilities 11,312 $ 10,994 4,253 414 9,533 13,835 5,003 411 26,973 27,516 8,510 2,284 28,782 25,376 7,646 2,354 Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes Total Current Liabilities Long-term debt Other liabilities Deferred income tax liabilities The Coca-Cola Company Shareowners' Equity Common stock, $0.25 par value; authorized 11,200 shares; issued 7,040 shares Capital surplus Reinvested earnings Accumulated other comprehensive income (loss) Treasury stock, at cost 2,760 and 2,772 shares, respectively Equity Attributable to Shareowners of The Coca-Cola Company Equity attributable to noncontrolling interests Total Equity Total Liabilities and Equity 1,760 17,154 65,855 (13,544) (52,244) 18,981 2,117 1,760 16,520 63,234 (12,814) (51,719) 16,981 2,077 19,058 83,216 21,098 $ 86,381 $ 2 Consolidated Balance Sheets (in millions of U.S. dollars) w 4 Common Size Analysis Horizontal Analysis IDecember 31, 2019 December 31, 2018 2019 2018 $ Change % Change $ $ 9 LO 6,480 $ 3,971 3,379 384 259 14,473 4,192 11,404 2,234 326 32,629 $ 9,077 19.86% 3,685 12.17% 3,071 10.36% 360 1.18% 198 0.79% 16,391 44.36% 4,1: Formula Bar 12.85% 11,505 34.95% 2,229 6.85% 391 1.00% 34,631 100.00% 26.21% 10.64% 8.87% 1.04% 0.57% 47.33% 11.88% 33.22% 6.44% 1.13% 100.00% 12,597) 286 308 24 61 (1,918) 77 (101) 5 (65) (2,002) -28.61% 7.76% 10.03% 6.67% 30.81% -11.70% 1.87% -0.88% 0.22% -16.62% -5.78% $ $ $ $ 4 1,548 685 184 5 6 ASSETS 7 Cash and cash equivalents 8 Receivables (less allowances of $524 in 2019 and $501 in 2018) Inventories Deferred income taxes 11 Other current assets 12 Total current assets 13 Property, plant and equipment, net 14 Goodwill 15 Intangible assets, net 16 Other assets 2 17 TOTAL ASSETS 18 LIABILITIES 19 Current portion of long-term debt 20 Accounts payable 21 Accrued marketing 2 Accrued employment costs 23 Dividends payable 24 Accrued postretirement health care costs 25 Other current liabilities 26 Total current liabilities 27 Long-term debt 28 Deferred Income taxes 29 Accrued pension costs 30 Accrued postretirement health care costs 31 Other liabilities 32 TOTAL LIABILITIES 33 Commitments and Contingencies (Note 11) 4 EQUITY Common stock, no par value (5,000,000 shares authorized; 601,402,816 shares issued at 35 December 27, 2014 and 596,843,449 at December 28, 2013) 36 Additional paid in capital 37 Retained earnings 38 Accumulated other comprehensive losses 9 Treasury stock, at cost 30 TOTAL EQUITY TOTAL LIABILITIES AND EQUITY 12 1,405 $ 1,537 511 163 324 192 641 4,773 8,627 340 1,105 3,399 338 18,582 313 197 479 3,410 9,976 662 405 3,080 428 17,961 4.31% 4.71% 1.57% 0.50% 0.99% 0.59% 1.96% 14.63% 26.44% 1.04% 3.39% 10.42% 1.04% 56.95% 0.01% 4.47% 1.98% 0.53% 0.90% 0.57% 1.38% 9.85% 28.81% 1.91% 1.17% 8.89% 1.24% 51.86% 1,401 (11) (174) (21) 11 (5) 162 1,363 (1,349) (322) 700 319 (90) 621 35025.00% -0.71% -25.40% -11.41% 3.51% -2.54% 33.82% 39.97% -13.52% 48.64% 172.84% 10.36% -21.03% 3.46% 4,678 1,045 (562) (796) 4,365 22,947 4,434 1.281 (499) (29) 5,187 23,148 0.00% 14.34% 3.20% -1.72% -2.44% 13.38% 70.33% 0.00% 12.80% 3.70% -1.44% -0.08% 14.98% 66.84% 244 (236) (63) 1767) (822) (201) 5.50% -18.42% 12.63% 2644.83% -15.85% -0.87% 11 CONSOLIDATED BALANCE SHEETS (In millions except par value) December 31, 2019 2018 ASSETS Current Assets Cash and cash equivalents Short-term investments Total Cash, Cash Equivalents and Short-Term Investments Marketable securities Trade accounts receivable, less allowances of $524 and $501, respectively Inventories Prepaid expenses and other assets Total Current Assets Equity method investments Other investments 6,480 $ 1,467 7,947 3,228 3,971 3,379 1,886 20,411 19,025 854 6,075 2,412 10,838 9,266 9,077 2,025 11,102 5,013 3,685 3,071 2,059 24,930 19,412 867 4,148 2,674 9,598 6,682 51 Other assets Deferred income tax assets Property, plant and equipment net Trademarks with indefinite lives Bottlers' franchise rights with indefinite lives Goodwill Other intangible assets Total Assets 109 16,764 14,109 627 745 $ 86,381 $ 83,216 LIABILITIES AND EQUITY Current Liabilities 11,312 $ 10,994 4,253 414 9,533 13,835 5,003 411 26,973 27,516 8,510 2,284 28,782 25,376 7,646 2,354 Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes Total Current Liabilities Long-term debt Other liabilities Deferred income tax liabilities The Coca-Cola Company Shareowners' Equity Common stock, $0.25 par value; authorized 11,200 shares; issued 7,040 shares Capital surplus Reinvested earnings Accumulated other comprehensive income (loss) Treasury stock, at cost 2,760 and 2,772 shares, respectively Equity Attributable to Shareowners of The Coca-Cola Company Equity attributable to noncontrolling interests Total Equity Total Liabilities and Equity 1,760 17,154 65,855 (13,544) (52,244) 18,981 2,117 1,760 16,520 63,234 (12,814) (51,719) 16,981 2,077 19,058 83,216 21,098 $ 86,381 $