Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help. Float has spent 600,000 NOK on a market survey which shows that there is potential to open another spa branch offering floatation therapy

please help.

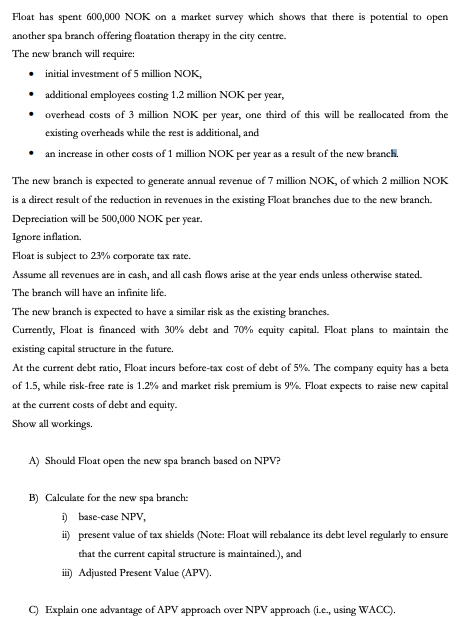

Float has spent 600,000 NOK on a market survey which shows that there is potential to open another spa branch offering floatation therapy in the city centre. The new branch will require: initial investment of 5 million NOK, additional employees costing 1.2 million NOK per year, overhead costs of 3 million NOK per year, one third of this will be reallocated from the existing overheads while the rest is additional, and an increase in other costs of 1 million NOK per year as a result of the new branch. The new branch is expected to generate annual revenue of 7 million NOK, of which 2 million NOK is a direct result of the reduction in revenues in the existing Float branches due to the new branch. Depreciation will be 500,000 NOK per year. Ignore inflation Float is subject to 29% corporate tax rate. Assume all revenues are in cash, and all cash flows arise at the year ends unless otherwise stated. The branch will have an infinite life. The new branch is expected to have a similar risk as the existing branches. Currently, Float is financed with 30% debt and 70% equity capital. Float plans to maintain the existing capital structure in the future, At the current debt ratio, Float incurs before-tax cost of debt of 5%. The company equity has a beta of 1.5, while tisk-free rate is 1.2% and market risk premium is 9%. Float expects to raise new capital at the current costs of debt and equity. Show all workings. A) Should Float open the new spa branch based on NPV? B) Calculate for the new spa branch: 1) base-case NPV, ii) present value of tax shields (Note: Float will rebalance its debt level regularly to ensure that the current capital structure is maintained.), and ii) Adjusted Present Value (APV). Explain one advantage of APV approach over NPV approach (Lc., using WACC). Float has spent 600,000 NOK on a market survey which shows that there is potential to open another spa branch offering floatation therapy in the city centre. The new branch will require: initial investment of 5 million NOK, additional employees costing 1.2 million NOK per year, overhead costs of 3 million NOK per year, one third of this will be reallocated from the existing overheads while the rest is additional, and an increase in other costs of 1 million NOK per year as a result of the new branch. The new branch is expected to generate annual revenue of 7 million NOK, of which 2 million NOK is a direct result of the reduction in revenues in the existing Float branches due to the new branch. Depreciation will be 500,000 NOK per year. Ignore inflation Float is subject to 29% corporate tax rate. Assume all revenues are in cash, and all cash flows arise at the year ends unless otherwise stated. The branch will have an infinite life. The new branch is expected to have a similar risk as the existing branches. Currently, Float is financed with 30% debt and 70% equity capital. Float plans to maintain the existing capital structure in the future, At the current debt ratio, Float incurs before-tax cost of debt of 5%. The company equity has a beta of 1.5, while tisk-free rate is 1.2% and market risk premium is 9%. Float expects to raise new capital at the current costs of debt and equity. Show all workings. A) Should Float open the new spa branch based on NPV? B) Calculate for the new spa branch: 1) base-case NPV, ii) present value of tax shields (Note: Float will rebalance its debt level regularly to ensure that the current capital structure is maintained.), and ii) Adjusted Present Value (APV). Explain one advantage of APV approach over NPV approach (Lc., using WACC)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started