Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help for answers and explain, thxx 1) 2) Summer is 22 years old, married but separated from her spouse and has AGI of $14,344.

Please help for answers and explain, thxx

1)

2)

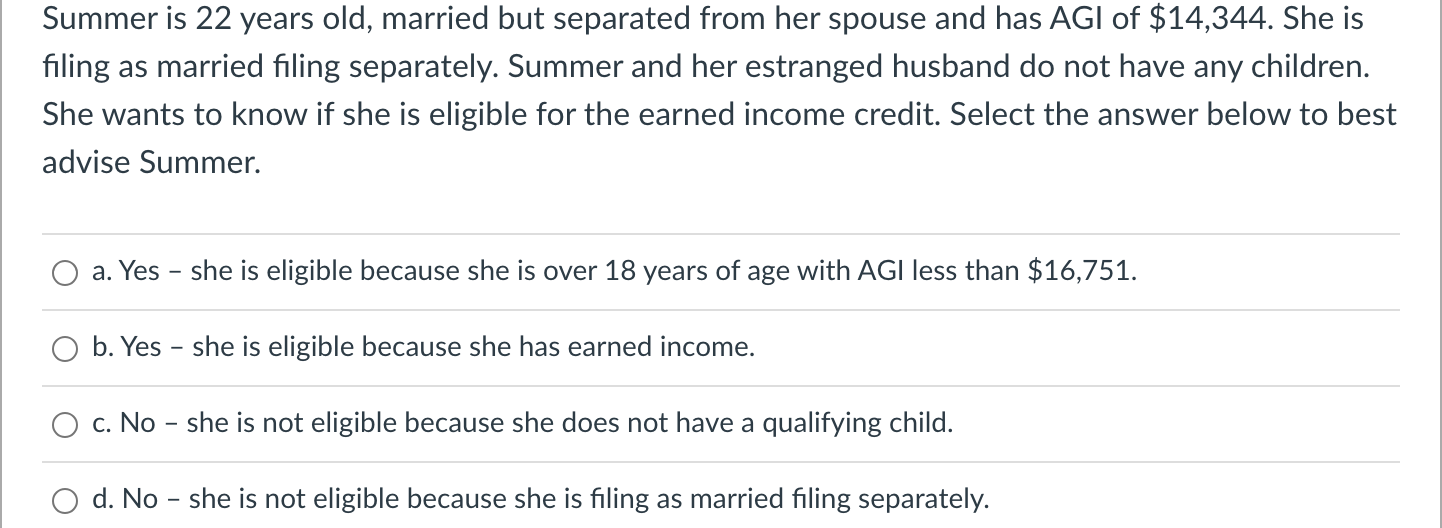

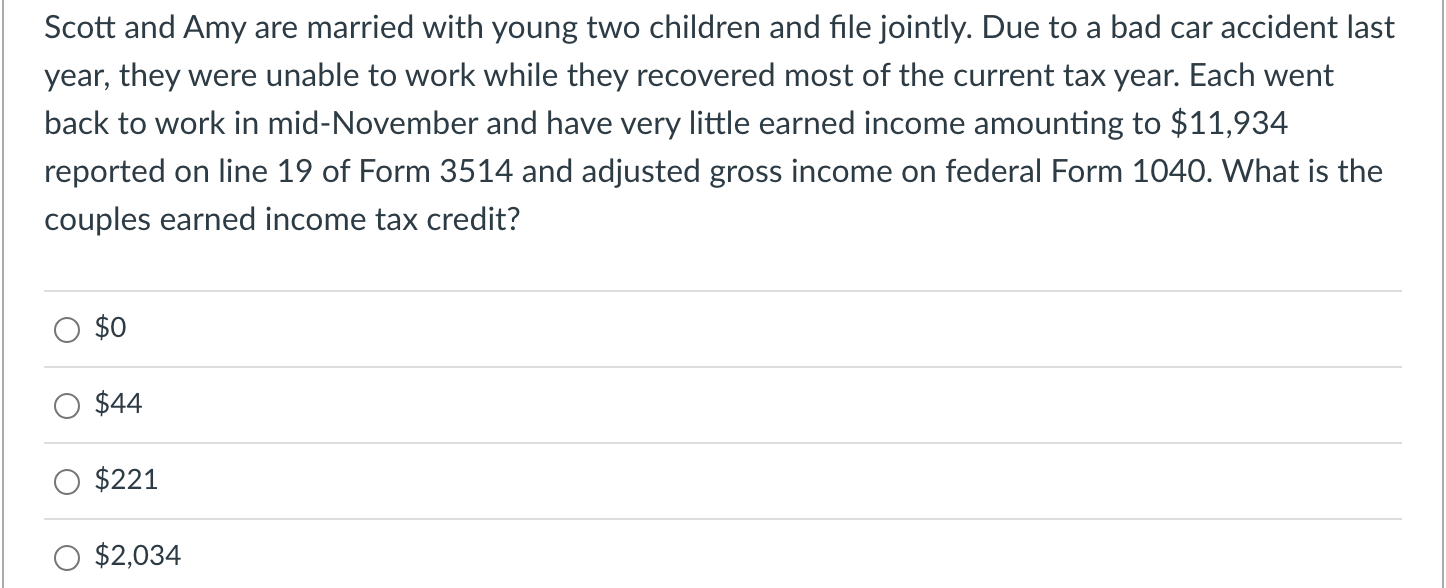

Summer is 22 years old, married but separated from her spouse and has AGI of $14,344. She is filing as married filing separately. Summer and her estranged husband do not have any children. She wants to know if she is eligible for the earned income credit. Select the answer below to best advise Summer. a. Yes - she is eligible because she is over 18 years of age with AGI less than $16,751. b. Yes - she is eligible because she has earned income. c. No - she is not eligible because she does not have a qualifying child. d. No - she is not eligible because she is filing as married filing separately. Scott and Amy are married with young two children and file jointly. Due to a bad car accident last year, they were unable to work while they recovered most of the current tax year. Each went back to work in mid-November and have very little earned income amounting to $11,934 reported on line 19 of Form 3514 and adjusted gross income on federal Form 1040. What is the couples earned income tax credit? $0 $44 $221 $2,034

Summer is 22 years old, married but separated from her spouse and has AGI of $14,344. She is filing as married filing separately. Summer and her estranged husband do not have any children. She wants to know if she is eligible for the earned income credit. Select the answer below to best advise Summer. a. Yes - she is eligible because she is over 18 years of age with AGI less than $16,751. b. Yes - she is eligible because she has earned income. c. No - she is not eligible because she does not have a qualifying child. d. No - she is not eligible because she is filing as married filing separately. Scott and Amy are married with young two children and file jointly. Due to a bad car accident last year, they were unable to work while they recovered most of the current tax year. Each went back to work in mid-November and have very little earned income amounting to $11,934 reported on line 19 of Form 3514 and adjusted gross income on federal Form 1040. What is the couples earned income tax credit? $0 $44 $221 $2,034 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started