Please help for remaining unsolved questions, and help review the answered questions as well.

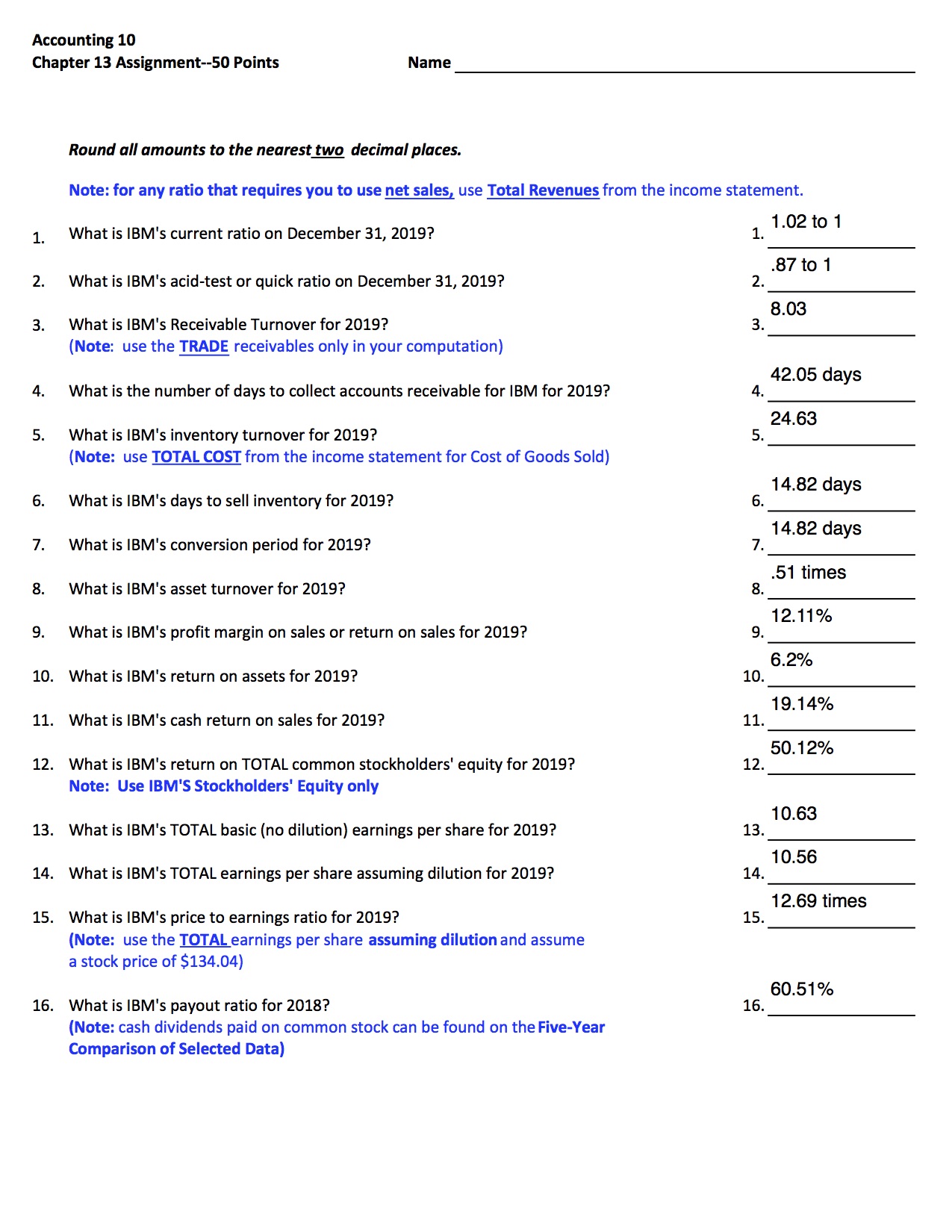

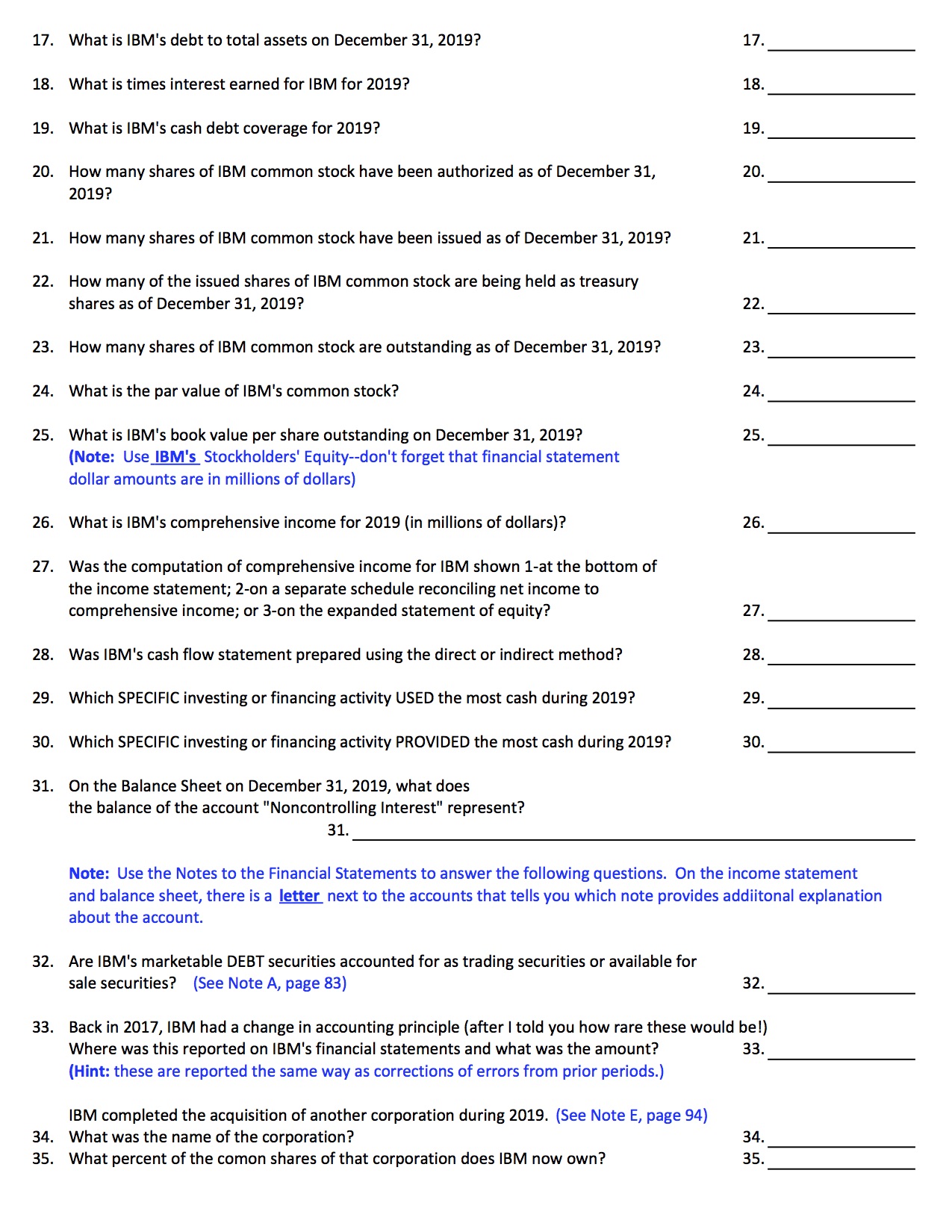

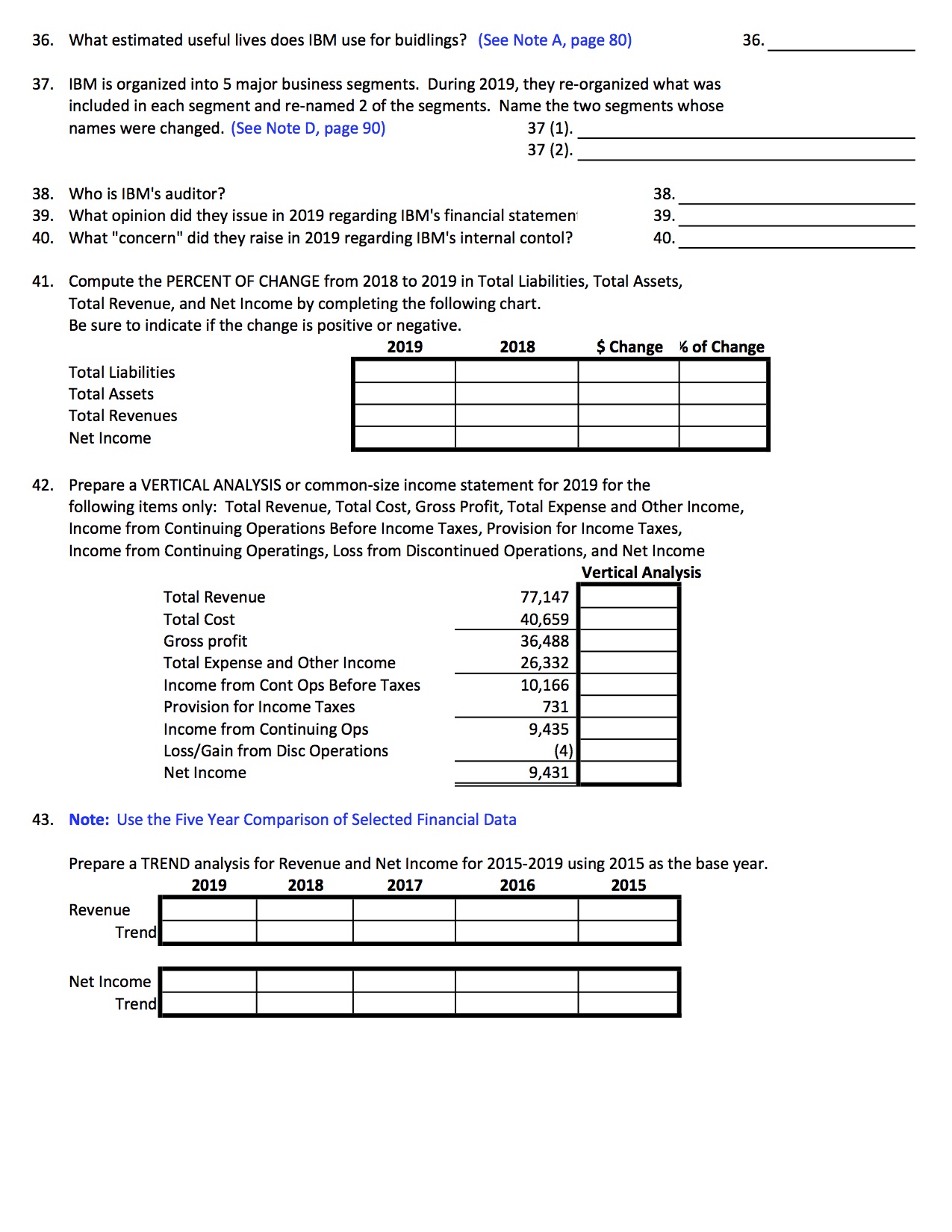

Accounting 10 Chapter 13 Assignment--50 Points Name Round all amounts to the nearest two declmal places. Note: for any ratio that requires you to use net salesI use Total Revenues from the income statement. 1_ What is IBM's current ratio on December 31, 2019? 1. 1'02 to 1 .87 to 1 2. What is IBM's acid-test or quick ratio on December 31, 2019? 2. 8.03 3. What is IBM's Receivable Turnover for 2019? 3. (Note: use the TRADE receivables only in your computation) 42.05 days 4. What is the number of days to collect accounts receivable for IBM for 2019? 4. 24.63 5. What is IBM's inventory turnover for 2019? 5. (Note: use TOTAL COST from the income statement for Cost of Goods Sold} 14.82 days 6. What is IBM's days to sell inventory for 2019? 6. 14.82 days 7. What is IBM's conversion period for 2019? 7. .51 times 3. What is IBM's asset turnover for 2019? 8. 1 2.1 1 % 9. What is IBM's prot margin on sales or return on sales for 2019? 9. 6.2% 10. What is IBM's return on assets for 2019? 10. 1 9.14% 11. What is IBM's cash return on sales for 2019? 11. 50.12% 12. What is IBM's return on TOTAL common stockholders' equity for 2019? 12. Note: Use IBM'S Stockholders' Equity only 10.63 13. What is IBM's TOTAL basic (no dilution) earnings per share for 2019? 13. 10.56 14. What is IBM's TOTAL earnings per share assuming dilution for 2019? 14. 12.69 times 15. What is IBM's price to earnings ratio for 2019? 15. [Note: use the TOTAL earnings per share assuming dilution and assume a stock price of 5134.04) 60.51% 16. What is IBM's payout ratio for 2018? 16. (Note: cash dividends paid on common stock can be found on the Five-Year Comparison of Selected Data) 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. What is IBM's debt to total assets on December 31, 2019? What is times interest earned for IBM for 2019? What is IBM's cash debt coverage for 2019? How many shares of IBM common stock have been authorized as of December 31, 2019? How many shares of IBM common stock have been issued as of December 31, 2019? How many of the issued shares of IBM common stock are being held as treasury shares as of December 31, 2019? How many shares of IBM common stock are outstanding as of December 31, 2019? What is the par value of IBM's common stock? What is IBM's book value per share outstanding on December 31, 2019? (Note: Use IBM's Stockholders' Equity--don't forget that financial statement dollar amounts are in millions of dollars) What is IBM's comprehensive income for 2019 [in millions of dollars}? Was the computation of comprehensive income for IBM shown 1-at the bottom of the income statement; 2-on a separate schedule reconciling net income to comprehensive income; or 3-on the expanded statement of equity? Was IBM's cash ow statement prepared using the direct or indirect method? Which SPECIFIC investing or financing activity USED the most cash during 2019? Which SPECIFIC investing or financing activity PROVIDED the most cash during 2019? On the Balance Sheet on December 31, 2019, what does the balance of the account "Noncontrolling Interest" represent? 31. Note: Use the Notes to the Financial Statements to answer the following questions. 0n the income statement and balance sheet, there is a letter next to the accounts that tells you which note provides addiitonal explanation about the account. Are IBM's marketable DEBT securities accounted for as trading securities or available for sale securities? [See Note A, page 83} 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 32. Back in 2017, IBM had a change in accounting principle (after I told you how rare these would be!) Where was this reported on IBM's financial statements and what was the amount? II-Iint: these are reported the same way as corrections of errors from prior periods.) IBM completed the acquisition of another corporation during 2019. (See Note E, page 94) What was the name of the corporation? What percent of the comon shares of that corporation does IBM now own? 33. 34. 35. 36. 37. 38. 39. 41. 42. 43. What estimated useful lives does IBM use for buidlings? (See Note A, page 80} 36. IBM is organized into 5 major business segments. During 2019, they re-organized what was included in each segment and renamed 2 of the segments. Name the two segments whose names were changed. (See Note D, page 90} 37(1). 37 (2). Who is IBM's auditor? 38. What opinion did they issue in 2019 regarding IBM's financial statemen' 39. What "concern" did they raise in 2019 regarding IBM's internal contol? 40. Compute the PERCENT OF CHANGE from 2018 to 2019 in Total Liabilities, Total Assets, Total Revenue, and Net Income by completing the following chart. Be sure to indicate if the change is positive or negative. 2019 2018 5 Change I6 of Change Total Liabilities Total Assets Total Reven ues Net Income Prepare a VERTICAL ANALYSIS or common-size income statement for 2019 for the following items only: Total Revenue, Total Cost, Gross Prot, Total Expense and Other Income, Income from Continuing Operations Before Income Taxes, Provision for Income Taxes, Income from Continuing Operatings, Loss from Discontinued Operations, and Net Income Vertical Analysis Total Revenue 77,147 Total Cost 40,659 Gross profit 36,488 Total Expense and Other Income 26,332 Income from Cont Ops Before Taxes 10,166 Provision for Income Taxes 731 Income from Continuing Ops 9,435 Loss/Gain from Disc Operations (4) Net Income 9,431 Note: Use the Five Year Comparison of Selected Financial Data Prepare a TREND analysis for Revenue and Net Income for 2015-2019 using 2015 as the base year. 2019 2018 2017 2016 2015 Revenue Trend Net Income Trend