Answered step by step

Verified Expert Solution

Question

1 Approved Answer

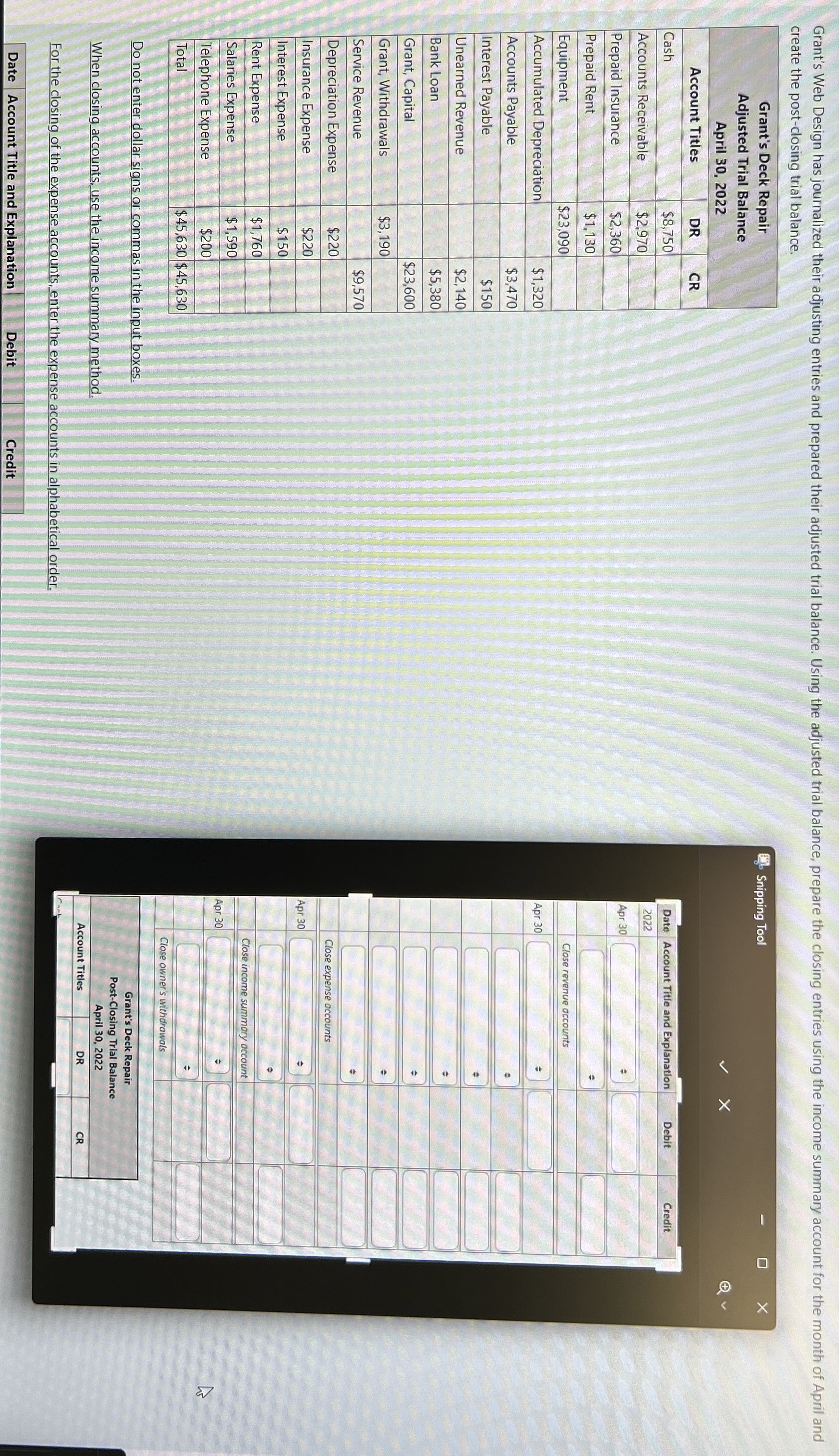

PLEASE HELP! Grant's Web Design has journalized their adjusting entries and prepared their adjusted trial balance. Using the adjusted trial balance, prepare the closing entries

PLEASE HELP! Grant's Web Design has journalized their adjusting entries and prepared their adjusted trial balance. Using the adjusted trial balance, prepare the closing entries using the income summary account for the month of April and

create the postclosing trial balance.

Do not enter dollar signs or commas in the input boxes.

When closing accounts, use the income summary method.

For the closing of the expense accounts, enter the expense accounts in alphabetical order.

Grant's Web Design has journalized their adjusting entries and prepared their adjusted trial balance. Using the adjusted trial balance, prepare the closing entries using the income summary account for the month of April and

create the postclosing trial balance.

Do not enter dollar signs or commas in the input boxes.

When closing accounts, use the income summary method.

For the closing of the expense accounts, enter the expense accounts in alphabetical order.

and please provide the post closing trial balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started