please help

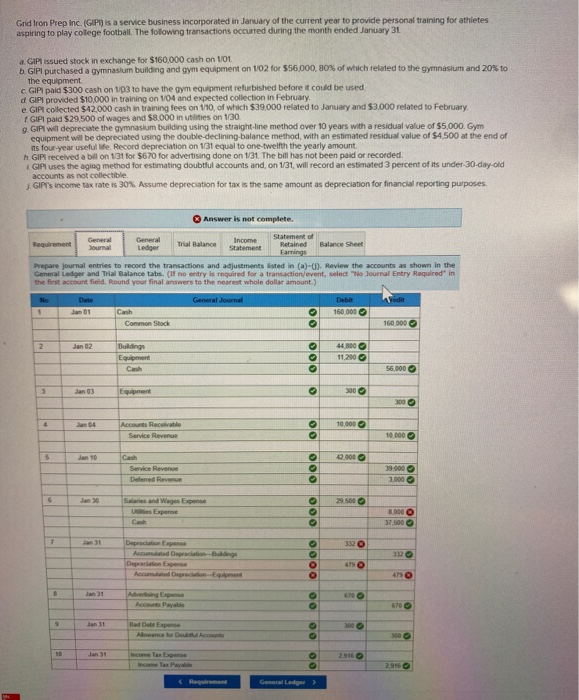

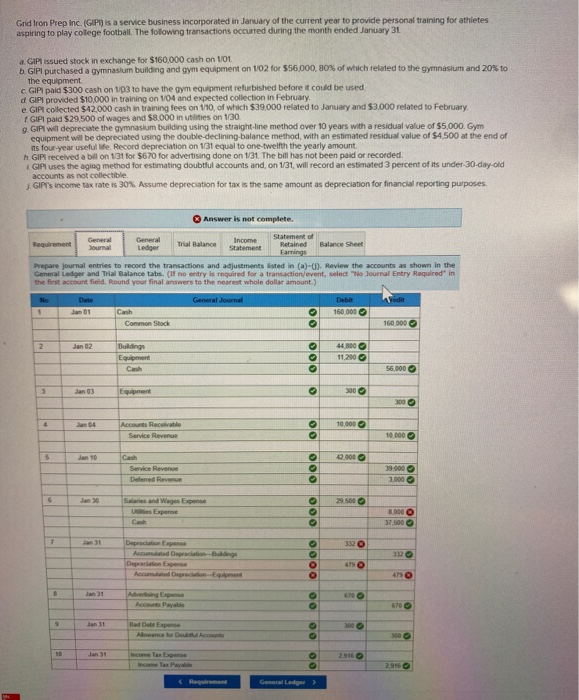

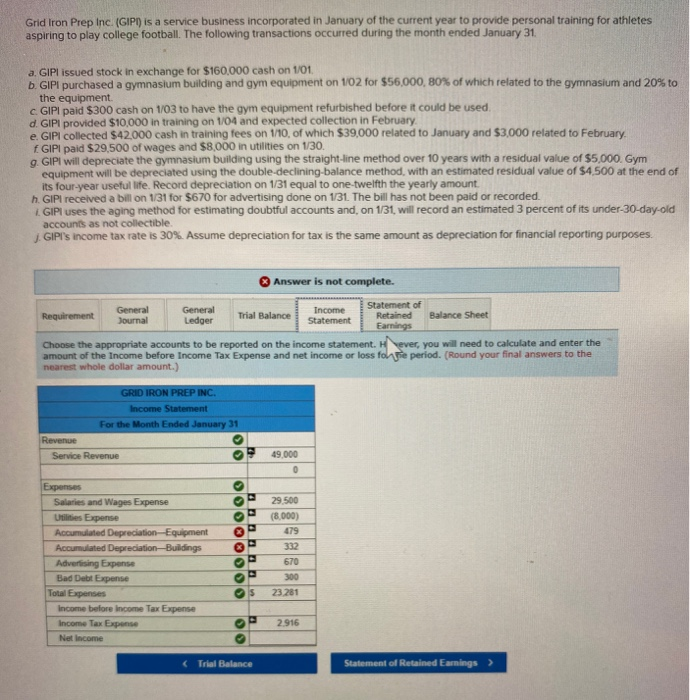

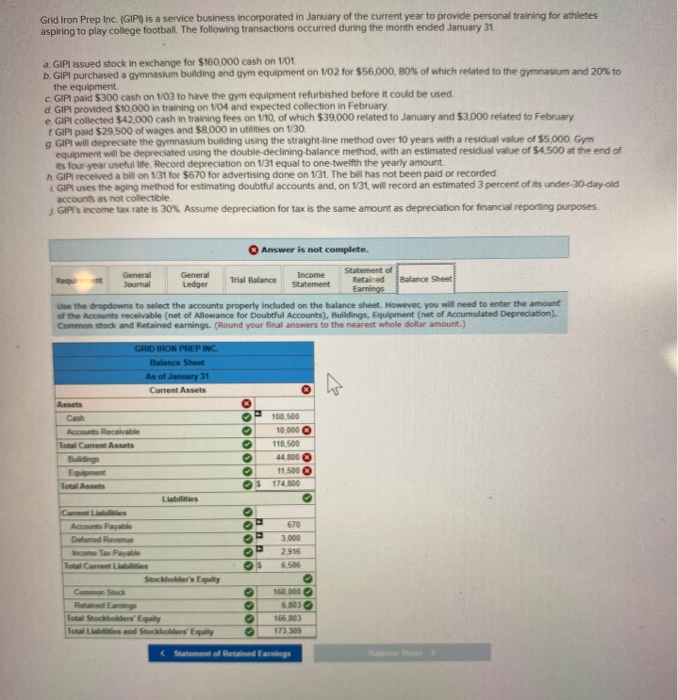

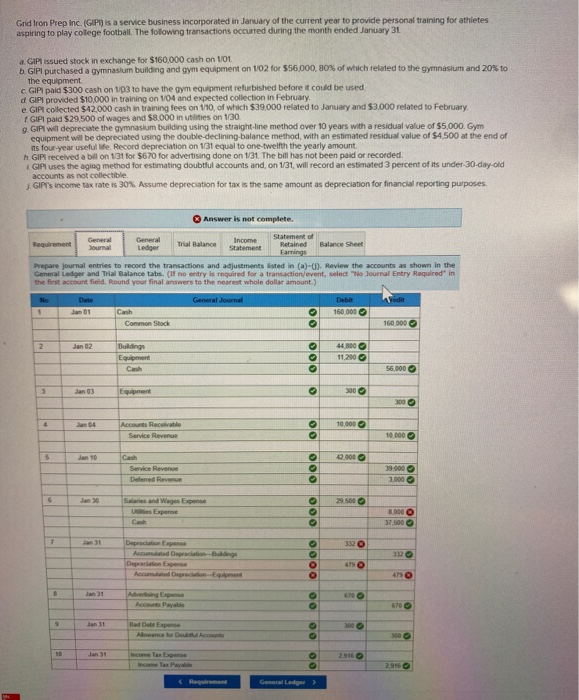

Grid Iron Prep Inc. (GIP) is a service business incorporated in January of the current year to provide personal training for athletes aspiring to play college football The following transactions occurred during the month ended January 31 a G issued stock in exchange for $160,000 cash on LOL GP purchased a gymnasium bulong and gym equipment on 102 for $56.000, 80% of which related to the gym and 20% to the equipment cap pad $300 cash on 103 to have the gym equipment refurbished before it could be used d provided 510.000 in bring on 104 and expected collection in February e collected $42.000 cash in training fees on 110 of which $39.000 related to January and $3000 related to February Grad 529 500 of wages and $8.000 inutities on 130 G wil depreciate the gymnasium building using the straight line method over 10 years with a residual value of $5000 Gym gument will be depreciated using the double-declining balance method, with an estimated residual value of $4500 at the end of s four year useful W. Record depreciation on 31 equal to one-twelfth the yearly amount h G received a b on 131 for $670 for advertising done on 131 The bill has not been paid or recorded Giuses the aging method for estimating doubtful accounts and, on 131, will record an estimated 3 percent of its under 30-day-old accounts as not collectible GIPT's income tax rate is 30%. Assume depreciation for tax is the same amount as depreciation for financial reporting purposes. Answer is not complete, Trial Balance Income Statement Statement of Retained Balance Sheet Prepare journal entries to record the transactions and adjustments listed in (a)-(1) Review the accounts as shown in the General Ledger and Trail Balance tats. (mentry is required for a transaction event, select Journal Entry Required in the first account Round your final anwers to the nearest whole dollar amount.) General Journal Jan 01 Cash Como Stock Jan 04 Accounts Receiva 500 00 00 General Ledge > Grid Iron Prep Inc. (GIP) is a service business incorporated in January of the current year to provide personal training for athletes aspiring to play college football. The following transactions occurred during the month ended January 31 a. GIPI issued stock in exchange for $160,000 cash on 1/01 b. GIPI purchased a gymnasium building and gym equipment on 102 for $56,000,80% of which related to the gymnasium and 20% to the equipment. C. GIPI paid $300 cash on 1/03 to have the gym equipment refurbished before it could be used d. GIPI provided $10,000 in training on 1/04 and expected collection in February e GIPI collected $42,000 cash in training fees on 1/10, of which $39,000 related to January and $3,000 related to February GIPI paid $29,500 of wages and $8,000 in utilities on 130. GIPI will depreciate the gymnasium building using the straight-line method over 10 years with a residual value of $5,000. Gym equipment will be depreciated using the double-declining-balance method, with an estimated residual value of $4,500 at the end of its four-year useful life. Record depreciation on 1/31 equal to one-twelfth the yearly amount h GIPI received a bill on 131 for $670 for advertising done on 131. The bill has not been paid or recorded GIPI uses the aging method for estimating doubtful accounts and, on 1/31 will record an estimated 3 percent of its under 30-day-old accounts as not collectible GIPI's income tax rate is 30%. Assume depreciation for tax is the same amount as depreciation for financial reporting purposes. Answer is not complete. General General Income Statement of Requirement Journal Ledger Trial Balance Statement Retained Balance Sheet Earnings Choose the appropriate accounts to be reported on the income statement. H ever, you will need to calculate and enter the amount of the Income before Income Tax Expense and net income or loss folie period. (Round your final answers to the nearest whole dollar amount.) GRID IRON PREP INC. Income Statement For the Month Ended January 31 Expenses Salaries and Wages Expense Utilities Expense Accumulated Depreciation Equipment Accumulated Depreciation Buildings Advertising Expense Bad Debt Expense Total Expenses Income before Income Tax Expense Income Tax Expo OOOOOOOO Net Income (T alance Statement of Retained Earnings > Grid Iron Prep Inc. (GIP) is a service business incorporated in January of the current year to provide personal training for athletes aspiring to play college football The following transactions occurred during the month ended January 31 a. GIPI issued stock in exchange for $160,000 cash on 1/01 b. GIPI purchased a gymnasium building and gym equipment on 1/02 for $56.000, 80% of which related to the gymnasium and 20% to the equipment c. GIPI paid $300 cash on 1/03 to have the gym equipment refurbished before it could be used d. GIPI provided $10,000 in training on 104 and expected collection in February e GIPI collected $42.000 cash in training fees on 1/10, of which $39,000 related to January and $3,000 related to February GIPI paid $29.500 of wages and $8,000 in utilities on 130 O. GIPI will depreciate the gymnasium building using the straight-line method over 10 years with a residual value of $5000 Gym equipment will be depreciated using the double-declining balance method, with an estimated residual value of $4.500 at the end of its four year useful life. Record depreciation on 1/31 equal to one-twelfth the yearly amount h GIPI received a bill on 131 for $670 for advertising done on 131. The bill has not been paid or recorded GIPl uses the aging method for estimating doubtful accounts and, on 131, will record an estimated 3 percent of its under 30-day-old accounts as not collectible J.GIPI's income tax rate is 30%. Assume depreciation for tax is the same amount as depreciation for financial reporting purposes Answer is not complete. General Ledger Trial Balance income Sement Statement of Retained Earning Ralance he Use the dropdowns to select the accounts properly included on the balance sheet. However, you will need to enter the amount of the receivable (net of Allowance for Doubtful Accounts), Buildings, Equipment (net of Accumulated Depreciation Common stock and Retained earnings. (Round your final answers to the nearest whole dollar amount.) GRID IRON PREP INC Balance Sheet As of January 31 Current Assets Total Soccer Equity Rated Total Stockholders' Equity Total s and stockholders' Equity