PLease help guys!

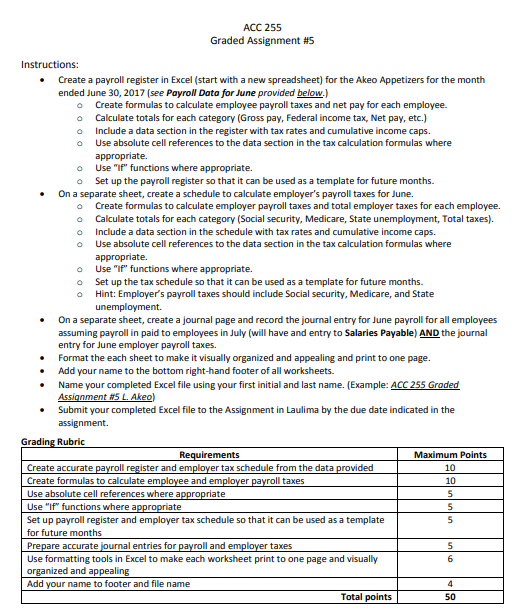

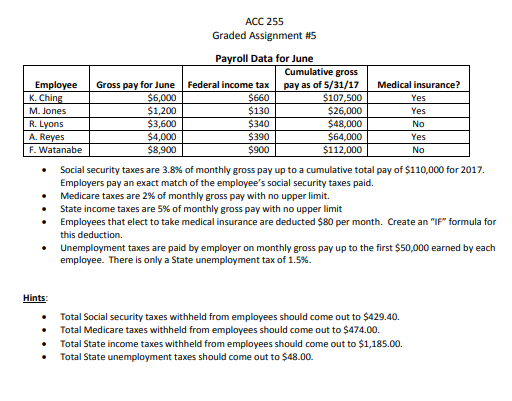

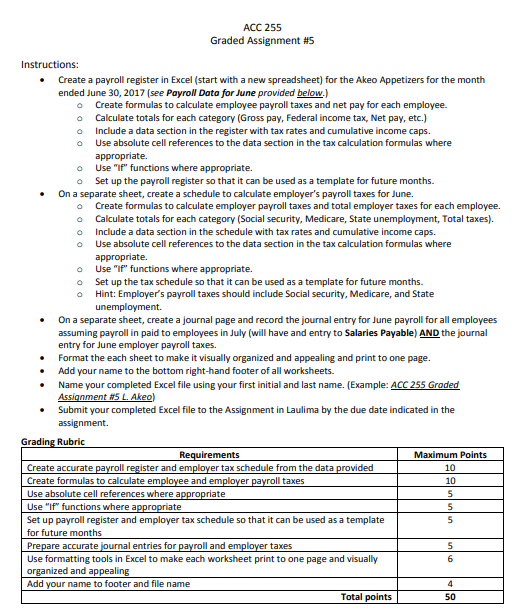

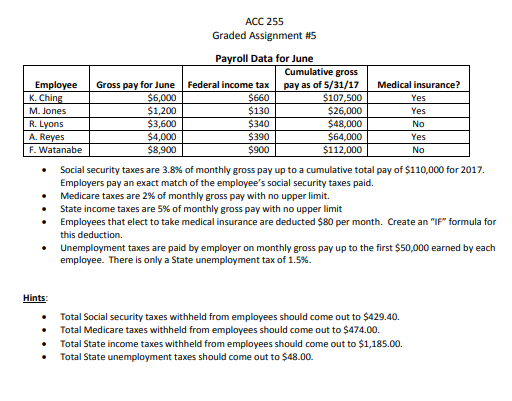

ACC 255 Graded Assignment #5 Create a payroll register in Excel (start with a new spreadsheet) for the Akeo Appetizers for the month ended June 30, 2017 (see Payroll Data for June provided below,) o o o o Create formulas to calculate employee payroll taxes and net pay for each employee. Calculate totals for each category (Gross pay, Federal income tax, Net pay, etc.) Include a data section in the register with tax rates and cumulative income caps. Use absolute cell references to the data section in the tax calculation formulas where appropriate. o Use "If" functions where appropriate. o Set up the payroll register so that it can be used as a template for future months. On a separate sheet, create a schedule to calculate employer's payroll taxes for June. o o o o Create formulas to calculate employer payroll taxes and total employer taxes for each employee. Calculate totals for each category (Social security, Medicare, State unemployment, Total taxes). Include a data section in the schedule with tax rates and cumulative income caps. Use absolute cell references to the data section in the tax calculation formulas where appropriate. o Use "If" functions where appropriate. o Set up the tax schedule so that it can be used as a template for future months. o Hint: Employer's payroll taxes should include Social security, Medicare, and State On a separate sheet, create a journal page and record the journal entry for June payroll for all employees assuming payroll in paid to employees in July (will have and entry to Salaries Payable) AND the journal entry for June employer payroll taxes. Format the each sheet to make it visually organized and appealing and print to one page. Add your name to the bottom right-hand footer of all worksheets. Name your completed Excel file using your first initial and last name. (Example: ACC 255 Groded Submit your completed Excel file to the Assignment in Laulima by the due date indicated in the assignment. Rubric Gr uirements Maximum Points 10 10 Create accurate payroll register and employer tax schedule from the data provided Create formulas to calculate em Use absolute cell references where a Use "If functions where a Set up payroll register and employer tax schedule so that it can be used as a template for future months taxes are accurate entries for payroll and r taxes Use formatting tools in Excel to make each worksheet print to one page and visually organized and appealing Total points 50 ACC 255 Graded Assignment #5 Create a payroll register in Excel (start with a new spreadsheet) for the Akeo Appetizers for the month ended June 30, 2017 (see Payroll Data for June provided below,) o o o o Create formulas to calculate employee payroll taxes and net pay for each employee. Calculate totals for each category (Gross pay, Federal income tax, Net pay, etc.) Include a data section in the register with tax rates and cumulative income caps. Use absolute cell references to the data section in the tax calculation formulas where appropriate. o Use "If" functions where appropriate. o Set up the payroll register so that it can be used as a template for future months. On a separate sheet, create a schedule to calculate employer's payroll taxes for June. o o o o Create formulas to calculate employer payroll taxes and total employer taxes for each employee. Calculate totals for each category (Social security, Medicare, State unemployment, Total taxes). Include a data section in the schedule with tax rates and cumulative income caps. Use absolute cell references to the data section in the tax calculation formulas where appropriate. o Use "If" functions where appropriate. o Set up the tax schedule so that it can be used as a template for future months. o Hint: Employer's payroll taxes should include Social security, Medicare, and State On a separate sheet, create a journal page and record the journal entry for June payroll for all employees assuming payroll in paid to employees in July (will have and entry to Salaries Payable) AND the journal entry for June employer payroll taxes. Format the each sheet to make it visually organized and appealing and print to one page. Add your name to the bottom right-hand footer of all worksheets. Name your completed Excel file using your first initial and last name. (Example: ACC 255 Groded Submit your completed Excel file to the Assignment in Laulima by the due date indicated in the assignment. Rubric Gr uirements Maximum Points 10 10 Create accurate payroll register and employer tax schedule from the data provided Create formulas to calculate em Use absolute cell references where a Use "If functions where a Set up payroll register and employer tax schedule so that it can be used as a template for future months taxes are accurate entries for payroll and r taxes Use formatting tools in Excel to make each worksheet print to one page and visually organized and appealing Total points 50