Answered step by step

Verified Expert Solution

Question

1 Approved Answer

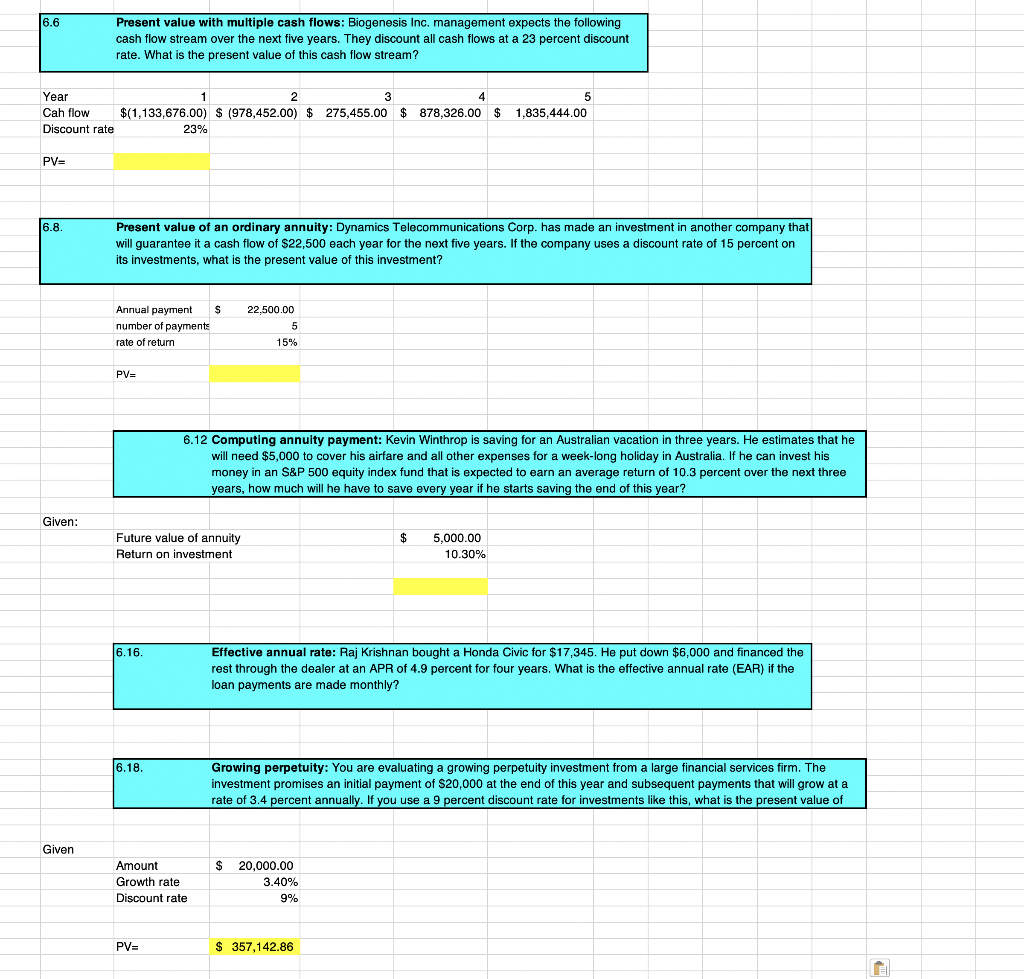

Please help I am struggling to figure out how to answer these in excel. The last one I did but I don't know if I

Please help I am struggling to figure out how to answer these in excel. The last one I did but I don't know if I did it right. Thank you, I will rate right away!

(Please answer them showing me how to input in excel)

Present value with multiple cash flows: Biogenesis Inc. management expects the following cash flow stream over the next five years. They discount all cash flows at a 23 percent discount rate. What is the present value of this cash flow stream? Year Cah flow Discount rate 1,835,444.00 $(1,133,676.00) $ (978,452.00) $ 275,455.00 $ 878,326.00 $ 23% PV= 6.8. Present value of an ordinary annuity: Dynamics Telecommunications Corp. has made an investment in another company that will guarantee it a cash flow of $22,500 each year for the next five years. If the company uses a discount rate of 15 percent on its investments, what is the present value of this investment? $ Annual payment number of payments rate of return 22,500.00 5 15% PV= 6.12 Computing annuity payment: Kevin Winthrop is saving for an Australian vacation in three years. He estimates that he will need $5,000 to cover his airfare and all other expenses for a week-long holiday in Australia. If he can invest his money in an S&P 500 equity index fund that is expected to earn an average return of 10.3 percent over the next three years, how much will he have to save every year if he starts saving the end of this year? Given: $ Future value of annuity Return on investment 5,000.00 10.30% 6.16. Effective annual rate: Raj Krishnan bought a Honda Civic for $17,345. He put down $6,000 and financed the rest through the dealer at an APR of 4.9 percent for four years. What is the effective annual rate (EAR) if the loan payments are made monthly? Growing perpetuity: You are evaluating a growing perpetuity investment from a large financial services firm. The investment promises an initial payment of $20,000 at the end of this year and subsequent payments that will grow at a rate of 3.4 percent annually. If you use a 9 percent discount rate for investments like this, what is the present value of Given $ Amount Growth rate Discount rate 20,000.00 3.40% 9% PV= $ 357,142.86Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started