Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help i am stuck. I wrote the answers for each box to the right... thank you! 2. Introduction to the future value of money

Please help i am stuck. I wrote the answers for each box to the right... thank you!

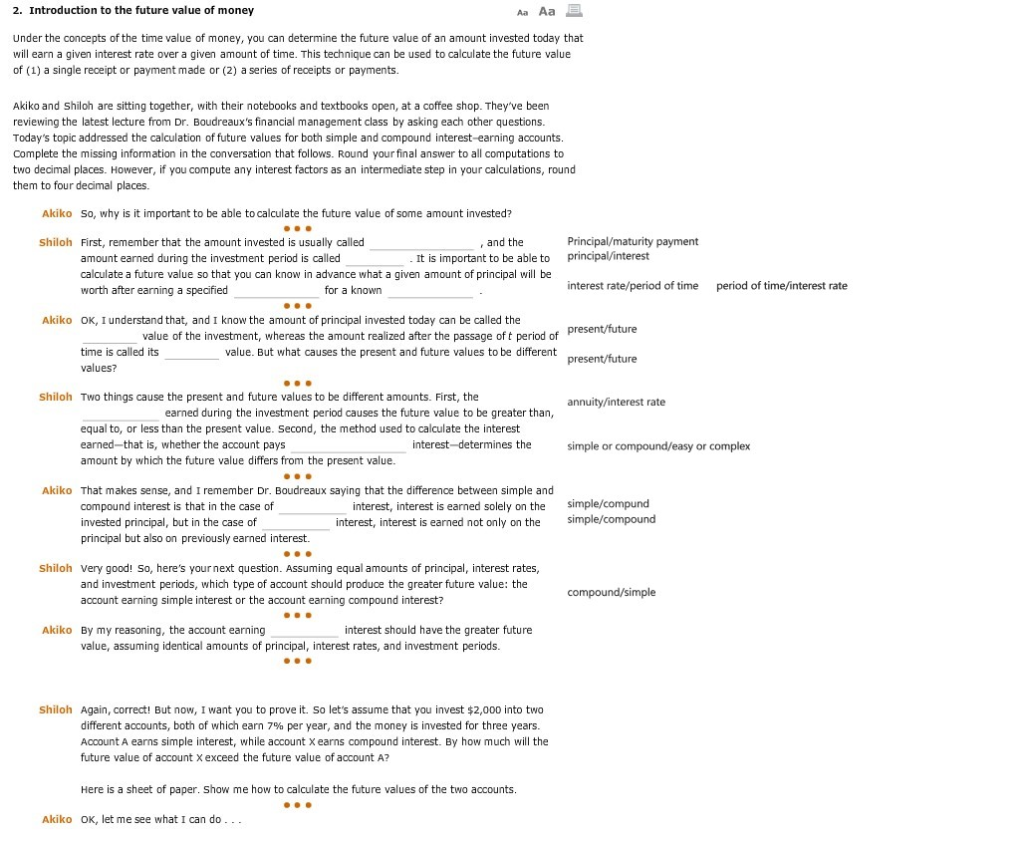

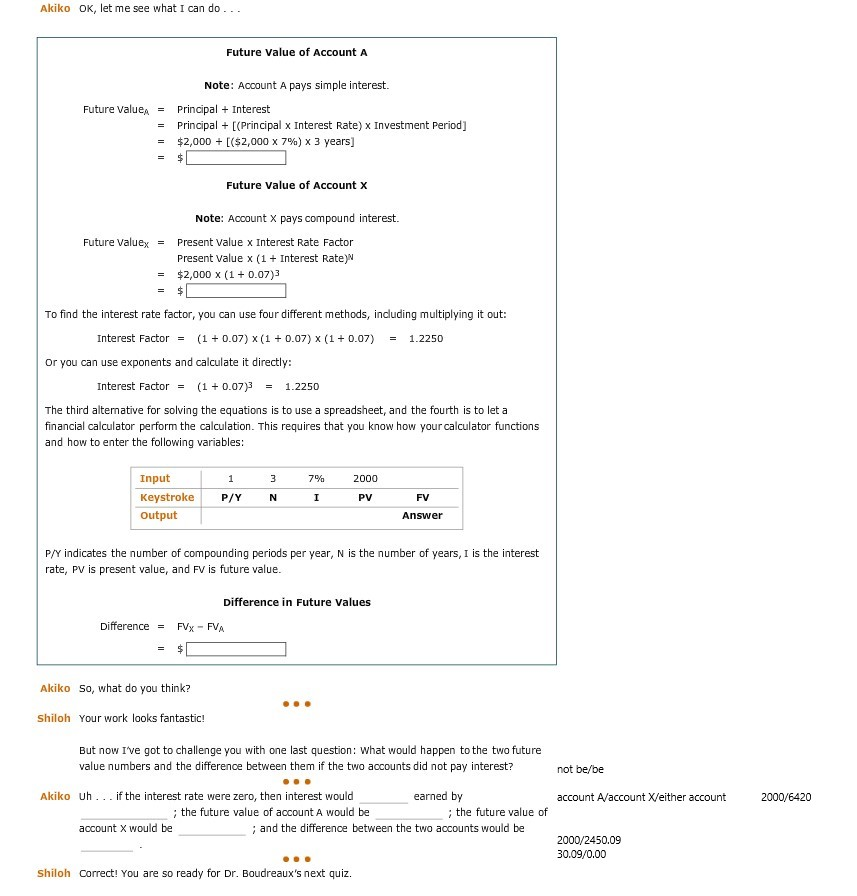

2. Introduction to the future value of money Aa Aa Under the concepts of the time value of money, you can determine the future value of an amount invested today that will earn a given interest rate over a given amount of time. This technique can be used to calculate the future value of (1) a single receipt or payment made or (2) a series of reoeipts or payments. Akiko and Shiloh are sitting together, with their notebooks and textbooks open, at a coffee shop. They've been reviewing the latest lecture from Dr. Boudreaux's financial management class by asking each other questions Today's topic addressed the calculation of future values for both simple and compound interest-earning accounts. Complete the missing information in the conversation that follows. Round your final answer to all computations to two decimal places. However, if you compute any interest factors as an intermediate step in your calculations, round them to four decimal places. Akiko So, why is it important to be able to calculate the future value of some amount invested? Principal/maturity payment principal/interest Shiloh First, remember that the amount invested is usually called and the it is important to be able to amount earned during the investment period is called calculate a future value so that you can know in advance what a given amount of principal will be worth after earning a specified for a known interest rate/period of time period of time/interest rate Akiko OK, I understand that, and I know the amount of principal invested today can be called the value of the investment, whereas the amount realized after the passage of t period of value. But what causes the present and future values to be different time is called its values? Shiloh Two things cause the present and future values to be different amounts. First, the annuity/interest rate earned during the investment period causes the future value to be greater than, equal to, or less than the present value. Second, the method used to calculate the interest earned-that is, whether the account pays amount by which the future value differs from the present value. interest-determines thesimple or or complex Akiko That makes sense, and I remember Dr. Boudreaux saying that the difference between simple and compound interest is that in the case of invested principal, but in the case of principal but also on previously earned interest. interest, interest is earned solely on the interest, interest is earned not only on the simple/compund simple/compound Shiloh Very good! So, here's your next question. Assuming equal amounts of principal, interest rates, and investment periods, which type of account should produce the greater future value: the account earning simple interest or the account earning compound interest? Akiko By my reasoning, the account earning value, assuming identical amounts of principal, interest rates, and investment periods interest should have the greater future Shiloh Again, correct! But now, I want you to prove it. So let's assume that you invest $2,000 into two different accounts, both of which earn 7% per year, and the money is invested for three years. Account A earns simple interest, while account X earns compound interest. By how much will the future value of account X exceed the future value of account A? Here is a sheet of paper. Show me how to calculate the future values of the two accounts Akiko OK, let me see what I can do Akiko OK, let me see what I can do Future Value of Account A Note: Account A pays simple interest. Future valPrincipal + Interest Principal[(Principal x Interest Rate) x Investment Period] $2,000 + [($2,000 x 7%) x 3 years] - Future Value of Account X Note: Account X pays compound interest. Future valuexPresent value x Interest Rate Factor Present Value x 1Interest Rate)N - $2,000 x (1 0.07)3 To find the interest rate factor, you can use four different methods, including multiplying it out: Interest Factor (1 0.07) x (1 0.07) x (1 0.07)1.2250 Or you can use exponents and calculate it directly Interest Factor = (1+0.07 1.2250 = The third alternative for solving the equations is to use a spreadsheet, and the fourth is to let a financial calculator perform the calculation. This requires that you know how your calculator functions and how to enter the following variables Input Keystroke output 7% 2000 P/Y N PV FV Answer P/Y indicates the number of compounding periods per year, N is the number of years, I is the interest rate, PV is present value, and FV is future value. Difference in Future Values Difference = FVx-FVA Akiko So, what do you think? Shiloh Your work looks fantastic! But now Ive got to challenge you with one last question: What would happen to the two future value numbers and the difference between them if the two accounts did not pay interest? not be/be Akiko Uh.. if the interest rate were zero, then interest would earned by account A/account X/either account 2000/6420 the future value of account A would be : the future value of account X would be and the difference between the two accounts would be 2000/2450.09 30.09/0.00 Shiloh Correct! You are so ready for Dr. Boudreaux's next quizStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started