please help!! I can't figure this out. And let me know if my current answers are correct

Please me know if my answers for a-d are correct, if they aren't let me know how to do them!

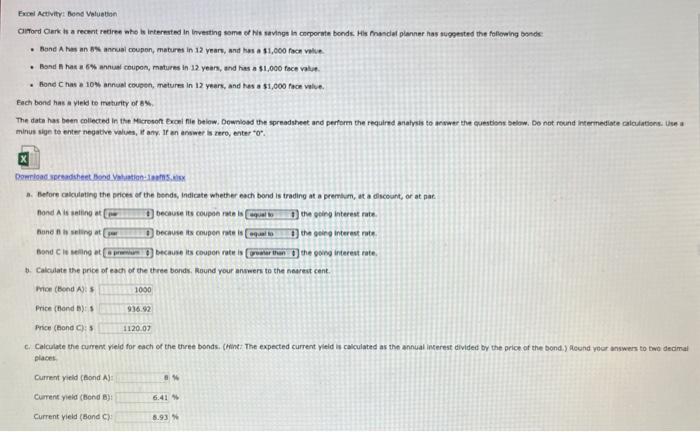

E.

1. Fill in the blank

2. Fill in the blank

3. YTM is less/greater/equal, Mr. Clark should/should not, earn YTC/YTM

F. interest rates is called price risk/reinvestment risk, drop in interedt rates is called price risk/reinvestment risk

A 1 year bond with an 8% annual coupon/5 yesr bond with an 8% annual coupon/5 year bond with a zero coupon/10 year bond with an 8% annual coupon/10 year bond with a zero coupon

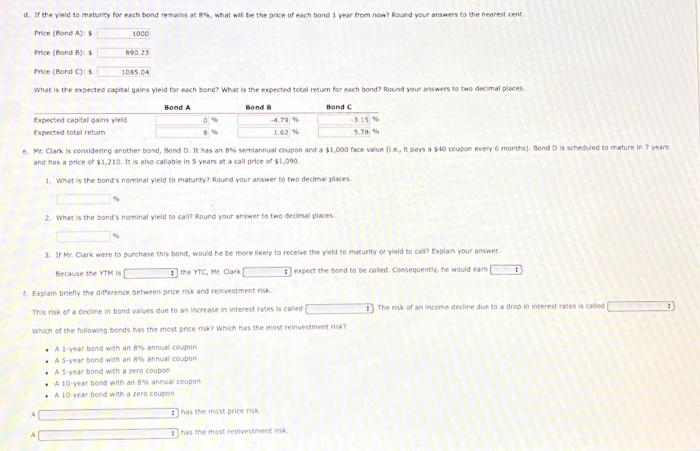

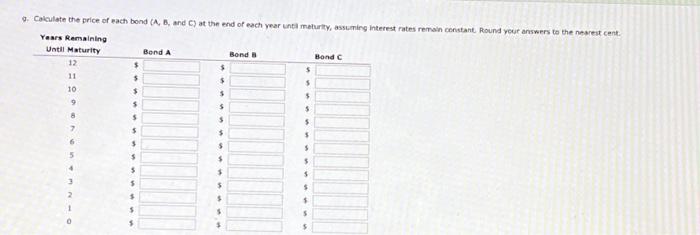

G. Calculate the price of each bond: fill in the blank for bond a, bond b, bond c

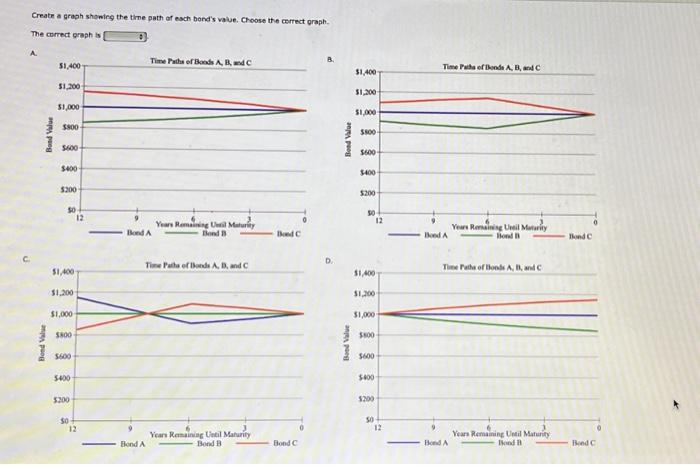

the correct graph is: A/B/C/D

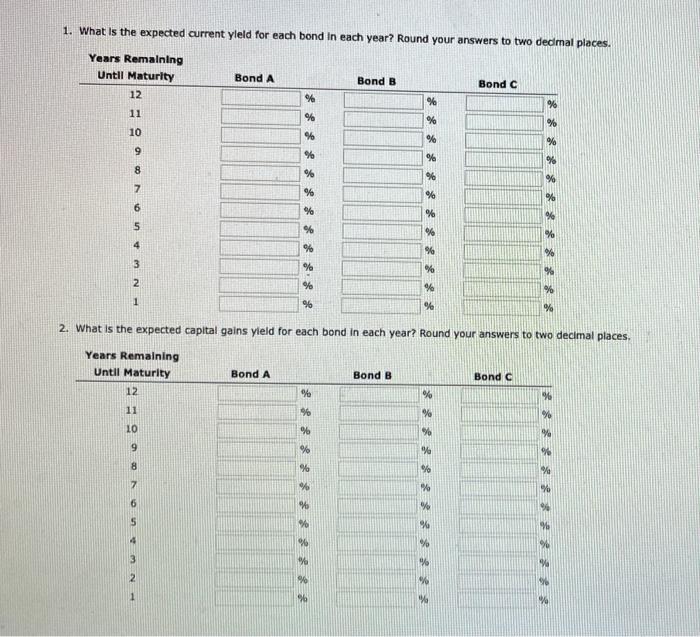

1. What is the expected current yield for each bond in each year? Fill in all the blanks for bond a, bond b, and bond c

2. What is the expected capital gains yield for each bond in each year? Fill in the blanks for bond a, bond b, bond c

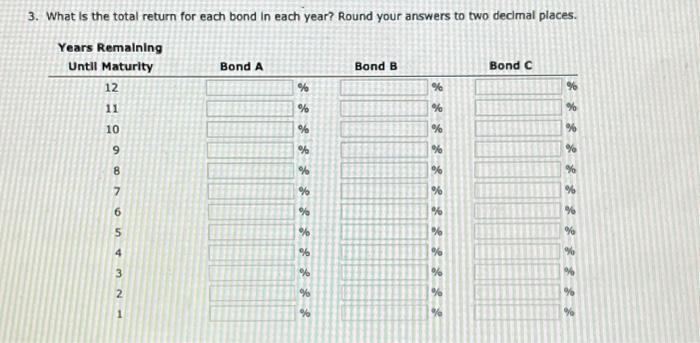

3. What is the total return for each bond in each year? Fill in the blanks for bond a, bond b, bond c

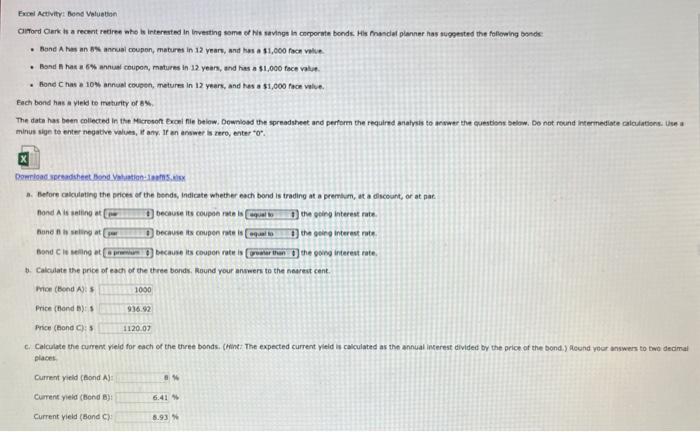

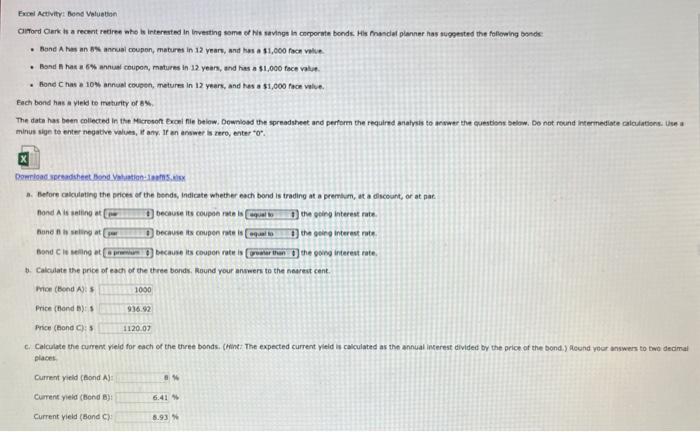

Fxcel Activity: Bend Veluebion - Bond A hat an bs annual coupon, wetures in 12 yeare, wnd has a 11,000 focm velie - Band a hat a 6% annua coupon, matures in 12 years, thd has a 51,000 face valip. * Bond c has a 10 in annsel couoch, metures in 12 years, and has a $1,000 face valie. Fach bond has a viekd to ituturty of gyw. minus sign te enter negative values, if any. If an answer is rero, enter " 0. Xe B. Betore calculating the prices of the bends, indicate whether each bond is trading at a premtum, at a discount, or at pat. 3. Calculate the price of each of the thee bonds. Aound your answen to the neareat cent. Froe (Bond A): of Price (thorid B) \& Price (fond ct): 9 placet. Gument yield (Aond A ) Camens yieid (bond B): Gurrent yield \{Eond C?) a. Ir the yeid ts maturty for eech bond remwns ak aw, what wir be the prise of esch bond 1 vear trem noa? Rasued your arawers ta the nearest cent. Frice (Bond A): 3 Price (Bosd B)=4 Frion (Bond C)s What is the expected cagieal gairs yleld for each bend? What is the expected tecel refurn for each bond? Rownd your onsers to two decimal ploces. and has a price of $1,210. In is ale caliabie in 5 yean at a call price of $1,090. 1. Whet is the bondis nominal yield to maturty? figued your arswer to two decimal placi. 2. whac is the bonds neminal yieid to cail? Rnurd your answer to teo decimal places. 3. If Wh. Cark were to putchsie this bond, would he be msre Akeiv to recelve the yeld to matiarily or yiaid to call Expiaio your answer Because the YTM is the rTC, Me ciacik expect the send to be caled. Consequenth, he aould earn t. Expiain bnefy the differtace between brite risk and reifvestment nsk. This risk of a crcine in bond values due to an increase in intelest fates is cated The nisk of an income decive dut to a drop in interent rates is called Which ef the foliging bonds has the mest pnce riak which has the most reirlupetmenk risk? - A l-vear band with an ak ennual coupon - A 5.vear bond wath an a w arnual coupon - A Syrear bond with a rero coupon - A 10-rear bend with an dW aneual coupont - A 10-year bend with a zero coupon Phas the most price risk has the most feinursitent mik. 9. Colculate the price of each bond (A,B, and C ) at the end of each year uncil melurity, assuming interest fates remain censtant Round your answers to the neareit cent Years Remsaining Create a graph showirg the time path of esch bond's value. Choose the correct oraph. The correct greph is 1. What is the expected current yleld for each bond in each year? Round your answers to two dedmal places. 2. What is the expected capital gains yleld for each bond in each year? Round your answers to two decimal places 3. What is the total return for each bond in each year? Round your answers to two decmal places. Fxcel Activity: Bend Veluebion - Bond A hat an bs annual coupon, wetures in 12 yeare, wnd has a 11,000 focm velie - Band a hat a 6% annua coupon, matures in 12 years, thd has a 51,000 face valip. * Bond c has a 10 in annsel couoch, metures in 12 years, and has a $1,000 face valie. Fach bond has a viekd to ituturty of gyw. minus sign te enter negative values, if any. If an answer is rero, enter " 0. Xe B. Betore calculating the prices of the bends, indicate whether each bond is trading at a premtum, at a discount, or at pat. 3. Calculate the price of each of the thee bonds. Aound your answen to the neareat cent. Froe (Bond A): of Price (thorid B) \& Price (fond ct): 9 placet. Gument yield (Aond A ) Camens yieid (bond B): Gurrent yield \{Eond C?) a. Ir the yeid ts maturty for eech bond remwns ak aw, what wir be the prise of esch bond 1 vear trem noa? Rasued your arawers ta the nearest cent. Frice (Bond A): 3 Price (Bosd B)=4 Frion (Bond C)s What is the expected cagieal gairs yleld for each bend? What is the expected tecel refurn for each bond? Rownd your onsers to two decimal ploces. and has a price of $1,210. In is ale caliabie in 5 yean at a call price of $1,090. 1. Whet is the bondis nominal yield to maturty? figued your arswer to two decimal placi. 2. whac is the bonds neminal yieid to cail? Rnurd your answer to teo decimal places. 3. If Wh. Cark were to putchsie this bond, would he be msre Akeiv to recelve the yeld to matiarily or yiaid to call Expiaio your answer Because the YTM is the rTC, Me ciacik expect the send to be caled. Consequenth, he aould earn t. Expiain bnefy the differtace between brite risk and reifvestment nsk. This risk of a crcine in bond values due to an increase in intelest fates is cated The nisk of an income decive dut to a drop in interent rates is called Which ef the foliging bonds has the mest pnce riak which has the most reirlupetmenk risk? - A l-vear band with an ak ennual coupon - A 5.vear bond wath an a w arnual coupon - A Syrear bond with a rero coupon - A 10-rear bend with an dW aneual coupont - A 10-year bend with a zero coupon Phas the most price risk has the most feinursitent mik. 9. Colculate the price of each bond (A,B, and C ) at the end of each year uncil melurity, assuming interest fates remain censtant Round your answers to the neareit cent Years Remsaining Create a graph showirg the time path of esch bond's value. Choose the correct oraph. The correct greph is 1. What is the expected current yleld for each bond in each year? Round your answers to two dedmal places. 2. What is the expected capital gains yleld for each bond in each year? Round your answers to two decimal places 3. What is the total return for each bond in each year? Round your answers to two decmal places