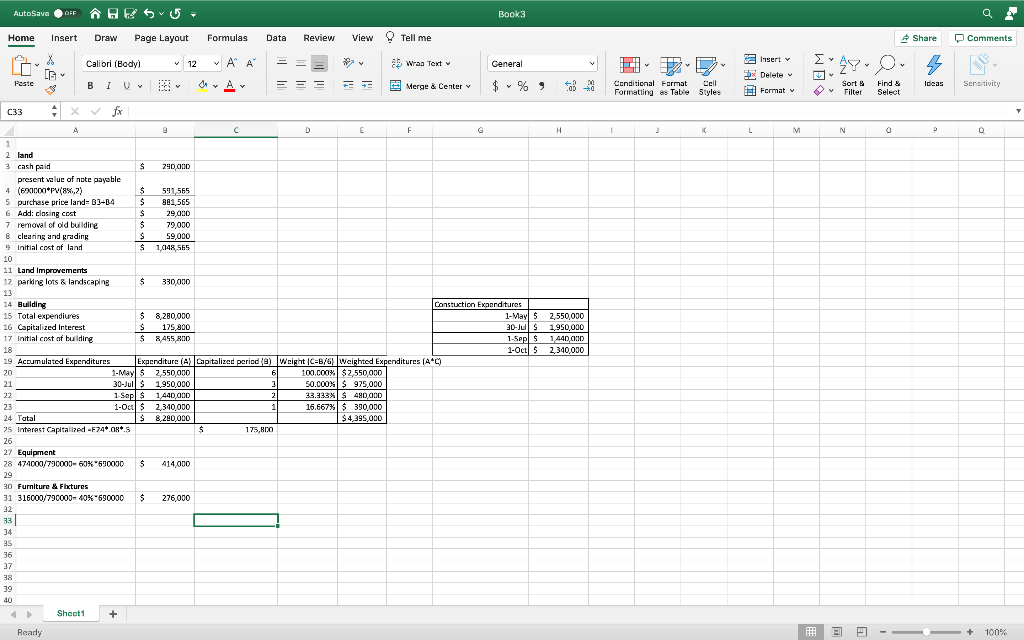

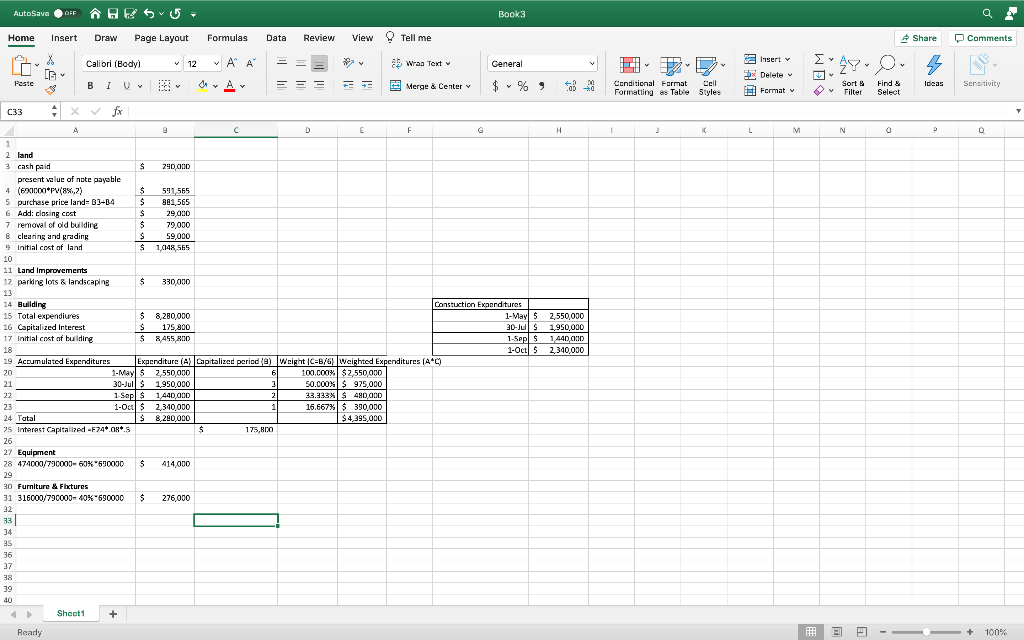

Please help!!!! i cant get the building portion and can't figure out what i'm doing wrong. I've given all of my work so it can be seen on what i'm doing wrong.

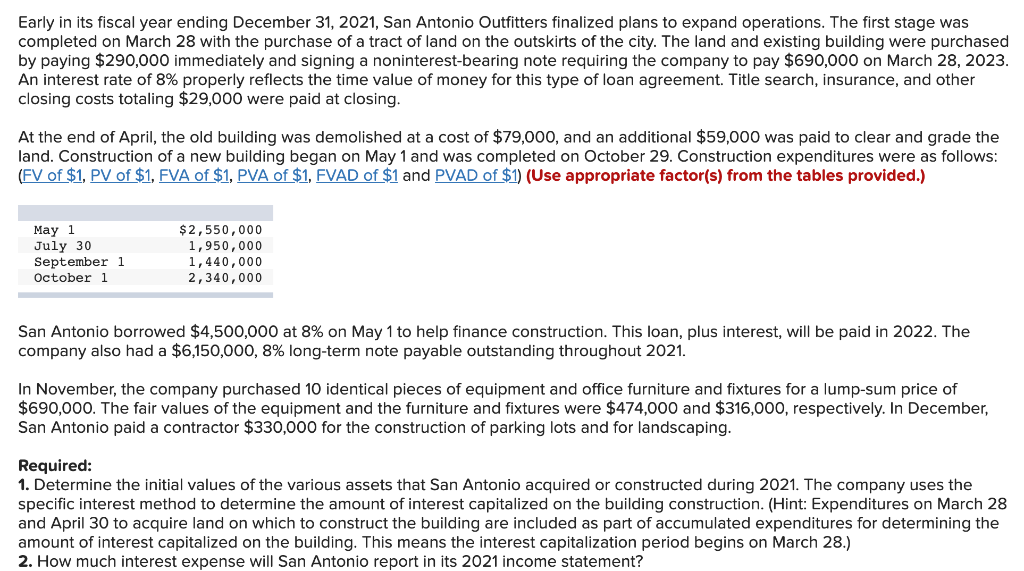

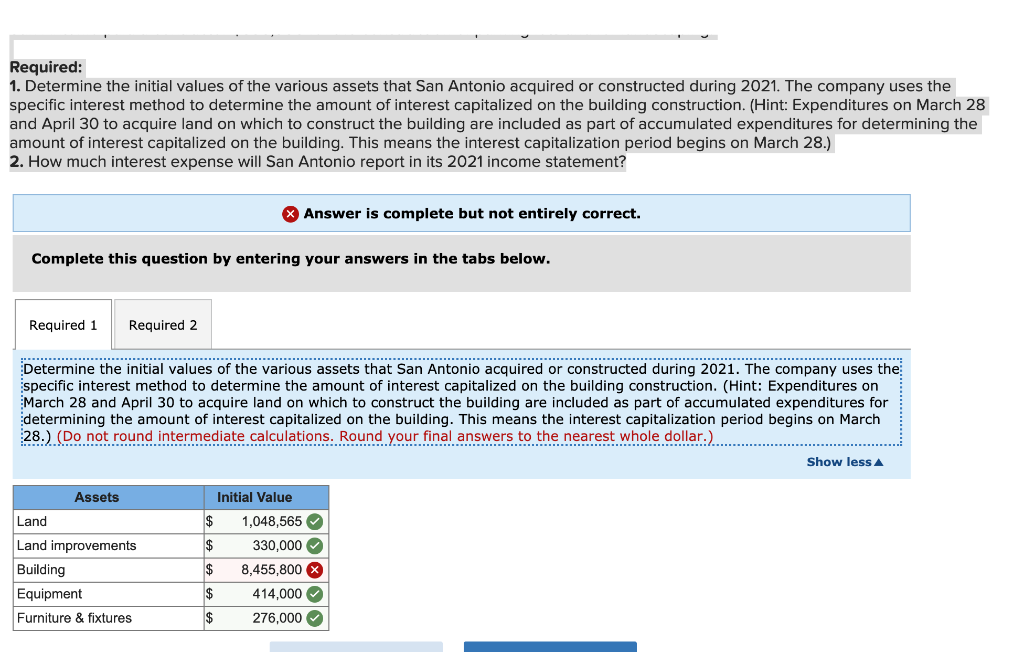

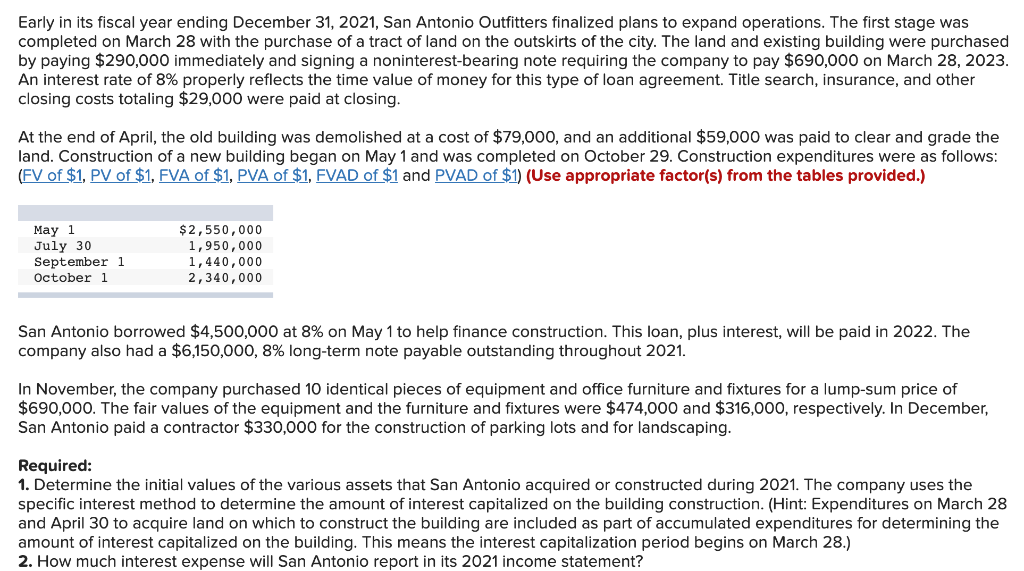

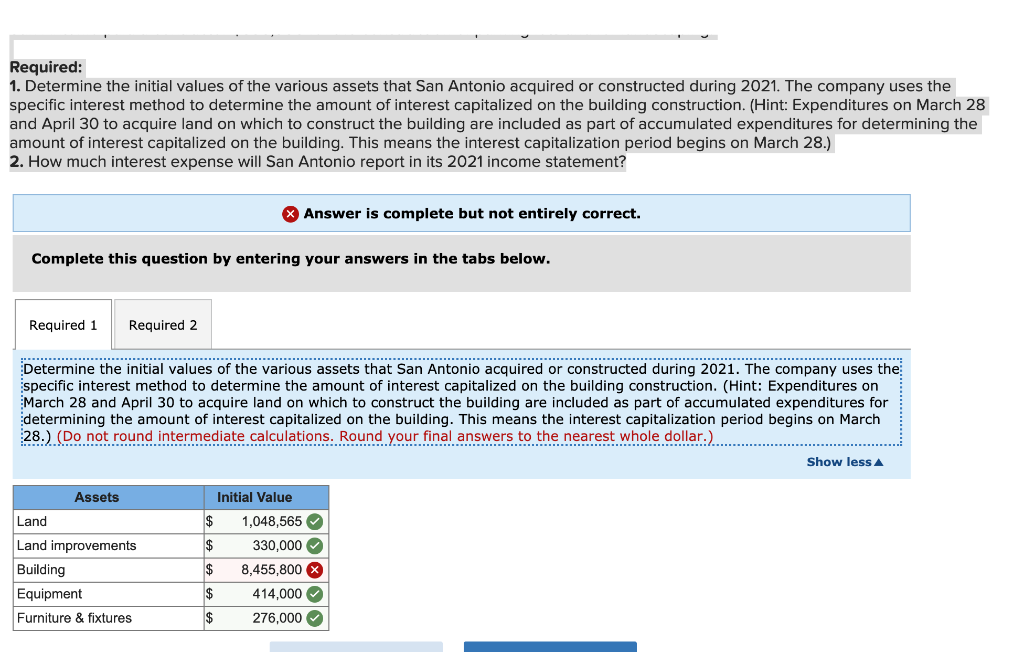

Early in its fiscal year ending December 31, 2021, San Antonio Outfitters finalized plans to expand operations. The first stage was completed on March 28 with the purchase of a tract of land on the outskirts of the city. The land and existing building were purchased by paying $290,000 immediately and signing a noninterest-bearing note requiring the company to pay $690,000 on March 28, 2023. An interest rate of 8% properly reflects the time value of money for this type of loan agreement. Title search, insurance, and other closing costs totaling $29,000 were paid at closing. At the end of April, the old building was demolished at a cost of $79,000, and an additional $59,000 was paid to clear and grade the land. Construction of a new building began on May 1 and was completed on October 29. Construction expenditures were as follows: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) May 1 July 30 September 1 October 1 $2,550,000 1,950,000 1,440,000 2,340,000 San Antonio borrowed $4,500,000 at 8% on May 1 to help finance construction. This loan, plus interest, will be paid in 2022. The company also had a $6,150,000, 8% long-term note payable outstanding throughout 2021. In November, the company purchased 10 identical pieces of equipment and office furniture and fixtures for a lump-sum price of $690,000. The fair values of the equipment and the furniture and fixtures were $474,000 and $316,000, respectively. In December, San Antonio paid a contractor $330,000 for the construction of parking lots and for landscaping. Required: 1. Determine the initial values of the various assets that San Antonio acquired or constructed during 2021. The company uses the specific interest method to determine the amount of interest capitalized on the building construction. (Hint: Expenditures on March 28 and April 30 to acquire land on which to construct the building are included as part of accumulated expenditures for determining the amount of interest capitalized on the building. This means the interest capitalization period begins on March 28.) 2. How much interest expense will San Antonio report in its 2021 income statement? Required: 1. Determine the initial values of the various assets that San Antonio acquired or constructed during 2021. The company uses the specific interest method to determine the amount of interest capitalized on the building construction. (Hint: Expenditures on March 28 and April 30 to acquire land on which to construct the building are included as part of accumulated expenditures for determining the amount of interest capitalized on the building. This means the interest capitalization period begins on March 28.) 2. How much interest expense will San Antonio report in its 2021 income statement? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 ............... Determine the initial values of the various assets that San Antonio acquired or constructed during 2021. The company uses the specific interest method to determine the amount of interest capitalized on the building construction. (Hint: Expenditures on March 28 and April 30 to acquire land on which to construct the building are included as part of accumulated expenditures for determining the amount of interest capitalized on the building. This means the interest capitalization period begins on March 28.) (Do not round intermediate calculations. Round your final answers to the nearest whole dollar.) Show less A Assets Land Land improvements Building Equipment Furniture & fixtures Initial Value $ 1,048,565 $ 330,000 $ 8,455,800 x $ 414,000 $ 276,000 AutoSave OFF AGE SU Book3 Insert Draw Page Layout Home - Formulas Data Review View Tell me Share Comments X X LG Insert v Calibri (Body) ~ Al A v 12 a Wras Text Ceneral AY DX Delete Paste B 1 1 A = = = Merge & Center v Conditional Format Cell Formatting as Table Styles Ideas Sort Filter Format Sensitivity v Find & Select C33 . T K L M N 0 D 0 9 C D F G H 1 2 land 3 cash paid $ 290.000 present value of note payable 4 (690000+PV(8%,2) $ 591,565 5 purchase price land=B3-B4 $ 381,565 6 Add: closing cost $ 29,000 removal of old buildine $ 79,000 8 clearing and grading $ 59,000 9 Initial cost of land S $ 1,148, 565 10 11 Land improvements 12 parking lots & landscaping $ 330,000 13 14 Building Constuction Experdituras 15 Total expendiures $ 8,280,000 1- May 5 2,550,000 16 Capitalized Interest $ 175,800 * 30-Juls 1,950,000 17 Initial cost of building $ $ 8,455,400 1-Sep $ 1,440,00 18 1-Octs 2.340,000 19 Acumulated Expenditures Expenditure (A) Capitalized period (8) Weight (C=B/6) Weighted Expenditures (AC) 20 1-May$ 2,550,000 6 100.00% $ 2.550.000 21 30-Jull $ 1,950,000 3 50.coOx $ 975,000 22 1 Sops 1,440,000 2 33.333X $ 480,000 23 1-Octs 2,310,000 1 15.667% $ 390,000 24 Tatal S 8,280,000 $4,395,000 25 Interest Capitalized -F74.c.5 S 175,800 26 27 Equipment 28 474000/790000-60%"590000 $ 414,000 29 30 Furniture & Fixtures 31 316000/790000-40% 690000 $ 276,000 32 33 34 35 36 37 38 39 40 Sheet1 + Ready E- 100%