Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help! I don't understand this! Consi TU. - - . A A = % im Nate Conditional Federal my head Post Cols El Led

Please help! I don't understand this!

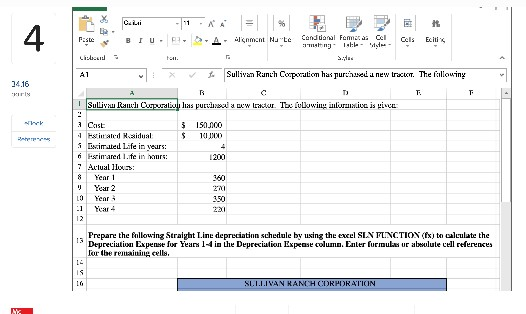

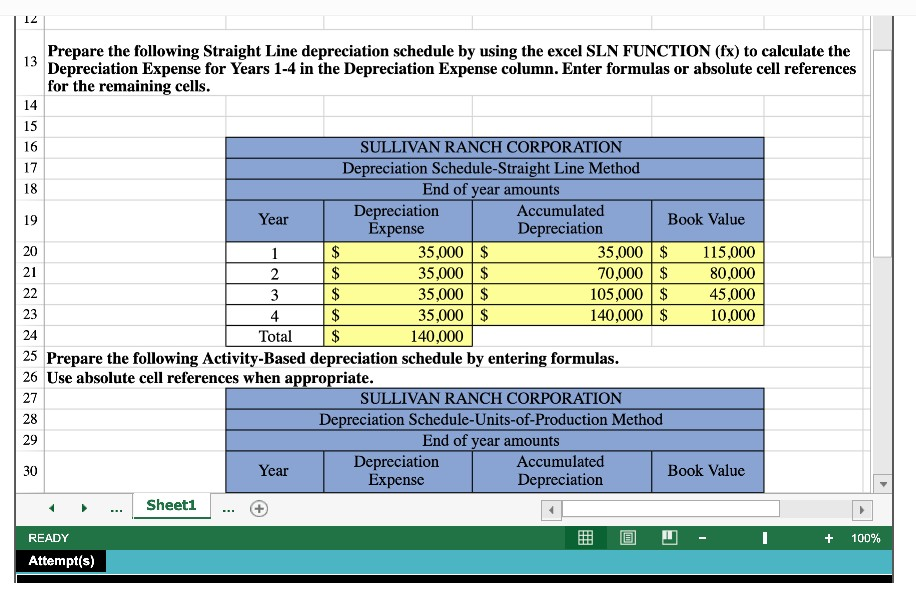

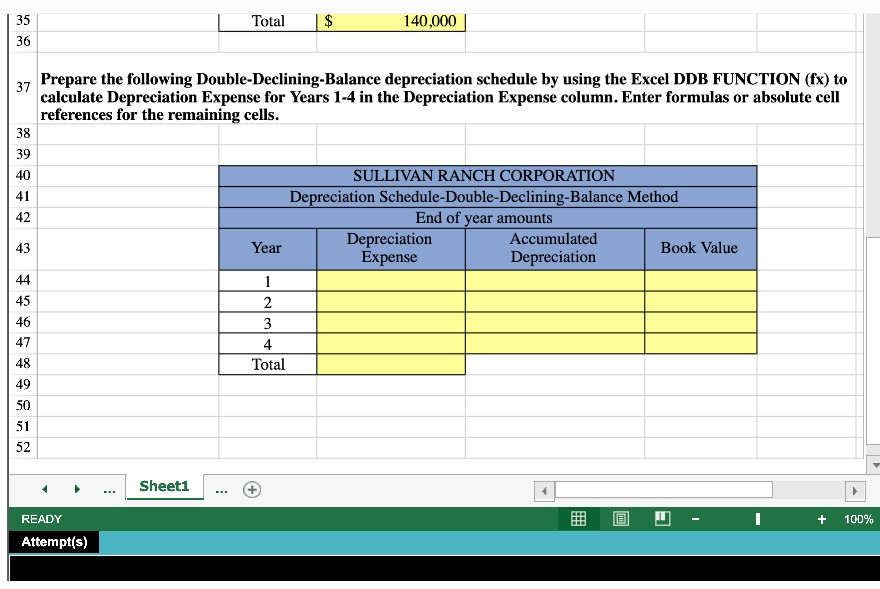

Consi TU. - - . A A = % im Nate Conditional Federal my head Post Cols El Led Sullivan Ranch Cooperation has pure a new tract. The fillowiny Sullivu Ranch Cupra luas purvol cwrddur. The fullowing usiais IN 3 SA 100 $ 100 Cast iled Naidual Encimited Life in yeurs: in vared 1. fe in ours: Actually 1200 V Year 2 Year Yeart 150 .1 Prepare the following Straight line depreciation schedule by using the excel SIN FUNCTION (Ex) to calculate the Depreciation Experte for Years 1-4 in the Depreciation Expense column. Enler furmules ur alwulule cell references for the remaining cells SII.IVAN RANCH CORPORATKIN Prepare the following Straight Line depreciation schedule by using the excel SLN FUNCTION (fx) to calculate the Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. SULLIVAN RANCH CORPORATION Depreciation Schedule-Straight Line Method End of year amounts Depreciation Accumulated Year Book Value Expense Depreciation 35,000 $ 35,000 $ 115,000 2 $ 35,000 $ 70,000 $ 80,000 3 $ 35,000 $ 105,000 $ 45,000 35,000 $ 140,000 $ 10,000 Total 140,000 Prepare the following Activity-Based depreciation schedule by entering formulas. Use absolute cell references when appropriate. SULLIVAN RANCH CORPORATION Depreciation Schedule-Units-of-Production Method End of year amounts Depreciation Accumulated Year Book Value Expense Depreciation Sheet1 $ D + 100% READY Attempt(s) Total $ 140,000 Prepare the following Double-Declining-Balance depreciation schedule by using the Excel DDB FUNCTION (fx) to calculate Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. SULLIVAN RANCH CORPORATION Depreciation Schedule-Double-Declining-Balance Method End of year amounts Depreciation Accumulated Expense Depreciation Book Value Year Total ... Sheet1 ... 6 @ 0 - 1 + 100% READY Attempt(s)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started