Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help i have three questions due in 10 mins You plan to invest in Fixed income so you have decided that Corporate Bonds are

please help i have three questions due in 10 mins

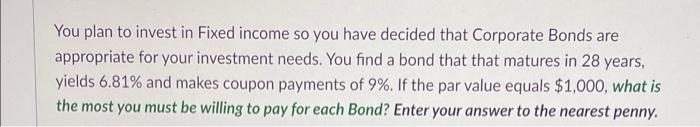

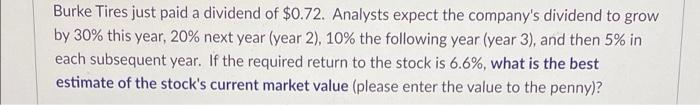

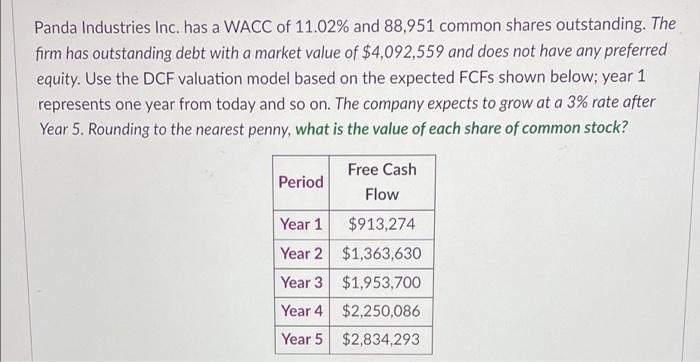

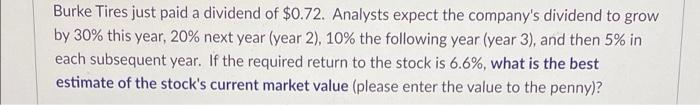

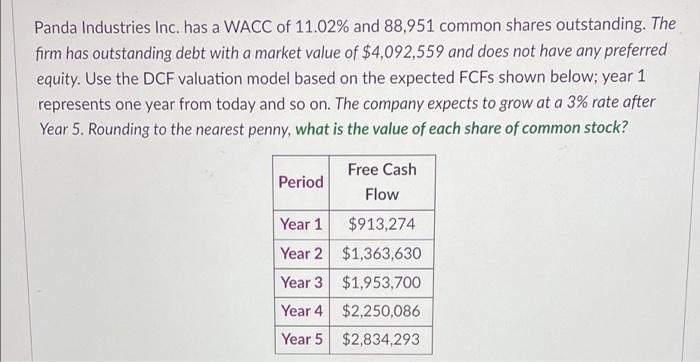

You plan to invest in Fixed income so you have decided that Corporate Bonds are appropriate for your investment needs. You find a bond that that matures in 28 years, yields 6.81% and makes coupon payments of 9%. If the par value equals $1,000, what is the most you must be willing to pay for each Bond? Enter your answer to the nearest penny. Burke Tires just paid a dividend of $0.72. Analysts expect the company's dividend to grow by 30% this year, 20% next year (year 2), 10% the following year (year 3), and then 5% in each subsequent year. If the required return to the stock is 6.6%, what is the best estimate of the stock's current market value (please enter the value to the penny)? Panda Industries Inc. has a WACC of 11.02% and 88,951 common shares outstanding. The firm has outstanding debt with a market value of $4,092,559 and does not have any preferred equity. Use the DCF valuation model based on the expected FCFs shown below; year 1 represents one year from today and so on. The company expects to grow at a 3% rate after Year 5. Rounding to the nearest penny, what is the value of each share of common stock? Period Year 1 Year 2 Year 3 Year 4 Year 5 Free Cash Flow $913,274 $1,363,630 $1,953,700 $2,250,086 $2,834,293

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started