PLEASE HELP!!! I NEED HELP ON THESE ASAP. PLEAse provide accurate answers to all of these and put in order as well.

PLEASE HELP!!! I NEED HELP ON THESE ASAP. PLEAse provide accurate answers to all of these and put in order as well.

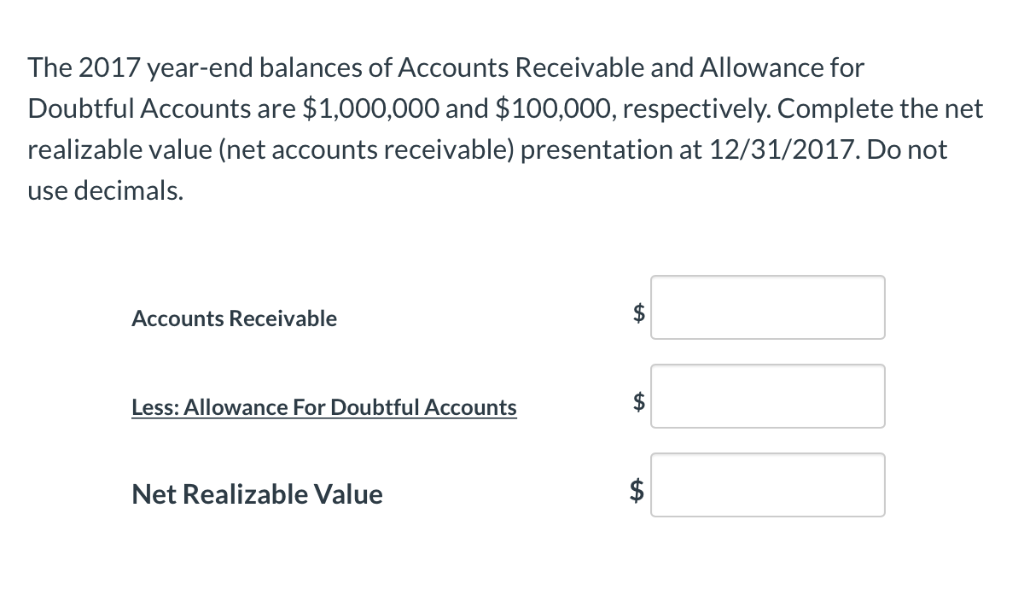

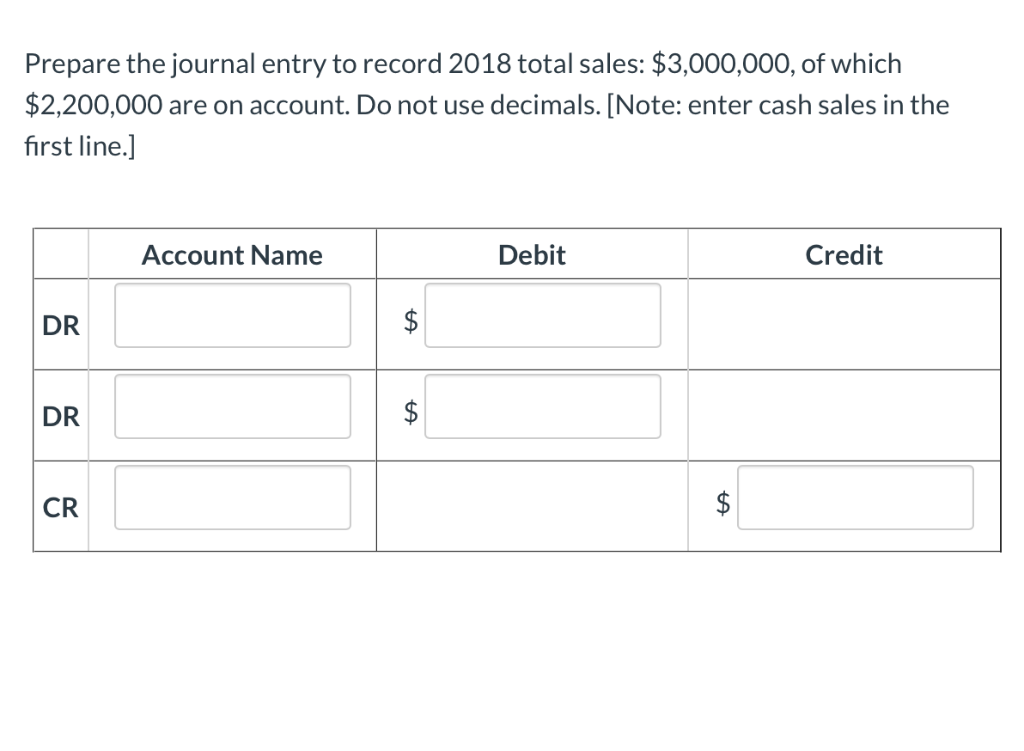

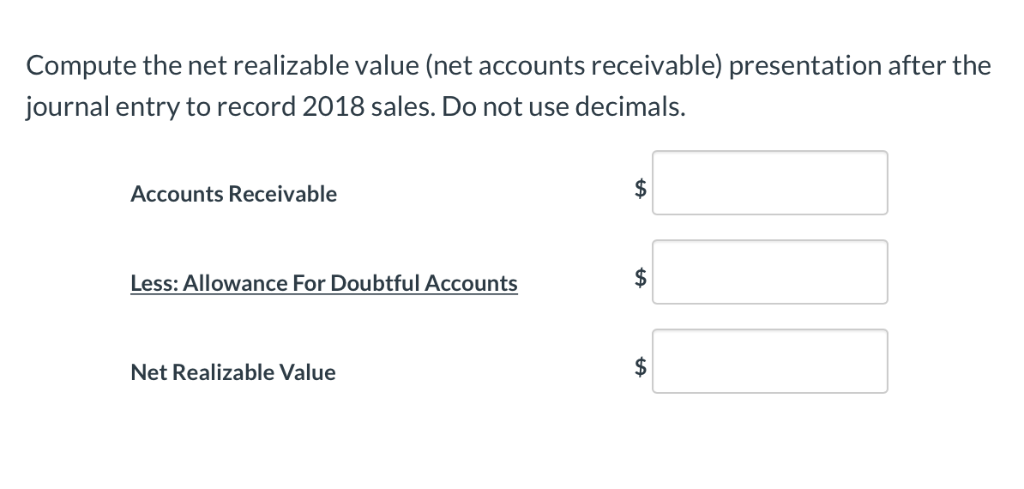

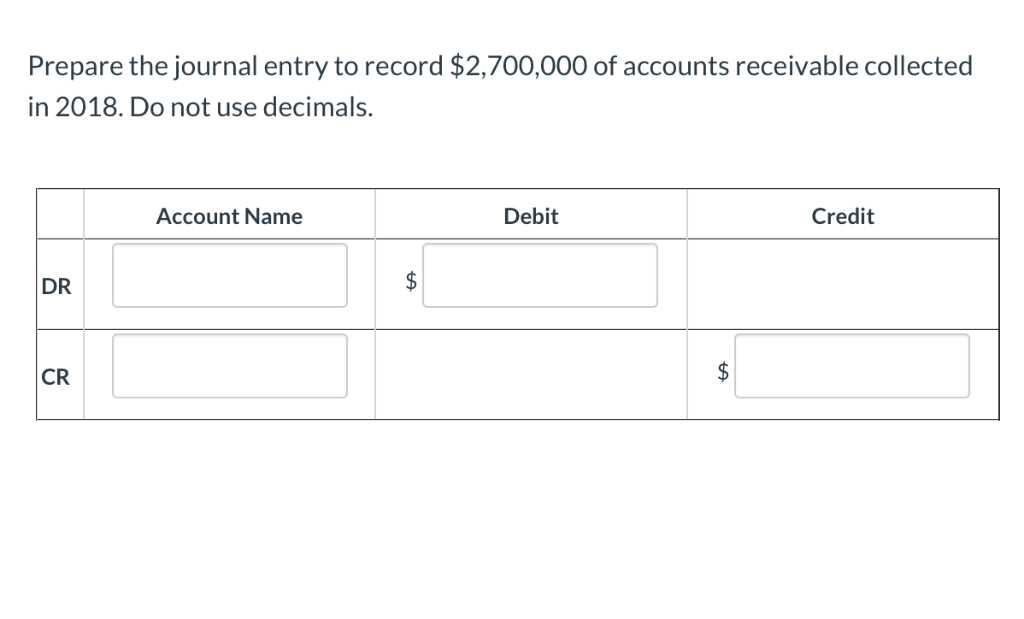

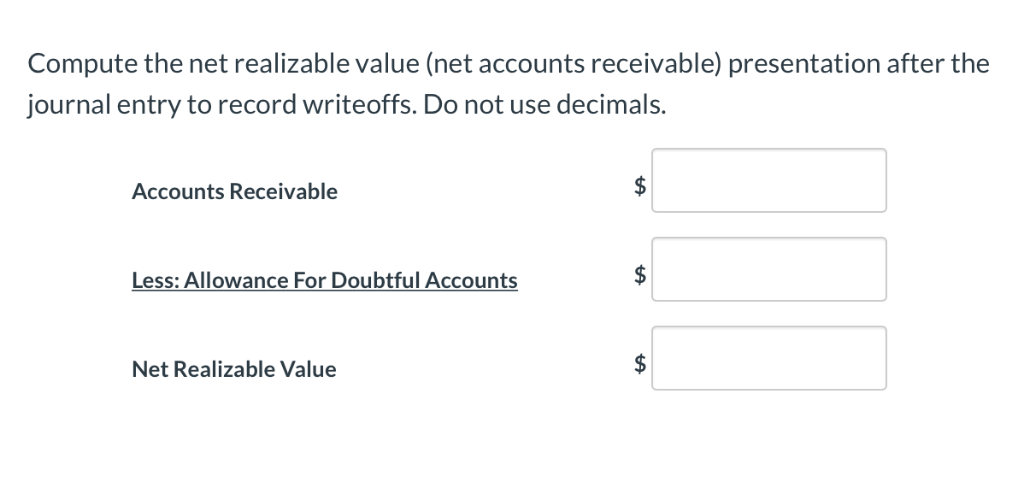

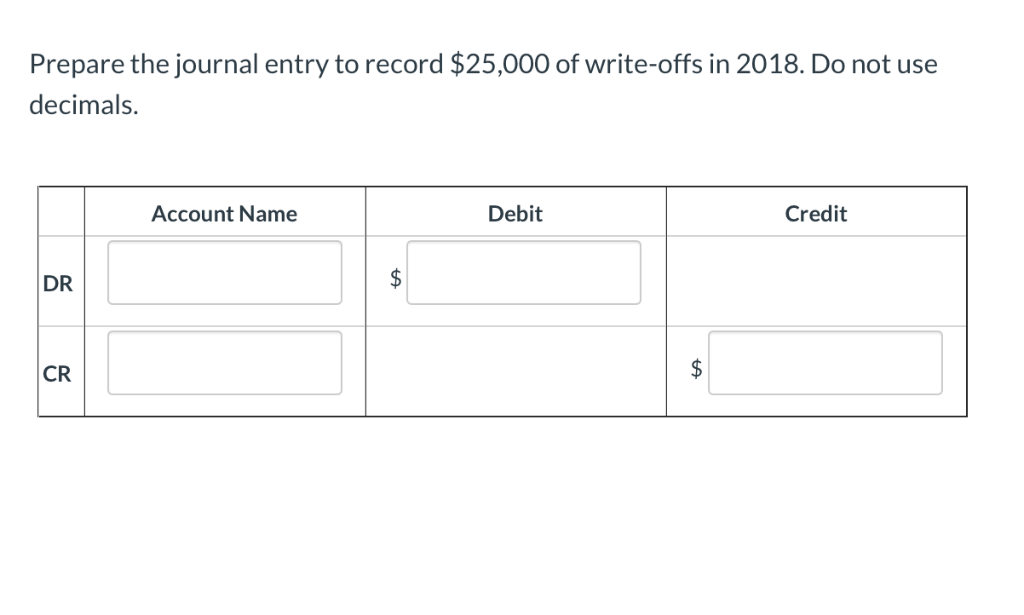

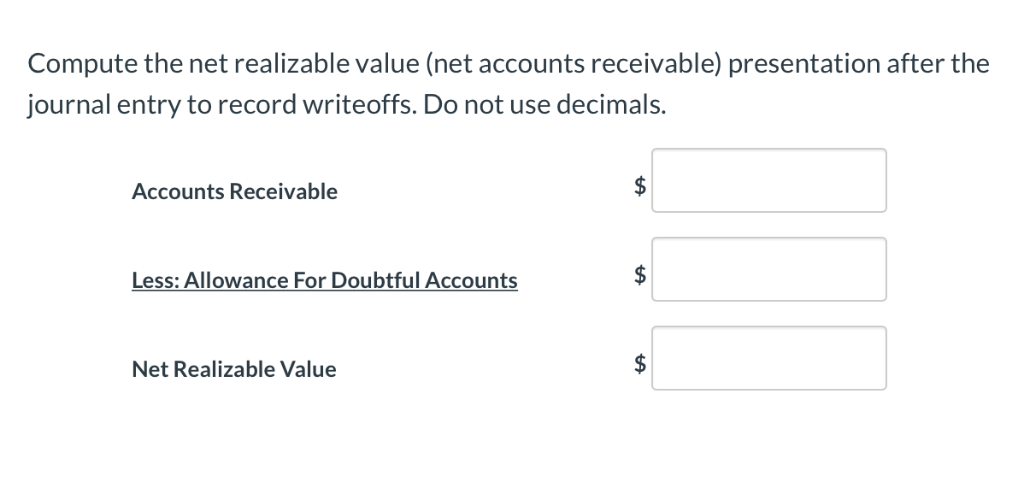

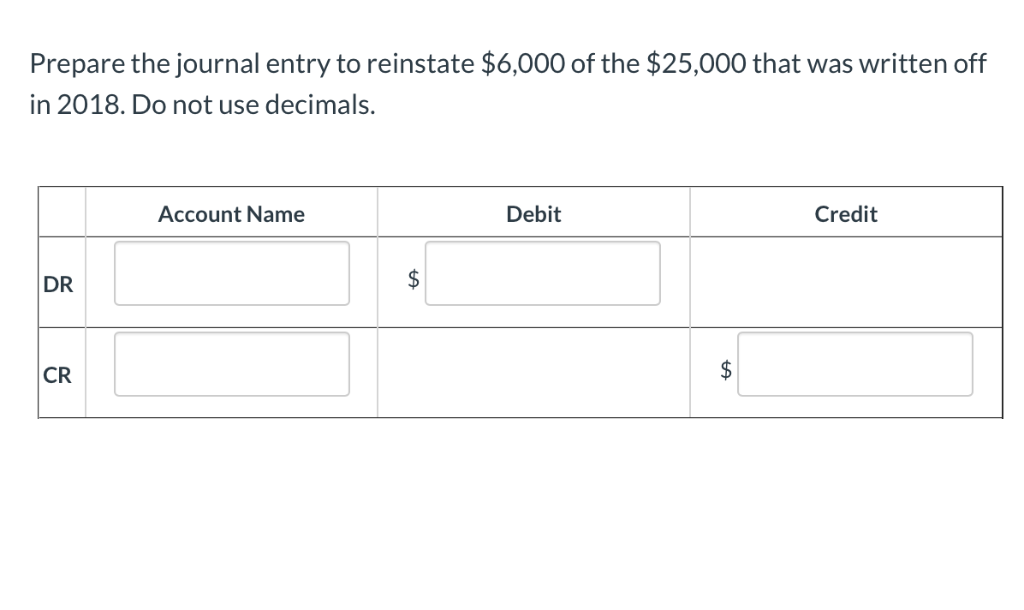

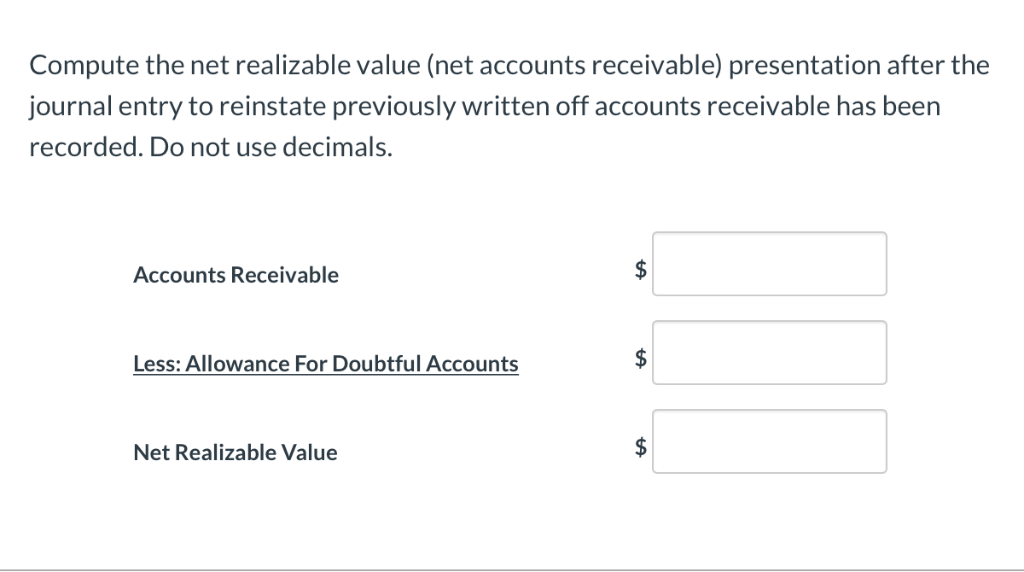

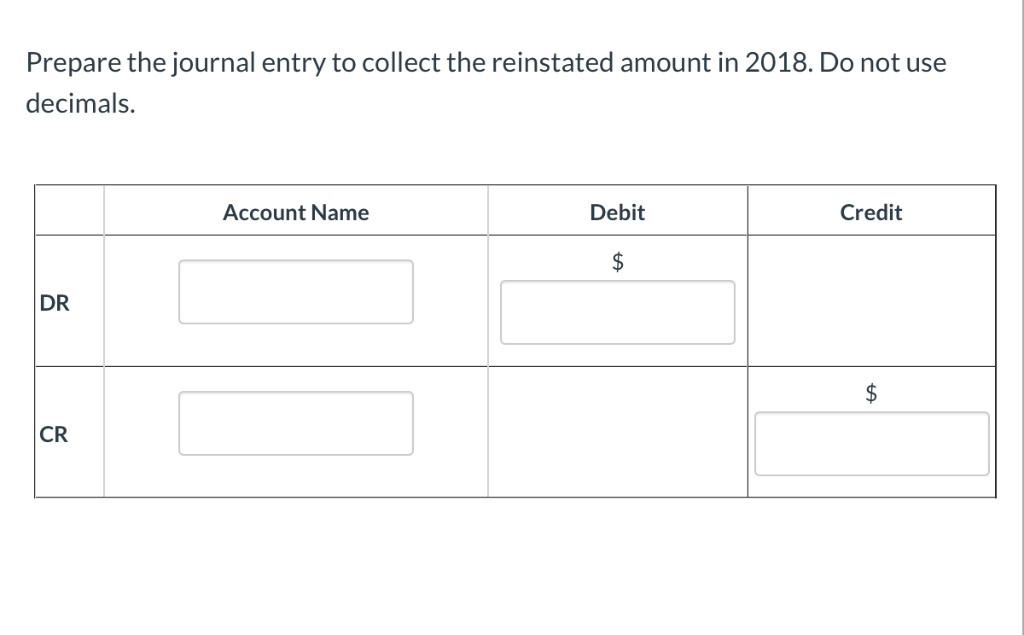

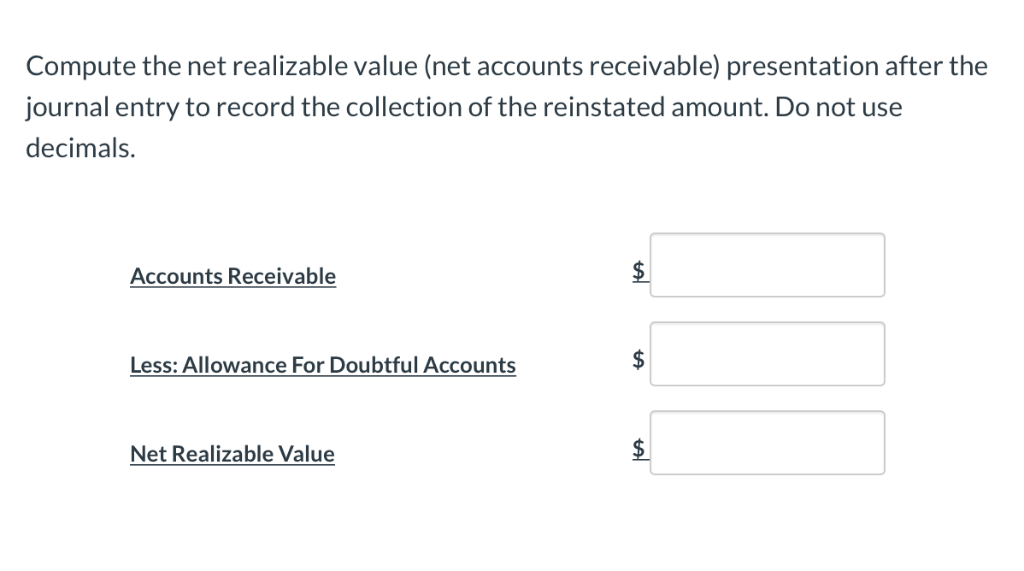

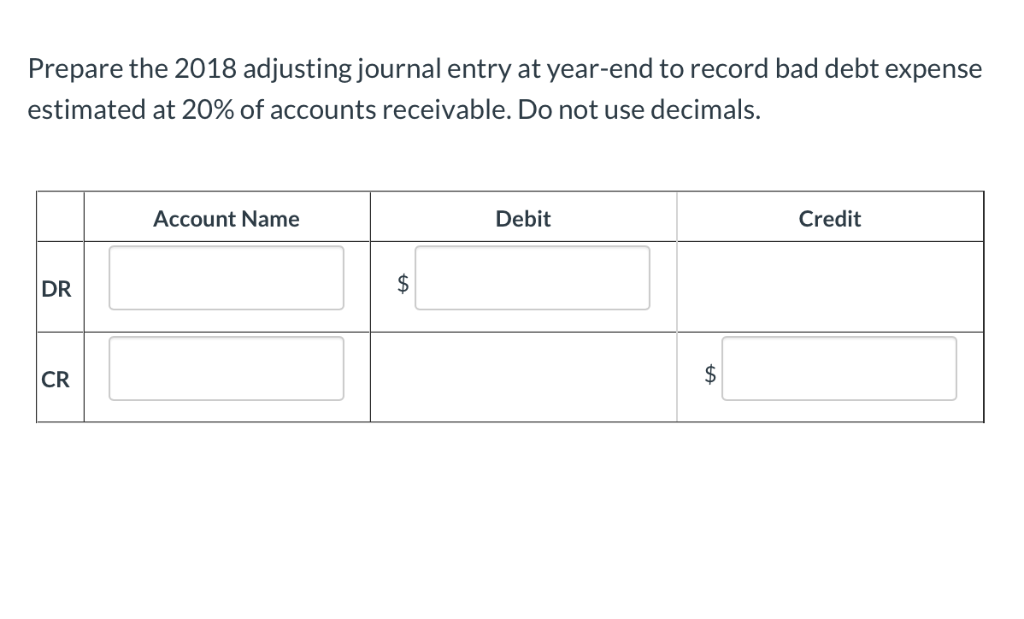

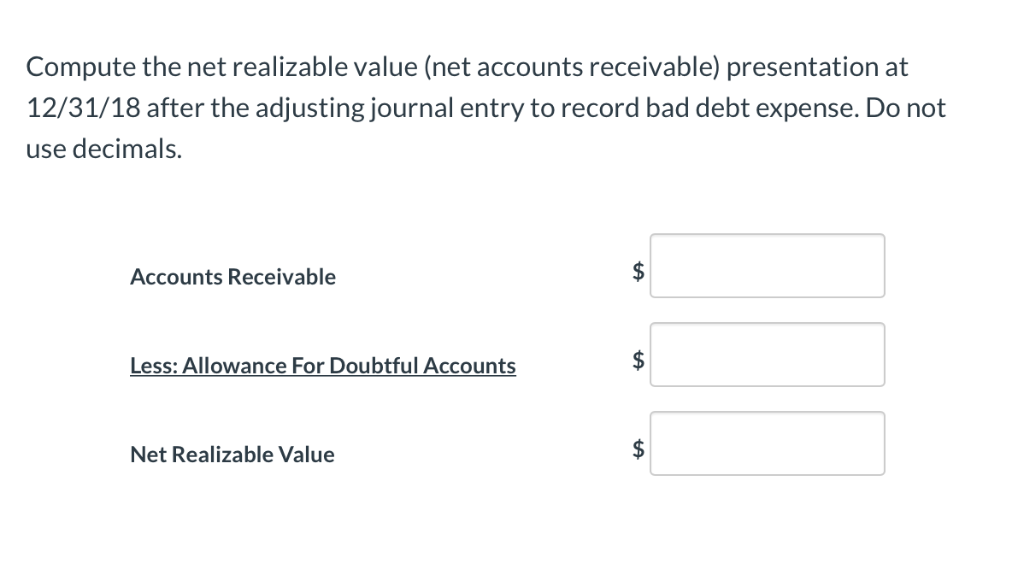

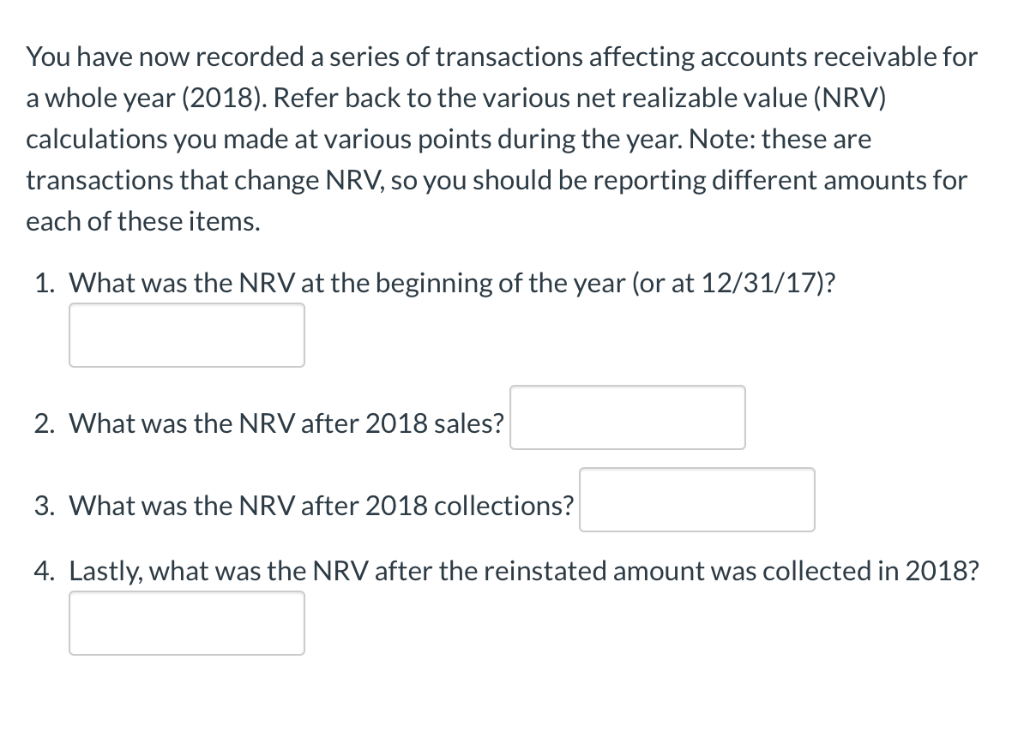

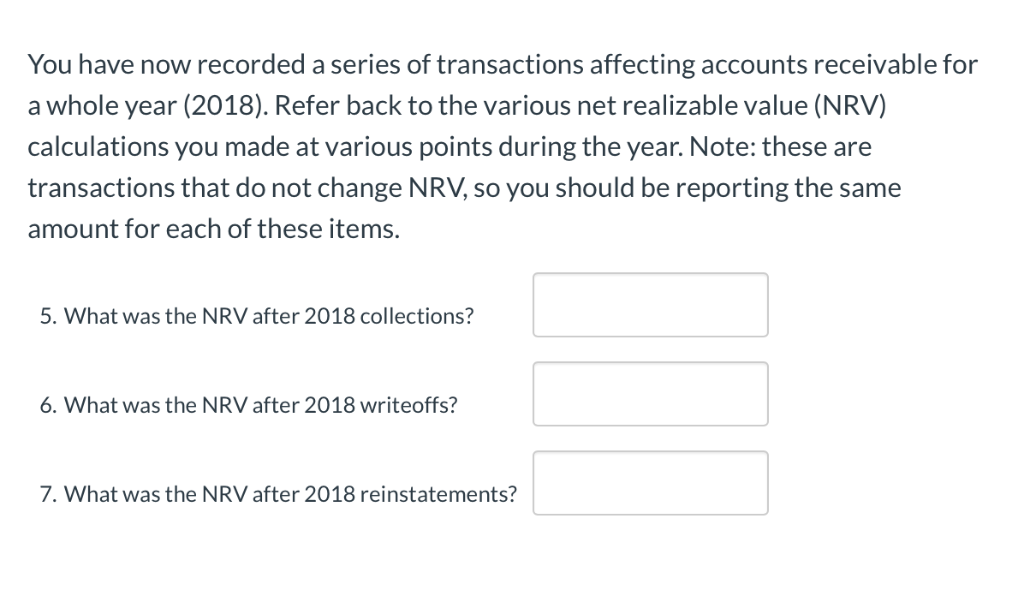

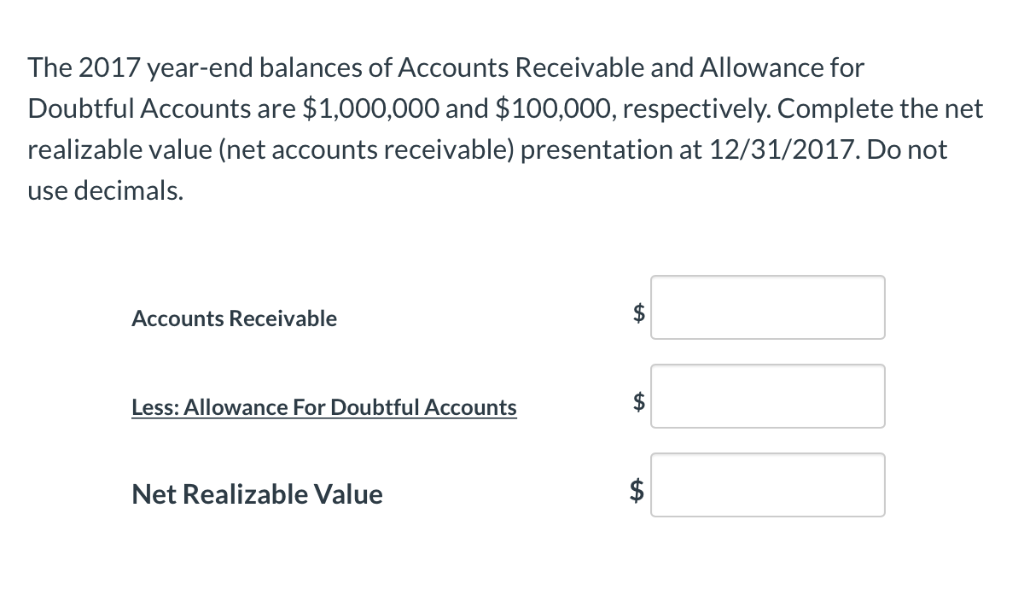

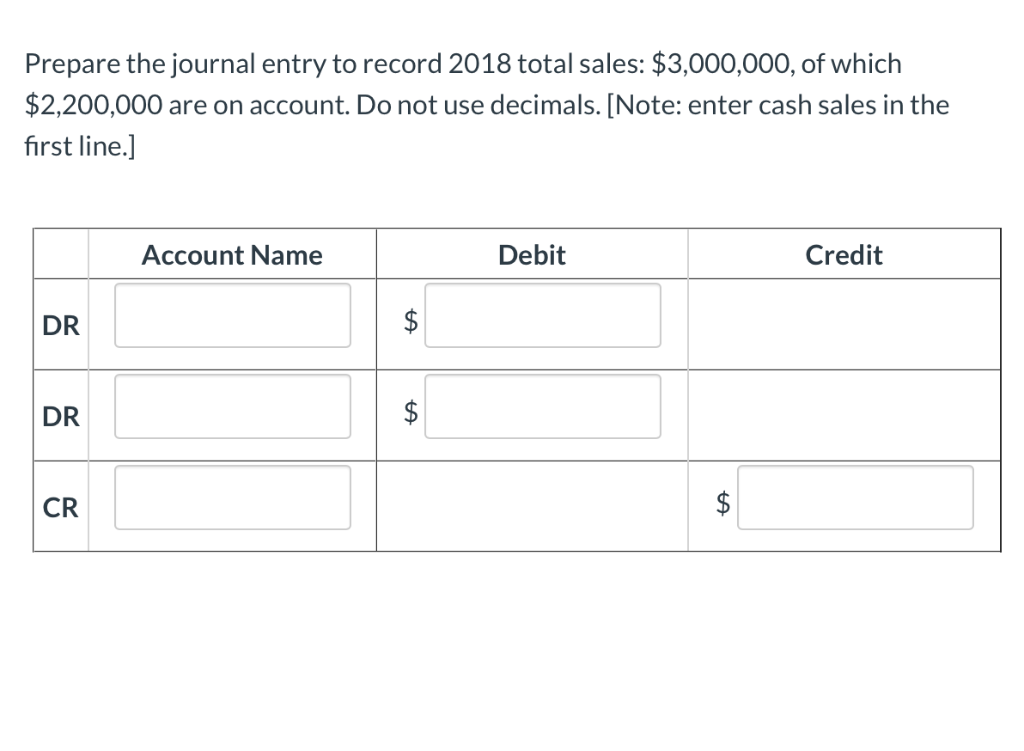

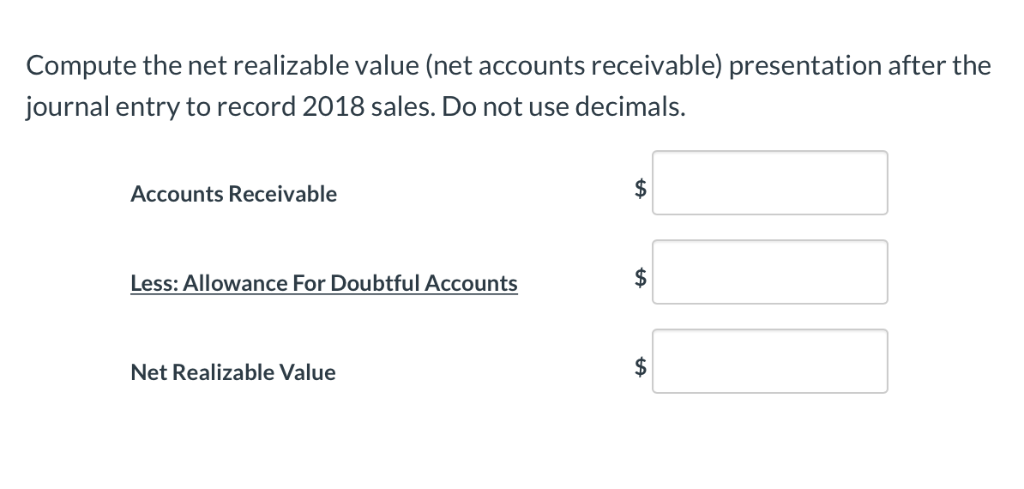

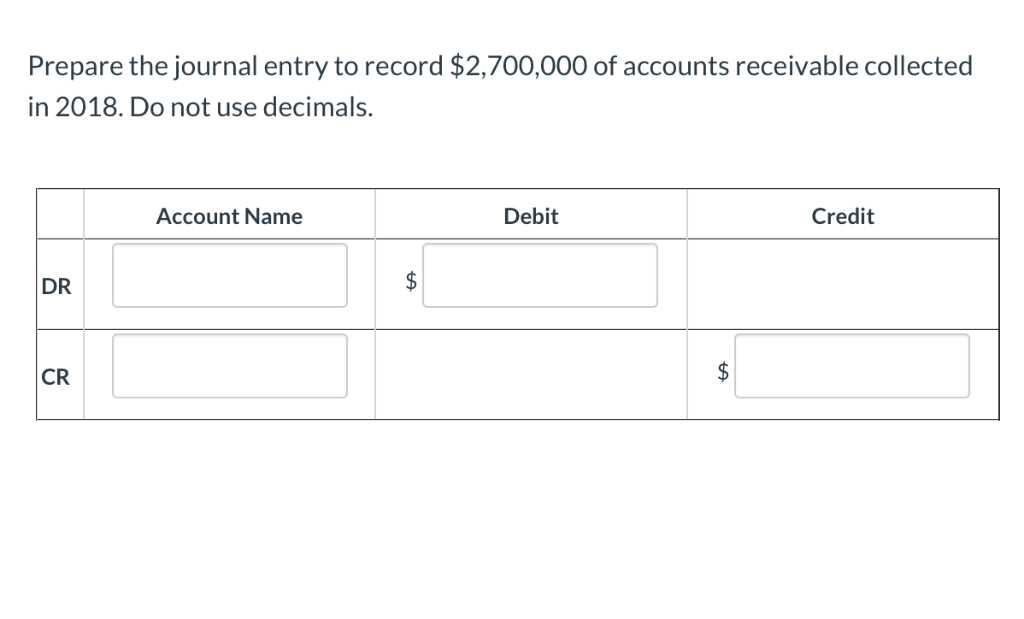

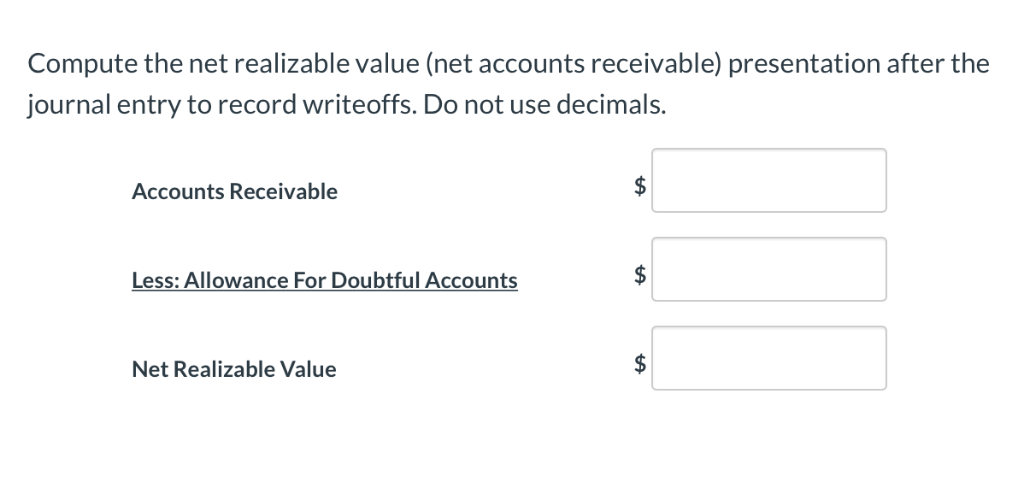

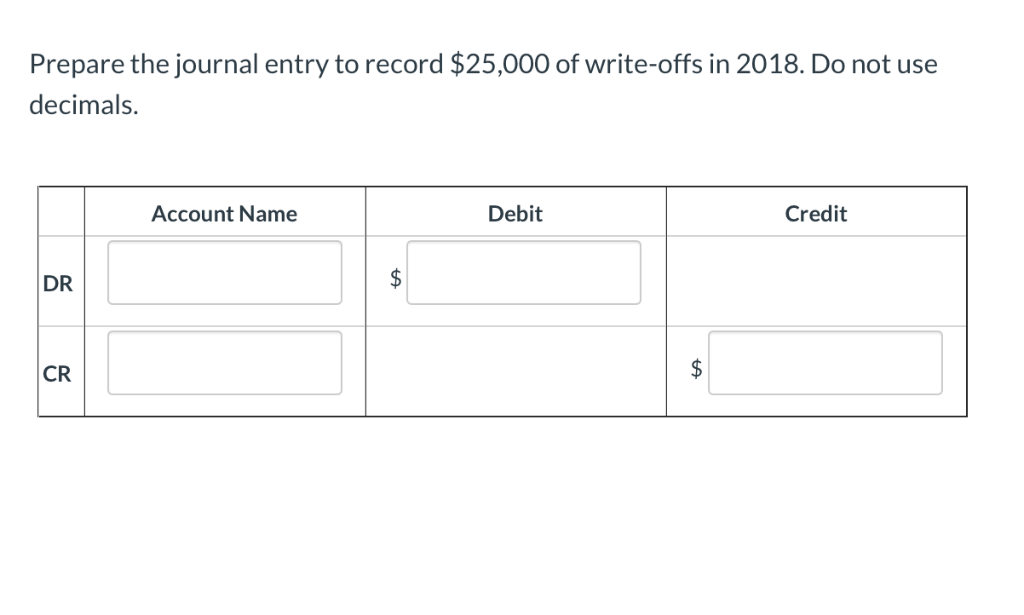

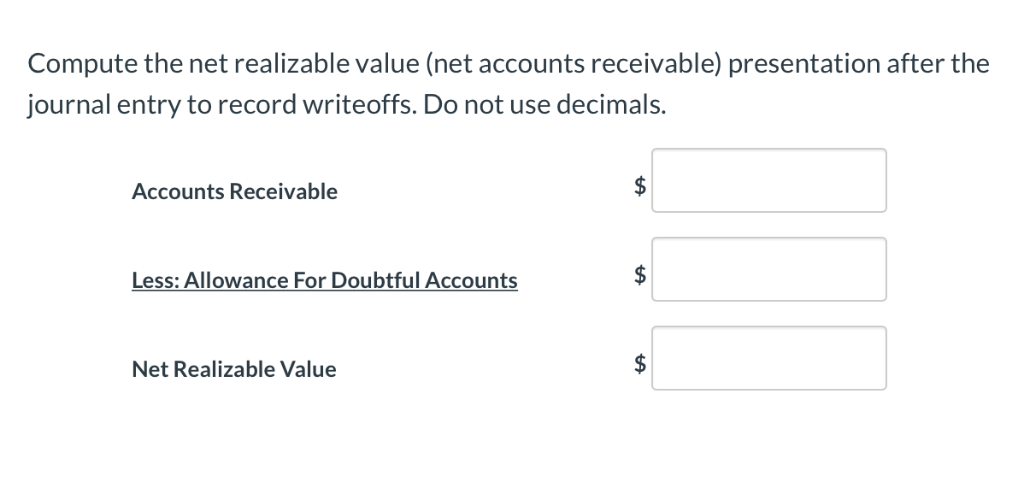

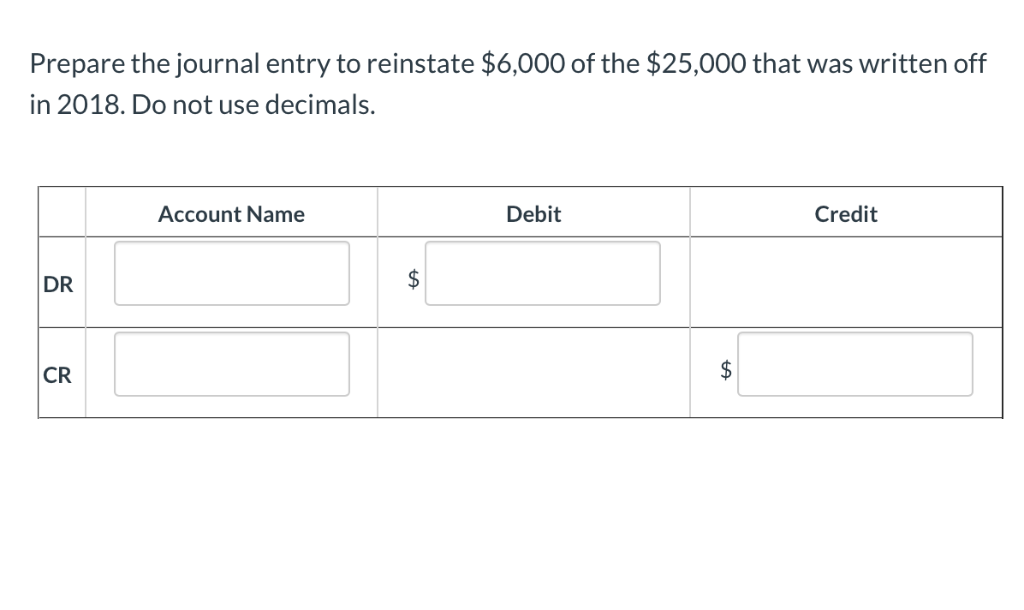

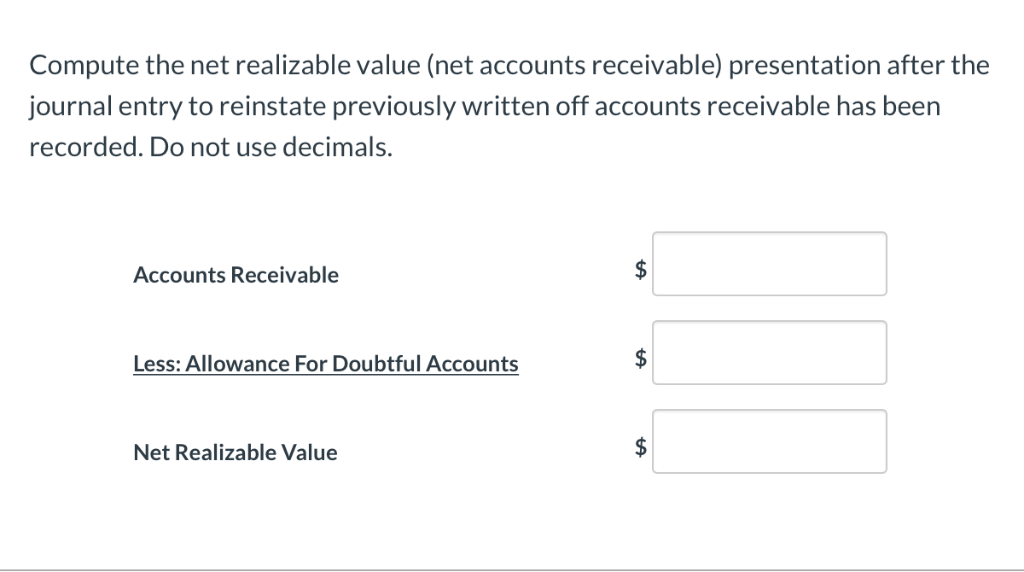

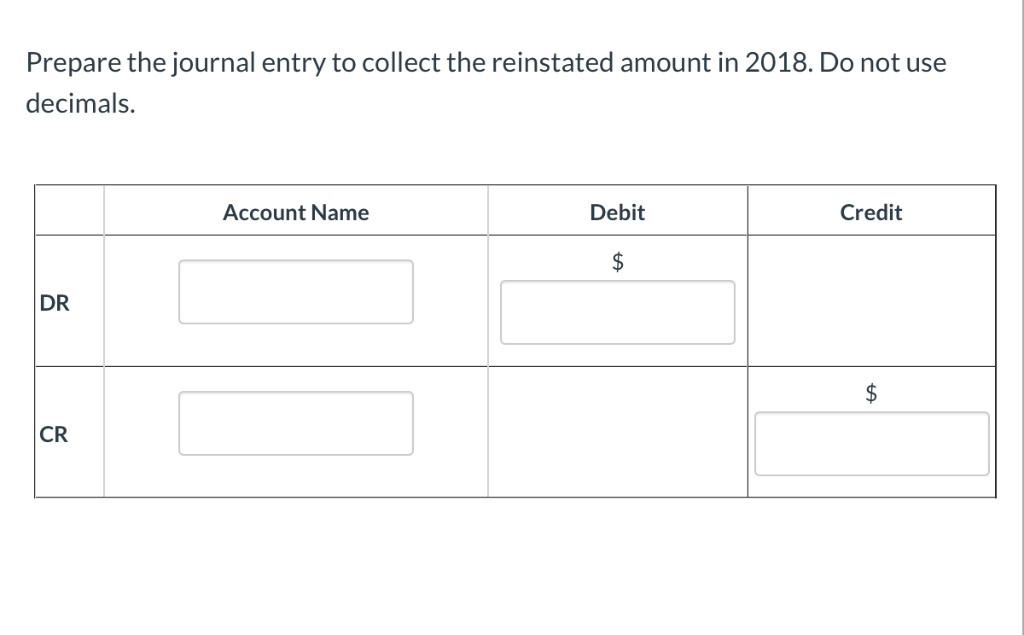

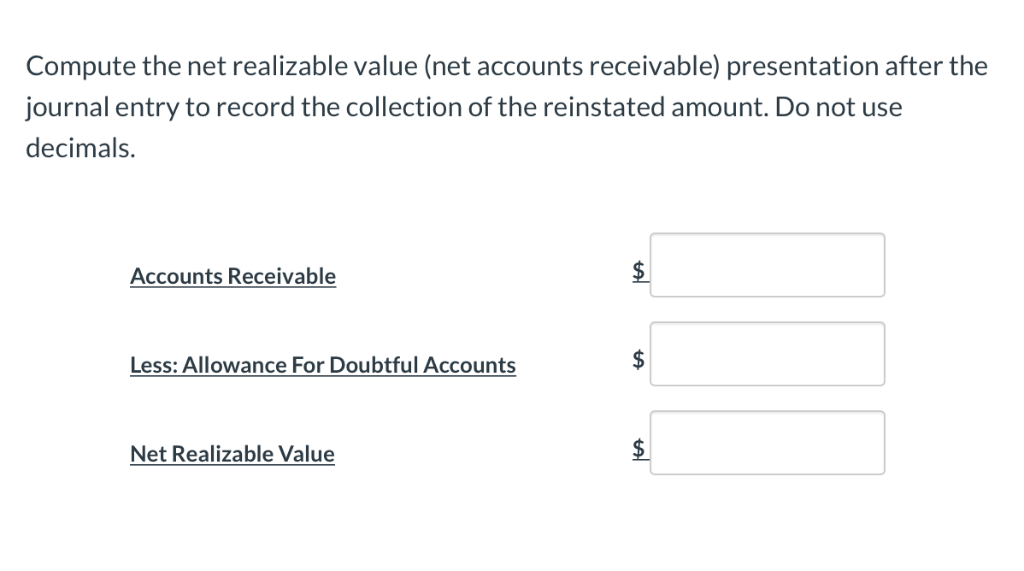

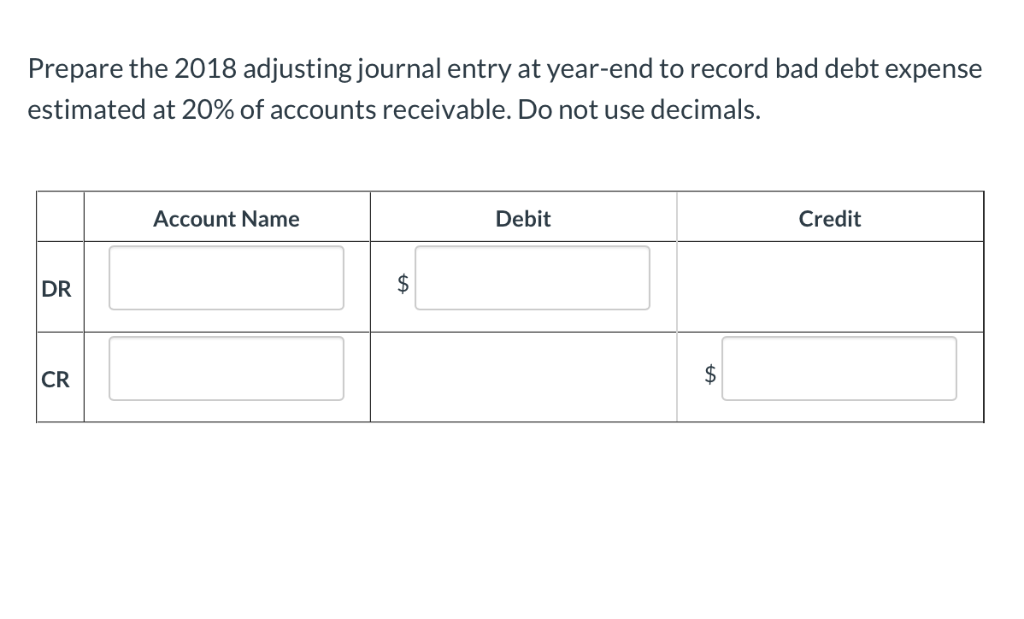

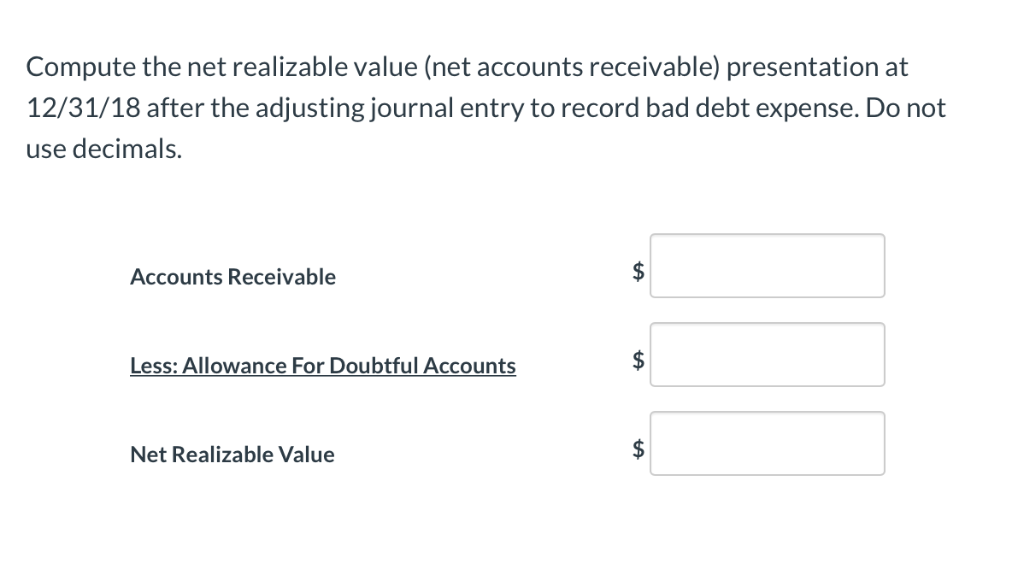

The 2017 year-end balances of Accounts Receivable and Allowance for Doubtful Accounts are $1,000,000 and $100,000, respectively. Complete the net realizable value (net accounts receivable) presentation at 12/31/2017. Do not use decimals. Accounts Receivable Less: Allowance For Doubtful Accounts Net Realizable Value Prepare the journal entry to record 2018 total sales: $3,000,000, of which $2,200,000 are on account. Do not use decimals. [Note: enter cash sales in the first line.] Credit Debit Account Name DR DR CR tA Compute the net realizable value (net accounts receivable) presentation after the journal entry to record 2018 sales. Do not use decimals. $ Accounts Receivable $ Less: Allowance For Doubtful Accounts $ Net Realizable Value Compute the net realizable value (net accounts receivable) presentation after the journal entry to record writeoffs. Do not use decimals. $ Accounts Receivable $ Less: Allowance For Doubtful Accounts $ Net Realizable Value Prepare the journal entry to record $25,000 of write-offs in 2018. Do not use decimals. Account Name Debit Credit $ DR $ CR Compute the net realizable value (net accounts receivable) presentation after the journal entry to record writeoffs. Do not use decimals. $ Accounts Receivable $ Less: Allowance For Doubtful Accounts $ Net Realizable Value Prepare the journal entry to reinstate $6,000 of the $25,000 that was written off in 2018. Do not use decimals. Debit Credit Account Name DR CR Compute the net realizable value (net accounts receivable) presentation after the journal entry to reinstate previously written off accounts receivable has been recorded. Do not use decimals. Accounts Receivable Less: Allowance For Doubtful Accounts Net Realizable Value Prepare the journal entry to collect the reinstated amount in 2018. Do not use decimals Debit Account Name Credit DR CR Compute the net realizable value (net accounts receivable) presentation after the journal entry to record the collection of the reinstated amount. Do not use decimals. Accounts Receivable $ Less: Allowance For Doubtful Accounts $ Net Realizable Value Prepare the 2018 adjusting journal entry at year-end to record bad debt expense estimated at 20% of accounts receivable. Do not use decimals. Account Name Debit Credit Compute the net realizable value (net accounts receivable) presentation at 12/31/18 after the adjusting journal entry to record bad debt expense. Do not use decimals. $ Accounts Receivable $ Less: Allowance For Doubtful Accounts $ Net Realizable Value You have now recorded a series of transactions affecting accounts receivable for whole year (2018). Refer back to the various net realizable value (NRV) calculations you made at various points during the year. Note: these are transactions that change NRV, so you should be reporting different amounts for each of these items. 1. What was the NRV at the beginning of the year (or at 12/31/17)? 2. What was the NRV after 2018 sales? 3. What was the NRV after 2018 collections? 4. Lastly, what was the NRV after the reinstated amount was collected in 2018? You have now recorded a series of transactions affecting accounts receivable for a whole year (2018). Refer back to the various net realizable value (NRV) calculations you made at various points during the year. Note: these are transactions that do not change NRV, so you should be reporting the sam amount for each of these items. 5. What was the NRV after 2018 collections? 6. What was the NRV after 2018 writeoffs? 7. What was the NRV after 2018 reinstatements

PLEASE HELP!!! I NEED HELP ON THESE ASAP. PLEAse provide accurate answers to all of these and put in order as well.

PLEASE HELP!!! I NEED HELP ON THESE ASAP. PLEAse provide accurate answers to all of these and put in order as well.