Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE help! I posted different questions regarding this problem and all its parts 4-5 times and I haven't received a response. I believe part 1,

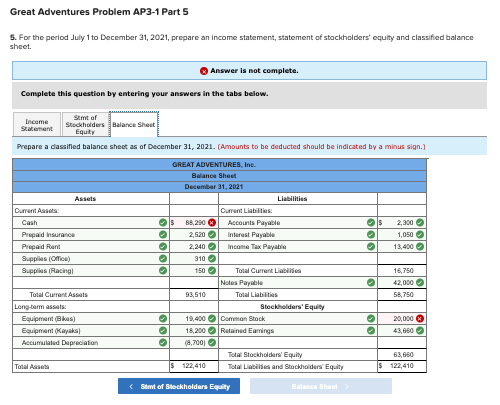

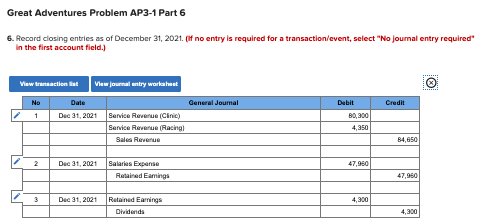

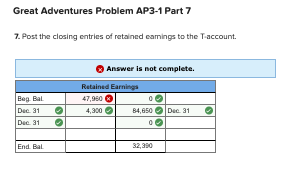

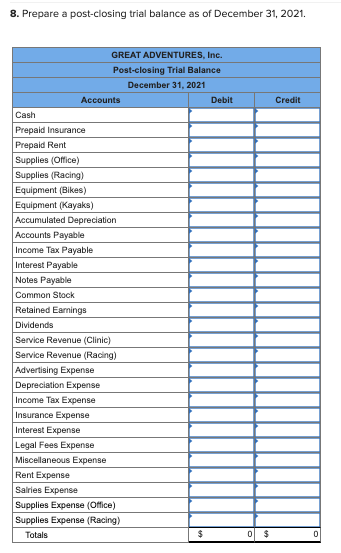

PLEASE help! I posted different questions regarding this problem and all its parts 4-5 times and I haven't received a response. I believe part 1, part 2, and part 6 are correct. Other parts are partially correct like part 5 and 7, so I would appreciate the answers for the ones in red or what else I'm missing. In part 3, a majority in the beginning is correct, but towards the end I have a lot of errors, so I will appreciate the help in part 3. Also, I have not begun part 8.

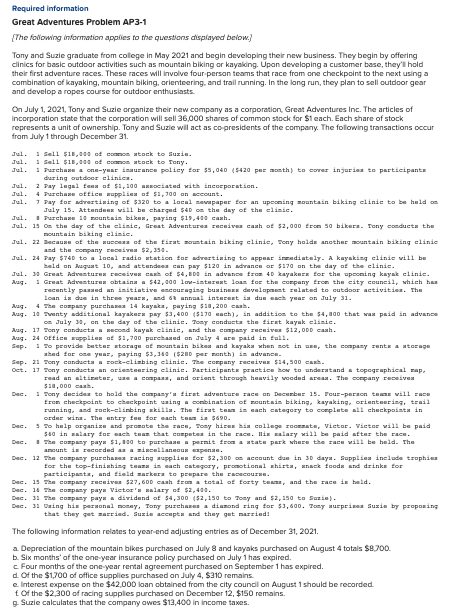

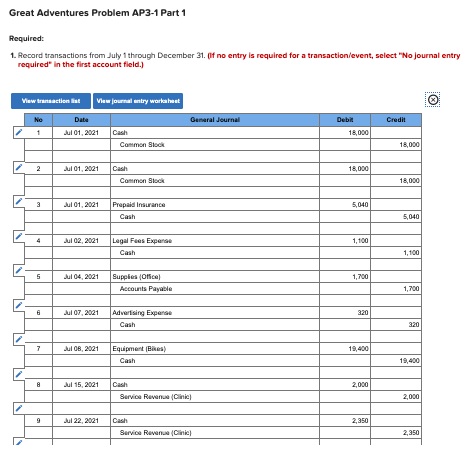

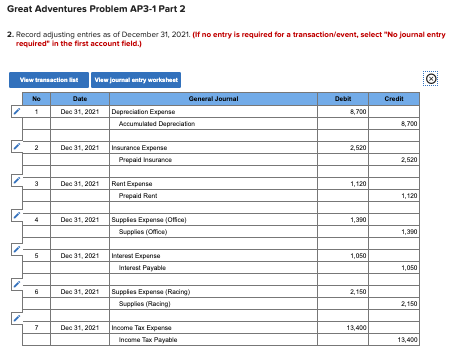

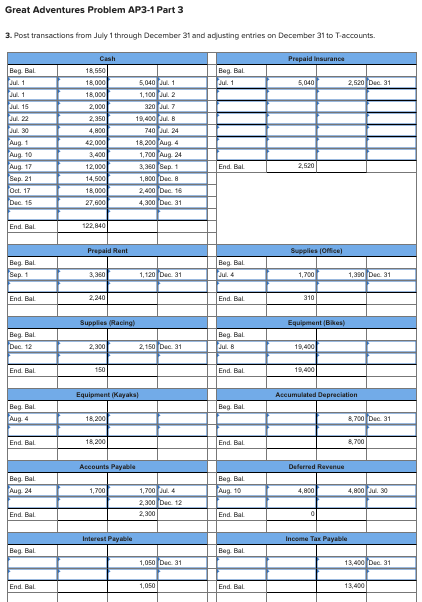

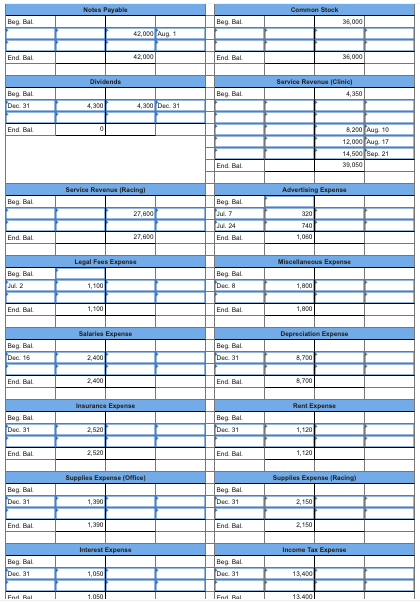

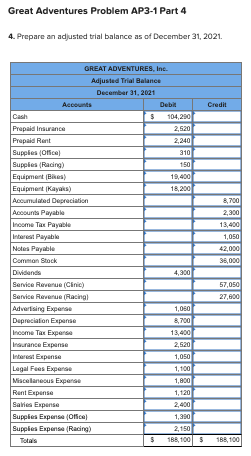

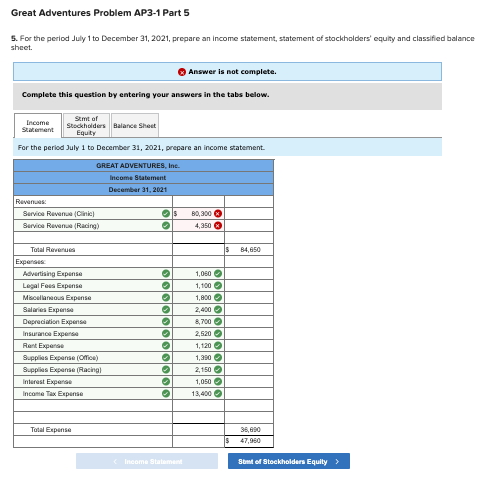

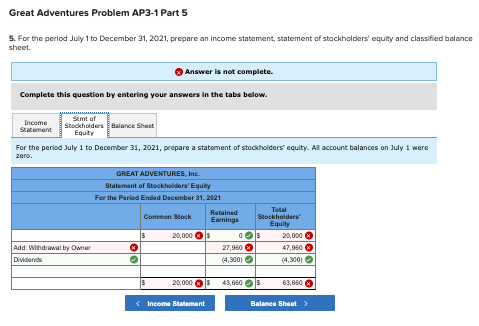

1 TO BE $10,000 Required information Great Adventures Problem AP3-1 The following information applies to the questions displayed below.) Tony and Suzie graduate from college in May 2021 and begin developing their new business. They begin by offering clinics for basic outdoor activities such as mountain biking or kayaldng. Upon developing a customer base, they'll hold their first adventure races. These races will involve four person teams that race from one checkpoint to the next using a combination of kayaking, mountain biking, orienteering and trail running. In the long run, they plan to sell outdoor gear and develop a ropes course for outdoor enthusiasts. On July 1, 2021, Tony and Suzie organize their new company as a corporation, Great Adventures Inc. The articles of Incorporation state that the corporation will sell 36,000 shares of common stock for Si each. Each share of stock represents a unit of ownership. Tony and Suzie wil act as co-presidents of the company. The following transactions occur from July 1 through December 31. Jul. 1 Sell $10,000 of conceatock to Suzis. Jul. 1 Sell $10,000 of toek te Tony. Jul. 1 Purchase a one-year cance policy for $5,040 5420 per month) to corres injuries to participants during outdoor clinica. Jul. 2 Pay lagal toes of $1,100 asociated with incorporation. Jul. barchase office supplies of $1,100 on account. Jal. 7 Pay for advertising of $320 to local savapaper for an upcoming mountain biking clinic to be held on July 15. Attendees vill be charged $40 on the day of the clinic. Jul. Purchase 10 mountain bikes, paying $19,400 cash. Jul. 15 Os the day of the clinic, Great Adventures receive cash of $2,000 from 50 bikers. Tony conducts the mountain biking alinic. Tel. 22 Because of the success of the first sountain biking clinic, Sony holds another mountain biking clinic and the company rea $2,350. Jul. 24 pay $740 to a local radio station for advertising to appear immediately. A kayaking clinic will be beld on Haguat 10, and attendees can pay $120 in advance or $170 on the day of the clinie. Jul. 3 Great Adventures receive cash of $4,000 in advance from 4D kayakers for the upcoming kayak clinic. 1 Great Adventure obtaina . $42.000 low-interest loss to the company from the city council, which has recently pued an initiative encouraging business developeat related to outdoor activities. The loan in die in three years, and an interest sa due each year on July 31. Aug. 4 purchases 14 kayak Mag. 10 sventy additional kayakers paying 528,200 each 53,600 cach), in addition to the $4,000 that was paid in advance on July 3, on the day of the clinic. Toy conducta the first kayak clinic. Aug. 17 Tony candecta second kayak clinic, and the company receive $12,000 cash. of $1,700 purchased an July 4 are paid in full. Sep. storage butter se year, paying $3,40 $200 per month advance. mountain bikes and kayaka when not in use, the company renta storage Sep. 21 Pony candectacock-clisbing clinic. The company receives $24,500 ch Oct. 17 Sony conducta un orienteering clinie. Participants practice how to understand topographical map. read an altimeter, we campana, and orient thropga heavily wooded areas. The company receives CUM Dee. Sony from checkpoint to checkpoint using a combination of mountain biking, kayaking, orientering, trail running, ed sock-climbing skills. The first tea is cach category to complete all checkpointa in order wina. The entry fee for each tema is $690. 3 to help organize and promote the TRC, Sony hire his college cate, Victor. Victor will be paid $60 in salary for each team that compete in the race. llis salary will be paid after the race. the Compasy pays $1,400 to purchase permit from a state park where the race will be held. The amount is recorded a nicellaneous expense. Dec. 12 The company purchases racing supplies for $2,300 account due in 3 daya. Supplies include trophies for the top-finishing teams in cach category, promotional shirta, unuck food and drinks for participants, and field saker to prepare the rescue. Dec. 15 The company receives 527,600 cash from a total of Forty tease, and the race is huid. Dec. 16 The compey pays Victor's salary of $2,400. Dec. 31 The company pays dividend of 54,300 (52,150 to Tony and $2,250 to Suzie). Dec. 32 Daing his personal money, Tony purchases diamond ring for 53,600. Toey surprise Suzie by proposing that they get married. Suzie accepts and they get married! The following information relates to year-end adjusting entries as of December 31, 2021. a Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totals $8.700. b. Six months of the one year Insurance policy purchased on July 1 has expired. Four months of the one year rental agreement purchased on September 1 has expired. d. Of the $1,700 of office supplies purchased on July 4, 5210 remains e Interest expense on the $42.000 loan obtained from the city council on August 1 should be recorded t Of the $2,300 of racing supplies purchased on December 12, $150 remains. 9 Suzie calculates that the company owes $13,400 in income taxes. ad for Great Adventures Problem AP3-1 Part 1 Required: 1. Record transactions from July 1 through December 31. Of no entry is required for a transaction/event, select "No Journal entry required in the first account field.) View transactional View journal entry warhaat No Date General Journal Credit 1 Debit 18,000 Jul 01, 2021 Cash Commen Stock 18,000 2 Jul 01, 2021 18,000 Cash Canimon Stock 18,000 Jul 01, 2021 5,040 Prepaid Insurance Cash 5,040 Jul 02, 2021 1,100 Legal Fees Expense Cash 1,100 Jul 04, 2021 1,700 Supplies Office Accounts Payable 1,700 Jul 07, 2021 320 Advertising Expense Cash 320 Jul 08, 2021 19,400 Equipment Bies) Cash 19,400 Jul 15, 2021 2,000 Cash Service Revenue (Clinic 2,000 Jul 22.2021 2,350 Cash Service Revenue 2,350 Great Adventures Problem AP3-1 Part 2 2. Record adjusting entries as of December 31, 2021. (if no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transactional View journal entry warheet Date General Journal Dec 31, 2021 Depreciation Expense Accumulated Depreciation No Credit Debit &,700 8,700 2 2,520 Dec 31, 2021 Insurance Expense Prepaid insurance 2,520 Dec 31, 2021 1,120 Rent Expense Prepaid Rent 1,120 1,350 Dec 31, 2021 Suppies Expense (Office) Supplies (Office) 1,290 5 1,050 Dec 31, 2021 Interest Expense Interest Payable 1,050 2,150 Dec 31, 2021 Supplies Expense (Racing) Supplies (Racing 2,150 Dec 31, 2021 13,400 Income Tax Expand Income Tax Payable 13,400 Great Adventures Problem AP3-1 Part 3 3. Post transactions from July 1 through December 31 and adjusting entries on December 31 to T-accounts. Cash Prepaid insurance 18,550 Beg Bal Jul 1 18,000 5,040 2,520 Dec 31 18,000 2,000 2,350 4,800 Beg Bal ul. 1 ul. 1 ul. 15 Ju. 22 ul. 30 Aug 1 Aug. 10 Aug 17 Sep 21 Oct. 17 Dec 15 42,000 5,0401 1,1002 320 Jul. 7 19,400 JB 740 u. 24 18,200 Aug 4 1,700 Aug 24 3,360 Sep 1 1,800 Die 2,400 Dec 16 4,300 Dec 31 3,400 End. Bal 2,520 12,000 14,500 18,000 27,000 End. Bal 122,840 Prepaid Rent Supplies Office Beg Bal Sep 1 Beg Bal 3,360 1,120 Dec 31 1.700 1,390 Dec 31 End. Bal. 2.240 End Bal 310 Supplies (Racing Equipment Bikes Beg Bal Dec 12 Beg Bal JUL 8 2.300 2,150 Dec 31 19,400 End. Bal 150 End Bal 19,400 Equipment (Kayaks Accumulated Depreciation Beg Bal Beg Bal Aug 4 18,200 8,700 Dec 31 End. Bal 18,200 End Bal 8,700 Accounts Payable Deferred Revenue Beg Bal Aug 24 Beg Bal Aug 10 1,700 4,800 4,900 CM 30 1,700 Jul. 4 2,900 Dec 12 2,300 End Bal End Bal 0 Interest Payable Income Tax Payable Beg Bal Beg Bal 1,050 Dec. 31 13,400 Dec. 31 End Bal 1,050 End. Bal 13,400 Notes Payable Common Stock Beg Bal Beg Bal 35,000 42,000 Aug 1 End. Bal 42,000 End. Bal 35,000 Dividends Service Revenue Cine 4,350 Beg Bad Beg Bal Dec 31 4,300 4,300 Dec 31 End. Bal 8,200 Aug. 10 12,000 Aug 17 14,500 Sep 21 39,050 End Bal Service Ravena Racing Advertising Expense Beg Bal 27,000 Beg Bal Jul. Jul 24 320 740 1,050 End. Bal 27,000 End Ral Legal Fees Expense Miscellaneous Expense Beg Bal Jul.2 Beg Bal Dec 1,100 1,800 End. Bal 1,100 End Bal 1,800 Salaries Expense Depreciation Expense | Bap Bal. Beg Bal Dec. 16 2,400 Dec 31 8,700 End. Bal 2,400 End. Bal 8,700 Insurance Expense Rent Expense Beg Bal Dec. 31 Beg Bal Dec 31 2,520 1,120 End. Bal 2,520 End Bal 1,120 Supplies Expense (Office) Supplies Expense Racing) Beg Bal Beg Bal Dec 31 1,390 Dec 31 2,150 End. Bal 1910 End Bal 2,150 Interest Expense Income Tax Expense | Bap Bal. Dec. 31 Beg Bal Dec 31 1,050 13,400 I Ford Ral 1.050 Inil Ral 13.4001 Great Adventures Problem AP3-1 Part 4 4. Prepare an adjusted trial balance as of December 31, 2021. Credit GREAT ADVENTURES, Ine. Adjusted Trial Balance December 31, 2021 Accounts Debit Cash 104,200 Prepaid Insurance 2,520 Prepaid Rent 2,240 Supplies Office 310 Supplies (Racing) 150 Equipment Bies) 19,400 Equipment Kayaks) 18,200 Accumulated Depreciation Accounts Payable Income Tax Payable Interest Payable Notes Payable Common Stock Dividende 4,900 Service Revenue (Cinic) Service Revenue (Racing) Advertising Expense 1,050 Depreciation Experts 8,700 Income Tax Expense 13,400 Insurance Expense 2,520 Interest Expense 1,050 Legal Fees Expense 1,100 Miscelaneous Expense 1,800 Runt Expense 1,120 Sales Expense 2,400 Supplies Expense (Office 1,390 Supplies Expense Racing) 2,150 Totals $ 188,100 $ 8,700 2,300 13,400 1,050 42,000 35,000 57,050 27,600 188,100 Great Adventures Problem AP3-1 Part 5 5. For the period July 1 to December 31, 2021, prepare an income statement, statement of stockholders' equity and classified balance sheet. Answer is not complete. Complete this question by entering your answers in the tabs below. Samt of Income Start Stockholders Balance Sheet Equity For the period July 1 to December 31, 2021, prepare an income statement GREAT ADVENTURES, Ine. Income Statement December 31, 2021 Revens Service Revenue Cink IS B0,300 Service Revenue (Racing) 4,350 lolol Is B4,650 1,050 1.100 1,800 2,400 Total Revenue Expenses Advertising Expense Legal Fees Expense Miscellaneous Expense Salaries Experts Depreciation Expense Insurance Expense Rent Expense Supplies Expense (Office) Supplies Expense (Racing Interest Expense Income Tax Expense 8,700 ololololololololololo 2,520 1,120 1,390 2,150 1,050 13,400 Total Expense 36,690 47,950 Income Somt of Stockholders Equity > Great Adventures Problem AP3-1 Part 5 5. For the period July 1 to December 31, 2021, prepare an income statement, statement of stockholders' equity and classified balance sheet Answer is not complete Complete this question by entering your answers in the tabs below. Income Semt af Statement Stockholders Balance Sheet Equity For the period July 1 to December 31, 2021, prepare a statement of stockholders' equity. Al account balances on July 1 were zero. GREAT ADVENTURES, Ine. Statement of Stockholders' Equity For the Period Ended December 31, 2021 Total Common Stock Retained Earnings Stockholders' Equity 20,000 $ 0 s 20,000 Add Withdrawal by Owner 27,960 47,950 Dividende (4,300) (4,3001 $ 20,000 $ 43,660 83,650 Great Adventures Problem AP3-1 Part 5 5. For the period July 1 to December 31, 2021, prepare an income statement, statement of stockholders' equity and classified balance sheet Answer is not complete. Complete this question by entering your answers in the tabs below. Income Samt of Statement Stockholders Balance Sheet Equity Prepare a dassified balance sheet as of December 31, 2021. (Amounts to be deducted should be indicated by a minus sign.) Assets Current Asset Cash TO s 2,300 1,050 Prepaid insurance Prepaid Rent Supplies Oil Supplies (Racing OOOOO 13.400 GREAT ADVENTURES, Ine. Balance Sheet December 31, 2021 Liabilities Current Liabilities IS 38,200 Accounts Payable 2,520 Interest Payable 2,240 Income Tax Payable 310 150 Total Current Liabi Notes Payable 93,510 Total Liabilities Stockholders' Equity 19,400 Common Stock 18,200 Retained Earrings (9,700 Total Stockholders Equity S 122,410 Total Liabies and Stockholders' Equity 16.750 42,000 58,750 Total Current Assets Long-term as Equipment) Equipment (Kayaks Accumulated Depreciation OO 20,000 43,660 63,660 $ 122,410 Total AssetsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started