Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Help! I tried so many different formulas and many other Chegg examples, and they are all wrong. Also if you could show me your

Please Help! I tried so many different formulas and many other Chegg examples, and they are all wrong. Also if you could show me your work so I can understand what I am doing wrong. Thank you in advance for your help.!

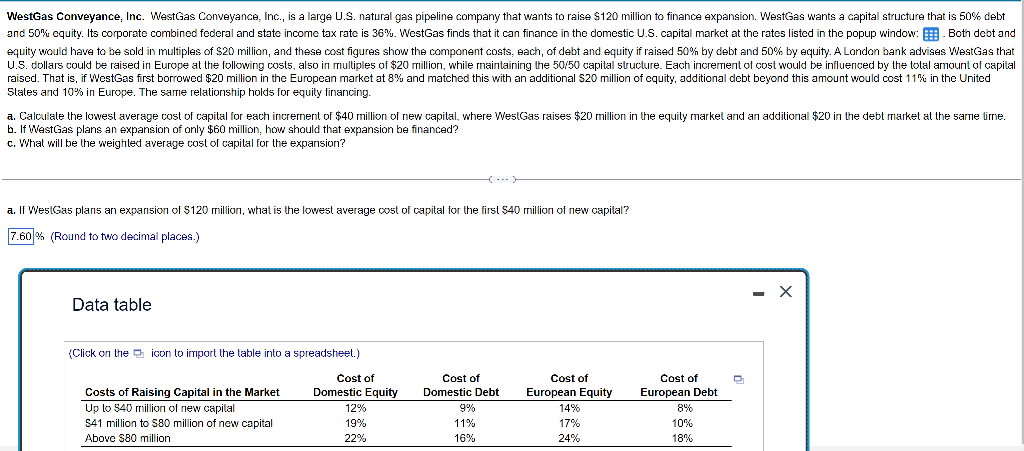

WestGas Conveyance, Inc. WestGas Conveyance, Inc., is a large U.S. natural gas pipeline company that wants to raise $120 million to finance expansion. WestGas wants a capital structure that is 50% debt and 50% equity. Its corporate combined federal and state income tax rate is 36%. WestGas finds that it can finance in the domestic U.S. capital market at the rates listed in the popup window: equity would have to be sold in multiples of $20 million, and these cost figures show the component costs, each, of debt and equity if raised 50% by debt and 50% by equity. A London bank advises WestGas that U.S. dollars could be raised in Europe at the following costs, also in multiples of $20 million, while rnaintaining the 50/50 capital structure. Each increment of cost would be influenced by the total arnount of capital raised. That is, if WestGas first borrowed $20 million in the European market at 8% and matched this with an additional $20 million of equity, additional debt beyond this amount would cost 11% in the United States and 10% in Europe. The same relationship holds for equity financing. a. Calcolate the lowest average cost of capital for each increment of $40 million of new capital, where WestGas raises $20 million in the equity market and an additional $20 in the debt market at the same time. b. If WestGas plans an expansion of only $60 million, how should that expansion be financed? c. What will be the weighted average cost of capital for the expansion? a. If WestGas plans an expansion of $120 million, what is the lowest average cost of capital for the first $40 million of new capital? \% (Round to two decimal places.) Data table (Click on the the icon to import the table into a spreadsheet.) WestGas Conveyance, Inc. WestGas Conveyance, Inc., is a large U.S. natural gas pipeline company that wants to raise $120 million to finance expansion. WestGas wants a capital structure that is 50% debt and 50% equity. Its corporate combined federal and state income tax rate is 36%. WestGas finds that it can finance in the domestic U.S. capital market at the rates listed in the popup window: equity would have to be sold in multiples of $20 million, and these cost figures show the component costs, each, of debt and equity if raised 50% by debt and 50% by equity. A London bank advises WestGas that U.S. dollars could be raised in Europe at the following costs, also in multiples of $20 million, while rnaintaining the 50/50 capital structure. Each increment of cost would be influenced by the total arnount of capital raised. That is, if WestGas first borrowed $20 million in the European market at 8% and matched this with an additional $20 million of equity, additional debt beyond this amount would cost 11% in the United States and 10% in Europe. The same relationship holds for equity financing. a. Calcolate the lowest average cost of capital for each increment of $40 million of new capital, where WestGas raises $20 million in the equity market and an additional $20 in the debt market at the same time. b. If WestGas plans an expansion of only $60 million, how should that expansion be financed? c. What will be the weighted average cost of capital for the expansion? a. If WestGas plans an expansion of $120 million, what is the lowest average cost of capital for the first $40 million of new capital? \% (Round to two decimal places.) Data table (Click on the the icon to import the table into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started