PLEASE HELP! I WILL LIKE ANSWER!

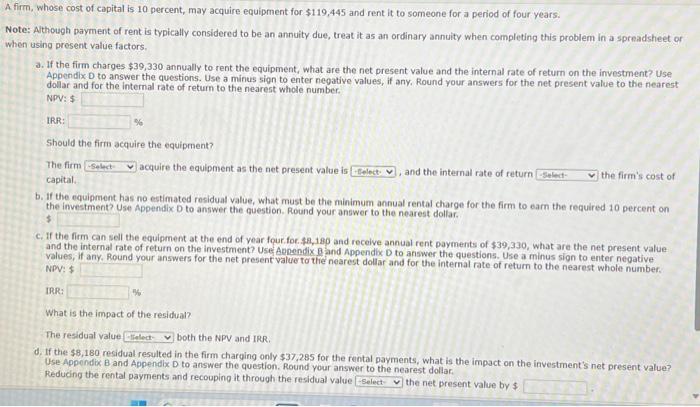

A firm, whose cost of capital is 10 percent, may acquire equipment for $119,445 and rent it to someone for a period of four years. Note: Although payment of rent is typically considered to be an annuity due, treat it as an ordinary annuity when completing this problem in a spreadsheet or when using present value factors.

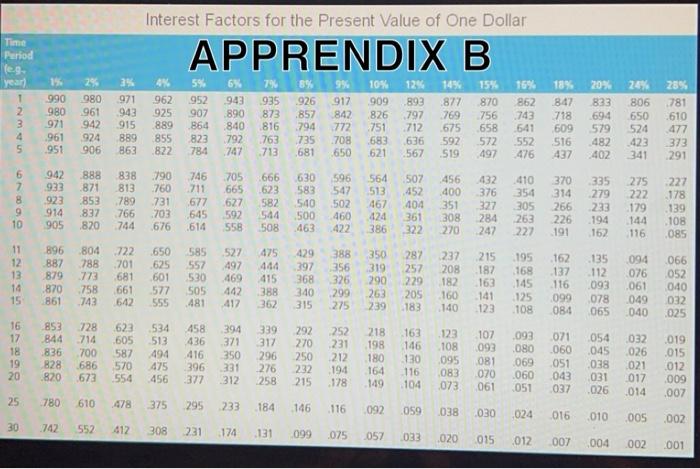

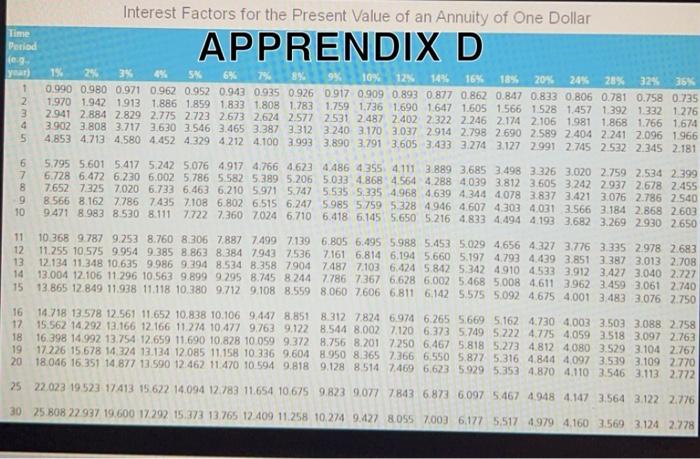

a. If the firm charges $39,330 annually to rent the equipment, what are the net present value and the internal rate of return on the investment? Use Appendix D to answer the questions. Use a minus sign to enter negative values, if any. Round your answers for the net present value to the nearest dollar and for the internal rate of return to the nearest whole number. NPV: $ IRR:

%

irm, whose cost of capital is 10 percent, may acquire equipment for $119,445 and rent it to someone for a period of four years. te: Although payment of rent is typically considered to be an annuity due, treat it as an ordinary annuity when completing this problem in a spreadsheet or ien using present value factors. a. If the firm charges $39,330 annually to rent the equipment, what are the net present value and the internal rate of return on the investment? Use Appendix D to answer the questions. Use a minus sign to enter negative values, if any. Round your answers for the net present value to the nearest dollar and for the internal rate of return to the nearest whole number. NPV: 5 IRR: % Should the firm sequire the equipment? The firm acquire the equipment as the net present value is , and the internal rate of return the firm's cost of capital. b. If the equipment has no estimated residual value, what must be the minimum annual rental charge for the firm to eam the required 10 percent on the investments use Appendix D to answer the question. Round your answer to the nearest dollar. $ c. If the firm can sell the equipment at the end of vear four. for. $8,18p and recelve annial rent payments of $39,330, what are the net present value. and the internal rate of return on the investment? Use Apoendix B and Appendix D to answer the questions. Use a minus sign to enter negative. values, If any. Round vour answers for the net present value to the nearest dollar and for the internal rate of return to the nearest whole number. NPV: $ IRR: \% What is the impact of the residual? The residual value both the NPV and IRR. d. If the $8,180 residual resulted in the firm charging only $37,285 for the rental payments, what is the impact on the investment's net present value? Use Appondix B and Appendlx D to answer the question. Round your answer to the nearest dollar. Reducing the rental payments and recouping it through the residual value the net present value by $ APPRENDIX B Interest Factors for the Present Value of an Annuitv of One Dollar