Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help I will like please help I'm trying to learn how to do it Deadtha racconante - X Requirements Non-merchandising transactions eq egi Jan.

Please help I will like

please help I'm trying to learn how to do it

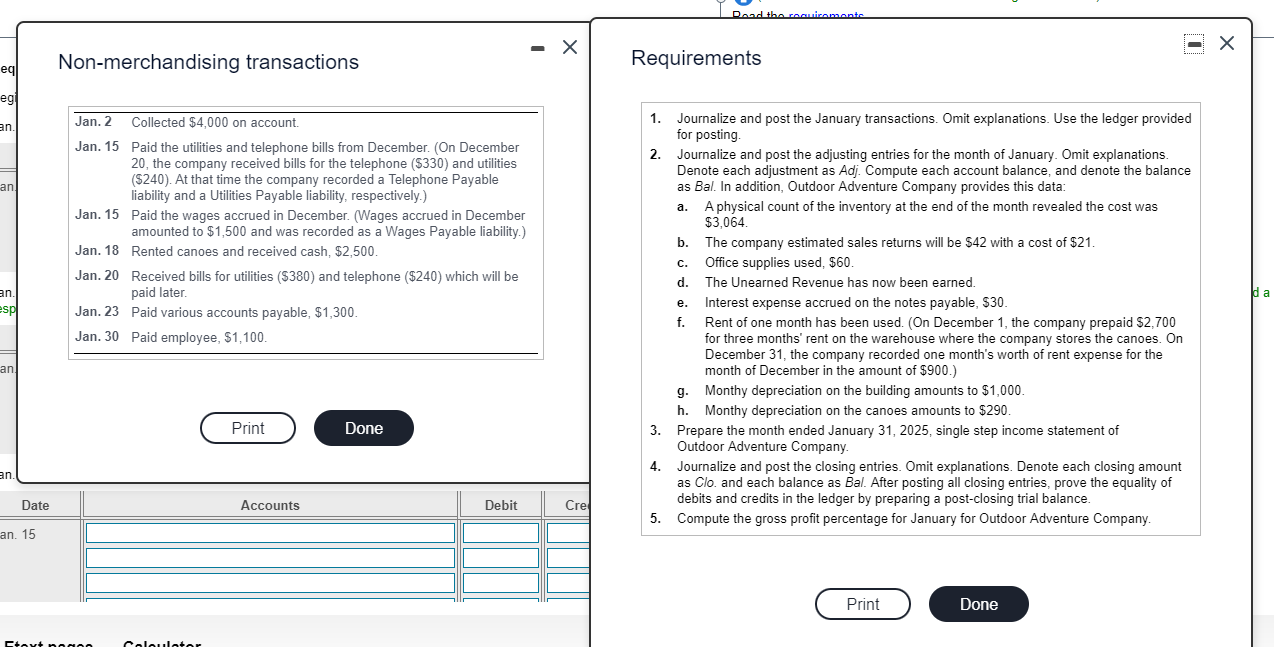

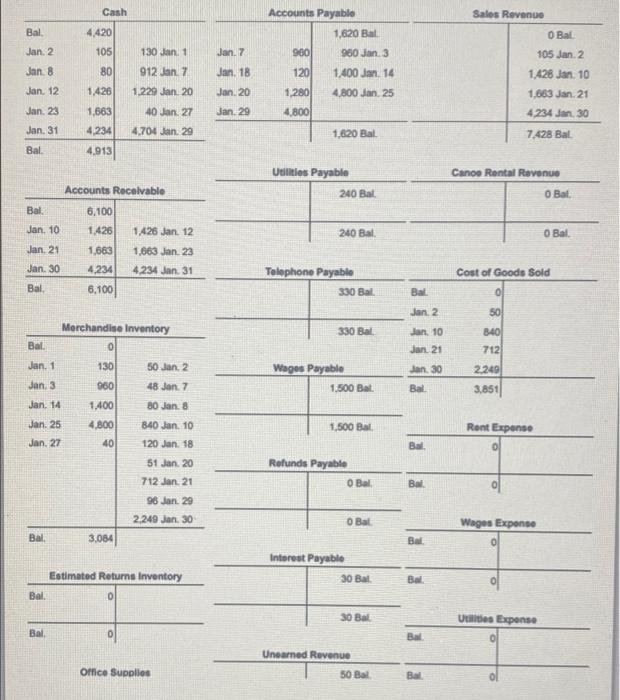

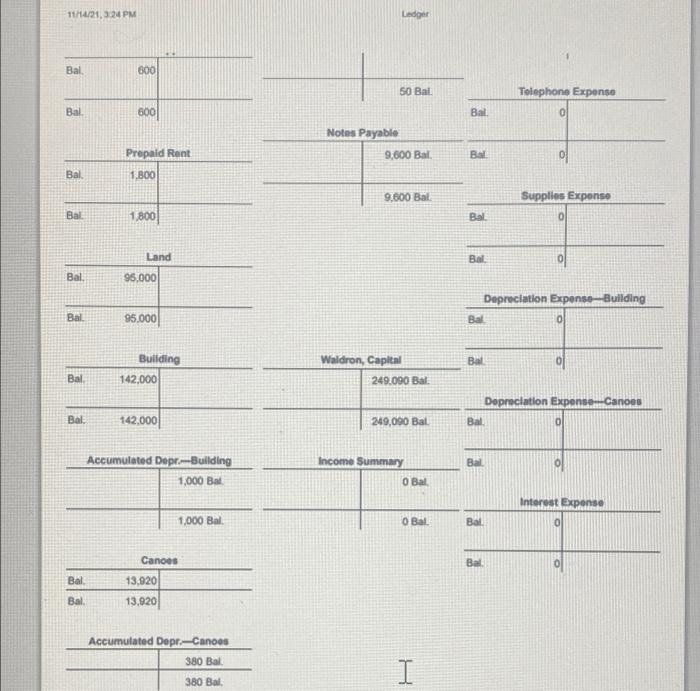

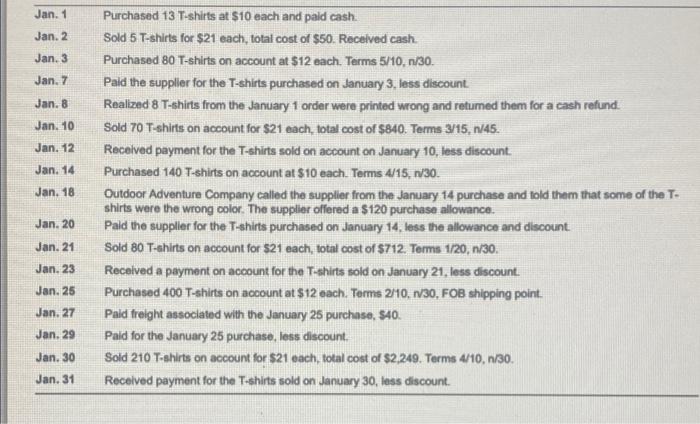

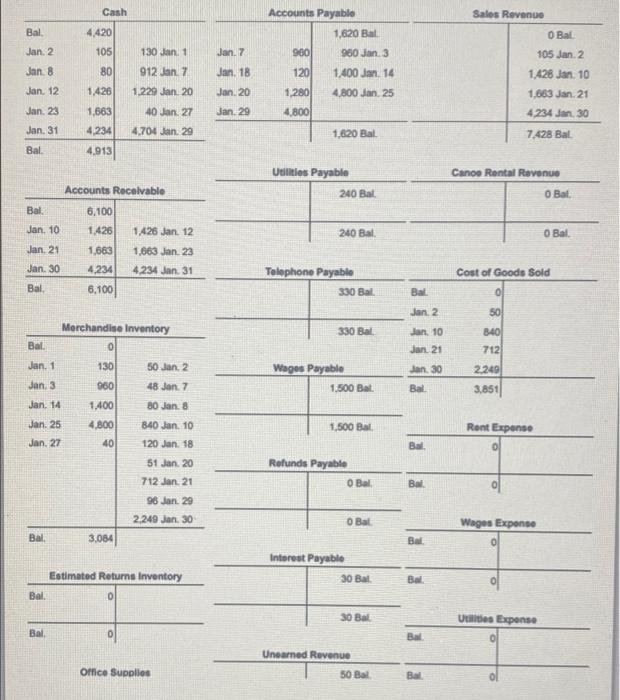

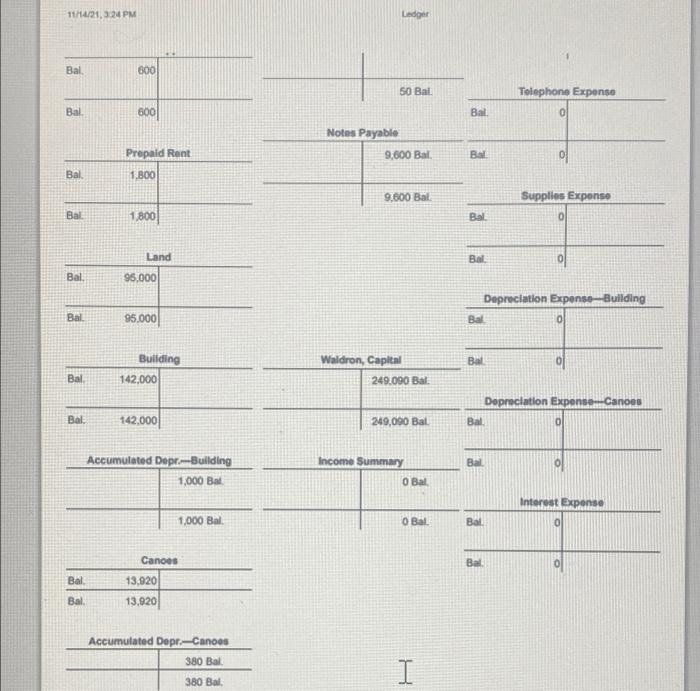

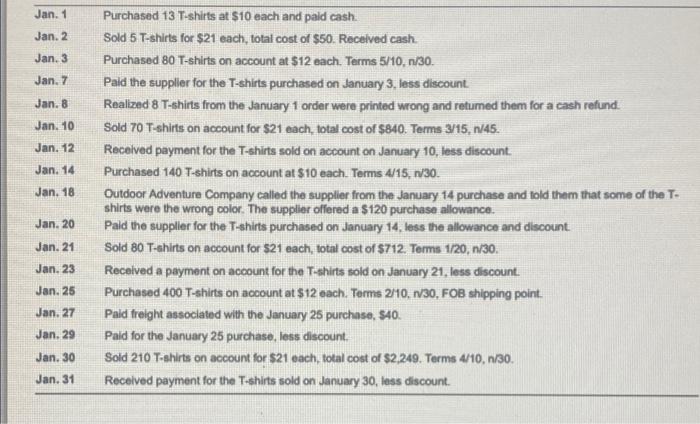

Deadtha racconante - X Requirements Non-merchandising transactions eq egi Jan. 2 Collected $4.000 on account. an. an Jan. 15 Paid the utilities and telephone bills from December. (On December 20, the company received bills for the telephone (5330) and utilities ($240). At that time the company recorded a Telephone Payable liability and a Utilities Payable liability, respectively.) Jan. 15 Paid the wages accrued in December. (Wages accrued in December amounted to $1,500 and was recorded as a Wages Payable liability.) Jan. 18 Rented canoes and received cash, $2,500 Jan. 20 Received bills for utilities ($380) and telephone ($240) which will be paid later. Jan. 23 Paid various accounts payable, $1,300. Jan. 30 Paid employee, $1,100. c. an. espl e. 1. Journalize and post the January transactions. Omit explanations. Use the ledger provided for posting 2. Journalize and post the adjusting entries for the month of January. Omit explanations. Denote each adjustment as Adj. Compute each account balance, and denote the balance as Bal. In addition, Outdoor Adventure Company provides this data: a. A physical count of the inventory at the end of the month revealed the cost was $3,064 b. The company estimated sales returns will be $42 with a cost of $21. Office supplies used, $60. d. The Unearned Revenue has now been earned. Interest expense accrued on the notes payable, $30. f. Rent of one month has been used. (On December 1, the company prepaid $2,700 for three months' rent on the warehouse where the company stores the canoes. On December 31, the company recorded one month's worth of rent expense for the month of December in the amount of $900.) g. Monthy depreciation on the building amounts to $1,000 h. Monthy depreciation on the canoes amounts to $290. 3. Prepare the month ended January 31, 2025, single step income statement of Outdoor Adventure Company. 4. Journalize and post the closing entries. Omit explanations. Denote each closing amount as Clo, and each balance as Bal. After posting all closing entries, prove the equality of debits and credits in the ledger by preparing a post-closing trial balance. 5. Compute the gross profit percentage for January for Outdoor Adventure Company. an! Print Done an. Date Accounts Debit Cre an. 15 Print Done Etoyt naann calculator Cash Salos Revenue Bal. O Bal Jan. 2 Jan. 7 4,420 105 80 1,426 130 Jan. 1 912 Jan 7 Accounts Payable 1,620 Bal 960 960 Jan 3 120 1.400 Jan 14 1.280 4.800 Jan 25 4.800 105 Jan 2 1.428 Jan. 10 Jan 8 Jan. 18 Jan. 20 Jan. 12 1.663 Jan 21 4.234 Jan. 30 Jan. 23 1229 Jan 20 40 Jan 27 4.704 Jan. 29 1,663 4,234 Jan. 29 Jan. 31 1.620 Bal. 7.428 Bal Bal 4.913 Canoe Rental Revenue Utilities Payable 240 Bal Accounts Recolvable O Bal Bal 6.100 Jan. 10 240 Bal OBal Jan 21 1.426 1.663 4,234 6,100 1,426 Jan. 12 1,663 Jan 23 4,234 Jan 31 Jan. 30 Cost of Goods Sold Telephone Payable 330 Bal Bal, Bal 0 Jan 2 50 Merchandise Inventory 330 Bar Bal. Jan 10 Jan 21 840 712 0 Jan. 1 130 2.249 Wages Payable 1.500 Bal 50 Jan 2 48 Jan.7 80 Jan 8 Jan. 30 Bal Jan 3 960 1.400 3,851 Jan. 14 840 Jan 10 1,500 Bal Jan 25 Jan. 27 4.800 40 Rent Expense 120 Jan 18 Ba Refunds Payable OBal, Bal 51 Jan. 20 712 Jan 21 96 Jan. 29 2.249 Jan. 30 O Bal Wages Exponse Bal 3,064 Bal Interest Payable Estimated Returns Inventory 30 Bal Bal 0 Bal. 0 30 Bal Uit Expense Bal Bal Unearned Revenue 50 Ball Office Supplies Bai. 11/14/21,324 PM Ledger Bal 600 50 Bal. Telephone Expense 0 Bal 600 Bal. Notes Payable Prepaid Rent 9,600 Bal Bal 0 Bal 1.800 9.600 Bal Supplies Expense 0 Bal 1.800 Bal Land Bal Bal 95.000 Depreciation Expense Building Bal Bal 95.000 0 Bal Building 142.000 Waldron, Capital 249.090 Bal. Bal Depreciation Expense-Canoes Bal 142.000 249,090 Bal Bal 0 Bail Accumulated Depr.--Building 1,000 Bal Income Summary O Bal Interest Expense 1,000 Bal O Bal Bal 0 Bal Bal Canoes 13,920 13.920 Bal. Accumulated Depr.-Canoos 380 Bal I 380 Bal Jan. 1 Jan. 2 Jan. 3 Jan. 7 Jan. 8 Jan. 10 Jan. 12 Jan. 14 Jan. 18 Purchased 13 T-shirts at $10 each and paid cash. Sold 5 T-shirts for $21 each, total cost of $50. Recelved cash. Purchased 80 T-shirts on account at $12 each. Terms 5/10.6/30. Paid the supplier for the T-shirts purchased on January 3, less discount Realized 8 T-shirts from the January 1 order were printed wrong and retumed them for a cash refund. Sold 70 T-shirts on account for $21 each, total cost of $840. Terms 3/15, 1/45. Received payment for the T-shirts sold on account on January 10, less discount. Purchased 140 T-shirts on account at $10 each. Terms 4/15, 130. Outdoor Adventure Company called the supplier from the January 14 purchase and told them that some of the T- shirts were the wrong color. The supplier offered a $120 purchase allowance. Pald the supplier for the T-shirts purchased on January 14, less the allowance and discount Sold 80 T-shirts on account for $21 each, total cost of $712. Terms 1/20, 1/30. Received a payment on account for the T-shirts sold on January 21, less discount. Purchased 400 T-shirts on account at $12 each. Terms 2/10, 1/30, FOB shipping point. Pald freight associated with the January 25 purchase, $40. Pald for the January 25 purchase, less discount Sold 210 T-shirts on account for $21 each, total cost of $2,249. Terms 4/10, 1/30. Received payment for the T-shirts sold on January 30, less discount. Jan. 20 Jan. 21 Jan. 23 Jan. 25 Jan. 27 Jan. 29 Jan. 30 Jan. 31 Deadtha racconante - X Requirements Non-merchandising transactions eq egi Jan. 2 Collected $4.000 on account. an. an Jan. 15 Paid the utilities and telephone bills from December. (On December 20, the company received bills for the telephone (5330) and utilities ($240). At that time the company recorded a Telephone Payable liability and a Utilities Payable liability, respectively.) Jan. 15 Paid the wages accrued in December. (Wages accrued in December amounted to $1,500 and was recorded as a Wages Payable liability.) Jan. 18 Rented canoes and received cash, $2,500 Jan. 20 Received bills for utilities ($380) and telephone ($240) which will be paid later. Jan. 23 Paid various accounts payable, $1,300. Jan. 30 Paid employee, $1,100. c. an. espl e. 1. Journalize and post the January transactions. Omit explanations. Use the ledger provided for posting 2. Journalize and post the adjusting entries for the month of January. Omit explanations. Denote each adjustment as Adj. Compute each account balance, and denote the balance as Bal. In addition, Outdoor Adventure Company provides this data: a. A physical count of the inventory at the end of the month revealed the cost was $3,064 b. The company estimated sales returns will be $42 with a cost of $21. Office supplies used, $60. d. The Unearned Revenue has now been earned. Interest expense accrued on the notes payable, $30. f. Rent of one month has been used. (On December 1, the company prepaid $2,700 for three months' rent on the warehouse where the company stores the canoes. On December 31, the company recorded one month's worth of rent expense for the month of December in the amount of $900.) g. Monthy depreciation on the building amounts to $1,000 h. Monthy depreciation on the canoes amounts to $290. 3. Prepare the month ended January 31, 2025, single step income statement of Outdoor Adventure Company. 4. Journalize and post the closing entries. Omit explanations. Denote each closing amount as Clo, and each balance as Bal. After posting all closing entries, prove the equality of debits and credits in the ledger by preparing a post-closing trial balance. 5. Compute the gross profit percentage for January for Outdoor Adventure Company. an! Print Done an. Date Accounts Debit Cre an. 15 Print Done Etoyt naann calculator Cash Salos Revenue Bal. O Bal Jan. 2 Jan. 7 4,420 105 80 1,426 130 Jan. 1 912 Jan 7 Accounts Payable 1,620 Bal 960 960 Jan 3 120 1.400 Jan 14 1.280 4.800 Jan 25 4.800 105 Jan 2 1.428 Jan. 10 Jan 8 Jan. 18 Jan. 20 Jan. 12 1.663 Jan 21 4.234 Jan. 30 Jan. 23 1229 Jan 20 40 Jan 27 4.704 Jan. 29 1,663 4,234 Jan. 29 Jan. 31 1.620 Bal. 7.428 Bal Bal 4.913 Canoe Rental Revenue Utilities Payable 240 Bal Accounts Recolvable O Bal Bal 6.100 Jan. 10 240 Bal OBal Jan 21 1.426 1.663 4,234 6,100 1,426 Jan. 12 1,663 Jan 23 4,234 Jan 31 Jan. 30 Cost of Goods Sold Telephone Payable 330 Bal Bal, Bal 0 Jan 2 50 Merchandise Inventory 330 Bar Bal. Jan 10 Jan 21 840 712 0 Jan. 1 130 2.249 Wages Payable 1.500 Bal 50 Jan 2 48 Jan.7 80 Jan 8 Jan. 30 Bal Jan 3 960 1.400 3,851 Jan. 14 840 Jan 10 1,500 Bal Jan 25 Jan. 27 4.800 40 Rent Expense 120 Jan 18 Ba Refunds Payable OBal, Bal 51 Jan. 20 712 Jan 21 96 Jan. 29 2.249 Jan. 30 O Bal Wages Exponse Bal 3,064 Bal Interest Payable Estimated Returns Inventory 30 Bal Bal 0 Bal. 0 30 Bal Uit Expense Bal Bal Unearned Revenue 50 Ball Office Supplies Bai. 11/14/21,324 PM Ledger Bal 600 50 Bal. Telephone Expense 0 Bal 600 Bal. Notes Payable Prepaid Rent 9,600 Bal Bal 0 Bal 1.800 9.600 Bal Supplies Expense 0 Bal 1.800 Bal Land Bal Bal 95.000 Depreciation Expense Building Bal Bal 95.000 0 Bal Building 142.000 Waldron, Capital 249.090 Bal. Bal Depreciation Expense-Canoes Bal 142.000 249,090 Bal Bal 0 Bail Accumulated Depr.--Building 1,000 Bal Income Summary O Bal Interest Expense 1,000 Bal O Bal Bal 0 Bal Bal Canoes 13,920 13.920 Bal. Accumulated Depr.-Canoos 380 Bal I 380 Bal Jan. 1 Jan. 2 Jan. 3 Jan. 7 Jan. 8 Jan. 10 Jan. 12 Jan. 14 Jan. 18 Purchased 13 T-shirts at $10 each and paid cash. Sold 5 T-shirts for $21 each, total cost of $50. Recelved cash. Purchased 80 T-shirts on account at $12 each. Terms 5/10.6/30. Paid the supplier for the T-shirts purchased on January 3, less discount Realized 8 T-shirts from the January 1 order were printed wrong and retumed them for a cash refund. Sold 70 T-shirts on account for $21 each, total cost of $840. Terms 3/15, 1/45. Received payment for the T-shirts sold on account on January 10, less discount. Purchased 140 T-shirts on account at $10 each. Terms 4/15, 130. Outdoor Adventure Company called the supplier from the January 14 purchase and told them that some of the T- shirts were the wrong color. The supplier offered a $120 purchase allowance. Pald the supplier for the T-shirts purchased on January 14, less the allowance and discount Sold 80 T-shirts on account for $21 each, total cost of $712. Terms 1/20, 1/30. Received a payment on account for the T-shirts sold on January 21, less discount. Purchased 400 T-shirts on account at $12 each. Terms 2/10, 1/30, FOB shipping point. Pald freight associated with the January 25 purchase, $40. Pald for the January 25 purchase, less discount Sold 210 T-shirts on account for $21 each, total cost of $2,249. Terms 4/10, 1/30. Received payment for the T-shirts sold on January 30, less discount. Jan. 20 Jan. 21 Jan. 23 Jan. 25 Jan. 27 Jan. 29 Jan. 30 Jan. 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started