Answered step by step

Verified Expert Solution

Question

1 Approved Answer

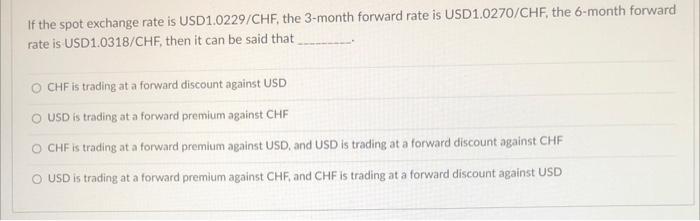

Please help If the spot exchange rate is USD1.0229/CHF, the 3-month forward rate is USD 1.0270/CHF, the 6-month forward rate is USD1.0318/CHF, then it can

Please help

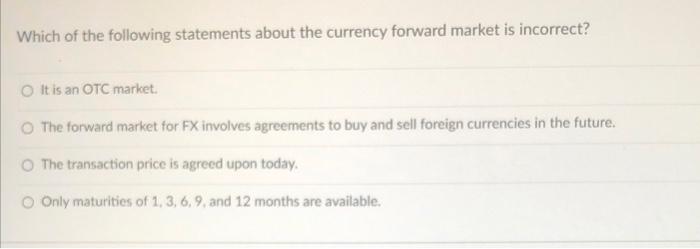

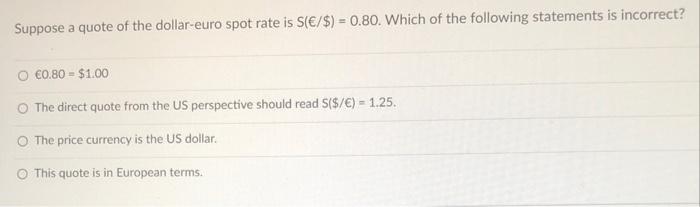

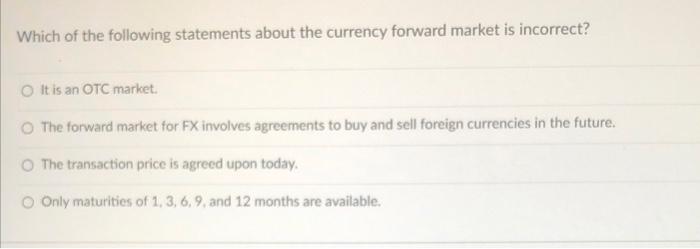

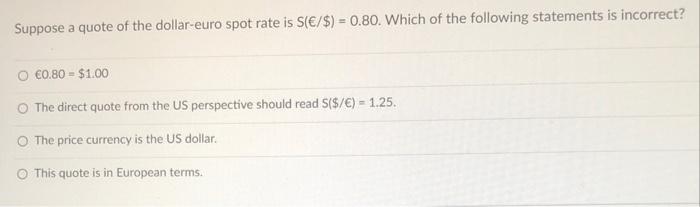

If the spot exchange rate is USD1.0229/CHF, the 3-month forward rate is USD 1.0270/CHF, the 6-month forward rate is USD1.0318/CHF, then it can be said that CHF is trading at a forward discount against USD USD is trading at a forward premium against CHF CHF is trading at a forward premium against USD, and USD is trading at a forward discount against CHF a O USD is trading at a forward premium against CHF and CHF is trading at a forward discount against USD Which of the following statements about the currency forward market is incorrect? It is an OTC market The forward market for FX involves agreements to buy and sell foreign currencies in the future. The transaction price is agreed upon today, o Only maturities of 1, 3, 6, 9 and 12 months are available. Suppose a quote of the dollar-euro spot rate is S(/$) = 0.80. Which of the following statements is incorrect? 0.80 - $1.00 The direct quote from the US perspective should read S($/) 1.25. O The price currency is the US dollar. This quote is in European terms

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started