Please help if you know the answer

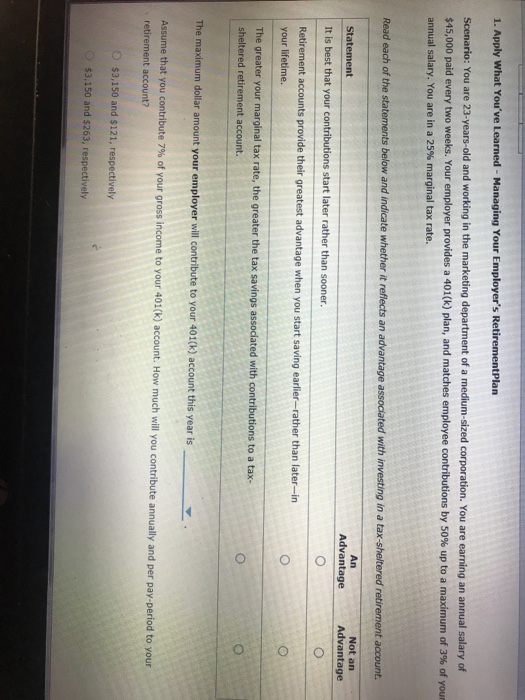

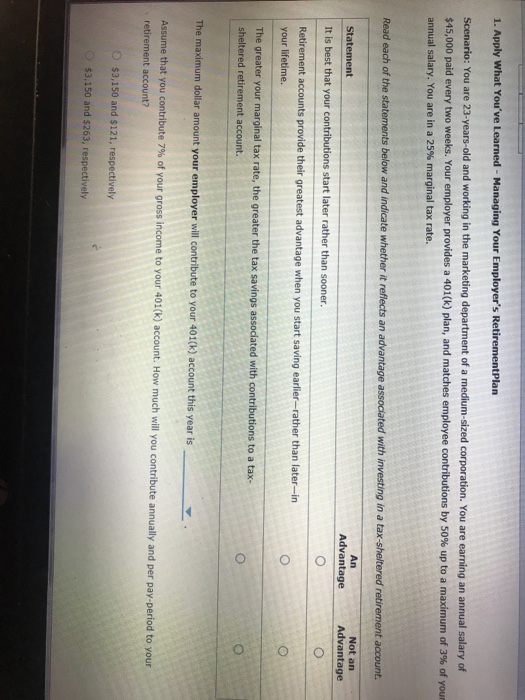

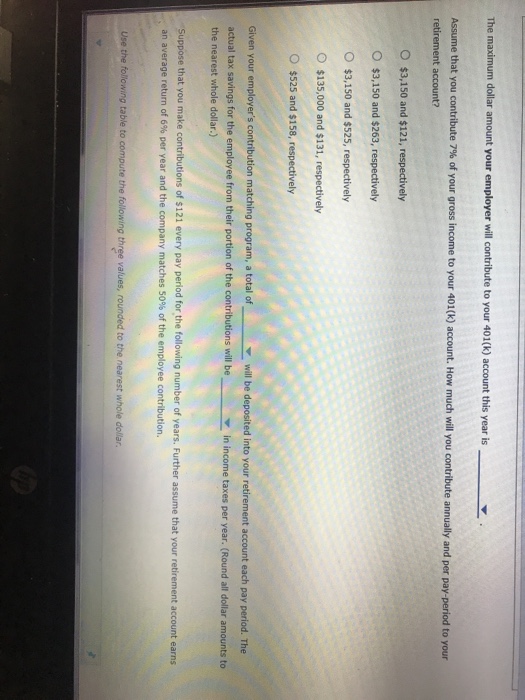

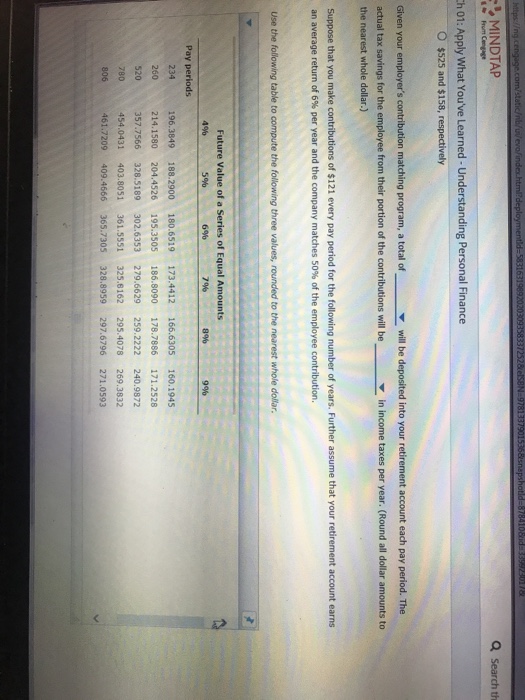

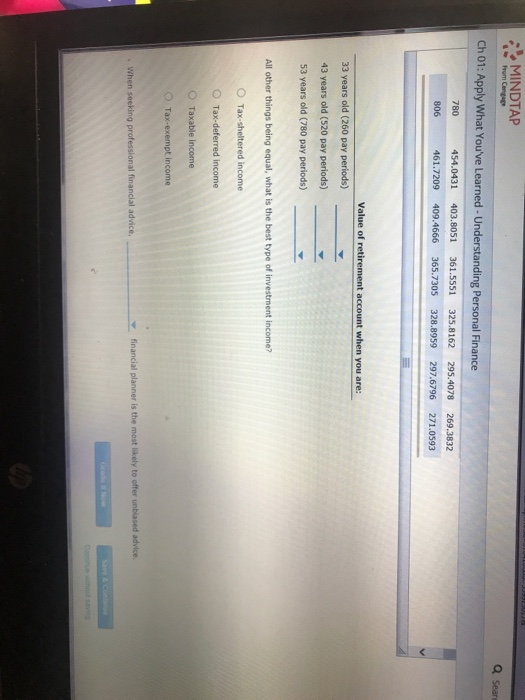

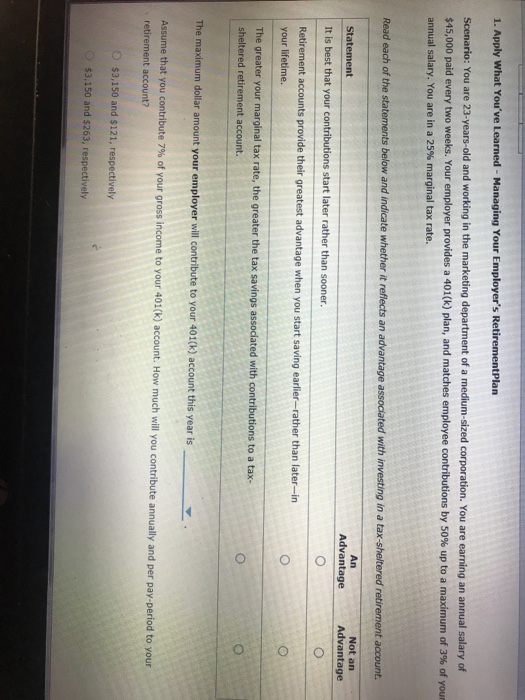

1. Apply What You've Learned - Managing Your Employer's Reti Scenario: You are 23-years-old and working in the marketing department of a medium-sized corporation. You are earning an annual salary of $45,000 paid every two weeks. Your employer provides a 401(k) plan and matches employee contributions by 50% up to a maximum of 3% of your annual salary. You are in a 25% marginal tax rate. Read each of the statements below and indicate whether it reflects an advantage associated with investing in a tax-sheltered Not an Advantage Statement It is best that your contributions start later rather than sooner. Retirement accounts provide their greatest advantage when you start saving earlier-rather than later-in your lifetime. The greater your tax rate, the grea ter the tax savings associated with contributions to a tax- sheltered retirement account. The maximum dollar amount your employer will contribute to your 401(k) account this year is Assume that you contribute 7% of your gross income to your 401(k) accou retirement account? nt. How much will you contribute annually and per pay-period to your $3,150 and $121, respectively $3,150 and $263, respectively 1. Apply What You've Learned - Managing Your Employer's Reti Scenario: You are 23-years-old and working in the marketing department of a medium-sized corporation. You are earning an annual salary of $45,000 paid every two weeks. Your employer provides a 401(k) plan and matches employee contributions by 50% up to a maximum of 3% of your annual salary. You are in a 25% marginal tax rate. Read each of the statements below and indicate whether it reflects an advantage associated with investing in a tax-sheltered Not an Advantage Statement It is best that your contributions start later rather than sooner. Retirement accounts provide their greatest advantage when you start saving earlier-rather than later-in your lifetime. The greater your tax rate, the grea ter the tax savings associated with contributions to a tax- sheltered retirement account. The maximum dollar amount your employer will contribute to your 401(k) account this year is Assume that you contribute 7% of your gross income to your 401(k) accou retirement account? nt. How much will you contribute annually and per pay-period to your $3,150 and $121, respectively $3,150 and $263, respectively