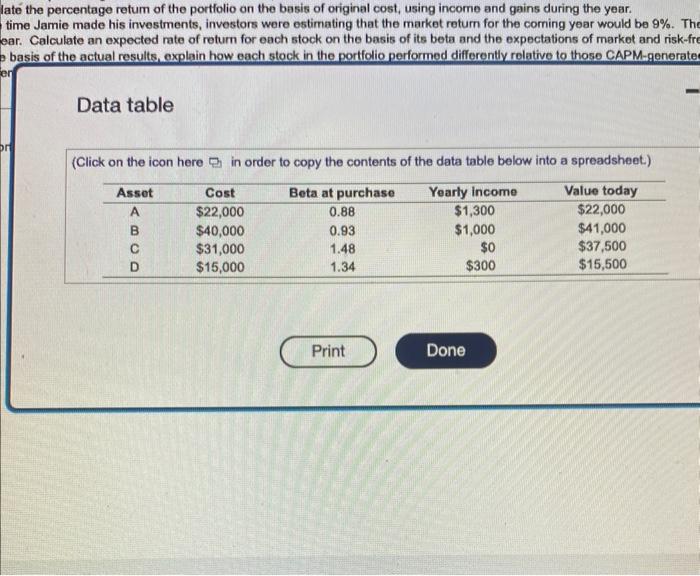

te the percentage retum of the portfolio on the basis of original cost, using income and gains during the year. ime Jamie made his investments, investors were estimating that the market retum for the coming year would be 9%. Th ar. Calculate an expected rate of return for each stock on the basis of its beta and the expectations of market and risk-fr basis of the actual results, explain how each stock in the portfolio performed differently rolative to those CAPM-generate Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Portfollio return and beta Pornonal Finasce Problem Jamio Peters invesied $100,000 to set ip the followng portholo one yeor ago: a. Calculate the portfolio beta on the basis of the orighal cost figures. b. Calculate the percentage return of each asset in the portfolio for the year. c. Calculate the percertage relum of the portfolio on me bosis of crighal cost, using income and gains during the year: d. At the fime damie made his investrnents, investars were estimating that the markot rebum for the coming yoar would be 9%. The ostimate of the risk-froe rale of return avoraged 3% for the coming year. Calculale an expected rate of retum for each stock on the basis of its beta and the expoctasions of markot and risk. free returns. e. On the basis of the actual results, explain how each stock in the portfolio performed diffecenty relative lo those chP M-generated expectatlans of perlormance. Whet factars could explain these differences? a. The portfolio beth on the basis of the original cost fgures is (Round to two decimal places.) te the percentage retum of the portfolio on the basis of original cost, using income and gains during the year. ime Jamie made his investments, investors were estimating that the market retum for the coming year would be 9%. Th ar. Calculate an expected rate of return for each stock on the basis of its beta and the expectations of market and risk-fr basis of the actual results, explain how each stock in the portfolio performed differently rolative to those CAPM-generate Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Portfollio return and beta Pornonal Finasce Problem Jamio Peters invesied $100,000 to set ip the followng portholo one yeor ago: a. Calculate the portfolio beta on the basis of the orighal cost figures. b. Calculate the percentage return of each asset in the portfolio for the year. c. Calculate the percertage relum of the portfolio on me bosis of crighal cost, using income and gains during the year: d. At the fime damie made his investrnents, investars were estimating that the markot rebum for the coming yoar would be 9%. The ostimate of the risk-froe rale of return avoraged 3% for the coming year. Calculale an expected rate of retum for each stock on the basis of its beta and the expoctasions of markot and risk. free returns. e. On the basis of the actual results, explain how each stock in the portfolio performed diffecenty relative lo those chP M-generated expectatlans of perlormance. Whet factars could explain these differences? a. The portfolio beth on the basis of the original cost fgures is (Round to two decimal places.)