Question: Please help! Im at a loss on what to do . Show working notes! The following data relates to the operations of XYZ Company, a

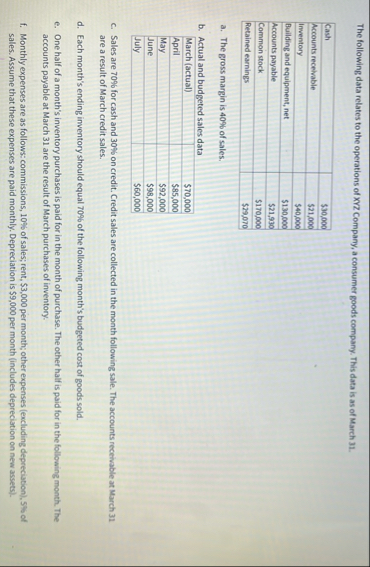

Please help! Im at a loss on what to do Show working notes! The following data relates to the operations of XYZ Company, a consumer goods company. This data is as of March

tableCash$

Equipment costing $ will be purchased for cash in April and equipment costing $ will be purchased for cash in May.

h Management would like to maintain a minimum cash balance of at least $ at the end of each month. The company has an agreement with a local bank that allows the company to borrow in increments of $ at the beginning of each month, up to a total loan balance of $ The interest rate on these loans is per month. For simplicity, we will assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the end of the quarter.

Using the data provided, use the Excel Template to prepare the following budget schedules.

Sales Budget Merely enter the sales data provided.

Schedule of Expected Cash Collections

Merchandise Purchases Budget

Schedule of Expected Cash Disbursements Merchandise Purchases

Schedule of Expected Cash Disbursements Selling and Administrative Expenses

Cash Budget

Please note that Excel formulas or functions should be used throughout the budget wherever possible, instead of entering numbers into each cell.

Managerial Accounting Course Project

Budgeted Sales

tableMarchApril,May,June,July

tableSchedule of Expected Cash CollectionsCash Sales Credit Sales Total Collections,April,May,June,Quarter$$Merchandise Purchases BudgetApril,May,June,QuarterBudgeted Cost of Goods Sold,$Total Needs,less: Beginning Inventory,Required Purchases,$

tableSchedule of Expected Cash Disbursements Merchandise PurchaesApril May June Quarter,,$March Purchases,April Purchases,,,May Purchases,,,June Purchases,$Total Disbursements,,,

Schedule of Expected Cash Disbursements Selling & Administrative

tableApril,May,June,QuarterCommissions$RentOther Expenses,Total Disbursements,$Cash Budget,,,AprilMay,June,QuarterCash Balance Beginning,$Add: Cash Collections,Total Cash Availlable,,,,Less Cash DisbursementsFor Inventory,For Expenses,For Equipment,Total Cash Disbursements,,,,Excess deficiency of Cash,BorrowingRepaymentsInterest Paid,,,,Ending Cash Balance,,,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock