Please help im upvoting

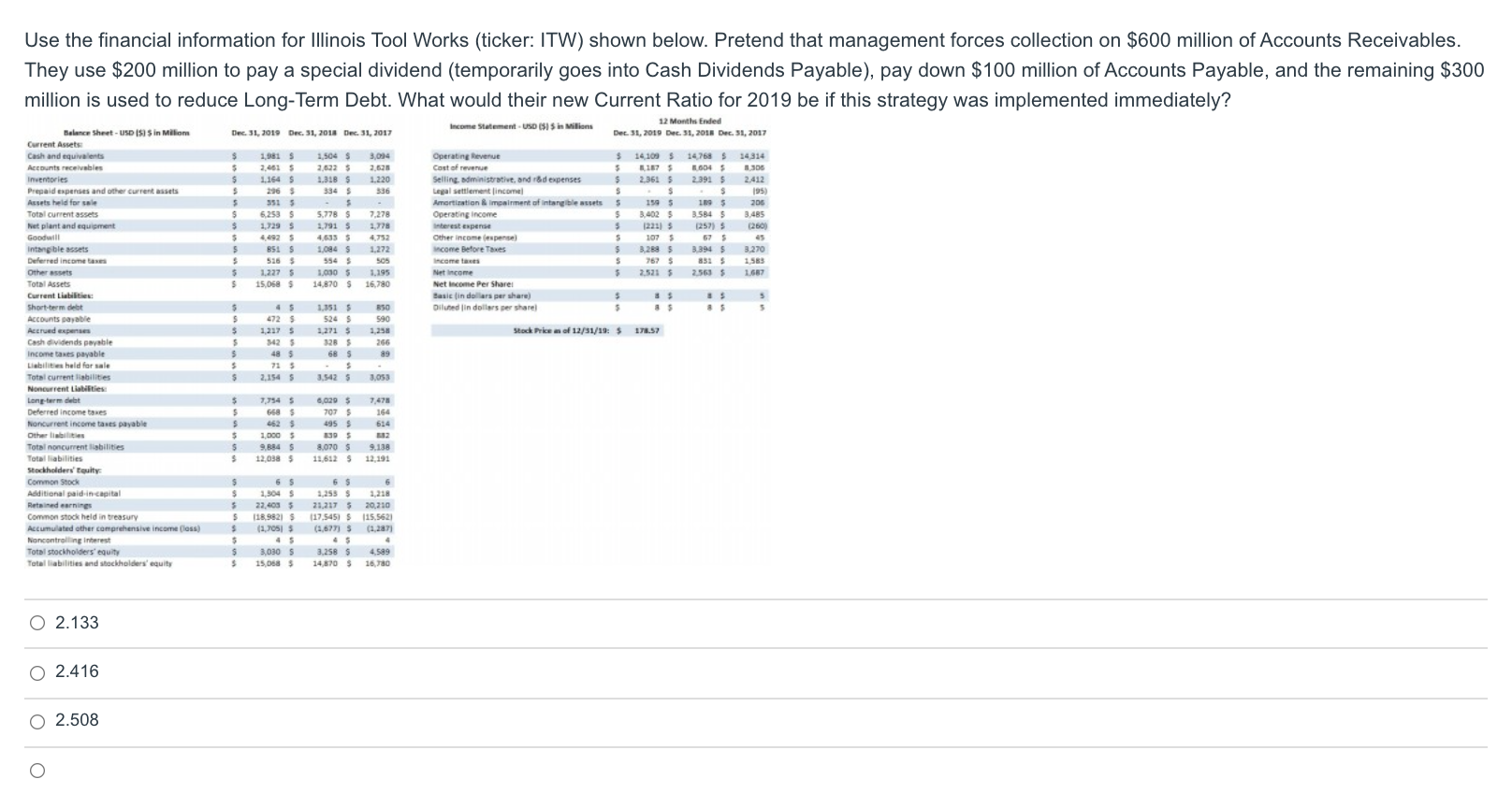

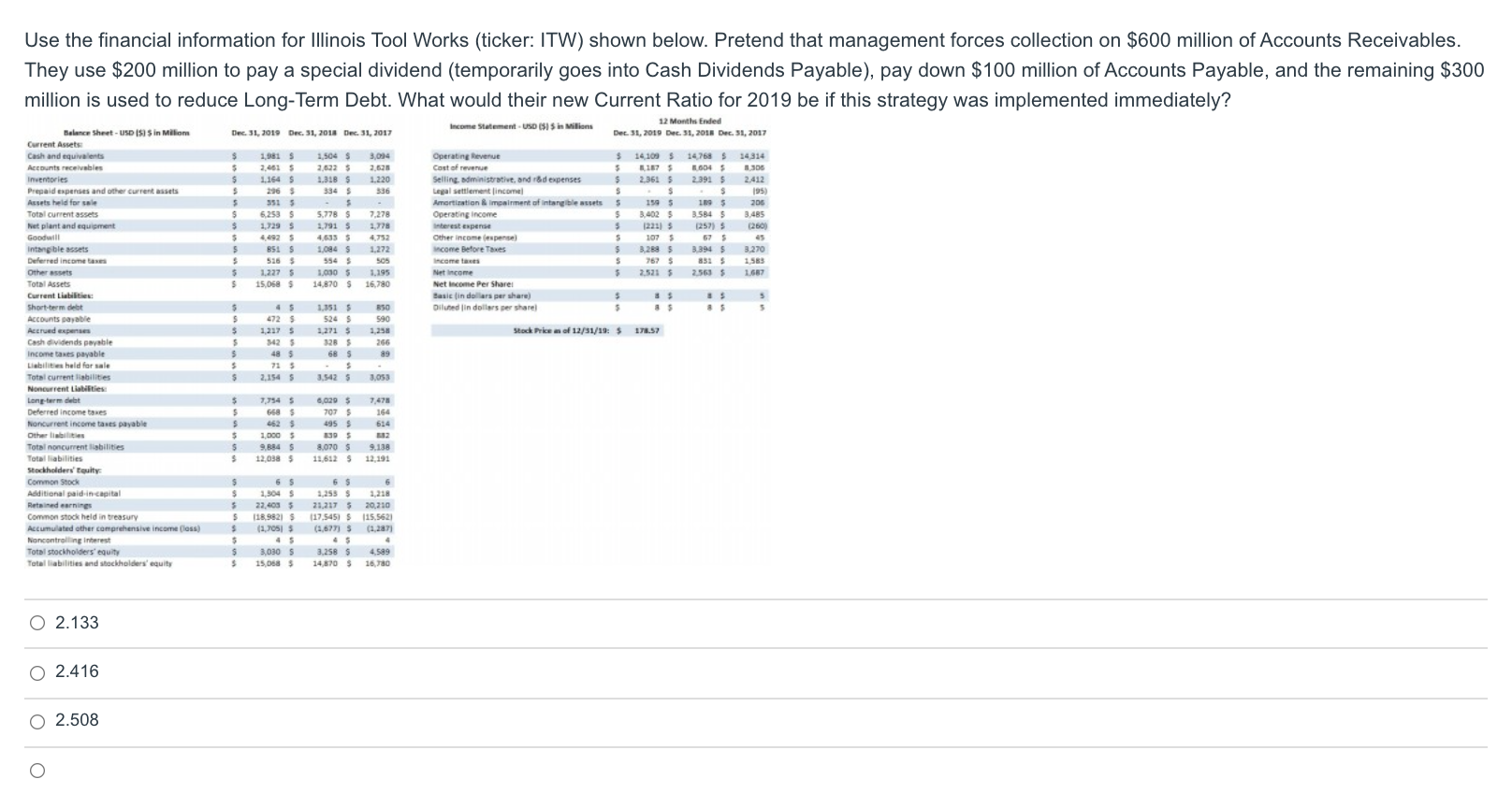

Use the financial information for Illinois Tool Works (ticker: ITW) shown below. Pretend that management forces collection on $600 million of Accounts Receivables. They use $200 million to pay a special dividend (temporarily goes into Cash Dividends Payable), pay down $100 million of Accounts Payable, and the remaining $300 million is used to reduce Long-Term Debt. What would their new Current Ratio for 2019 be if this strategy was implemented immediately? Balance Sheet - USD ISIS in Miliom (1in 12 Months Ended Income Statement - USD 151 Sin Millions Dec 31, 2019 Dec 31, 2018 Dec 31, 2017 Dec 31, 2019 Dec 31, 2018 Dec 31, 2017 1.9815 2.461 1.164 $ 296 $ 5 $ $ 5 $ $ 5 5 5 5 5 $ 6.2535 1,7295 1,504 $ 3,094 2.6225 2,625 1.31B $ 1.220 3345 336 $ 5.778 5 7,278 1.7915 1,778 4.752 1,084 1,272 5545505 1.0305 1.195 14.870 $ 16,780 Operating Revenue Cost of revenue Selling, administrative, and expenses Legal settlement income Amortization & Impairment of Intangible assets Operating income Interest expense Other income pense income Before Taxes Income taxes Net income Net Income Per Shares Basic in dollars per share) Diluted in dollars per sharel $ 14109 5 14.768 $ 14314 5 1675 604 3.306 $ 2.361 2.391 $ 2.412 5 $ $ 195 S 195 206 $ 3402 3.5845 3.485 $ 122115 (257) 0260) 5 1075 57 5 es 5 3.289 $ 3.3945 3.270 S 7675 835 1.58 5 5 2.5215 2.5635 1667 8515 5165 1.227 S 15,068 $ $ 5 5 Current Assets Cash and equivalents Accounts receivables Inventories Prepaid expenses and other current assets Assets held for sale Total current assets Net plant and equipment Goodwill Intangble assets Deferred income taxe Other assets Total Assets Current Liabilities Short-term debet Accounts payable Accrued expenses Cash dividends payable Income taxes payable Liabilities held for sale Total current abilities Noncurrent Lates Long term debet Deferred income taxes Noncurrent income tants payable Others Total noncurrentlisbilities Total liabilities Stockholders' tuity Common Stock Additional paid-in-capital Retained earnings Common stock held in treasury Accumulated other comprehensive income oss) Noncontrolling interest Total stockholders' equity Total liabilities and stockholders' equity $ $ $ $ 5 5 5 Stock Price of 12/31/14: $ 176.57 1.3515 5245 1,271 $ 3285 685 4725 1,2175 342 485 715 2,1545 850 590 1.250 266 89 3.5425 3,055 $ 7.754 5 6.020 7.478 S 6685 7075 164 $ 462 $ 4955614 $1,000 5 0512 $ 9,884 5 8,070 $ 9.138 $ 12,0385 11.612 12.191 $ $ $ 5 5 $ $ $ $ 65 1,3045 22.03 118.9921 $ (1.7055 45 3.0305 15 oss 6 $ 5 1,2535 1.218 21.2175 20,210 117.545) 5 115,5621 (1,677) $ (3,287 4 3.258 $ 4.599 14,870 $ 16,780 O 2.133 O 2.416 0 2.508