PLEASE HELP!! Include formulas if possible!

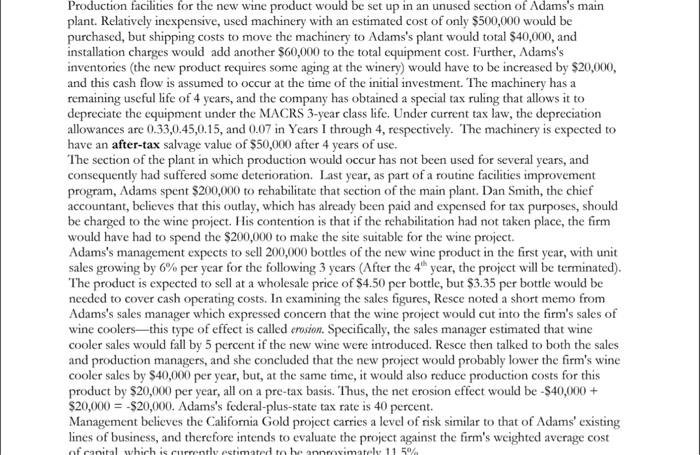

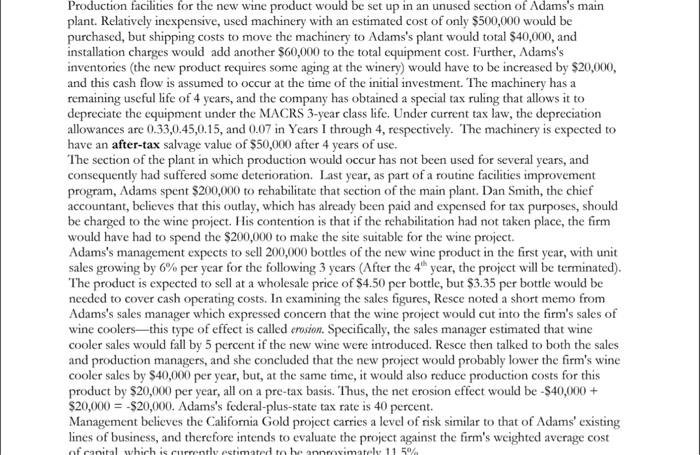

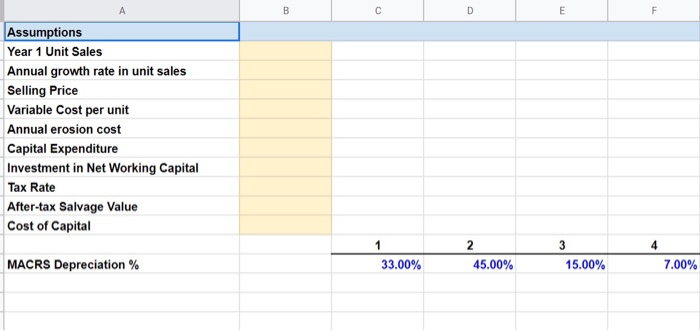

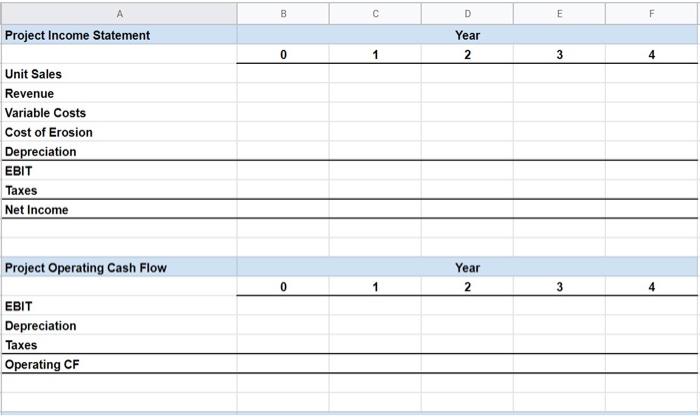

Production facilities for the new wine product would be set up in an unused section of Adams's main plant. Relatively inexpensive, used machinery with an estimated cost of only $500,000 would be purchased, but shipping costs to move the machinery to Adams's plant would total $40,000, and installation charges would add another $60,000 to the total equipment cost. Further, Adams's inventories (the new product requires some aging at the winery) would have to be increased by $20,000, and this cash flow is assumed to occur at the time of the initial investment. The machinery has a remaining useful life of 4 years, and the company has obtained a special tax ruling that allows it to depreciate the equipment under the MACRS 3-year class life. Under current tax law, the depreciation allowances are 0.33,0.45,0.15, and 0.07 in Years I through 4, respectively. The machinery is expected to have an after-tax salvage value of $50,000 after 4 years of use. The section of the plant in which production would occur has not been used for several years, and d some deterioration. Last year, as part of a routine facilities improvement spent $200,000 to rehabilitate that section of the main plant. Dan Smith, the chief accountant, believes that this outlay, which has already been paid and expensed for tax purposes, should be charged to the wine project. His contention is that if the rehabilitation had not taken place, the firm would have had to spend the $200,000 to make the site suitable for the wine project. Adams's management expects to sell 200,000 bottles of the new wine product in the first year, with unit sales growing by 6% per year for the following 3 years (After the 4 year, the project will be terminated) The product is expected to sell at a wholesale price of $4.50 per bottle, but $3.35 per bottle would be needed to cover cash operating costs. In examining the sales figures, Resce noted a short memo from Adams's sales manager which expressed concern that the wine project would cut into the firm's sales of wine coolersthis type of effect is called erosion. Specifically, the sales manager estimated that wine cooler sales would fall by 5 percent of the new wine were introduced. Resce then talked to both the sales and production managers, and she concluded that the new project would probably lower the firm's wine cooler sales by $40,000 per year, but, at the same time, it would also reduce production costs for this product by $20,000 per year, all on a pre-tax basis. Thus, the net erosion effect would be -S40,000+ $20,000 = -$20,000. Adams's federal-plus-state tax rate is 40 percent. Management believes the California Gold project carries a level of risk similar to that of Adams' existing lines of business, and therefore intends to evaluate the project against the firm's weighted average cost of capital which is currently estimated to be annoyimately 11 5% Assumptions Year 1 Unit Sales Annual growth rate in unit sales Selling Price Variable Cost per unit Annual erosion cost Capital Expenditure Investment in Net Working Capital Tax Rate After-tax Salvage Value Cost of Capital MACRS Depreciation % Project Income Statement Year 2 Unit Sales Revenue Variable Costs Cost of Erosion Depreciation EBIT Taxes Net Income Project Operating Cash Flow Year EBIT Depreciation Taxes Operating CF