Answered step by step

Verified Expert Solution

Question

1 Approved Answer

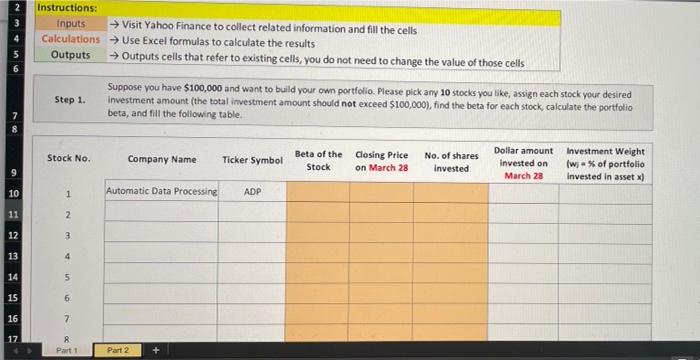

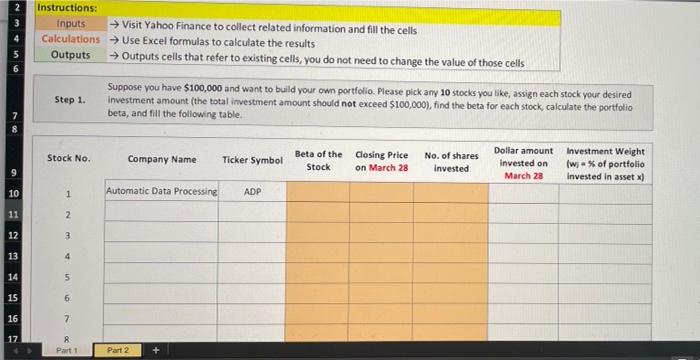

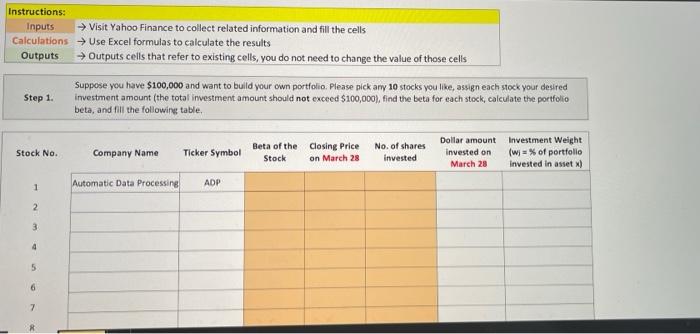

please help Instructions: Inputs Visit Yahoo Finance to collect related information and fill the cells Calculations - Use Excel formulas to calculate the results Outputs

please help

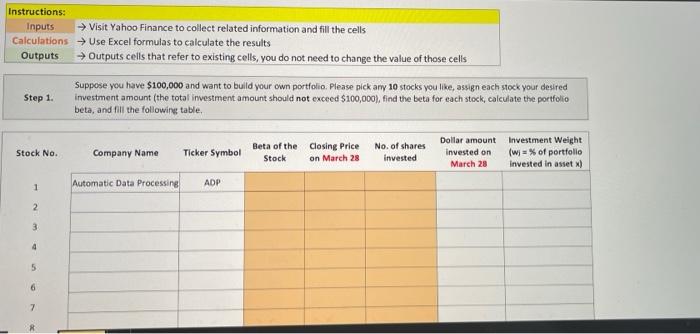

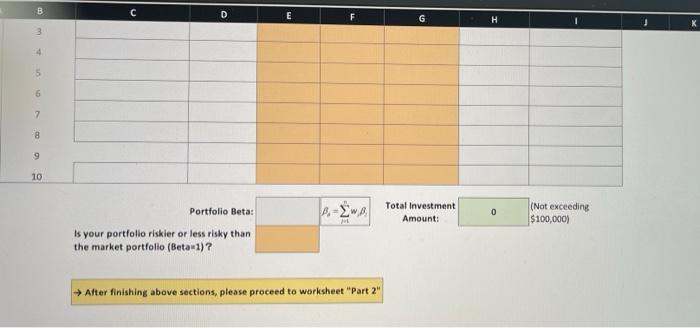

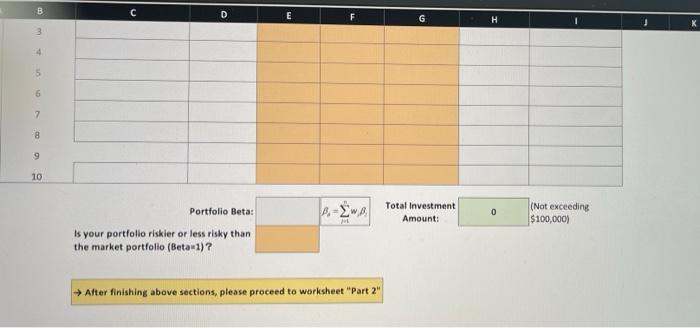

Instructions: Inputs Visit Yahoo Finance to collect related information and fill the cells Calculations - Use Excel formulas to calculate the results Outputs Outputs cells that refer to existing cells, you do not need to change the value of those cells Suppose you have $100,000 and want to build your own portfolio. Please pick any 10 stocks you like, assign each stock your desired Step 1. investment amount (the total investment amount should not exceed $100,000), find the beta for each stock calculate the portfolio beta, and fill the following table. Stock No. Company Name Ticker Symbol Beta of the closing Price Stock on March 28 No. of shares Invested Dollar amount Invested on March 28 Investment Weight fws - % of portfolio Invested in asset x) 9 10 1 Automatic Data Processing ADP 11 2 12 3 13 4 14 5 15 6 16 7 17 8 Part 1 Part 2 Instructions: Inputs Visit Yahoo Finance to collect related information and fill the cells Calculations Use Excel formulas to calculate the results Outputs Outputs cells that refer to existing cells, you do not need to change the value of those cells Step 1. Suppose you have $100,000 and want to build your own portfolio. Please pick any 10 stocks you like, assign each stock your desired investment amount (the total investment amount should not exceed $100,000), find the beta for each stock, calculate the portfolio beta, and fill the following table, Stock No. Company Name Ticker Symbol Beta of the closing Price Stock on March 28 No. of shares invested Dollar amount Investment Weight invested on (wj = % of portfolio March 28 Invested in asset) ADP Automatic Data Processing 1 2. 3 4 5 6 7 B D E F H K 3 4 5 6 7 8 9 10 Portfolio Beta: - Total Investment Amount: 0 (Not exceeding $100,000) Is your portfolio riskler or less risky than the market portfolio (Beta-1)? After finishing above sections, please proceed to worksheet"Part 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started