Answered step by step

Verified Expert Solution

Question

1 Approved Answer

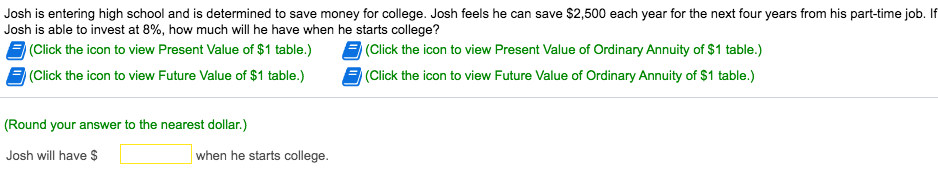

Please help! Josh is entering high school and is determined to save money for college. Josh feels he can save $2,500 each year for the

Please help!

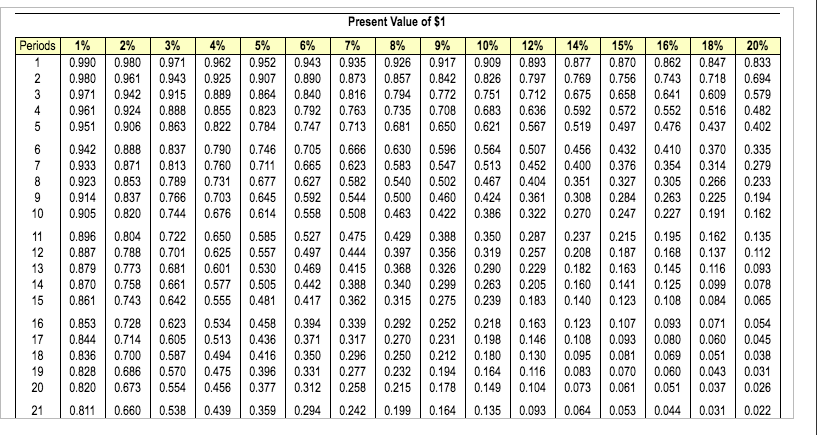

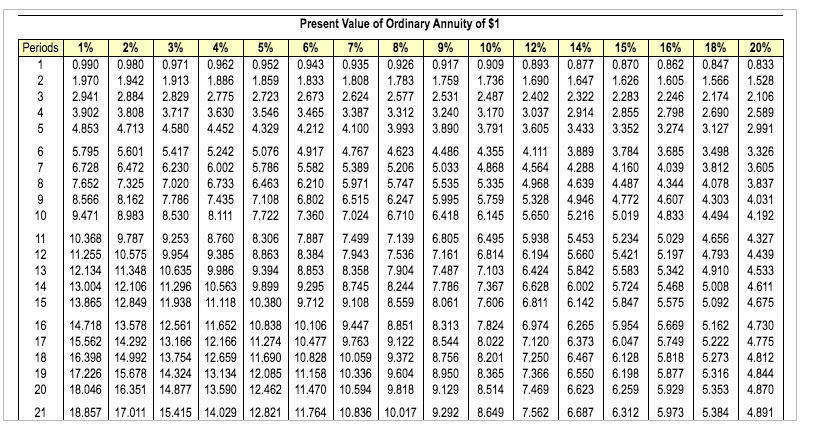

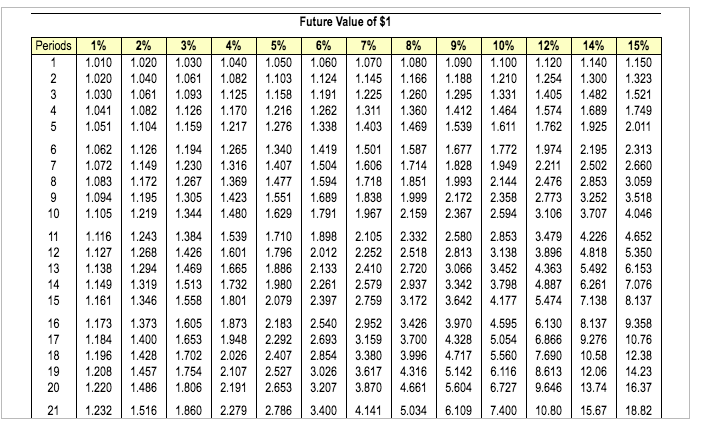

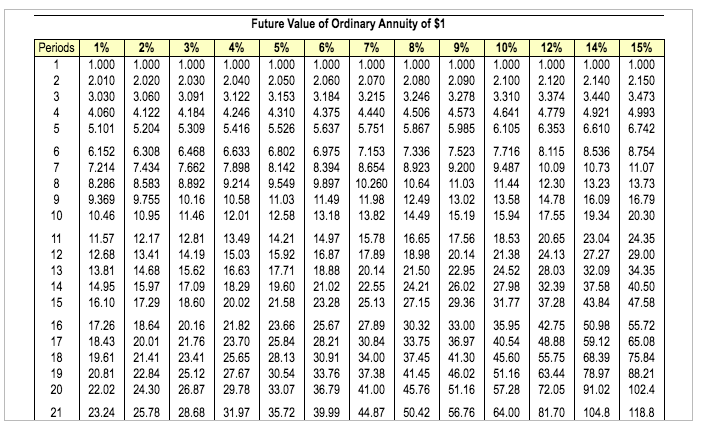

Josh is entering high school and is determined to save money for college. Josh feels he can save $2,500 each year for the next four years from his part-time job. If Josh is able to invest at 8%, how much will he have when he starts college? (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) (Click the icon to view Future Value of Ordinary Annuity of $1 table.) (Round your answer to the nearest dollar.) Josh will have $ when he starts college. Present Value of $1 Periods 2 3 4 5 1% 0.990 0.980 0.971 0.961 0.951 2% 0.980 0.961 0.942 0.924 0.906 3% 0.971 0.943 0.915 0.888 0.863 4% 0.962 0.925 0.889 0.855 0.822 5% 0.952 0.907 0.864 0.823 0.784 6% 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 7% 0.935 0.873 0.816 0.763 0.713 9% 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 12% 0.893 0.797 0.712 0.636 0.567 14% 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 15% 0.870 0.756 0.658 0.572 0.497 16% 0.862 0.743 0.641 0.552 0.476 18% 0.847 0.718 0.609 0.516 0.437 20% 0.833 0.694 0.579 0.482 0.402 6 0.942 0.933 0.923 0.914 0.905 0.888 0.871 0.853 0.837 0.820 0.837 0.813 0.789 0.766 0.744 8% 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.790 0.760 0.731 0.703 0.676 0.666 0.623 0.582 0.544 0.508 0.507 0.452 0.404 0.361 0.322 0.432 0.376 0.327 0.284 0.247 0.410 0.354 0.305 0.263 0.227 0.370 0.314 0.266 0.225 0.191 0.335 0.279 0.233 0.194 0.162 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.505 0.481 10 11 12 13 14 15 0.896 0.887 0.879 0.870 0.861 0.804 0.788 0.773 0.758 0.743 0.722 0.701 0.681 0.661 0.642 0.650 0.625 0.601 0.577 0.555 0.475 0.444 0.415 0.388 0.362 0.388 0.356 0.326 0.299 0.275 0.350 0.319 0.290 0.263 0.239 0.287 0.257 0.229 0.205 0.183 0.237 0.208 0.182 0.160 0.140 0.215 0.187 0.163 0.141 0.123 0.195 0.168 0.145 0.125 0.108 0.162 0.137 0.116 0.099 0.084 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.038 0.031 0.026 16 17 18 19 20 0.853 0.844 0.836 0.828 0.820 0.728 0.714 0.700 0.686 0.673 0.623 0.605 0.587 0.570 0.554 0.534 0.513 0.494 0.475 0.456 0.527 0.497 0.469 0.442 0.417 0.394 0.371 0.350 0.331 0.312 0.294 0.458 0.436 0.416 0.396 0.377 0.339 0.317 0.296 0.277 0.258 0.292 0.270 0.250 0.232 0.215 0.252 0.231 0.212 0.194 0.178 0.218 0.198 0.180 0.164 0.149 0.163 0.146 0.130 0.116 0.104 0.123 0.108 0.095 0.083 0.073 0.107 0.093 0.081 0.070 0.061 0.093 0.080 0.069 0.060 0.051 0.071 0.060 0.051 0.043 0.037 21 0.811 0.660 0.538 0.439 0.359 0.242 0.199 0.164 0.135 0.093 0.064 0.053 0.044 0.031 0.022 Periods 1 2 3 4 5 12% 0.893 1.690 2.402 3.037 3.605 14% 0.877 1.647 2.322 2.914 3.433 15% 0.870 1.626 2.283 2.855 3.352 16% 0.862 1.605 2.246 2.798 3.274 18% 0.847 1.566 2.174 2.690 3.127 20% 0.833 1.528 2.106 2.589 2.991 7 8 9 10 Present Value of Ordinary Annuity of $1 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 17.226 15.678 14.324 13.134 | 12.085 11.158 10.336 9.604 8.950 8.365 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 8.649 4.111 4.564 4.968 5.328 5.650 3.889 4.288 4.639 4.946 5.216 3.784 4.160 4.487 4.772 5.019 3.685 4.039 4.344 4.607 4.833 3.498 3.812 4.078 4.303 4.494 3.326 3.605 3.837 4.031 4.192 11 12 13 14 15 5.938 6.194 6.424 6.628 6.811 5.234 5.421 5.583 5.724 5.847 5.029 5.197 5.342 5.468 5.575 4.656 4.793 4.910 5.008 5.092 4.327 4.439 4.533 4.611 4.675 5.453 5.660 5.842 6.002 6.142 6.265 6.373 6.467 6.550 6.623 16 17 18 19 20 6.974 7.120 7.250 7.366 7.469 5.954 6.047 6.128 6.198 6.259 5.669 5.749 5.818 5.877 5.929 5.162 5.222 5.273 5.316 5.353 4.730 4.775 4.812 4.844 4.870 21 7.562 6.687 6.312 5.973 5.384 4.891 Periods 1% 1.010 1.020 1.030 1.041 1.051 2 3 4 5 2% 1.020 1.040 1.061 1.082 1.104 3% 1.030 1.061 1.093 1.126 1.159 4% 1.040 1.082 1.125 1.170 1.217 Future Value of $1 5% 6% 7% 1.050 1.060 1.070 1.103 1.124 1.145 1.158 1.191 1.225 1.216 1.262 1.311 1.276 1.338 1.403 8% 1.080 1.166 1.260 1.360 1.469 9% 1.090 1.188 1.295 1.412 1.539 10% 1.100 1.210 1.331 1.464 1.611 12% 1.120 1.254 1.405 1.574 1.762 1.974 2.211 2.476 2.773 3.106 14% 1.140 1.300 1.482 1.689 1.925 15% 1.150 1.323 1.521 1.749 2.011 6 7 8 9 10 1.062 1.072 1.083 1.094 1.105 1.126 1.149 1.172 1.195 1.219 1.194 1.230 1.267 1.305 1.344 1.265 1.316 1.369 1.423 1.480 1.340 1.407 1.477 1.551 1.629 1.419 1.504 1.594 1.689 1.791 1.501 1.606 1.718 1.838 1.967 1.587 1.714 1.851 1.999 2.159 1.677 1.828 1.993 2.172 2.367 1.772 1.949 2.144 2.358 2.594 2.195 2.502 2.853 3.252 3.707 2.313 2.660 3.059 3.518 4.046 11 12 13 14 15 1.116 1.127 1.138 1.149 1.161 1.243 1.268 1.294 1.319 1.346 1.384 1.426 1.469 1.513 1.558 1.539 1.601 1.665 1.732 1.801 1.710 1.796 1.886 1.980 2.079 1.898 2.012 2.133 2.261 2.397 2.105 2.252 2.410 2.579 2.759 2.332 2.518 2.720 2.937 3.172 2.580 2.813 3.066 3.342 3.642 2.853 3.138 3.452 3.798 4.177 3.479 3.896 4.363 4.887 5.474 4.226 4.818 5.492 6.261 7.138 4.652 5.350 6.153 7.076 8.137 16 17 18 19 20 1.173 1.184 1.196 1.208 1.220 1.373 1.400 1.428 1.457 1.486 1.605 1.653 1.702 1.754 1.806 1.873 1.948 2.026 2.107 2.191 2.183 2.292 2.407 2.527 2.653 2.540 2.693 2.854 3.026 3.207 2.952 3.159 3.380 3.617 3.870 3.426 3.700 3.996 4.316 4.661 3.970 4.328 4.717 5.142 5.604 4.595 5.054 5.560 6.116 6.727 6.130 6.866 7.690 8.613 9.646 8.137 9.276 10.58 12.06 13.74 9.358 10.76 12.38 14.23 16.37 21 1.232 1.516 1.860 2.279 2.786 3.400 4.141 5.034 6.109 7.400 10.80 15.67 18.82 Periods 1 2 3 4 5 2% 1.000 2.020 3.060 4.122 5.204 6.308 7.434 8.583 9.755 10.95 3% 1.000 2.030 3.091 4.184 5.309 10% 1.000 2.100 3.310 4.641 6.105 12% 1.000 2.120 3.374 4.779 6.353 14% 1.000 2.140 3.440 4.921 6.610 6 1% 1.000 2.010 3.030 4.060 5.101 6.152 7.214 8.286 9.369 10.46 11.57 12.68 13.81 14.95 16.10 7 6.468 7.662 8.892 10.16 11.46 Future Value of Ordinary Annuity of $1 4% 5% 6% 7% 8% 9% 1.000 1.000 1.000 1.000 1.000 1.000 2.040 2.050 2.060 2.070 2.080 2.090 3.122 3.153 3.184 3.215 3.246 3.278 4.246 4.310 4.375 4.440 4.506 4.573 5.416 5.526 5.637 5.751 5.867 5.985 6.633 6.802 6.975 7.153 7.336 7.523 7.898 8.142 8.394 8.654 8.923 9.200 9.214 9.549 9.897 10.260 10.64 11.03 10.58 11.03 11.49 11.98 12.49 13.02 12.01 12.58 13.18 13.82 14.49 15.19 13.49 14.21 14.97 15.78 16.65 17.56 15.03 15.92 16.87 17.89 18.98 20.14 16.63 17.71 18.88 20.14 21.50 22.95 18.29 19.60 21.02 22.55 24.21 26.02 20.02 21.58 23.28 25.13 27.15 29.36 7.716 9.487 11.44 13.58 15.94 8.536 10.73 13.23 16.09 19.34 15% 1.000 2.150 3.473 4.993 6.742 8.754 11.07 13.73 16.79 20.30 24.35 29.00 34.35 40.50 47.58 8.115 10.09 12.30 14.78 17.55 20.65 24.13 28.03 32.39 37.28 9 10 11 12 13 14 15 12.17 13.41 14.68 15.97 17.29 18.53 21.38 24.52 27.98 31.77 23.04 27.27 32.09 37.58 43.84 12.81 14.19 15.62 17.09 18.60 20.16 21.76 23.41 25.12 26.87 16 17 18 19 20 17.26 18.43 19.61 20.81 22.02 18.64 20.01 21.41 22.84 24,30 21.82 23.70 25.65 27.67 29.78 23.66 25.84 28.13 30.54 33.07 25.67 28.21 30.91 33.76 36.79 27.89 30.84 34.00 37.38 41.00 30.32 33.75 37.45 41,45 45.76 33.00 36.97 41.30 46.02 51.16 35.95 40.54 45.60 51.16 57.28 42.75 48.88 55.75 63.44 72.05 50.98 59.12 68.39 78.97 91.02 55.72 65.08 75.84 88.21 102.4 21 23.24 25.78 28.68 31.97 35.72 39.99 44.87 50.42 56.76 64.00 81.70 104.8 118.8Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started