Please Help just with the question in bold

1- How does a financial analyst who is responsible for determining credit-worthiness compare to two Polish companies in the same industry when one is using the zloty as a functional currency and the other is using the U.S. dollar as a functional currency?

Case 8-1

Columbia Corporation

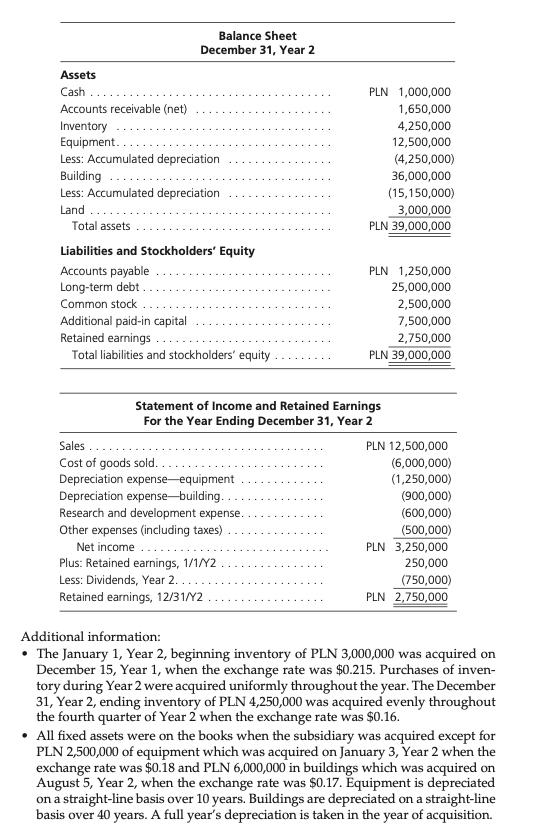

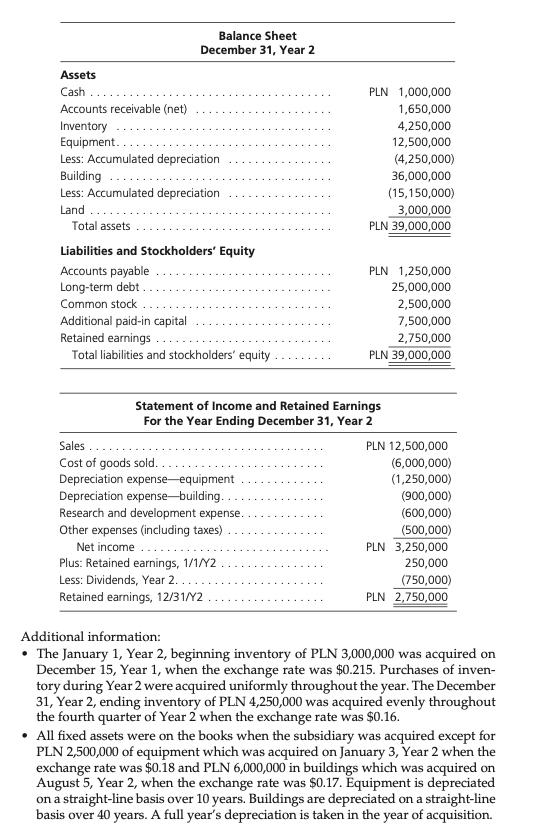

Columbia Corporation, a U.S.-based company, acquired a 100 percent interest in Swoboda Company in Lodz, Poland, on January 1, Year 1, when the exchange rate for the Polish zloty (PLN) was $0.25. The financial statements of Swoboda as of December 31, Year 2, two years later, are as follows:

Balance Sheet December 31, Year 2 Assets Cash .......... Accounts receivable (net) ...... Inventory Equipment. ........ Less: Accumulated depreciation ..... PLN 1,000,000 1,650,000 4,250,000 12,500,000 (4,250,000) 36,000,000 (15,150,000) 3,000,000 PLN 39,000,000 Building ......................... Less: Accumulated depreciation ....... Land ... Total assets .................... Liabilities and Stockholders' Equity Accounts payable Long-term debt................... Common stock ..................... Additional paid-in capital ..................... Retained earnings ........................ Total liabilities and stockholders' equity ......... PLN 1,250,000 25,000,000 2,500,000 7,500,000 2,750,000 PLN 39,000,000 Statement of Income and Retained Earnings For the Year Ending December 31, Year 2 Sales ...... PLN 12,500,000 Cost of goods sold............ (6,000,000) Depreciation expense-equipment ....... (1,250,000) Depreciation expense-building................ (900,000) Research and development expense............. (600,000) Other expenses (including taxes) ............... (500,000) Net income ... PLN 3,250,000 Plus: Retained earnings, 1/1/42 ........ 250,000 Less: Dividends, Year 2.. (750,000) Retained earnings, 12/31/42 .......... PLN 2,750,000 Additional information: The January 1, Year 2, beginning inventory of PLN 3,000,000 was acquired on December 15, Year 1, when the exchange rate was $0.215. Purchases of inven- tory during Year 2 were acquired uniformly throughout the year. The December 31, Year 2, ending inventory of PLN 4,250,000 was acquired evenly throughout the fourth quarter of Year 2 when the exchange rate was $0.16. All fixed assets were on the books when the subsidiary was acquired except for PLN 2,500,000 of equipment which was acquired on January 3, Year 2 when the exchange rate was $0.18 and PLN 6,000,000 in buildings which was acquired on August 5, Year 2, when the exchange rate was $0.17. Equipment is depreciated on a straight-line basis over 10 years. Buildings are depreciated on a straight-line basis over 40 years. A full year's depreciation is taken in the year of acquisition