Answered step by step

Verified Expert Solution

Question

1 Approved Answer

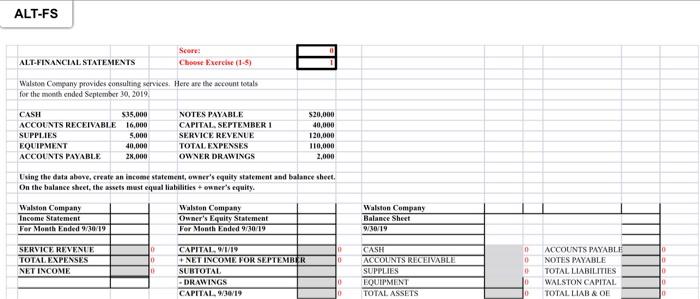

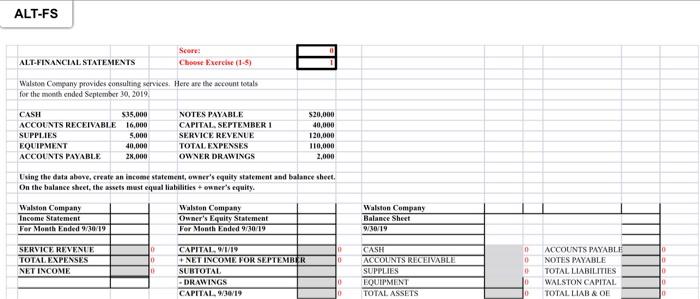

Please help ke with this Accounting assignment. Highly appreciated! ALT-FS Score: Choose Exercise (1-5) ALT-FINANCIAL STATEMENTS Walston Company provides consulting services. Here are the account

Please help ke with this Accounting assignment. Highly appreciated!  ALT-FS Score: Choose Exercise (1-5) ALT-FINANCIAL STATEMENTS Walston Company provides consulting services. Here are the account totals for the month ended September 30, 2019, CASH $35.000 ACCOUNTS RECEIVABLE 16,000 SUPPLIES 5,000 EQUIPMENT 40,000 ACCOUNTS PAYABLE 28,000 NOTES PAYABLE CAPITAL, SEPTEMBER 1 SERVICE REVENUE TOTAL EXPENSES OWNER DRAWINGS $20,000 40,000 120,000 110,000 2,000 Using the data above.create an income statement, owner's equity statement and balance sheet. On the balance sheet, the assets mest equal liabilities + owner's equity. Walston Company Income Statement For Mowth Ended 9/30/19 Walston Company Owner's Equity Statement For Month Ended 930/19 Walton Company Balance Sheet W10/19 SERVICE REVENUE TOTAL EXPENSES NET INCOME 0 10 10 0 0 0 CAPITAL 1/19 NET INCOME FOR SEPTEMBER SUBTOTAL DRAWINGS CAPITAL W30/19 CASH ACCOUNTS RECEIVABLE SUPPLIES EQUIPMENT TOTAL ASSETS 0 ACCOUNTS PAYABLES NOTES PAYABLE TOTAL LIABILITIES WALSTON CAPITAL TOTAL LIAB & OF 0 0

ALT-FS Score: Choose Exercise (1-5) ALT-FINANCIAL STATEMENTS Walston Company provides consulting services. Here are the account totals for the month ended September 30, 2019, CASH $35.000 ACCOUNTS RECEIVABLE 16,000 SUPPLIES 5,000 EQUIPMENT 40,000 ACCOUNTS PAYABLE 28,000 NOTES PAYABLE CAPITAL, SEPTEMBER 1 SERVICE REVENUE TOTAL EXPENSES OWNER DRAWINGS $20,000 40,000 120,000 110,000 2,000 Using the data above.create an income statement, owner's equity statement and balance sheet. On the balance sheet, the assets mest equal liabilities + owner's equity. Walston Company Income Statement For Mowth Ended 9/30/19 Walston Company Owner's Equity Statement For Month Ended 930/19 Walton Company Balance Sheet W10/19 SERVICE REVENUE TOTAL EXPENSES NET INCOME 0 10 10 0 0 0 CAPITAL 1/19 NET INCOME FOR SEPTEMBER SUBTOTAL DRAWINGS CAPITAL W30/19 CASH ACCOUNTS RECEIVABLE SUPPLIES EQUIPMENT TOTAL ASSETS 0 ACCOUNTS PAYABLES NOTES PAYABLE TOTAL LIABILITIES WALSTON CAPITAL TOTAL LIAB & OF 0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started