Answered step by step

Verified Expert Solution

Question

1 Approved Answer

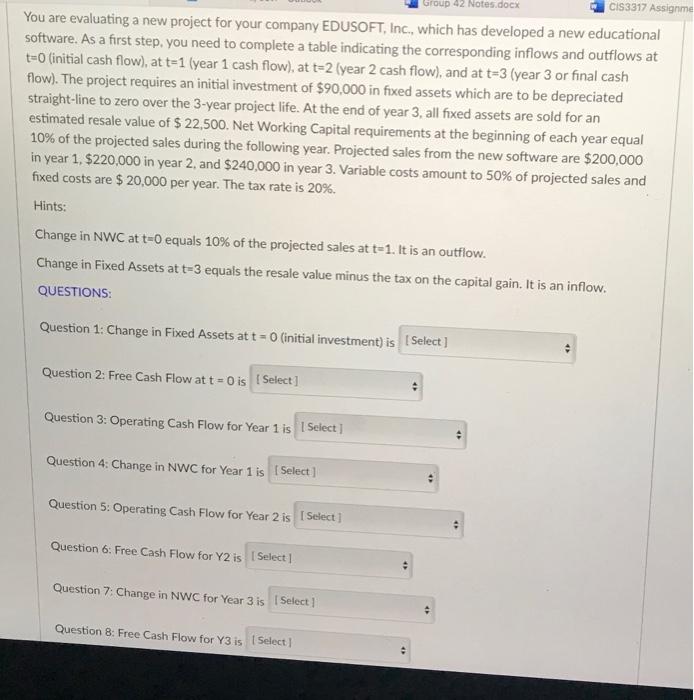

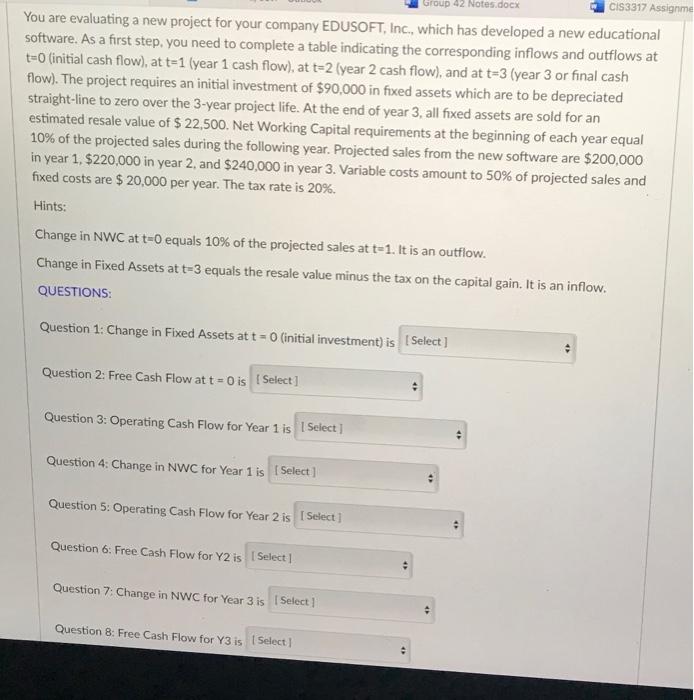

please help! lou are evaluating a new project for your company EDUSOFT, Inc., which has developed a new educatior ioftware. As a first step, you

please help!

lou are evaluating a new project for your company EDUSOFT, Inc., which has developed a new educatior ioftware. As a first step, you need to complete a table indicating the corresponding inflows and outflows t=0 (initial cash flow), at t=1 (year 1 cash flow), at t=2 (year 2 cash flow), and at t=3 (year 3 or final cash flow). The project requires an initial investment of $90,000 in fixed assets which are to be depreciated straight-line to zero over the 3-year project life. At the end of year 3 , all fixed assets are sold for an estimated resale value of $22,500. Net Working Capital requirements at the beginning of each year equal 10% of the projected sales during the following year. Projected sales from the new software are $200,000 in year 1,$220,000 in year 2, and $240,000 in year 3 . Variable costs amount to 50% of projected sales and fixed costs are $20,000 per year. The tax rate is 20%. Hints: Change in NWC at t=0 equals 10% of the projected sales at t=1. It is an outflow. Change in Fixed Assets at t=3 equals the resale value minus the tax on the capital gain. It is an inflow. QUESTIONS: Question 1: Change in Fixed Assets at t=O (initial investment) is Question 2: Free Cash Flow at t=0 is Question 3: Operating Cash Flow for Year 1 is Question 4: Change in NWC for Year 1 is Question 5: Operating Cash Flow for Year 2 is Question 6: Free Cash Flow for Y2 is Question 7: Change in NWC for Year 3 is Question 8: Free Cash Flow for Y3 is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started